Oil and other commodities are pulling back heavily after huge moves backed by geopolitical headlines. Geopolitical uncertainty might decrease in the short term with peace talks and a cease fire. But geopolitics will still be a huge concern in the long term. There is also the inflation trade, where yes, I think it would be prudent to hold commodities and other hard assets. I prefer physical metals, and then trade the paper contracts for other commodities.

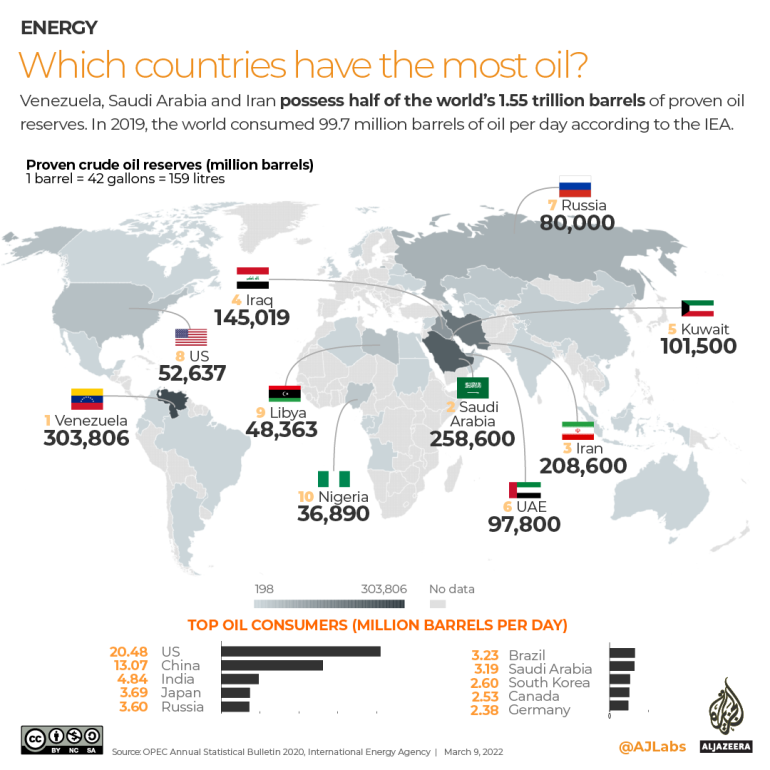

A lot of talk about Russian oil being banned, and how the West will make up for Russian imports. The US is actually considering Venezuelan and Iranian oil. Maybe not the latter after they shot missiles into Iraq anymore. But one thing should be noted. Why not Saudi Arabia? More on that in just a second.

When it comes to Russian energy, I am of the opinion that Europe needs Russia more than Russia needs Europe. This is why I am looking at shorting the Euro and buying the Ruble sometime later. For people who think I am crazy, a lot of traders are looking to buy Russian companies and the Ruble. At time of writing, the Ruble had a strong day gaining double digits against the US Dollar and the Euro.

So how can I say something as crazy as Russia doesn’t need Europe as much as Europe needs Russia? Well Russian energy will be flowing to Asia. China will gladly buy more, and India is already exploring a Rupee-Ruble exchange for Russian energy. South Korea and Japan will do the same, and the other emerging Asian markets like Philippines, Indonesia and more will likely be exploring CHEAP Russian energy. The issue will be how the US and allies respond. Will it mean sanctions? If so, then we are looking at a major East vs West split.

When it comes to energy, we have to talk about geopolitics. Some people are surprised at how China and India are supporting Russia, and all I can say is please go back and read about BRICS (Brazil, Russia, India, China and South Africa). These countries have been developing their own SWIFT payment system since 2015! They have been preparing for a time like this.

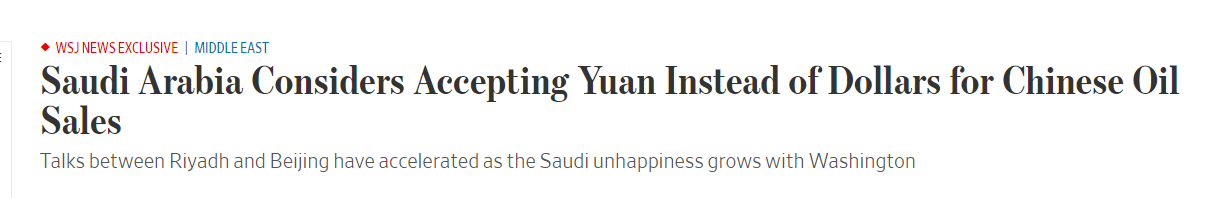

To add more drama to all of this, we need to bring up Saudi Arabia. Saudi and American relations don’t seem too great right now. In fact, future King and current Crown Prince Mohammed Bin Salman (MBS), have been becoming good friends with Putin in the last few years. Remember that MBS-Putin high five meme? Some of the contrarians have been saying all that is required to ‘kill’ the US Dollar would be the end of the PetroDollar system.

I wrote a piece for Equity Guru over two years ago titled, “The Tale of Two Dollars“. I suggest you read it…and look at what is happening in the world today. A lot of the points I brought up are occurring. I detail the Dollar and its reserve currency status. There is always artificial demand for the US Dollar. The Dollar is also used for oil and energy payments around the globe. This PetroDollar system was signed by King Faisal of Saudi Arabia. The Saudis are important to all of this.

What this means is as long as the world needs US Dollars, the US debt really doesn’t matter. They can continue to print dollars, and the world buys up US debt because they need Dollars. If the world begins to reject the Dollar…that’s when the you know what hits the fan. And we may be in that process right now.

Russia is obviously not accepting Dollars for their energy now. Before the situation in Ukraine, Russia signed a gas deal with China which was paid in EUROS. This was a sign to Europe, saying hey, we will gladly take your Euros instead of Dollars. The truth is Europe and many other countries still require Russian energy and commodities. These payments going forward will not happen with the US Dollar.

But wait. There’s more drama.

Just yesterday, this bombshell WSJ exclusive came out:

This is big. Really big folks. It does look like Russia and China are now making moves to bring down US Dollar demand…and eventually, the US Dollar with it. The Saudis will probably play both sides, but a lot of us contrarians have said MBS might flip East since he and Putin are good friends. What the Saudi royal family wants is military protection. If Russia and China can guarantee this, then they might consider dropping the PetroDollar.

Follow this story like a hawk, because this has the potential to change the whole economic landscape.

So should you be buying oil? The short answer is yes, I believe so. The long answer is to expect a bit of a pullback before jumping in. I expect some short term pullback on all commodities, but remain bullish on them for the long term.

We have the Fed up on the 16th of March. A hawkish Fed could cause the Dollar to rally, and thus, impact oil and other commodities. Long term, I still think geopolitical uncertainty will continue, and will be a factor for rising oil prices. It would be a prudent thing to add some oil plays in this drop down.

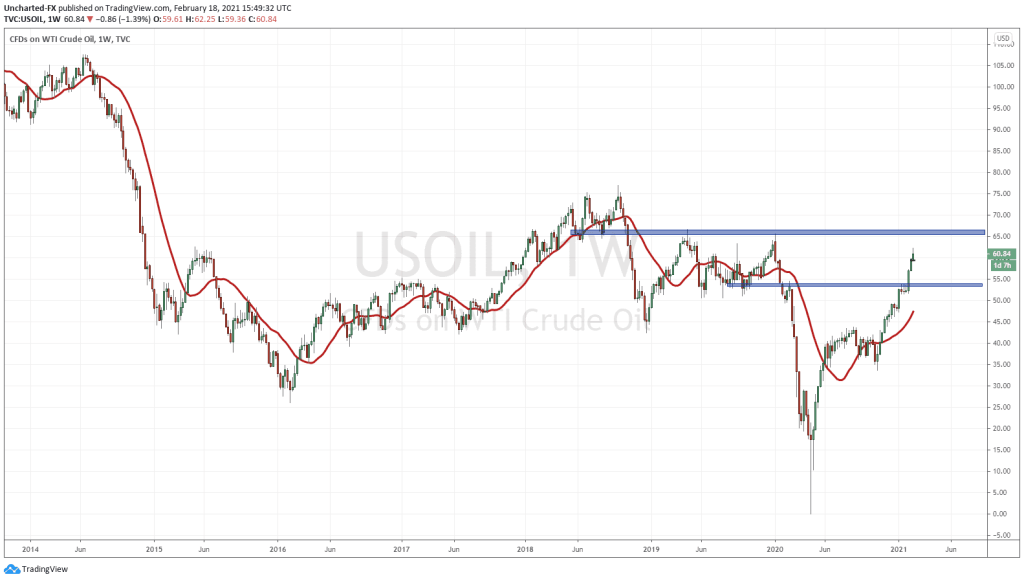

Above is my chart of US West Texas Oil. We have pulled back more than 20% since printing highs around $130. Now it is all about finding support. As of now, it does not look like $100 will hold a major psychological level.

I am thus looking for lower support. Around the $85 zone, and perhaps a hawkish Fed or some sort of peace treaty in Ukraine could get us there.

If that breaks, I look for support at $76 and then around $68, but to be honest, I don’t think we go down that far UNLESS we get some sort of major deflationary shock such as China locking down due to covid or other things.

In terms of plays, there are many ways to play oil.

The ETF XLE is many people’s preferred method to gain oil exposure. Note how we are testing a huge support level at $70 which also meets up with an uptrend line. A lot of oil charts will look like this.

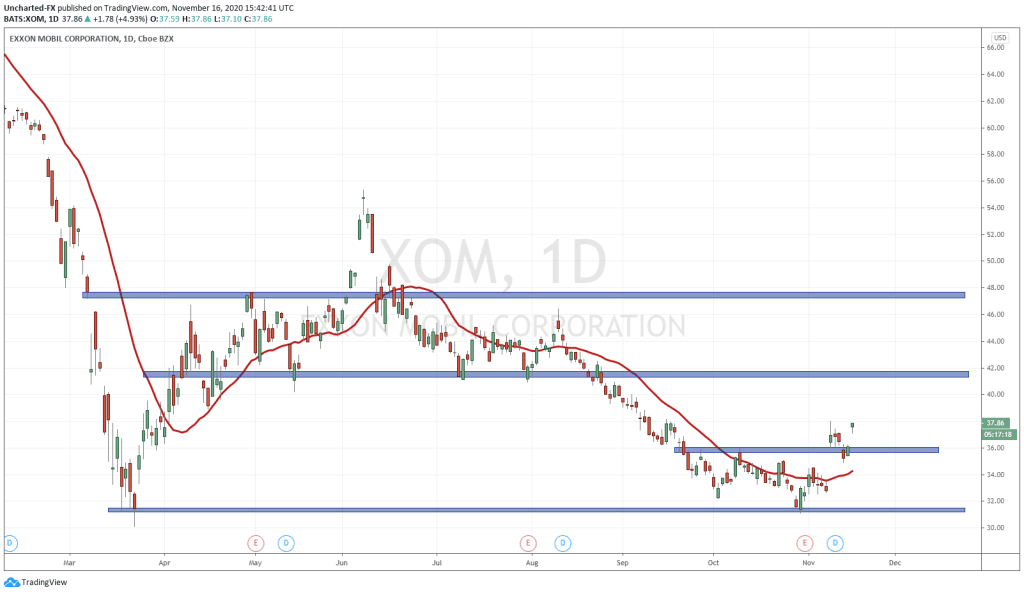

You can play the big dividend paying stocks such as Exxon Mobil and Chevron. A lot of people like Chevron because they have the best balance sheet of the big oil companies. They are also diversifying into things such as thermal and exploring other renewables. The stock is making new all time record highs after breaking above $135.

You want to invest like Warren Buffet? Look no further than Occidental Petroleum (OXY) which he recently bought. A substantial amount as well.

Berkshire bought 27.1 million shares of Occidental worth about $1.6 billion from Wednesday through Friday. The bulk of the purchases—some 24 million shares—occurred Wednesday when volume spiked to 134 million shares, above the average of 20 million in the past year.

Those are relatively safe plays for your portfolio. For those wanting to play Oil for the long term, I suggest looking at some smaller plays here. I am keeping an eye on Pulse Oil (PUL.V), Prairie Provident Resources (PPR.TO) and Hemisphere Energy (HME.V).

Pulse Oil (PUL.V)

Market Cap ~ 16 million

Pulse Oil Corp. engages in the exploration and production of oil and natural gas projects in Alberta. It owns 100% interests in the Bigoray assets covering approximately 5,349 net acres of land in the Bigoray area of Alberta; and the Queenstown assets covering approximately 3,023 net acres of land in the Queenstown area of Alberta.

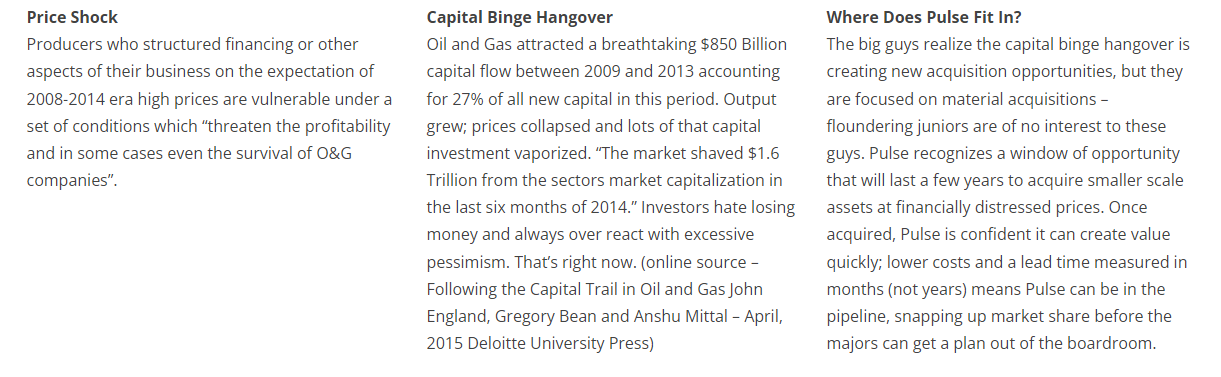

The company is led by Drew Cadenhead and Garth Johnson, and the goal is to take advantage of the current window acquisition opportunity to build a well located, productive and profitable property portfolio positioned for exceptional growth using Pulse Oil’s enhanced oil recovery program (EOR).

Recent news is about a $12.5 million financing at $0.05 per share. If it closes, the company has the cash for catalysts and long term goals.

For you traders out there, I am spotting a broader cup and handle pattern here. A break and close above $0.075 is required to trigger this. A trigger means a reversal pattern and the start of a new uptrend.

We don’t want to see the stock close below $0.035 as it would invalidate the handle part of the pattern. The stock looks like it is bottoming, and any major catalyst would provide you with a nice return on your money.

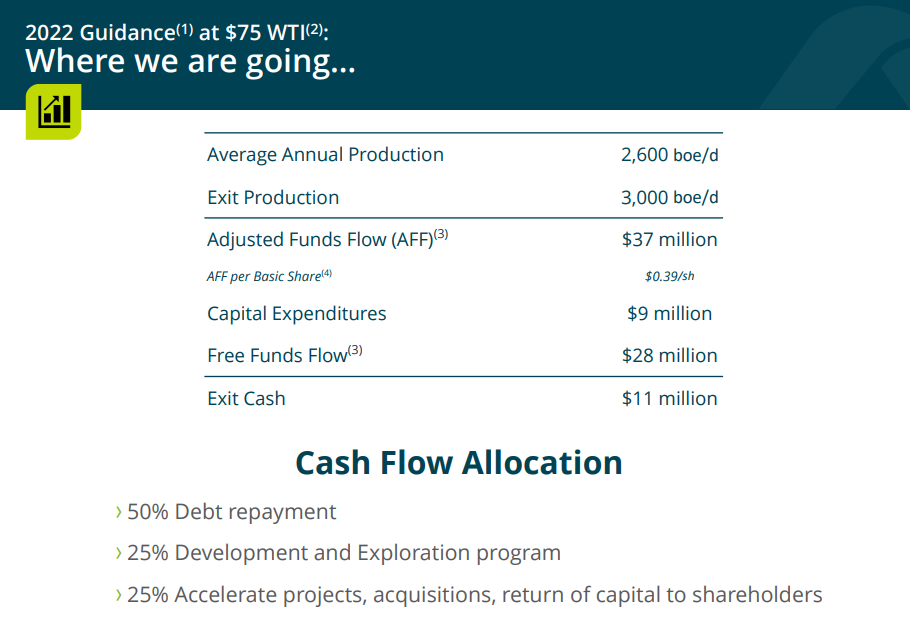

Hemisphere Energy (HME.V)

Market cap ~ 127 million

Hemisphere Energy Corporation acquires, explores for, develops, and produces petroleum and natural gas interests in Canada. It primarily owns a 100% working interest in 8,800 net acres of land in the Atlee Buffalo property located in southeastern Alberta; and a 100% working interest in 8,024 net acres of land in the Jenner property situated in southeastern Alberta.

The company was recently named to the 2022 top 50 TSX venture exchange performers.

Hemisphere develops conventional oil pools using enhanced oil recovery methods such as waterflood and polymer flood to maximize production and oil recovery. Develop low cost operations with a minimal environmental footprint.

Assets in Southeast Alberta. Developing two significant oil pools in the area of Atlee Buffalo.

Many believe the stock is still undervalued at these prices. Hemisphere energy will also be bringing production online from 4 new wells which were drilled in 2021. Corporate production for the month of January 2022 averaged approximately around 2,390 boe/d.

The stock has been printing all time record highs after climbing above $0.80. We hit highs of around $1.50 before turning around. With the fall in oil, there is a chance that Hemisphere breaks below $1.25 which is currently holding up as near term support right now. The major support comes in at $0.80, but I think the psychological zone at $1.00 is worth keeping your eyes on!

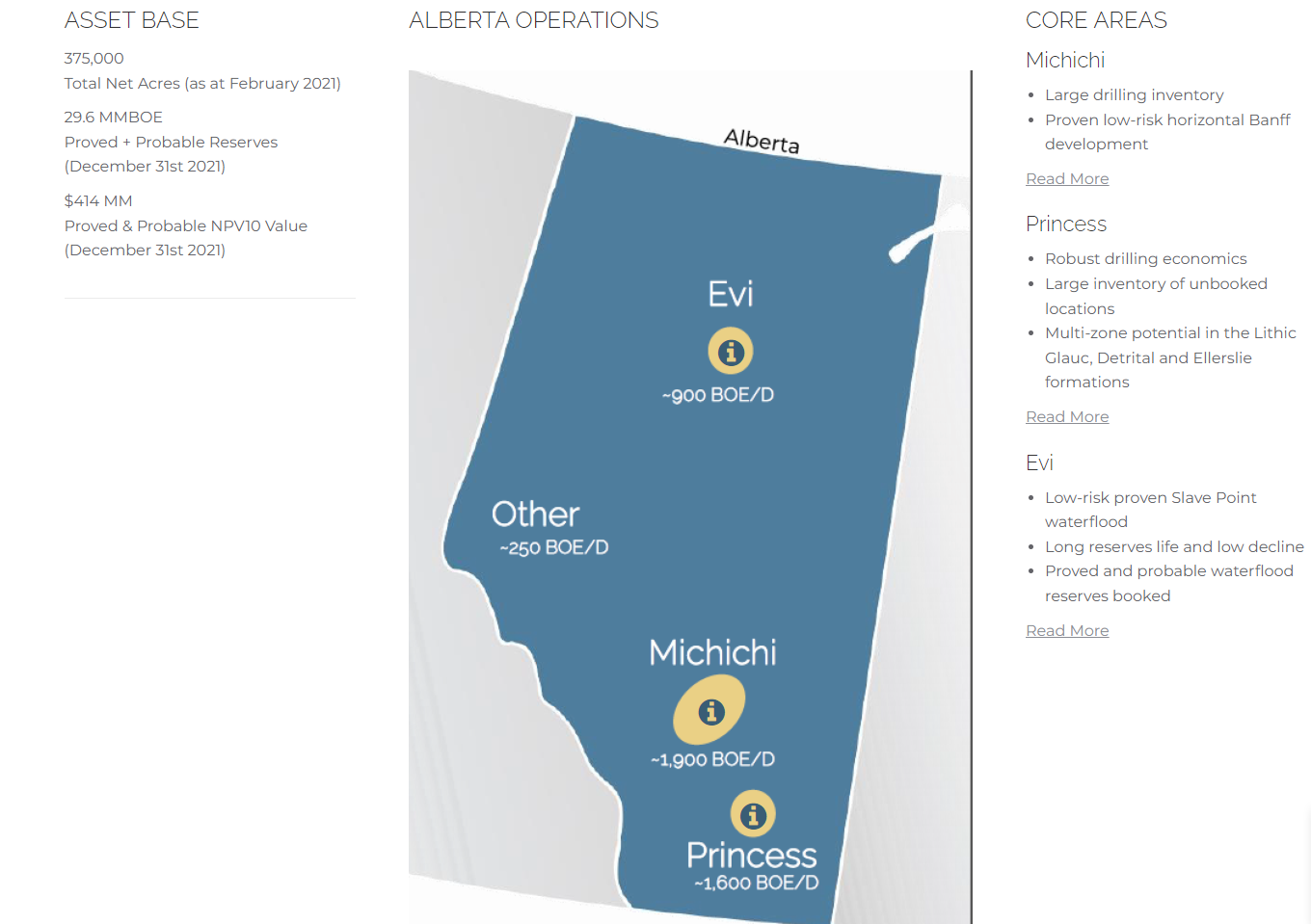

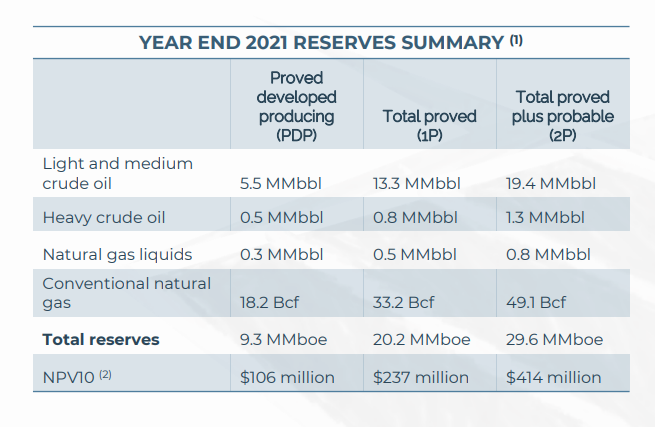

Prairie Provident Resources (PPR.TO)

Market cap ~ 26 Million

Prairie Provident Resources Inc. engages in the exploration and development of oil and natural gas properties. It explores for light and medium oil with associated natural gas. The company principally focuses on the Princess and Michichi areas targeting the Ellerslie, Lithic Glauconite, and Banff formations in Southern Alberta; and the Waterflood project at Evi property located in the Peace River Arch area of Northern Alberta.

The stock itself is at a major inflection point. We are testing $0.185, and a breakdown here could occur if oil continues to pull back. Watch how the price reacts around here, because if the trend is our friend, we should expect to see a nice bid from here.