The legal cannabis revolution was disruptive not dissimilar to the dot com boom. Tech was rapidly changing the way we lived, worked and entertained ourselves. Since the dot com era grew out the recession-ridden 1980s, investors were salivating for yield and the seemingly endless possibilities of tech became their preferred vehicle.

Legal marijuana grew in the wake of the 2015 economic crisis when industrial production remained negative for 12 months while retail sales continued to fall. Like the tech bubble, FOMO took over in legal cannabis and any ventures sporting that infamous leaf, received outrageous pre-revenue valuations.

In 2018, the party ended hard, valuations plummeted as investors ran for the hills. The legal marijuana sector was in ruins and the self-anointed kings of the marijuana market like Canopy Growth became unwilling jesters.

However, when the dot com bubble burst, the tech sector didn’t die. Sure, first movers like Yahoo and AOL atrophied into nothingness, but the undergrowth produced current global juggernauts like Google and Amazon.

So, Canopy Growth may be an overstuffed joke, but there is a second generation of legal cannabis operators, who have learned from their predecessors’ hubris and are positioning themselves as the next big thing in cannabis. BC Bud Co (BCBC.C) is one of those companies regenerating the legitimacy of the legal cannabis space.

Led by founder and legal cannabis icon, Brayden Sutton, BC Bud, is built on the legacy of uber-high quality weed grown in British Columbia before legislation allowed legal sale of cannabis in Canada.

Sutton is teamed with two other giants of legal cannabis, Marc Lustig and Josh Taylor. These names not only are associated with high-quality product, but best business practices and sustainable investment growth.

BC Bud is a vertically integrated player in the legal cannabis space which promotes product quality and consistency through exclusive partnerships with the best small-batch cannabis cultivators.

Currently the company’s product pipeline includes beverages, edibles and extracts with Buds Beverages, Canna Beans and Solventless Solutions.

To help propel its mandate forward, BC Bud has entered into strategic partnerships with Dunesberry Farms, the company’s first dried flower partnership and supply agreement, Blackrose Organics, a manufacturing agreement for the production of Canna Beans, Habitat, for the production of hash and rosin for use by Solventless Solutions, Tricanna Industries, packaging solutions for flower, pre-rolls and concentrates, and Peak Processing Solutions, beverage production and the manufacture of live resin vape pens.

Equity Guru founder, Chris Parry, dug into BC Bud Co recently to examine the company, its portfolio and why it is a positive anomaly in the legal cannabis sector.

Smartly diversified, BC Bud also sets itself apart from Gen One cannabis operations with fiscal responsibility. Sustainable organic growth is the hallmark of a company that is working to be around for the long term, not an executive team looking for a quick payout to buy a mansion in the Caribbean.

Since it is a good idea to account for the jockey when you are betting on the horse, Jody Vance took time to speak with Brayden Sutton to get his viewpoint on business, legal cannabis and why investors should put BC Bud on their radar.

BC Bud reported $191,423 CAD in cash and cash equivalents for the three months ending November 30, 2022 with $161,727 in revenue and a net loss of $173,975 for the same period.

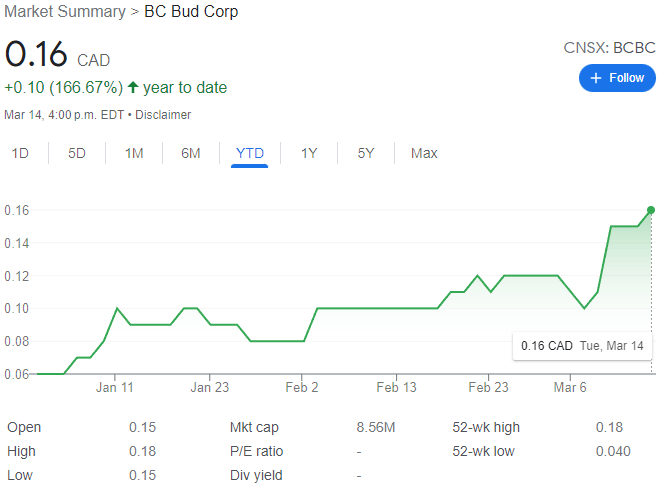

The company traded for $0.16 per share, up 166.67% YTD, on March 14, 2023, for a market cap of $8.56 million.