Last week, I warned readers that the banking headlines were not over. US regional banks saw their deposits drop as they released Q1 earning reports. Many customers have been moving funds to the larger banks on fears of a banking crisis resulting in the outflow of deposits. Only Huntington Bancshares managed to grow total deposits by $472 million from the prior quarter.

In one of my articles, I focused on Toronto-Dominion (TD Bank) being the largest bank short in the world. Now we can say that the reason for this short had to do with TD’s exposure to US regional lenders.

“I think that short interest was elevated by arbitrage investors betting on the (First Horizon) deal … suggesting that the market believes that the deal is at risk of closing,”

“I think the biggest factor is noise around closing of First Horizon and what TD could be paying for it,” said Lemar Persaud, an analyst at Cormark Securities.

Then came the earnings report from First Republic Bank. The troubled regional bank said deposits fell 40.8% to $104.5 billion in Q1. This flight was worse than expected with analysts expecting the figure to be around $145 billion. First Republic then stated in their press release:

“Deposit activity began to stabilize beginning the week of March 27, 2023, and has remained stable through Friday, April 21, 2023. Total deposits were $102.7 billion as of April 21, 2023, down only 1.7% from March 31, 2023, primarily reflecting seasonal client tax payments that occur each April,”

It is important to note that the deposit figure included $30 billion in time deposits from 11 larger banks announced on March 16th in an attempt to stabilize the banking system. If those deposits were excluded, First Republic’s deposits would have fallen by more than 50%.

The bank said it was pursuing “strategic options” to improve its capital position, a plan that could include asset sales to raise money, or the creation of a so-called bad bank — where any toxic or money-losing assets would be carved off and placed into a new entity, leaving the remaining bank healthy.

Shares fell nearly 50% on the earnings report.

In both articles, I highlighted the US Regional Banks ETF ticker IAT:

Here is what I said in that article:

Individual regional bank stocks have the similar market structure to the US regional banks ETF, ticker IAT, which I have shown above. A major sell off and breakdown below support in early March due to the banking crisis headlines. Since then, regional banks have begun to range. A range generally is a sign of trend exhaustion, meaning in this case, the downside trend could be over. However, consolidation cannot be considered a bottoming until we see a breakout. Until then, the range could just be a pause in this downtrend.

This means that banking fears and more downside for US regional banks may not be over.

And now, we kickstart the new week with news that First Republic Bank has become the third American bank to fail since March 2023. Regulators have taken possession over First Republic after efforts to persuade rival lenders to keep the bank afloat failed.

JP Morgan has emerged as the biggest winner of the weekend auction for First Republic assets. The super bank will get all of First Republic’s bank’s deposits and a “substantial majority of assets”.

A repeat of history. The failure of First Republic has resulted in the biggest bank failure since the 2008 financial crisis when Washington Mutual imploded. Back then, JP Morgan won the failed banks’ assets.

JP Morgan is getting about $92 billion in deposits in the deal, which includes the $30 billion that it and other large banks put into First Republic last month. The bank is taking on $173 billion in loans and $30 billion in securities as well.

JP Morgan said it was making a payment of $10.6 billion to the FDIC.

“As part of the transaction, First Republic Bank’s 84 offices in eight states will reopen as branches of JPMorgan Chase Bank, National Association, today during normal business hours,” the FDIC said in a statement. “All depositors of First Republic Bank will become depositors of JPMorgan Chase Bank, National Association, and will have full access to all of their deposits.”

CEO of JP Morgan, Jamie Dimon, had this to say:

“Our government invited us and others to step up, and we did,” he said. “This acquisition modestly benefits our company overall, it is accretive to shareholders, it helps further advance our wealth strategy, and it is complementary to our existing franchise.”

Dimon also said, “This part of the crisis is over,” referring to the end of this period of panic in the banking system.

Shares of the megabank are up over 3% at time of writing and is one of the biggest movers of the day.

I just shared my thoughts on the charts of the banking sector in this new chart attack video. I mentioned how the technicals can tell us that something is coming due to big money taking positions and price action showing sentiment. In a spooky way, the technicals can tell us the news before it happens. And the charts told us that banking fears were not over.

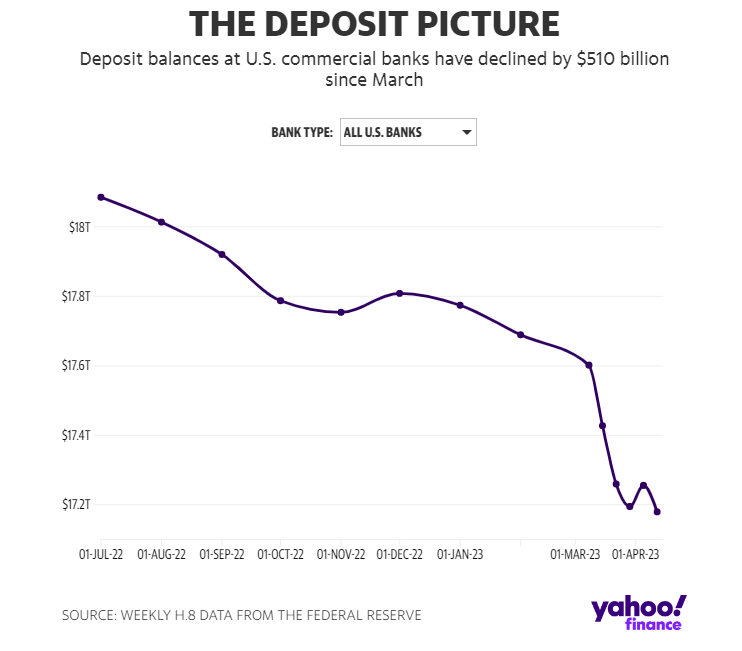

Jamie Dimon says that this part of the crisis is over, but we must remember that when you consider that deposits are shrinking and lending (a bank’s primary business) is slowing, and banks cannot profitably play treasuries by using cheap money to buy long term bonds anymore, all of this exacerbated by inflation and rising interest rates of course, you can understand why banks are feeling the pinch.

I just want to add something different here. Some may say this is in the realm of conspiracy, but I would say watch out for other regional banks to go under which may lead to the regional banks being swallowed up by the mega banks. Some would say this consolidation of banks is what the big banks want. In the end, they are the winners being too big to fail.

I will also leave you all with this chart:

Remember, this is all deposits. So perhaps there are still more banking headlines to come. People may be running into cash, but I would watch the price action of gold and even bitcoin, which may indicate money running into the safety of ‘confidence crisis’ assets.