If you are a gold bug, heck even if you are bullish on silver, then July 12th 2023 was a very good day for you. Here’s an image of the price action in the last three days:

Overall it was a great day for risk on assets. The precious metals popped, energy popped, other commodities popped, and stocks popped. The question is why?

Gold bugs are getting very excited, but there is one observation that I think is worth mentioning. I will get to it later in this article.

Fundamentals

Gold price is certainly moving on data points related to inflation and interest rates. At the beginning of the year, Wall Street analysts and traders stated that gold will go for a run once the Fed nears the end of its interest rate hike cycle. Why is this? Well, gold does not yield anything. Let’s talk about interest rates and inflation.

Interest rates are the talk of main street currently with central banks hiking rates to levels not seen for decades. When you hear about rates going to a certain number on mainstream financial media, they are referring to the nominal rate. The nominal rate shows the price of money (what it costs to borrow) and reflects the current market conditions.

The real interest rate is one that is adjusted for inflation and shows the real purchasing power. This is important when it comes to investing in bonds. Bonds are seen as a safety net. When things are volatile and there is fear, money managers tend to get out of stocks and increase their positions in bonds. Why? Because bonds are traditionally safe and they yield something as opposed to just holding a cash position. Remember, money managers are paid to provide a return and not paid to hold cash for a long period of time. Funds must be deployed.

So, let’s say the US 2 year bond is yielding 4.6%. That is the nominal return. The real rate is quite different. We need to factor in inflation. Recent US inflation data reported core CPI at 4.8%. If we get the nominal rate and subtract it with the inflation rate, we get a value of -0.2%. Technically, you are losing if you are holding bonds for yield. This sort of example also applies to saving accounts during periods of high inflation. This is why they say you are losing out by saving in these periods of time because you are losing purchasing power.

Historically, when the real rate of return is negative, gold does well. When real rates are high, gold tends to do poorly. It should be noted that gold is holding up extremely well even with nominal rates heading higher.

The reason why analysts have said gold will have its time to shine when the Fed reaches its terminal rate is because they expect a slowdown or recession to follow and the Fed would be CUTTING interest rates. Therefore the markets are pricing in the cutting of interest rates in advance.

There is one more fundamental reason why gold can perform well. When there is a confidence crisis, money runs into the safety of gold. If we see troubles with the government, central banks and the fiat currency, gold will see a bid. Some contrarians believe this is still the case, and we are just in the beginning stages of some crisis. A financial crisis would see money run into the safety of gold.

Geopolitics

If things are crazy in the world, money runs to gold. In times of conflict and war, gold is accepted money under any regime. Some would argue the war cycle is heating up. Yes, we all know about the war in Eastern Europe. Nobody knows how Russia will react if Ukraine is accepted into NATO. But there is also some stirring in Asia. Just yesterday, China sent a large group of warplanes and naval ships towards Taiwan and crossed the midline of the Taiwan strait. This strait is considered an unofficial boundary buffer between the island and the mainland.

Russia and China have also made headlines this week in the gold markets because of BRICS. It has come out that Russia and other BRICS nations are planning to unveil a new gold-backed currency at the upcoming BRICS summit in South Africa in August.

Last Friday, the Russian Embassy in Kenya declared that “the BRICS countries are planning to introduce a new trading currency, which will be backed by gold.” The news was confirmed by RT, the Russian state-controlled TV network.

A move towards de-dollarization? It is interesting that this news came out this week just a few days before the major drop in the US dollar.

Just some food for thought: what if other central banks decide to stock up on gold in order to participate with the BRICS nations? Maybe some central banks may even be repatriating their gold back from western vaults. We already know that central banks have been buying up gold, and many nations are now asking for their gold back in case the US freezes their assets just as they did with Russia.

The gold markets could be seeing some volatility from all of this come Fall of 2023.

old is seen as the anti-dollar. Russia and the BRICS nations are literally taking this to the next level. If the US can freeze assets then nations such as China will want to increase their gold position. Also, when a currency depreciates against the US dollar, gold in terms of that currency appreciates, which leaves the central bank of that nation in a positive position. We saw the Russians use this to counter US sanctions imposed way back in 2014.

US Dollar

Now we get to the observation which I stated I would get to at the beginning of this article.

Gold and other commodities saw a huge rally because of the fall in the US dollar.

The dollar continues to tank and has even broken below the major psychological 100 zone which I mentioned in my recent article.

The reason for this fall? US CPI data coming better than expected and with inflation cooling down, the markets pricing in the end of rate hikes. The markets are doubling down on this given the recent labor data for non farm payrolls for the month of June 2023 was weaker than expected. The Fed has always been pointing to a robust labor market for the reason why they continue to raise interest rates. Basically saying what economic slowdown? The labor market continues to surge!

When you combine weaker than expected jobs data and the lower CPI, the markets are doubling down on a Fed switching to being dovish. The dump in the dollar proves this.

Gold had a great day with the US dollar drop. Technically, we have closed back above the $1940 resistance zone. This means that the recent move lower was just a corrective move in the uptrend. As long as gold remains above $1940 on any retest, more highs are possible.

And yes, this means gold retesting previous all time record highs… and perhaps even breaking out this time.

Now gold bulls are excited. I am as well since I trade gold CFDs. But just a word of caution due to observations. Take a look at gold vs other currencies:

Notice something?

Yup. They continue to fall.

So in summary, we can say that this move is entirely a dollar sell off move and NOT an entire gold long move. Gold’s time to shine will occur when gold moves higher against all currencies. We are not seeing this. This is a reaction move to the weaker dollar and the other fundamentals for a gold push higher still aren’t present. Take advantage of this gold vs USD move as a trader, but I will be looking towards Fall 2023 for gold’s real time to shine.

Trade ideas

You can play gold by trading CFDs, futures, or options. This can be done by trading XAUUSD or GLD contracts.

Returns can also be made with the mining stocks. One can play the ETFs GDX and GDXJ:

Both which look prime for a move higher after taking out the previous lower high and downtrend line.

You can play the majors like Barrick Gold Corp or my preferred long term investment play in mining, the gold royalty and streamers like Franco Nevada.

Notice that the charts look similar to those of GDX and GDXJ. Same market structure and breakouts.

Or perhaps you are extremely bullish on gold for the long term and want to accumulate positions for when the real gold move occurs?

Well then the junior mining sector is where you want to look.

Tempus Resources (TMRR.V) is a junior explorer approaching mining through the lens of sustainable mining. A very important factor for the future as governments get tough with environmental laws.

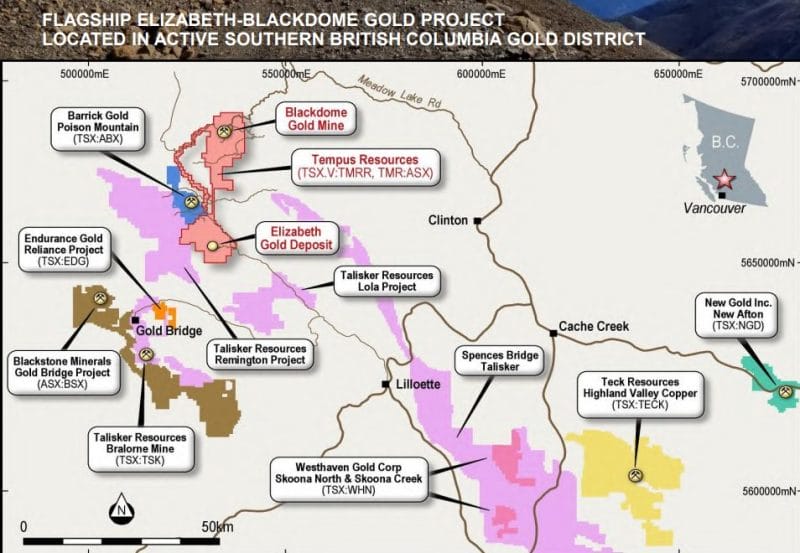

The Company’s flagship project is the Elizabeth- Blackdome Gold project located in Southern British Columbia, Canada in the prolific Bralorne Pioneer Gold District. The Elizabeth-Blackdome project boasts high-grade gold mineralisation and fully permitted mill and tailings storage infrastructure providing the potential for near-term production and cashflow once a mineable resource is established. The Company also is advancing strategically located gold exploration projects in Ecuador. One project is adjacent to Lundin Gold’s Fruta del Norte gold mine.

Tempus Resources’ strategic plans, environmental consciousness, and exciting projects give it a potential edge over its peers. The company is on the cusp of several exciting developments and is well worth keeping an eye on for investors interested in sustainable mining.

Equity Guru founder, Chris Parry, does a deep dive on Tempus Resources in his article titled, “Tempus Resources has all the pieces needed to put together a top flight gold project“. Be sure to check it out for all the fundamentals on the Company and project.

The stock is trading near all time lows. A range has developed indicating the bottom and exhaustion of selling pressure. A new trend could be beginning. Tempus has recently closed a financing. They now have money in the bank to put in the ground in terms of an exploration program. This means an upcoming catalyst for the stock.