I told you.

Then I told you again.

I know it’s uncouth to say “I told you so,” but I did, didn’t I?

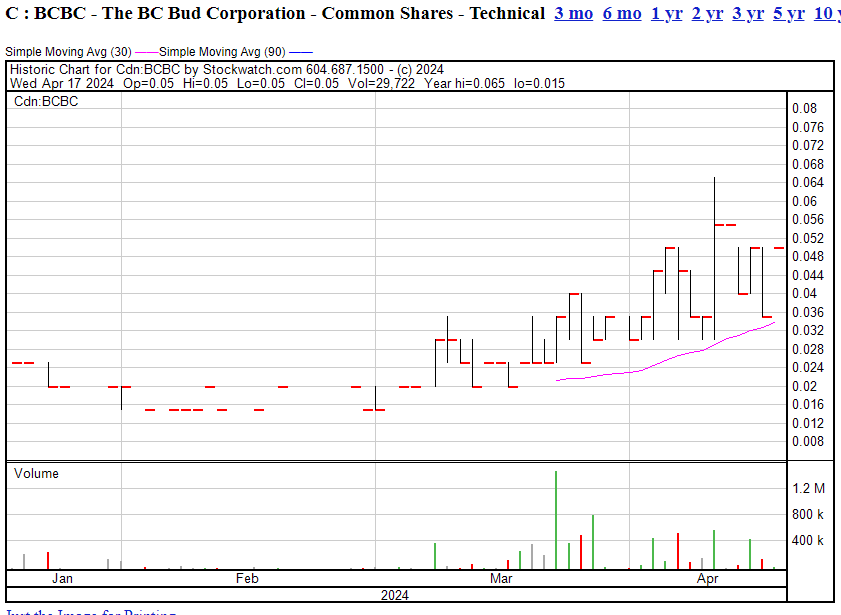

BC Bud Corporation (BCBC.C) has jumped to $0.05, up from $0.015 two months ago, even while closing a raise priced at $0.02.

BCBC boss Brayden Sutton, who has been a cannabis behind-the-scenes player since day one of the public markets weed movement, has steered his little weed aggregator through choppy market times, where everything canna-related has gone to the farm to die, and come out the other side wearing a smile.

I told you last month folks were gathering cheap stock quietly, I told you the company was raising money, I told you Sutton’s smile has been giving away that something’s cooking, and I told you as recently as a week ago that you should be paying attention RIGHT NOW.

The markets suck, everyone is in cash protection mode, nothing is moving up – and yet, somehow, Sutton’s deal is not just rising but multiplying.

Volume up.

Price up.

Volatility right where you want it.

And even when weak hands sold the thing off when it hit $0.04, all the way back to $0.025, it still had the balls to push through to as high as $0.065.

SO WHY ALL THE BUZZ?

The BC Bud Co. has crafted a business model that strategically leverages the legacy brand recognition of BC Bud and partnerships to navigate the competitive cannabis market.

Central to their approach is a focus on quality and brand integrity, associated with British Columbia’s reputation for premium cannabis. Their model can be broken down into several key components:

- Product Diversification: The BC Bud Co. offers a wide range of cannabis products, including flower, concentrates, edibles, and lifestyle apparel. This diversification allows them to cater to various segments of the market, from casual users to connoisseurs, thereby broadening their consumer base.

- Partnership and Collaboration: The company places a strong emphasis on forming strategic partnerships with other entities within the cannabis industry that have built prestige brands. For example, they collaborate with Habitat for the production of solventless concentrates and Black Rose Organics for the manufacturing of their premium edibles. These partnerships enable The BC Bud Co. to leverage the expertise and capabilities of established players in the industry, ensuring high-quality production without the necessity of extensive capital expenditure on facilities.

- Focus on Quality and Branding: The business model stresses the legacy and quality of BC Bud, which is renowned worldwide. By focusing on high-quality products and associating their offerings with the prestigious BC Bud label, they enhance brand loyalty and attract customers seeking premium cannabis products.

- Licensing Model: The BC Bud Co. employs a licensing model which allows them to focus more on brand development and less on the operational complexities of cannabis production. This model enables them to expand their brand reach and product distribution without the direct costs and risks associated with cultivation and production processes.

- Market Expansion and Consumer Experience: The company is actively looking to expand its market presence across various provinces in Canada, adjusting their product offerings in response to regional market demands and opportunities. Their emphasis on the consumer experience is evident in their marketing initiatives and product development, aiming to educate and engage consumers about the uniqueness of their products.

Overall, The BC Bud Co.’s business model is built on a foundation of strategic partnerships, quality focus, and brand prestige, which positions them well in the competitive landscape and allows for scalable growth within the evolving cannabis industry.

In short: They figured out how to do great weed without blowing through fat cash.

So, good company, rockstar legacy brands and execs, trading volume that’s beating down the weaak players, business model that’s low capex and low opex, and multiples already hitting.

BUT NO, YOU HAVENT MISSED THE TRAIN.

Today’s market cap is just $2.8 million.

You heard.

I’ve already got my triple, but even after that it’s still dirt cheap.

Look, I’m not telling you to buy BCBC. I’m not your financial advisor, I probably do more shrooms and weed drinks than I should, and I’m obviously conflicted because I own the stock, they’ve been a client before, and may well be one again soon (though we have no commercial arrangement presently).

So take everything I say with a grain of salt. Consider me sleazy and ignore me accordingly.

But also, take a look at their website, their brands, and their team.

I feel like you won’t need more convincing.

— Chris Parry

FULL DISCLOSURE: Not a client, has been before, might be again soon, I own stock and am buying more and daddy is eating steak.