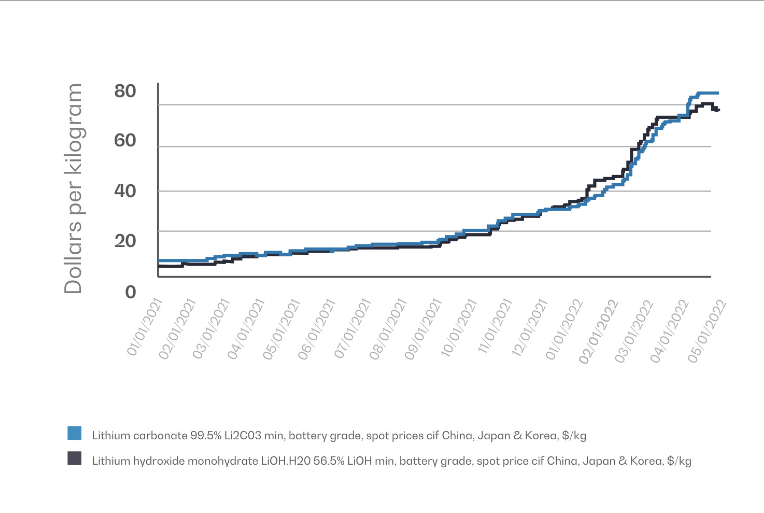

Lithium has been the talk on the streets. Global lithium prices are spiking. Prices of lithium carbonate have risen by 574% from January 2021 to January 2022, while lithium hydroxide monohydrate has increased by 366%, and the uptrend continues. Lithium carbonate is primarily used in batteries that power electric vehicles.

Everyone knows the bullish case for lithium. It is all about electric vehicles (EV) and this bullish cycle is due to the high demand in the EV market for lithium-ion batteries. Demand continues to surpass supply. This means that lithium miners will be signing mega supply deals in coming months and years and will set the tone for the rally in lithium stocks.

The lithium market also got bullish on two fundamental news pieces. Both to do with the government.

First off was the Inflation Reduction Act. The bill included a revision for the existing $7500 federal electric vehicle tax credit. The new credit will apply to the purchase of vehicles meeting specific criteria on purchase of vehicles:

- final assembly of the vehicle must occur in North America

- specific percentages of the vehicle battery’s critical minerals must originate or be recycled in the US or be produced in a US free trade agreement partner

- specified percentages of the vehicle battery’s components must be manufactured in North America

Now do you understand why investors are bullish lithium stocks? North American lithium miners and projects have gotten a major catalyst.

But that isn’t all. To add to the bullish case for North American lithium stocks, several US States will follow California’s lead in banning gas-powered car sales by 2035. This will accelerate the demand for EVs as the government addresses climate change. Government action will likely increase the demand for lithium needed for EVs. I do want to add a caveat though. Perhaps governments might scale back on this as we have seen recently the Californian government tell people to refrain from charging their EVs to avert power outages due to the stress on the power grid. *uranium bulls cackle with glee*

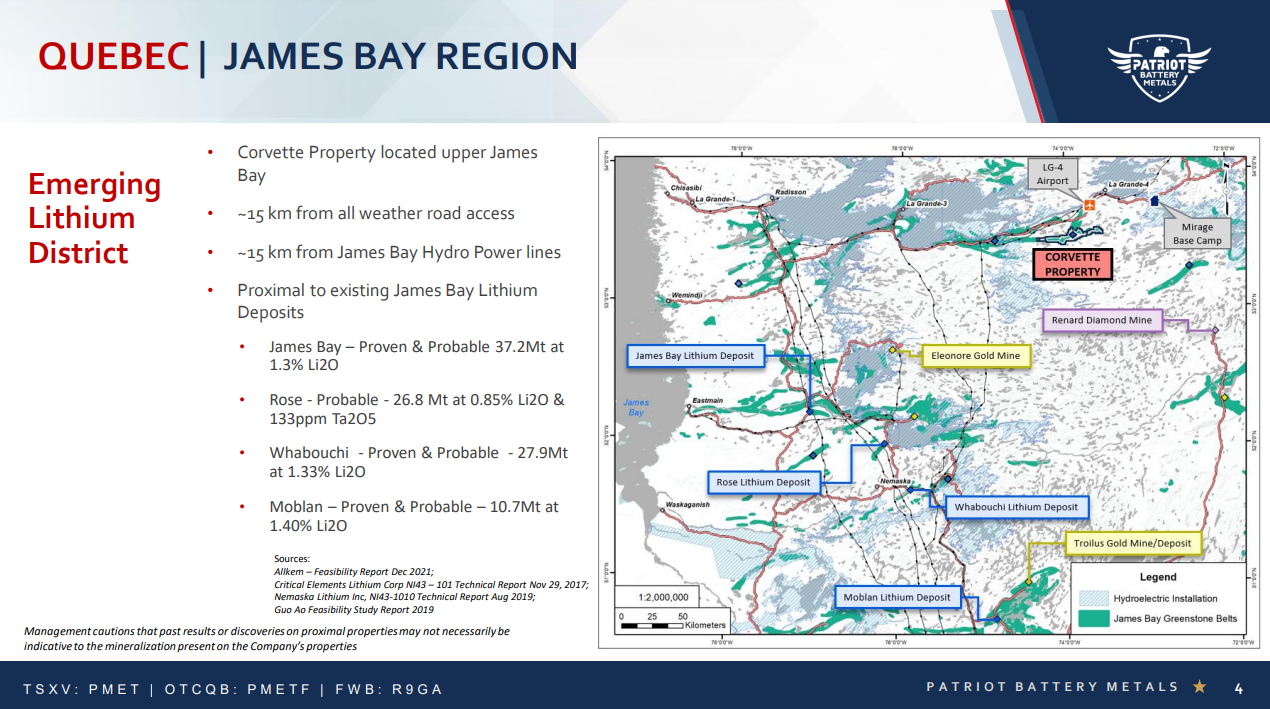

Lithium stocks have been on a recent tear and I spot many breakouts with my technical inclined eyes. The talk on the street has been the movement in Patriot Battery Metals (PMET.V). The company owns 100% of the Corvette Lithium property in the newly discovered Corvette lithium district.

Recent news highlighted the best lithium intercepts to date in drilling at Corvette:

-

- 1.65% Li2O and 193 ppm Ta2O5 over 159.7 m (from 131.8 m downhole), including 4.12% Li2O and 162 ppm Ta2O5 over 9.0 m (CV22-042)

- 2.13% Li2O and 163 ppm Ta2O5 over 86.2 m (from 244.4 m downhole), including 3.07% Li2O and 265 ppm Ta2O5 over 18.0 m (CV22-044)

- Continued strong lithium grades over wide intervals returned over western portion of drill area, between the CV5 and CV6 spodumene pegmatite outcrops

- 1.42% Li2O and 106 ppm Ta2O5 over 59.3 m (from 214.0 m downhole), including 2.06% Li2O and 141 ppm Ta2O5 over 7.2 m (CV22-038)

- 1.68% Li2O and 91 ppm Ta2O5 over 22.7 m (from 319.4 m downhole), including 3.13% Li2O and 75 ppm Ta2O5 over 7.0 m (CV22-043)

Nineteen drill holes are currently en route to or in process at the analytical lab.

The stock has been in red hot rally mode ever since it broke out above recent highs at around $4.35. Technical traders like me will tell you the run actually began with the break of the trendline back at $2.50. The stock had a 18% gainer green day on the 31st of August, the day when the above drill results were released.

For bulls, I need to say that ever since the stock broke out above recent highs at $4.35, the stock has rallied over 70% to highs at $7.24. Pullbacks have been bought so far.

Missed out on this monster rally? Don’t worry, I have you covered. Here are 5 other Canadian lithium stocks to keep on your radar.

Infinity Stone Ventures (GEMS.CN)

Infinity Stone Ventures is a company with a diversified portfolio of critical energy metals to meet the demand from battery and wind turbine manufacturers and nuclear and hydrogen energy producers. Their diversified portfolio includes 100% interest in lithium, copper, manganese, graphite, cobalt and nickel properties in Ontario and Quebec.

The company recently optioned the Taiga Lithium project. Combined with their Camaro project, Infinity Stone has expanded their land position to over 1,282 in the James Bay Lithium district.

There is a touch of Patriot Battery Metals here. The Taiga Lithium project is adjacent to Patriot Battery Metals’ Corvette Lithium discovery.

“Infinity Stone is excited to further increase our position in the rapidly expanding James Bay Lithium District. Our team is hopeful that the identified LCT pegmatite trend in the corridor presents a number of occurrences trending northeast to southwest,” said Michael Townsend, Executive Chairman of Infinity Stone. “The Taiga Lithium Project is strategically positioned with existing mapped pegmatites that present significant discovery potential given recent developments from other operators in the region,” further stated Mr. Townsend. “It is evident from regional mapping that there is a high potential there are additional pegmatites present on the Project,” concluded Mr. Townsend.

Now that’s a stock chart! Infinity has been in a long range going back to April of this year. $0.30 has been resistance for months, and we have just seen a breakout confirmed on August 31st 2022 on news the company closed a third tranche of a private placement. Now, Infinity Stone has the cash to initiate catalysts.

What does the stock do next? I have drawn out what I hope to see. I don’t recommend chasing runaway moves. Be patient and a sniper trader/investor. I would like to see a pullback to or near $0.30. This is just typical breakout price action. We tend to see the price retrace back to the breakout zone which presents an opportunity for those who missed out on the initial pop to jump in the stock.

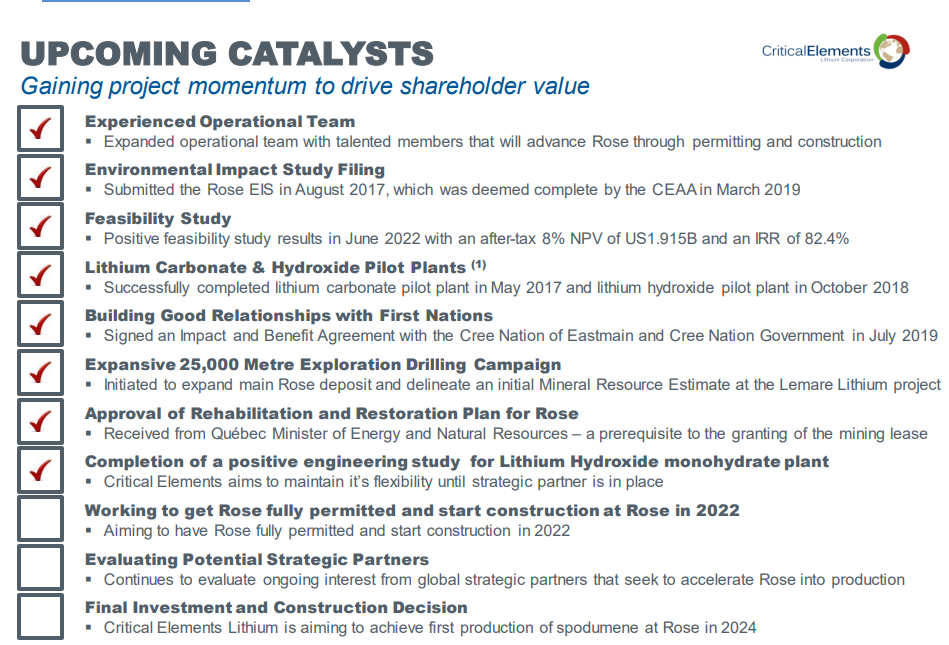

Critical Elements Lithium Corporation (CRE.V)

Critical Elements is an advanced lithium play. The company’s Rose lithium-titanium project is located in Quebec. Here are the economics of the project:

Average annual production:

- 173,317 tonnes of chemical grade 5.5% spodumene concentrate.

- 51,369 tonnes of technical grade 6.0% spodumene concentrate.

- 441 tonnes of tantalum concentrate.

Expected life of mine of 17 years.

Average operating costs:

- US$74.48 per tonne milled, US$540 per tonne of concentrate (all concentrate production combined).

- Estimated initial capital cost $US$357 million before working capital.

- 100% equity basis for project.

- Average gross margin 68.3%

After-tax NPV of US$1,915 million (at 8% discount rate), after-tax IRR of 82.4% and average price assumptions of US$1,852 per tonne chemical grade lithium concentrate, US$4,039 per tonne technical grade lithium concentrate, US$130 per kg tantalum pentoxide (Ta2O5).

Anticipated construction time to start of production of 21 months.

The asset is quite de-risked and the next major catalyst will be to get Rose fully permitted so construction can begin later this year.

There isn’t much to add to the chart. The stock has been in a range going back to 2021. Support comes in at $1.20 while resistance comes in at $1.70. A break of these levels is what gets the stock going. If you are looking for a lithium stock which won’t fluctuate too much in the short term and has big upside potential for the long term, Critical Elements might be the stock for you.

Recharge Resources (RR.CN)

Recharge Resources is a Canadian mineral exploration company focused on exploring and developing the production of high-value battery metals to meet the demands of the advancing electric vehicle and fuel cell market. Recharge has a portfolio focused on three high demand battery metals including lithium, nickel and cobalt.

Recharge Resource’s Georgia Lake project is located next to RockTech Lithium’s Georgia Lake property.

Recent news announced the commenced planning for a phase 1 exploration program at Georgia Lake.

RockTech announced a strategic partnership with Mercedes Benz on August 23rd 2022. Rock Tech and Mercedes-Benz AG jointly announced that the companies are about to enter into an agreement which provides for a strategic partnership to produce high-quality lithium hydroxide for the automaker and its battery suppliers.

Playing on ‘close-ology’, perhaps Recharge Resources has a resource just like their neighbours.

CEO and Director, David Greenway, states, “While we continue to advance our two fully-funded drill programs at Brussels creek and Pocitos 1 lithium Salar in Salta, Argentina, it is hard to ignore the developments by our neighbours Rock Tech Lithium and their new strategic partnership with premium automaker Mercedes-Benz. Recharge Resources will plan a surface reconnaissance exploration program on our Georgia Lake projects with a goal of identifying the potential for continuity of mineralization from Rock Tech’s active development at Georgia Lake.”

Another nice looking chart. The stock broke out above $0.30, and really we have the same game plan here as we did with Infinity Stone. The stock has rallied hard this week and a pullback is ideal. Profits will be taken and the stock can drop back to the breakout zone where bulls will be waiting to acquire shares. To the upside, the next resistance I have is $0.60.

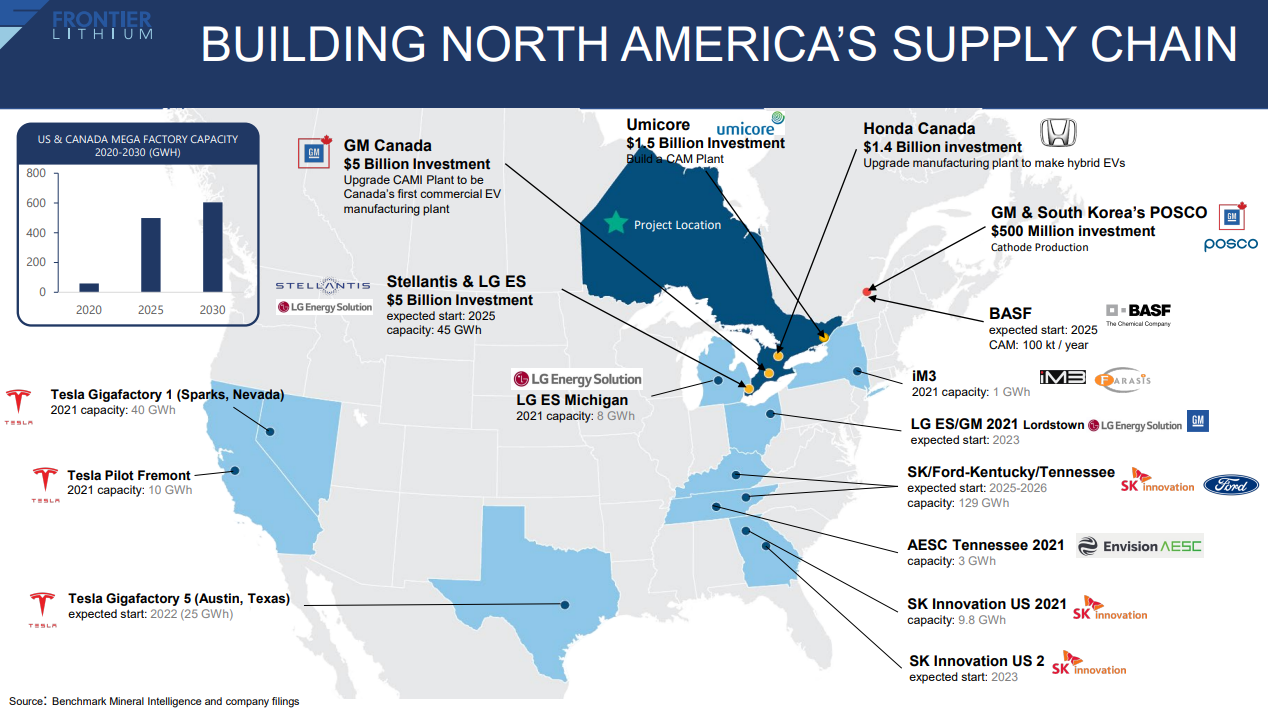

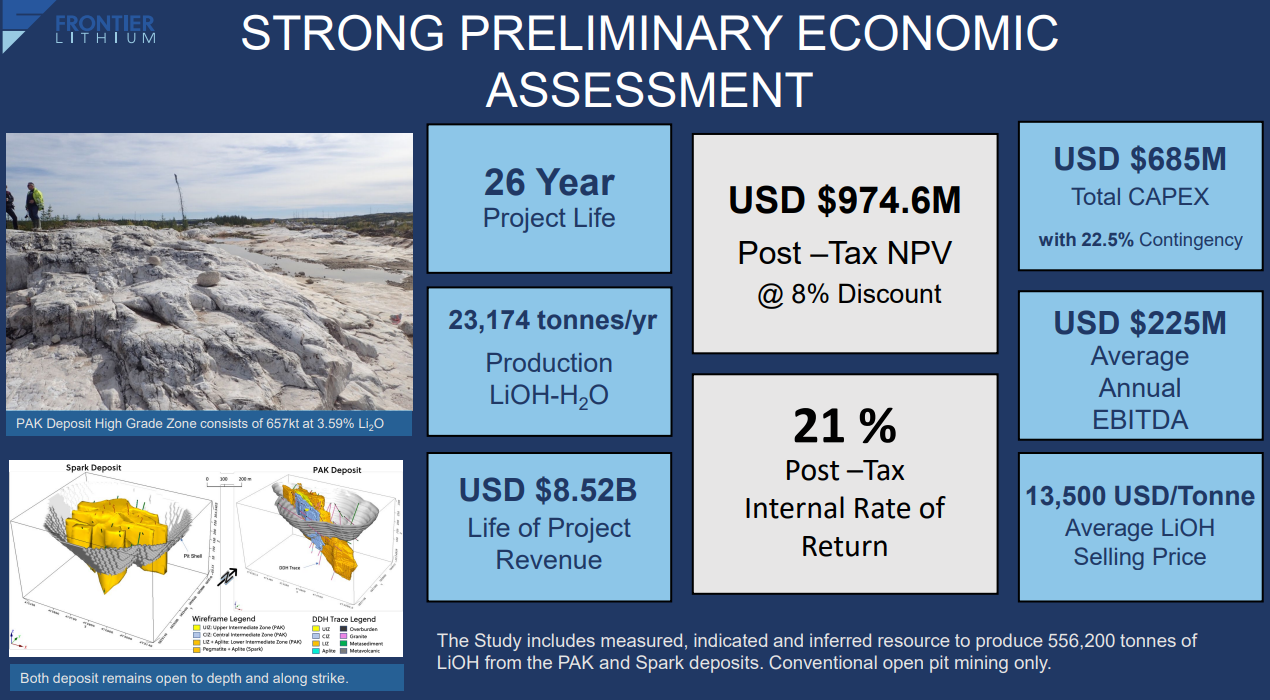

Frontier Lithium (FL.V)

Frontier Lithium is a pre-production business that is targeting to become a manufacturer of battery-quality lithium salts to support electric vehicle and battery supply chains in North America. Frontier is developing the PAK Lithium Project which contains one of North America’s highest-grade, large-tonnage hard-rock lithium resources in the form of a rare low-iron spodumene.

Frontier Lithium is a pure-play lithium development opportunity with the largest land position in the Electric Avenue, a premium lithium mineral district located in Northern Ontario.

Frontier has a tier one global lithium resource and is targeting to be a top 3 in contained lithium size in North America.

This stock chart looks different from the rest. Frontier Lithium had a drop back in May and the stock declined just over 64%. Now, we have recovered almost half of that move. Things are looking promising, but to a technical analyst like me, this kind of looks like a rising wedge pattern which usually hints at more downside.

What I would be looking for is a hold above $2.10 and a break above $2.75.

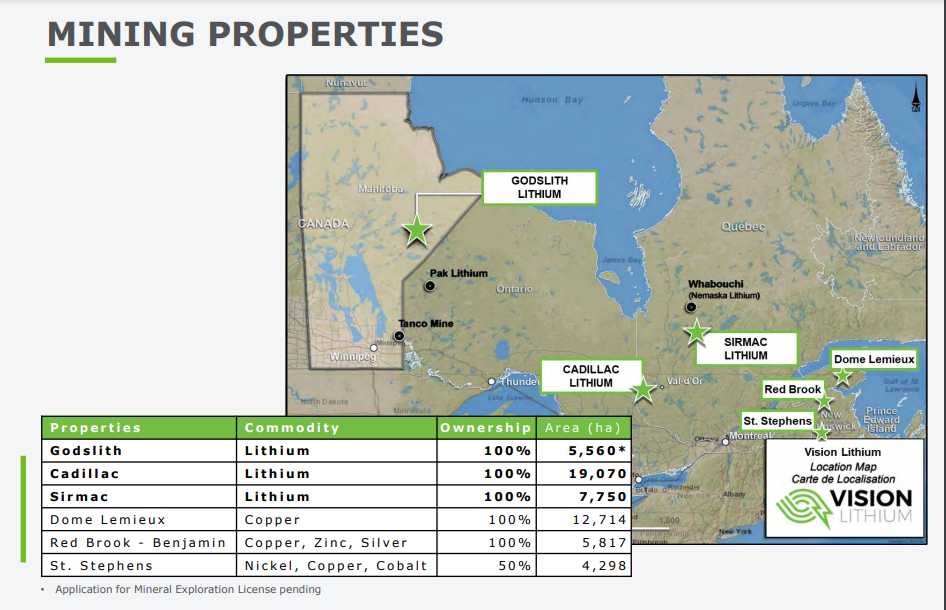

Vision Lithium (VLI.V)

Vision Lithium is a junior exploration company focused on exploring and developing high quality battery mineral assets including lithium and copper.

The company owns three 100% owned lithium properties: Godslith, Cadillac and Sirmac.

Assay results for the first set of drills at Cadillac came out in April 2022. Highlights include an intersect of up to 3.14% Li2O.

| Section | DDH # | Dike | From m | To m | Length m | Li2O % |

| 550E | CAD-22-04 | B | 31.80 | 32.40 | 0.60 | 1.15 |

| 550E | CAD-22-04 | B | 33.90 | 34.40 | 0.50 | 1.72 |

| 550E | CAD-22-04A | B | 31.20 | 32.20 | 1.00 | 3.14 |

| 400E | CAD-22-07 | B | 46.70 | 48.60 | 1.90 | 1.74 |

| 300E | CAD-22-08 | C | 124.60 | 125.77 | 1.17 | 0.79 |

| 450E | CAD-22-13 | C | 152.40 | 158.80 | 6.40 | 1.00 |

Yves Rougerie, President and CEO commented, “The first eleven holes were drilled on the main exposed dike on the property over an initial strike length of 150 m. The drill holes tested the B dike just below an area of surface high grade channel sample results reported in December and January. The B dike varies from 4 to 14 metres in core length and appears to dip at -70 to the South. Spodumene is observed in almost all holes as individual large crystals sparsely distributed throughout the central portion of the dike. This is similar to the observed mineralization on surface. We typically see large crystals in the core resulting in high grade values such as 3.14% Li2O in hole CAD-22-04A and 1.72% Li2O over 1.90 m in hole CAD-22-07 and 1.00% Li2O over 6.40 m in hole CAD-22-13 in the C dike. I am very encouraged by this first pass of drilling. There are still several holes to be reported and based on what we are seeing we will target deeper mineralization in the next round of drilling where the intersections are wider.”

Keep in mind that this is a very early stage explorer. There is more risk, but big upside potential. The stock has been slowly drifting downwards and requires a major catalyst to get things going. From a technical perspective, we would like to see a break and close above $0.08.