Earnings season is well upon us! Netflix was one of the most anticipated given the epic gap downs the last two earnings have caused. If you recall, back then the major drop in earnings affected the US stock market indices. This time, US stock markets were in the process of reversing and breaking out to the upside. This momentum would have been stopped in its tracks if Netflix stock gapped down for the third earnings in a row. Thankfully (for bulls!) it did not.

Netflix shares popped post market (nearly 8%!) yesterday after the company said it lost fewer subscribers than anticipated during the second quarter of 2022.

Why is this big? Well it is a surprise. In the last quarter earnings, Netflix warned investors that it expected to lose 2 million subscribers during the three month period ending June 30th. Instead, Netflix lost 970,000. The large gap down we saw in the previous earnings was pricing in this major subscriber loss. This means we should expect to see Netflix make up some of those lost gains.

Here is a quick summary of the numbers:

- EPS: $3.20 vs $2.94 per share, according to Refinitiv.

- Revenue: $7.97 billion, vs. $8.035 billion, according to Refinitiv survey.

- Global paid net subscribers: A loss of 970,000 subscribers vs. expectations of a loss of 2 million, according to StreetAccount estimates.

Subscriber growth could be turning. For Q3, Netflix expects net adds to reach 1 million reversing losses seen during the first half of the year. The streaming giant also said it is in the early stages of its paid sharing plan. Recall that this was the plan in order to upcharge Netflix members for sharing their subscription with others who live outside their home. A wider rollout of this is expected in 2023.

The most interesting element came from Netflix’s comments on a stronger dollar. As you all know, I have been warning about the US dollar strength. Netflix is saying the strong dollar will impact its international revenue, which makes up 60% of its top line. If the dollar keeps on strengthening, I am sure the effects on US corporations will be reflected in Q3 earnings.

The final bit of news that got investors excited had to do with comments on plans to unveil its lower cost, ad supported tier in early 2023. Microsoft will be the partner on the ad supported offering.

“We’ll likely start in a handful of markets where advertising spend is significant,” the company said in its shareholder letter. “Like most of our new initiatives, our intention is to roll it out, listen and learn, and iterate quickly to improve the offering. So, our advertising business in a few years will likely look quite different than what it looks like on day one.”

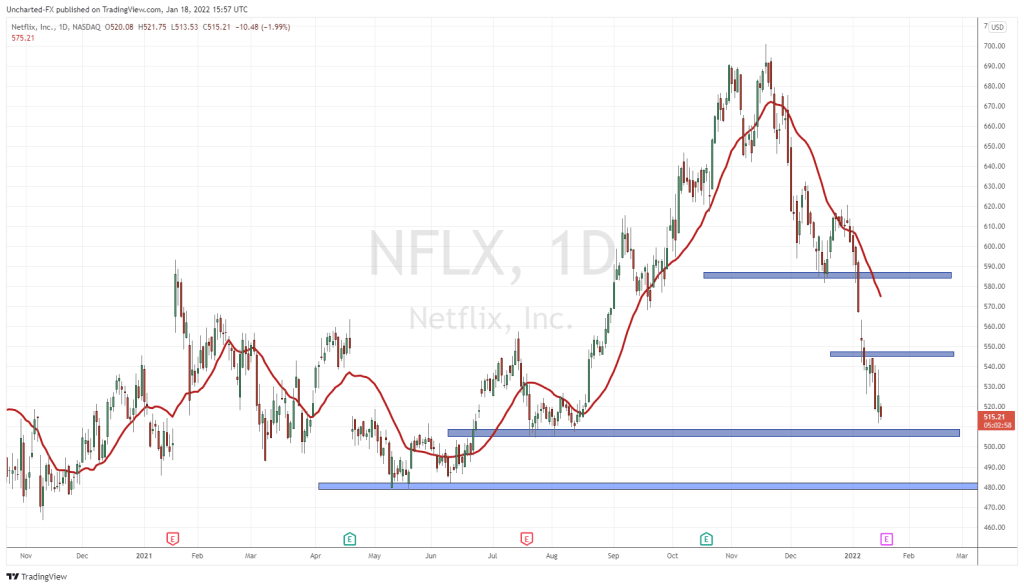

When it comes to the stock chart set up, I am a fan. It meets most of my criteria for a long. But there is just one element missing.

Netflix stock has been bouncing below $200 and above the $160 zone since May of 2022. A two month range is set to break depending on how we close today. The missing element is the confirmed breakout above the range, or a daily close above $200. Current price action is showing a breakout, but it is still very early in the trading day as I write this. A lot can happen from now until 1 pm PST/4 pm EST.

This break is happening at a crucial time. Netflix is breaking out of a range just as US stock markets are doing the same! Stock markets are showing signs of a bottom, and the Netflix pop will help in sustaining market breakouts. You can read about the bottoming set ups here.

Things are looking good. Now the next company I will be watching is Meta (Facebook) as its stock also gapped down like Netflix after the past two earnings.