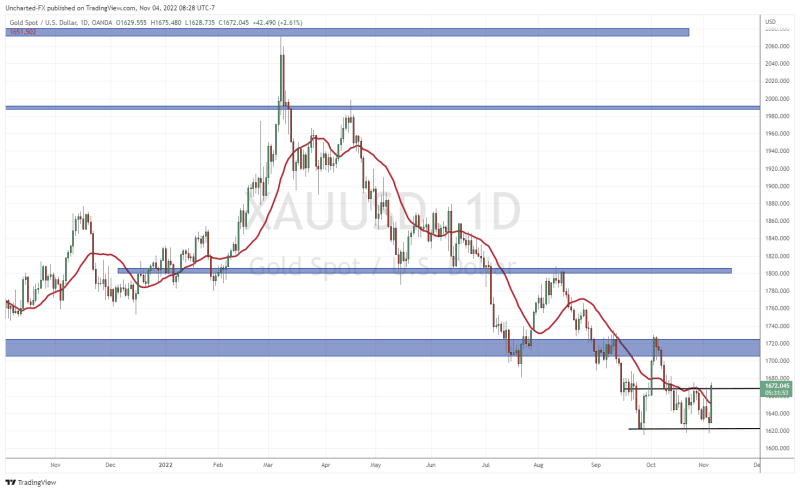

Gold prices are rallying as the US Dollar falls. Technically, the dollar is holding a range, so more work is required on the charts before we can confirm a major dollar reversal. If this happens (although many would say when!) we can safely say gold is ready to reverse.

Gold tested $1620 for the third time in recent weeks. Support is holding and we are currently breaking above some interim resistance at the $1670 zone. A strong close would easily get us testing the $1700-$1720 zone. There could be some trouble there, but be sure to read my technical report on gold for more information.

So why am I excited for the gold stocks? Well, first off they are some of the cheapest and undervalued stocks out there. Readers know that fundamentally, I do believe money runs into gold and other hard assets as the confidence crisis plays out. When people start losing confidence in the government, central banks and fiat is when gold rockets. People do not factor this when they talk about gold being an inflation hedge.

The second reason why I am excited for gold stocks is this:

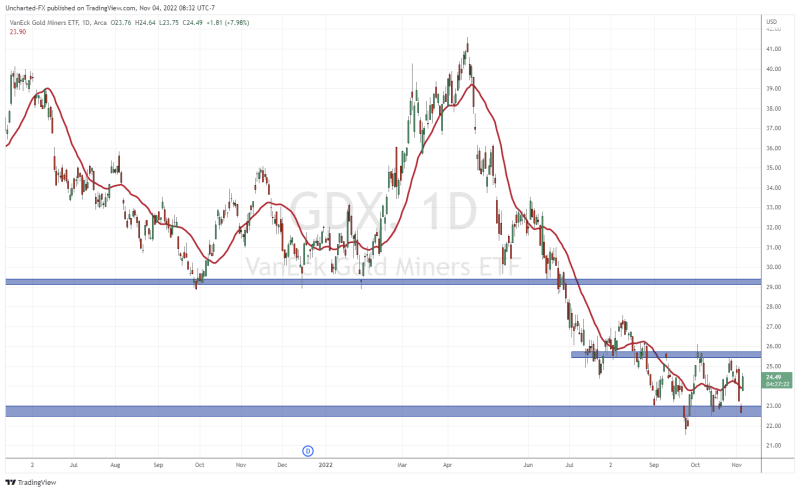

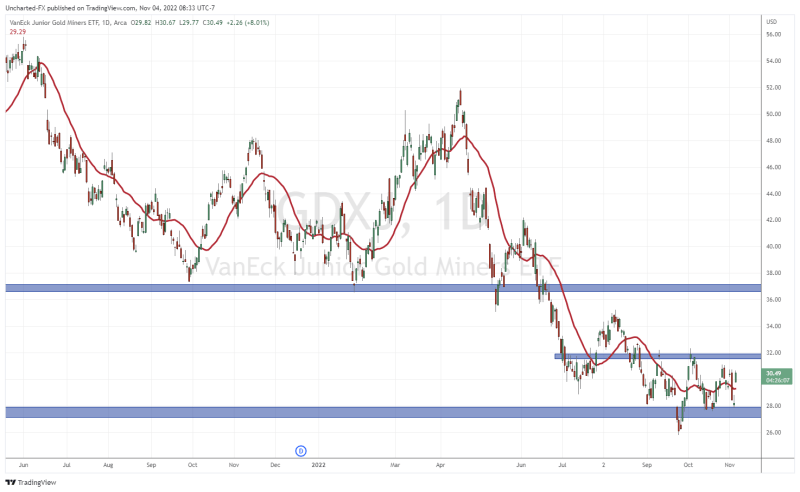

Both gold miner ETFs, GDX and GDXJ, meet my criteria for a potential reversal. A little recap for those who do not follow my work here on Equity Guru. If you don’t, then what are you doing! We have been accurate in predicting many market moves this year.

Markets move in three ways: an uptrend, a range and a downtrend. It doesn’t get any more fancier or complicated than that. Think of cycles. All assets go through cycles, and so do stocks. You can clearly see both GDX and GDXJ have been through a downtrend. Currently, both gold ETFs are now in their range/consolidation phase. This is a good sign for bulls because it means that selling pressure is exhausting and a bottom could be forming.

I say ‘could’ because we are missing one key element before we can confirm a new uptrend. We need a breakout above the range. The top portion of the range is known as resistance. Buyers tend to take profits at the top of the range while sellers enter short at the top of the range. This is how a range continues to… well range, between two levels forming a rectangle pattern. Once price breaks the top or bottom portion of this rectangle, you have a breakout trigger.

For GDX, the breakout is confirmed with a strong daily close above $25.75. For GDXJ, the breakout is confirmed with a strong close above $32.00.

So it is better to say that the probabilities of a bottom and a reversal have increased, but not yet confirmed. Remember, we can continue to range failing to breakout above our resistance levels. We can even break below the bottom portion of the range which would continue the downtrend.

If gold itself can climb over $1720, I think we will have a strong case for breakout reversals triggered on GDX and GDXJ.

Here are three gold juniors stocks I am keeping tabs on

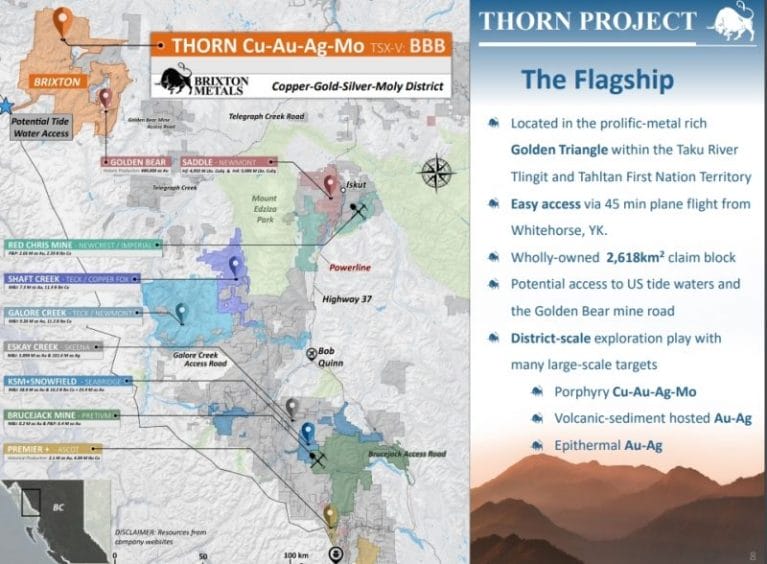

Brixton Metals (BBB.V)

Brixton Metals is an exploration company that acquires, explores, and develops mineral properties in Canada and the United States. They have four primary assets dealing with Gold, Silver, Copper and also Cobalt.

Now we know that juniors can be risky. However, I really do believe Brixton Metals is one of the best junior metals mining plays right now. I say this for three reasons:

- Assets in good jurisdictions and locations

- Cashed up with JV’s and BIG names as shareholders

- The technicals are hinting at a major reversal

Let’s break these down.

Not much needs to be said about jurisdiction. For mining, this is very important when it comes to the legal process of obtaining permits etc, and of course, you don’t want the government to just walk in and claim your resource/mine. Marin Katusa has a simple method of determining good jurisdiction: don’t invest in AK-47 countries. Canada and the US do not fall into this category.

When it comes to the projects, Brixton is focusing on the Thorn project in BC and Hog Heaven in Montana.

The flagship has investors excited with recent drill results.

Brixton entered a letter of intent with Pacific Bay Minerals where Pacific Bay has the Option to acquire 100% interest in the Atlin Goldfields Project located within the traditional territory of Taku River Tlingit First Nations, Atlin, British Columbia, Canada. Check out the press release for details and monetary amounts.

Earn-in-partner Pacific Bay Minerals began drilling at the Atlin Goldfields Project in early September 2022. Results and what Pacific Bay does next will be a catalyst for Brixton Metals.

A recent raise of $6,145,381 also means the company is cashed up for future exploration programs.

However, the most recent news plays in with the fact that major money is backing this company. On November 2nd 2022, Brixton announced that BHP Group LTD has agreed to invest at least CAD $13.4 million to acquire a 19.9% interest in Brixton Metals! BHP really likes the Thorn copper-gold project!

“We are excited to welcome BHP, a leading global resource company, to the Brixton share register and believe their investment speaks to the strength of the Thorn Project and Brixton’s geological team,” said Brixton Metals Chairman and CEO Gary Thompson.

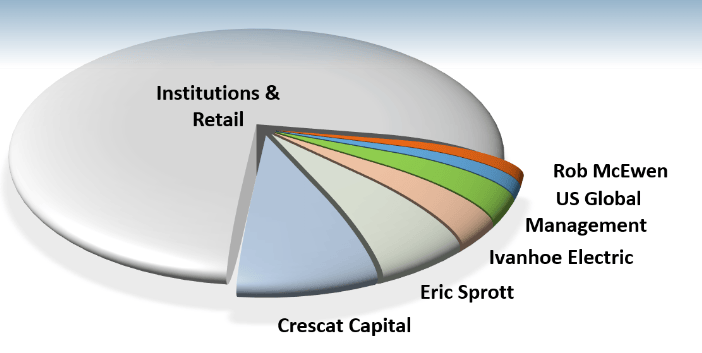

Under the strategic investment agreement, BHP will acquire the number of shares needed to own a 19.9% interest in Brixton, on an undiluted basis, upon the completion of a private placement at CAD $0.18 cents per share. The number of shares purchased, and BHP’s total investment, will be dependent upon whether Crescat Portfolio Management LLC elects to exercise its right to maintain its current interest in Brixton, which currently stands at around 13.5%.

If Crescat does not elect to exercise its rights, then BHP will invest C$13.4 million to acquire 74.36 million Brixton shares. If Crescat decides to fully exercise its participation, then BHP’s investment would be C$13.9 million to acquire 77.35 million shares, and Crescat would purchase 12.04 million shares for C$2.2 million.

As part of the agreement, Brixton has agreed to invest at least 90% of the funds raised in this financing into exploration at Thorn.

BHP joins a list of big name investors in Brixton Metals. I rest more easily knowing that big money has done their due diligence (especially when it comes to Geology!). If they see potential and like the probabilities of good drill results, so much so that they have skin in the game, then I feel comfortable investing with them.

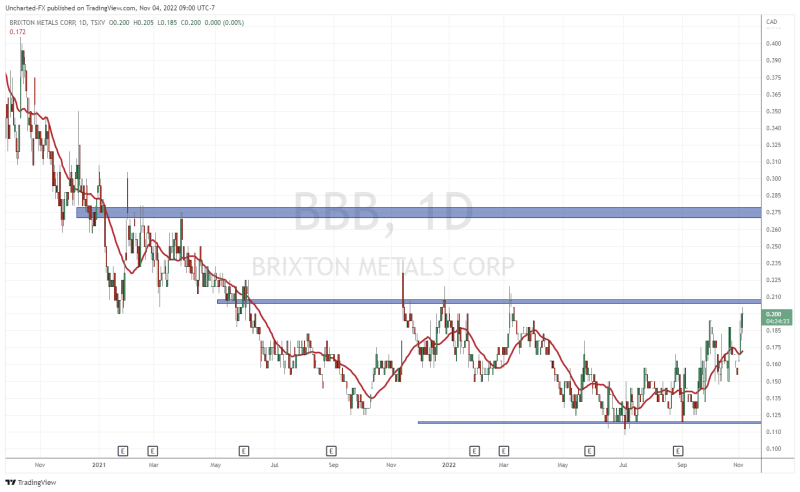

The chart is exciting. In fact, we notified readers of the bottoming and subsequent breakout when the stock was trading around $0.12. But a major technical breakout is about to trigger. I am watching for a close above $0.21 to confirm a breakout of levels which have held as resistance since Summer 2021. Think of this as a long range/consolidation phase. With the break, a new major uptrend begins for Brixton Metals. It sure does have all the right ingredients for higher stock prices!

Japan Gold (JG.V)

Readers know that I have been writing about the Bank of Japan (BoJ) and the Japanese Yen all through this year. We told investors that the BoJ will be one of the most important central banks to watch.

I also wrote a piece on gold exploration in Japan. For more information on Japan’s untapped potential I highly suggest you read that piece. There has not been much exploration by Western companies in the past due to expensive Yen. Now things are changing. The Yen is cheap and western explorers are eager to explore in an underexplored first world country, with the Japanese government supporting discovery of mineral resources.

Japan Gold is one for the history books. The Canadian based company was the first foreign explorer to apply for and be granted prospecting rights as well as drilling permits under the 2012 amendments to the mining act. Historic, and a game changer. Proving it is possible for a foreign junior resource company to successfully work through the Japanese regulatory and permitting system. The first mover advantage.

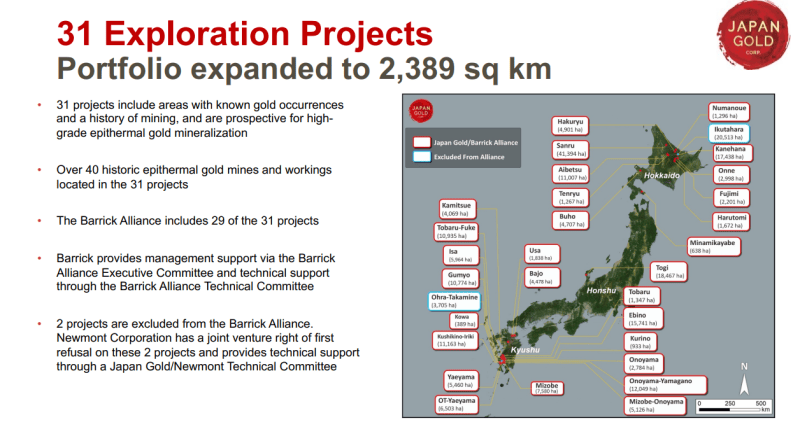

Japan Gold holds a portfolio of 31 Gold Projects which cover areas with known gold occurrences, a history of mining and are prospective for high-grade epithermal gold mineralization. To be exact, Japan Gold’s exploration licenses and applications cover at least 42 historically producing mines and workings.

Japan Gold’s two independent projects are located in Hokkaido and Kyushu. These are the Ikutahara and Ohra-Takamine projects, which are the most advanced projects in the Japan Gold portfolio.

Remember I said that major mining companies are paying attention to Japan? When we speak about Japan Gold, we need to mention Barrick Gold ($30 Billion market cap major) and Newmont ($46 Billion market cap major). These are big players, and I am sure those who follow mining know about these companies.

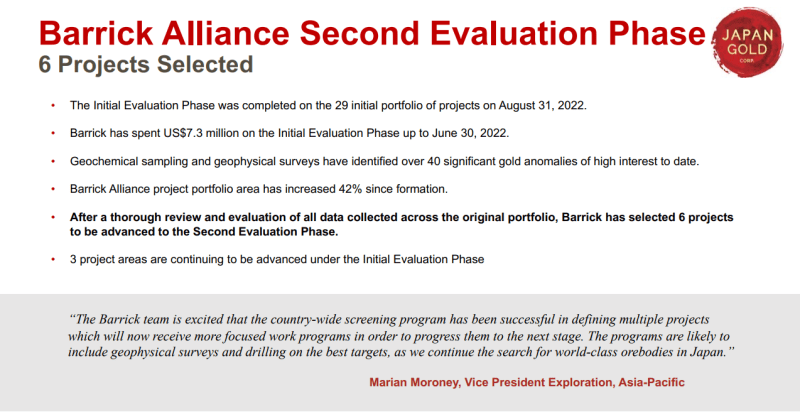

In 2020, Japan Gold formed a country-wide alliance with Barrick Gold (NYSE:GOLD, TSX:ABX) to jointly explore, develop and mine certain gold mineral properties and mining projects in Japan. As part of the agreement Barrick agreed to sole fund a 2-year Initial Evaluation Phase of each project and sole fund a subsequent 3-year Second Evaluation Phase on projects which meet Barrick criteria. Barrick has spent US$5.6 million on the Initial Evaluation Phase from the formation of the Barrick Alliance to the end of 2021.

With travel now easier to Japan, Barrick has selected 6 projects to be advanced to the second evaluation phase.

Barrick will sole fund a 3 year second evaluation phase of these projects: Aibetsu, Tenru and Hakuryu in Hokkaido, Togi in Honshu and Ebino and Mizobe in Kyushu. This plus Japan Gold’s own exploration and drilling ensures a nice flow of press releases and potential catalysts for the stock.

Technically, the stock remains in a channel pattern. The stock is basing near major support at $0.21 and all it needs is that one big catalyst news piece. It is likely to be from Barrick’s drill program. Technically, we still need a close above $0.30 which is above resistance and the channel, to begin a new major uptrend.

Minera Alamos (MAI.V)

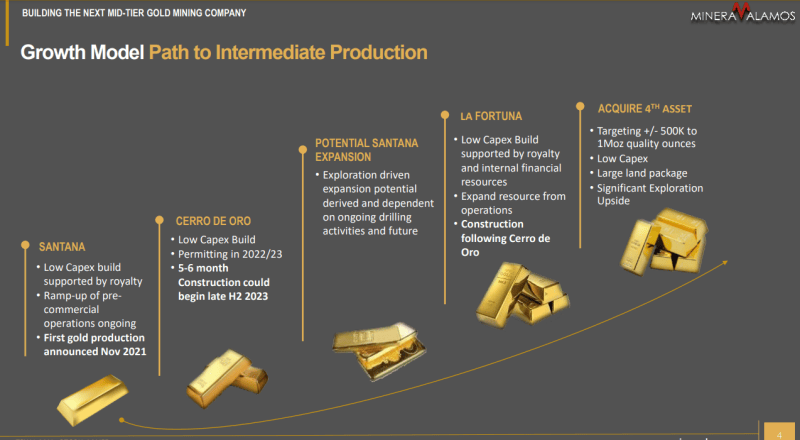

Minera Alamos is a company advancing multiple low capex projects to production in Mexico. This new gold producer is ramping up its first gold mine with its first production having taken place on October 21 2021. The team behind this company has brought 4 mines into production in Mexico over the last 13 years.

The Company has a portfolio of high-quality Mexican assets, including the 100%-owned Santana open-pit, heap-leach gold mine in Sonora currently ramping up toward commercial production in 2022. The 100%-owned Cerro de Oro oxide gold project in northern Zacatecas that has considerable past drilling and metallurgical work completed and where we are fast tracking the permitting process efforts. The La Fortuna open pit gold project in Durango (100%-owned) has an extremely robust and positive preliminary economic assessment (PEA) completed and the main Federal permits in hand.

It is fully funded for current development and operating plans. Oh and they have zero debt.

If you like a growth story, then this is one to watch, and I can tell you that the retail gold crowd definitely are watching Minera Alamos.

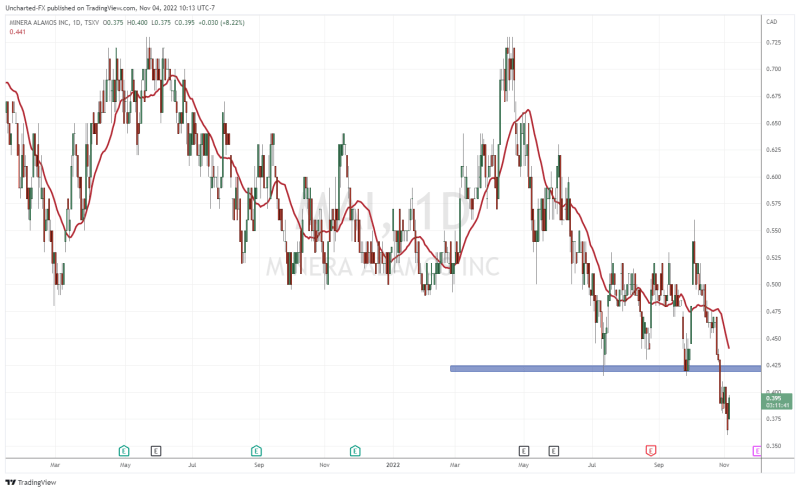

The stock recently broke below support at $0.425. Further downside is to be expected, however this could reverse given the price action we are seeing on gold, GDX, and GDXJ. My key trigger would be a candle close back above $0.425. We would then have a false breakdown and mean upside is coming.

Brixton Metals (BBB.V) releases first drill hole results from Camp Creek