Readers know here at Equity Guru we are bullish on all things commodity related. We believe this is the space you want to be in for the inflation trade. Now I admit, I am a bit more biased towards commodities of a shiny nature such as Gold, Silver and Platinum, but I don’t discriminate. I have been bullish on Oil and Gas way before a Russian tank rolled into Ukraine. Most of you know my work through the agricultural commodities, as I have called the bottom on those early in 2021. My Uranium charts are also continuing their upwards trajectory.

One commodity I may have neglected is lithium. I must admit, my hesitancy on lithium is the fact that the lithium battery might not be the be-all and end-all. These batteries operate in nice warm climates like California, hence why many of those in Silicon Valley drive their Tesla Roadsters as a convertible. But, lithium batteries seem to lose their charge quicker in colder climates. Being a Canadian, I’m not too down with that. I am already hearing about the extraordinary costs to pay in order to get the battery replaced.

Lithium is a silver-white light metal. Lithium hydroxide is used in batteries for electrical vehicles and mobile phones. Lithium hydroxide is produced from a chemical reaction between lithium carbonate and calcium hydroxide. The biggest lithium producers are Chile, China, Australia and Argentina. The largest lithium importers are China, Japan, South Korea and the United States.

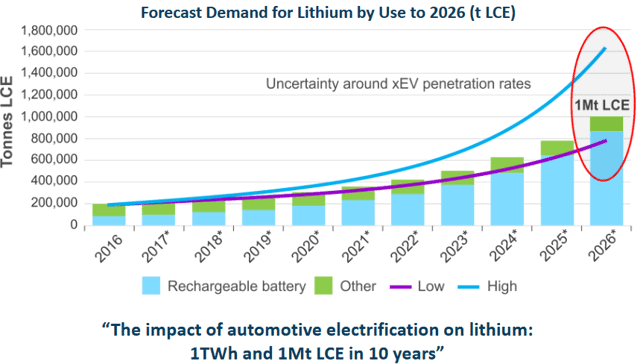

But as of now, electric vehicles (EV) and the lithium battery is what makes up the major demand for lithium. Lithium chemicals prices will remain strong in 2022 in a view that the increase in demand will far exceed new supplies.

Supply crunches is a term we are hearing far too often, but it is a bullish factor for lithium prices and lithium investors. In the Platts survey, a total 80% of the respondents expected that China’s average battery-grade lithium carbonate prices in 2022 would be higher than Yuan 250,000/mt ($39,354/mt), about 316% higher from what it was at the start of 2021. The supply crunch for lithium carbonate and hydroxide is expected to persist at least through the first half of 2022.

Just yesterday, Rivian CEO RJ Scaringe warned about a forthcoming shortage of battery supplies. EV companies are in a mad scramble for raw materials such as cobalt, lithium and nickel. It could explain why Tesla made a secret deal with Vale for nickel at the end of March 2022.

What does this mean for investors? Well firstly, many EV manufacturers may need to cut their production forecasts. We have seen this with Rivian, and to an extent with Nissan and Toyota. Keep your eyes on Tesla, but they will attribute forecast cuts due to lockdowns in China. The important thing for investors to take away is that EV manufacturers will need to expand their suppliers. They will need to receive raw materials and parts from multiple suppliers rather than a single supplier.

If demand for lithium is going to be increasing, while supply remains constrained, more money is likely to flood into developing lithium resources. Good news for lithium juniors that are de-risked and have a nice resource.

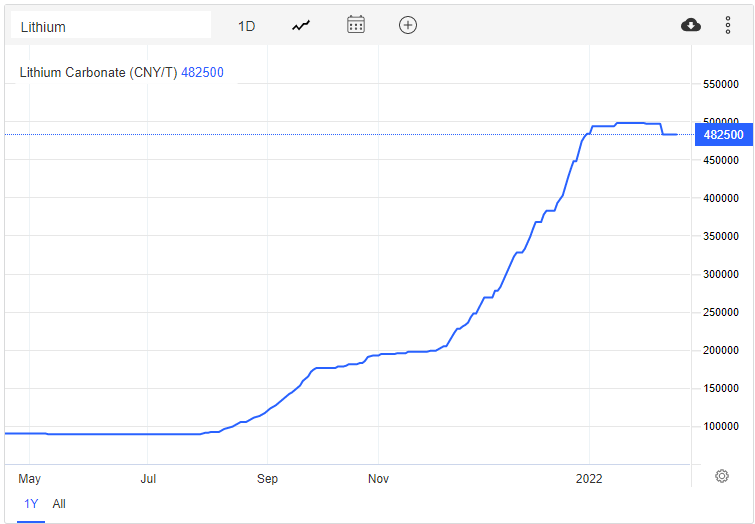

Lithium prices are already having a great year.

Lithium carbonate started off 2022 strongly before beginning to stall in March. This is the Lithium Carbonate which is traded in China, so the Shanghai lockdown explains why the prices have just ranged.

Meanwhile lithium futures in the US keep on rolling higher and higher. We tagged highs at $81.50 per kg.

When it comes to stock performances, it sort of is mixed.

The global X Lithium and battery tech ETF had a nice uptrend until Fall of 2021 before reversing and giving up the gains. There were signs of a nice recovery in early March 2022, but no momentum after breaking out above $80. Not much I can say on the technicals except that it is quite bearish for us to not build on momentum. I see a potential drop lower.

So what is the best way to invest in Lithium? Here are some companies for your consideration.

Alpha Lithium (ALLI.V)

Market Cap ~ $145 million.

Alpha Lithium is focused on the development of the Tolillar and Hombre Muerto Salars. In Tolillar, they have assembled 100% ownership of what may be one of Argentina’s last undeveloped lithium salars, encompassing 27,500 hectares (67,954 acres), neighboring multi-billion-dollar lithium players in the heart of the renowned “Lithium Triangle”.

The Lithium Triangle is found surrounding land mass in Argentina, Chile and Bolivia.

Alpha Lithium is surrounded by big players in the area. We are talking about billion dollar producers and acquisitions. Take a peek:

There was big news 5 months ago. Alpha Lithium secured US $30 million investment from Uranium One with the right to invest an additional US $185 million at Tolillar Salar. If the Option is exercised, Alpha would retain a 50% interest in Tolillar, which would be fully funded up to the point of commercial production. The implied project value is US $529 million, but this investment provides capital for the commercial production facility.

Just like the Lithium X ETF, the chart of Alpha Lithium follows the same structure. But we are battling near the important psychological zone of $1.00. I have drawn out a small range. $0.95 to the downside and $1.12 to the upside. Just wait for a break. If we do breakdown below $0.95 unfortunately it would mean a move back down to $0.65. Whereas a breakout could see us hit the resistance at $1.35.

Argentina Lithium and Energy (LIT.V)

Market Cap ~ $33 million

Argentina Lithium & Energy Corp is focused on acquiring high quality lithium projects in Argentina and advancing them towards production in order to meet the growing global demand from the battery sector. The management group has a long history of success in the resource sector of Argentina.

Their projects are also in the lithium triangle:

This company is still in the early stages but has a major factor: management. Joseph Grosso is a director and he is the President and Founder of Grosso group, who have been involved in four major mineral discoveries in Argentina. They are Gualcamayo Au (Mineros SA), Chinchillas Ag-Pb-Zn (SSR Mining), Navidad Ag-Pb (Pan American Silver Corp), and Amarillio Grande U-V (Blue Sky Uranium Corp). Can they add a fifth major discovery dealing with Lithium?

As mentioned earlier, this is an early stage company. Drilling is expected at Rincon W and Antofalla North this year. All their properties are located near good infrastructure which allows for year round access.

The stock had a nice pop in October of 2021, but then gave that move all back. Since then, the stock price has just been ranging between $0.50 as resistance and $0.315 as support. A breakout above $0.50 would see some resistance at $0.565 before making a larger move higher. However, the stock could just find itself in a range until drilling and a catalyst comes out.

Critical Elements (CRE.V)

Market Cap ~ $343 million

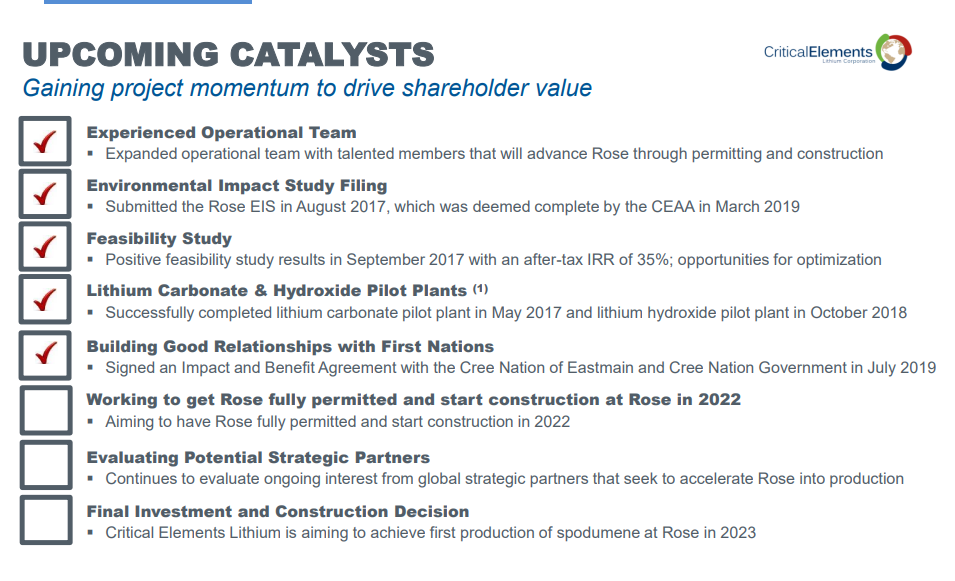

Let’s end off with a higher market cap company based in Quebec, Canada. Critical Elements is aspiring to become a large and responsible supplier of Lithium. Critical Elements is advancing the wholly owned, high purity Rose lithium project in Québec. Rose is the Corporation’s first lithium project to be advanced within a land portfolio of over 700 square kilometers.

A feasibility study was completed in 2017 for the production of spodumene concentrate. The internal rate of return for the Project is estimated at 34.9% after tax, with a net present value estimated at C$726 million at an 8% discount rate.

For the geography buffs, yes Quebec is much closer to US and EU markets than Argentina. Quebec offers good infrastructure including a low-cost, low-carbon power grid featuring 93% hydroelectricity.

The project has received approval from the Federal Minister of Environment and Climate Change on the recommendation of the Joint Assessment Committee, comprised of representatives from the Impact Assessment Agency of Canada and the Cree Nation Government. Now, Critical Elements is hoping to obtain the same approval under the Quebec environmental assessment process.

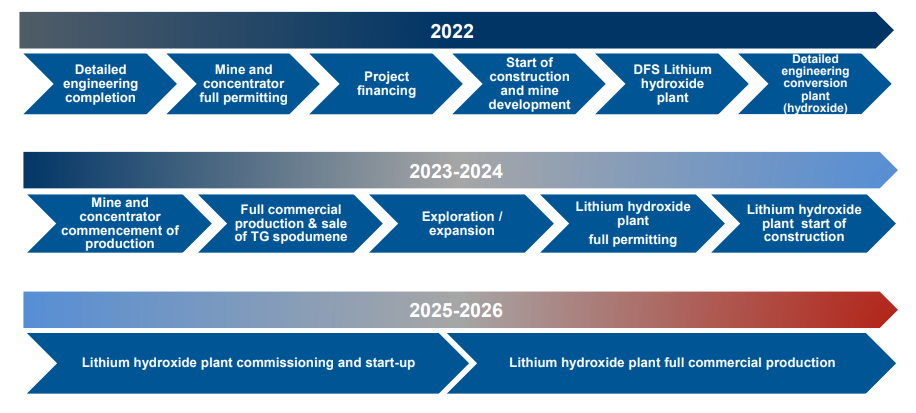

The company is expected to begin construction at Rose this year. Critical Elements is focusing on securing the final permits and project financing, aiming for first production in 2023. 2022 will be a big year for the company.

The stock has been ranging since the beginning of 2021. $1.20 is the major support, and I would be a buyer if the stock did drop back to that level. The peak was $1.95 in November 2021, a move with all the lithium companies. However, we do have some interim resistance around $1.70. We have seen the stock stall here before in June 2021, and we are now seeing a stall currently. There was a big 14% pop on March 31st 2022, but not much momentum on the days following. We would love to see more momentum higher especially with a large candle like that with volume around 1,000,000 shares traded.

I would watch to see if the stock can remain above $1.50, where we could find some interim support. But this is a stock definitely for the long term.

In summary lithium prices are also rallying alongside with most commodities. Things are looking good for lithium investors. We are hearing that demand is increasing while supply needs to catch up. This means we should expect to see money moving to some of these lithium stocks, especially those that are de-risked and close to near term production. Critical Elements and Alpha Lithium are companies that meet this criteria. Keep your eyes on both of them.