Admit it. When you think of helium, you probably think of funny squeaky voices and entertainment. Some of you might even be thinking about the helium (HNT) cryptocurrency. What doesn’t come to most people’s mind is helium being one of the top commodity performers of 2022. And it could just be the beginning given fundamentals.

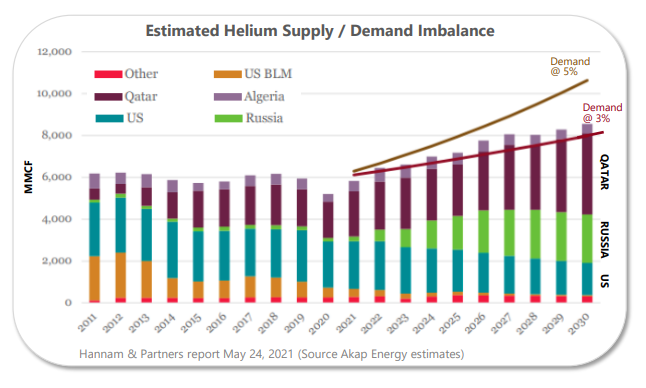

Three weeks ago NPR put out an interview from the show “All Things Considered” where the topic was helium. Helium prices are blowing up as the headline. A helium shortage is developing given the current situation of rising costs and supply disruptions. Yes, the war in Ukraine is also affecting helium.

Phil Kornbuth, President of Kornbluth Helium Consulting, says 4 of the 5 major helium suppliers have implemented “formal allocations”. Translation – they’re basically triaging existing customers. A company that is buying helium is getting somewhere between 45% and 65% of its historical volume depending on who their supplier is. Mr. Kornbuth also said that everything that could go wrong for helium has gone wrong in he first half of the year. War is one thing, but there has also been random fires and maintenance shutdowns.

This has even led to a rise in prices for party balloons, helium’s least important job. Balloons which were once $5 are now going for $20. Party supply stores and balloon decor specialists have been forced to raise prices…and even ration balloons. An example is given that the longstanding tradition of releasing red balloons at a Nebraska Huskers game after the first score has been dropped. The red balloons could not be provided.

But this commodity is not traded because of balloon demand. Helium has many important applications. One intriguing thing for investors is the fact that helium cannot be substituted for many of these applications! We are talking about helium being used to cool magnets in MRI machines and in manufacturing semiconductor chips. Industries such as aerospace, fiber optics and welding all need a bit of the helium. Hence, shortages will be a real problem.

This is why helium could be the hottest commodity play of 2022. This is saying something given the drop in commodities recently due to recession fears. The fundamental backdrop means that helium prices will remain buoyed. And as you will see below, acquisitions in the helium space are already occurring!

Here are other uses for helium:

1. Heliox mixtures in respiratory treatments for asthma, bronchitis and other lung deficiencies

2. MRI magnets

3. High speed Internet and Cable TV

4. Mobile phone, computer and tablet chips

5. Computer hard drives

6. Cleaning rocket fuel tanks

7. Microscopes

8. Airbags

9. Detecting leaks, such as in the hull of a ship

10. Shielding in welding

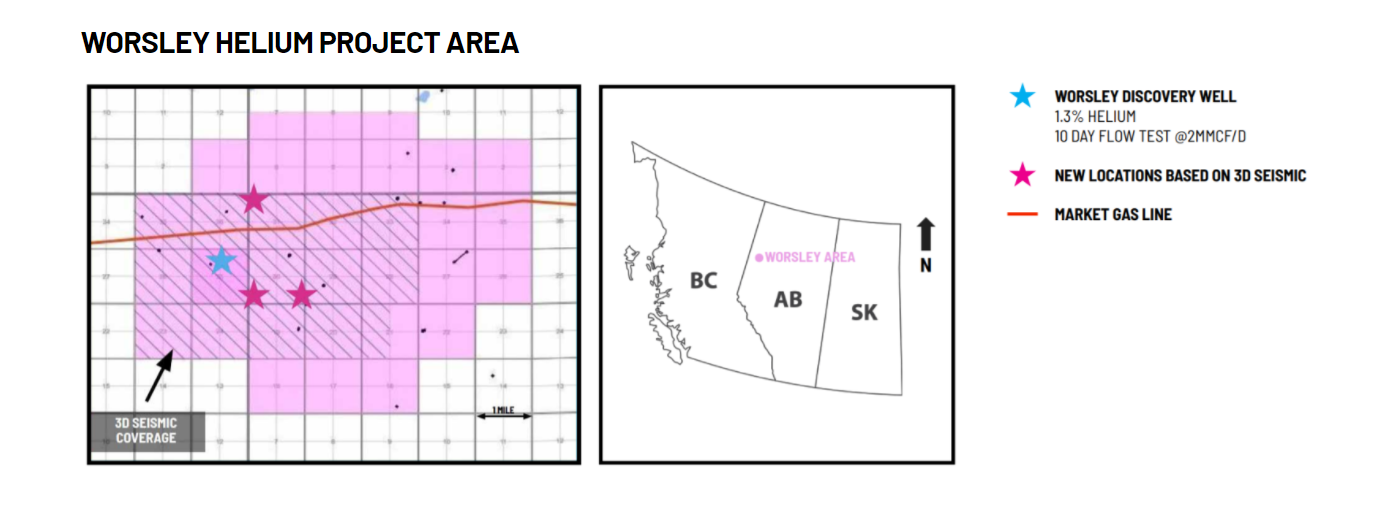

So what exactly is helium? After hydrogen, helium is the second most abundant element in the universe. It is also the second lightest making it easy to slip out of the Earth’s atmosphere. A lot of it is found deep under the Earth’s crust, and actually, in the same layer where natural gas is found. This is why helium mining occurs near current gas lines.

Extraction can be a challenge:

Helium is mined along with natural gas, using a drill rig to drill wells deep into the earth’s crust. A drill rig must penetrate a layer called the Cap Rock to reach a natural gas reserve. Once located, the natural gas and Helium rise and fill the rig, which are then led through a series of piping systems that transport the natural gas and crude Helium to a refining plant.

Most crude Helium tapped from natural gas reserves is only around 50% pure, so other gases must be separated through a scrubbing process. There is a significant amount of Nitrogen in crude Helium, as well as methane gases that must be removed. Cryogenic separation units compress the crude Helium, cooling the gases at subzero temperatures until they are liquified. Once liquified, the Nitrogen and methane gases are drained.

After this cooling process, heat and Oxygen are added to remove any Hydrogen left over. When Hydrogen and Oxygen molecules meet, they create water. The gases undertake an additional cooling process, in which the Hydrogen and Oxygen are drained from the mixture. Once Helium has gone through each of these steps, tiny particles are added to complete additional purification until the Helium reaches 99.99% purity.

With all this in mind, let’s take a look at 3 Canadian helium companies that are poised for a big 2022.

First Helium (HELI.V)

Market Cap ~ $31.8 Million

First Helium is an advanced helium miner in this list. To use a mining term, First Helium has a ‘shovel ready’ project with the goal of becoming a North American producer with cash flows in the near term. They are ready to produce pending processing facility installation.

The company is a helium exploration and development company operating in the Worsley area of Alberta, Canada. They acquired strategic mineral rights to over 32,000 hectares of land that provide control of a substantial portion of the prolific Worsley Trend. First Helium was founded to capitalize on the untapped potential of significant helium resources in Western Canada.

There has been some drilling this year, but the most recent news details cash flow from the sale of light oil. $1.2 million was received for sales during the month of April. This cash flow will be used to fund helium exploration and to build the development facility at Worsley.

The stock chart is at an interesting level. Just by looking at the slope of the chart, it does appear as if the uptrend is weakening. Some may argue it’s over.

The $0.50 zone tends to be a very important psychological level for stocks priced under a dollar. In recent days, first helium has seen a battle here between the bears and the bulls. The bulls are holding on so far. For the bears to win, we would need a close below this current range below $0.465. That would take us to $0.36.

For the upside, I would watch for a close above $0.56 to trigger a breakout of this recent range. Price could then pop up to $0.69 (nice!) before retesting previous all time highs.

As always, these are investments for the long term betting on the rise of helium prices and the need for more projects, seeing an inflow of capital to these companies.

Royal Helium (RHC.V)

Market Cap ~ $47.8 Million

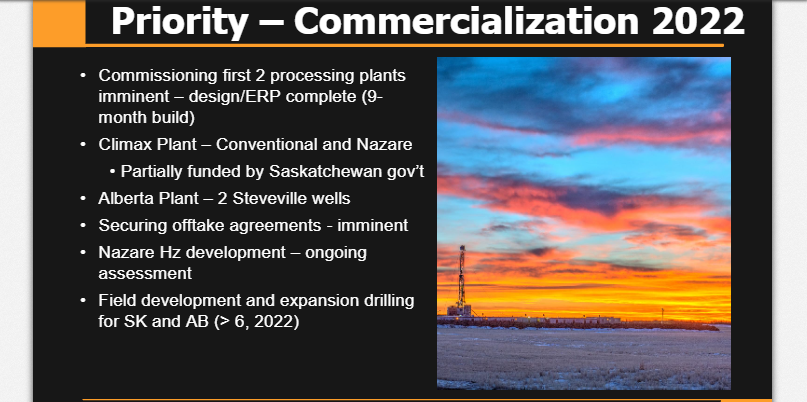

Royal Helium Ltd. engages in the exploration and evaluation of helium properties. Royal controls approximately 1,000,000 acres of prospective helium land in south-west and south-east Saskatchewan, making them one of the largest helium leaseholders in Canada.

All of Royals’ lands are in close vicinity to highways, roads, cities and importantly, close to existing oil and gas infrastructure, with a significant portion of its land near existing helium producing locations.

There has been some helium drilling in this, but the recent press release has to do with Royal Helium receiving a comprehensive simulation study for a multistage hydraulically fractured horizontal wells. Over 600 simulations were run with multiple variables, using the data from Royal’s DST and DFIT operations in the Climax-4 well. Royal is currently evaluating several of the viable production well models presented and will select the ultimate design(s) that will have the largest deliverability with the quickest payback period.

Royal anticipates well design finalization and drilling of the first Nazare well in late 2022. There’s an upcoming catalyst for shareholders.

There is another major catalyst, but I will discuss that with Imperial Helium below.

Now this is a type of set up that I tend to take for my swing trades. We see the same structure on many of the charts that I highlight in my Equity Guru articles. Set ups that lead to wins when they trigger.

Royal Helium is ranging after a downtrend. The bottom portion of the range comes in at $0.30, while the top part comes in at $0.38. The trigger is the breakout above $0.38. The stock could continue to range for longer given the current situation with Imperial Helium discussed below. In fact, the stock chart of Imperial looks very similar structurally. That is saying something.

Overall, when you combine the fundamentals of helium with technicals, Royal Helium has a very attractive set up for an entry.

Imperial Helium (IHC.V)

Market Cap ~ $ 15.9 Million

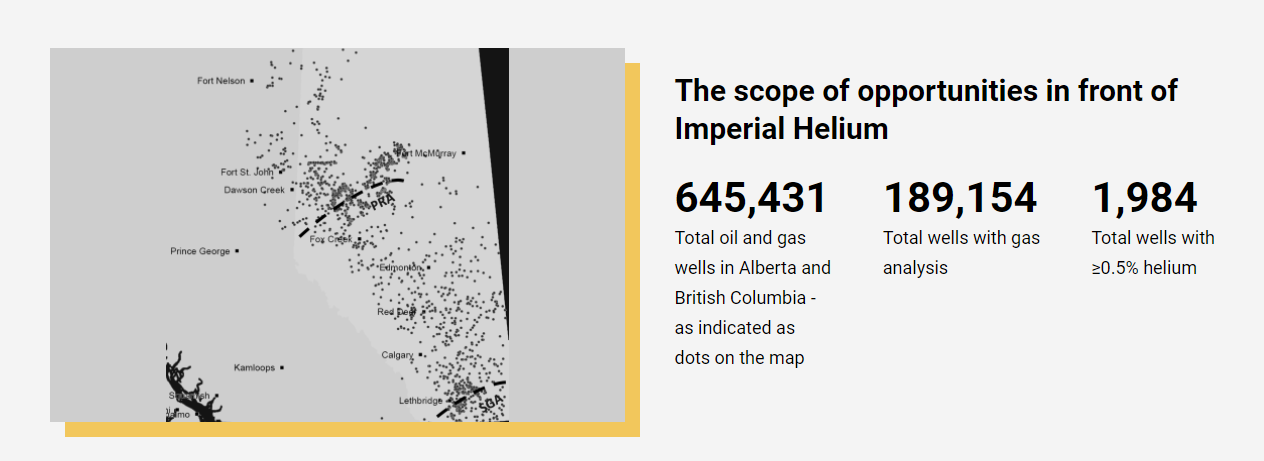

Imperial Helium Corp. is focused on the exploration and development of helium assets in North America, initially through the anticipated commercialization of its Steveville, Alberta helium discovery.

Imperial Helium has developed a proprietary database of existing helium bearing well bores that are being evaluated for acquisition. Targeting is focused on wells with contingent concentrations of helium and existing infrastructure. The analytical geoscience and engineering approach undertaken to source these helium opportunities eliminates the fiscal risk of finding uneconomic concentrations of helium in the exploration process.

The strategy is to prioritize acquisition of proven helium resources over higher risk exploration programs by using this proprietary database. This approach leads to helium production within 24 months of acquisition and helps fill a significant gap between demand and supply in North America.

I mentioned acquisitions already occurring in this space. On May 2nd 2022, Royal Helium announced that they have entered into an agreement to acquire Imperial Helium for a 10.01% premium to Imperial shareholders based on the closing price of Imperial shares on April 29th 2022 ($0.235).

The board of directors and executive management teams of both Royal and Imperial believe that the Arrangement will provide significant benefits to the shareholders of both companies. Some benefits are:

- represents an attractive opportunity for Imperial Shareholders to own shares in a larger, more liquid publicly traded entity at an exchange ratio that implies a 10.01% premium to the current trading price of Imperial Shares;

- allows Imperial Shareholders to participate in the exploration and development growth upside with Royal’s 1 million+ acre helium land base comprised of over 10 separate potential helium fairways that has seen over $20 million of capital investment to date in the form of magnetic surveys, seismic surveys, geoscience and exploration drilling;

- creates a larger entity with increased access to capital to enable the financing of ongoing exploration, development and processing plant expenditures;

- represents the accretive acquisition of two ready-to-produce helium wells to bring on production along with Royal’s Climax wells;

- increases Royal’s near-term production assets and expected early cash flow;

- creates a logical consolidator of additional helium exploration and development opportunities with Imperial Shareholders expected to realize the benefit of being early shareholders;

- creates an entity with significant indicative helium capacity enabling the expedition of offtake discussions and increased opportunity to monetize assets;

- materially reduces Royal and Imperial’s aggregate general and administrative costs;

- creates an entity of a scale that is expected to be more relevant to international investors with the combination creating one of the largest diversified helium companies listed on a Canadian exchange.

The shareholder meeting to approve the plan of arrangement will be held on July 12th 2022 and is expected to close no later than July 31, 2022 , the day after this article is published.

The stock chart looks similar to the structure of Royal Helium. A major range with a breakout triggered with a close above $0.20.

This isn’t a stock I would be chasing right now as there is the big acquisition news. We will find out how the shareholder meeting goes, but the better way to play this would be to own shares of Royal Helium after the acquisition. Royal gets Imperial’s proprietary database and does a lot of positive things for Royal as listed above.