Crude Oil Prices (West Texas-WTI) continue to be on a tear, as analysts and traders price in economic recovery and economies re-opening with a vaccine. I have said this before: Oil is the vaccine play. The demand for jet fuel when travel resumes will be overwhelming, and I do think Main Street is underestimating travel demand. Wall Street is not.

We have seen other ‘negative cases’ for Oil. President Biden’s green energy plan, and the fact that he cancelled the Keystone XL pipeline were seen as bearish for Oil. But the truth is that Oil is still the lifeblood of the economy. What this actually did was adjust supply and demand models for Oil.

Speaking about supply and demand, we need to talk about the Saudi’s and OPEC plus Russia. Production cuts have been in place to cope with the reduced economic activity. Just one month ago, the Saudi’s said that they would maintain their production cut through February and March. The Saudi’s are now likely to reverse course. Production may increase into the Spring due to the recovery and the fact Oil prices are this high.

But fair warning from Saudi Arabian Energy Minister Prince Abdulaziz bin Salman:

“We are in a much better place than we were a year ago, but I must warn, once again, against complacency. The uncertainty is very high, and we have to be extremely cautious,” he said. “Those who are trying to predict the next move of OPEC-plus, to those I say, don’t try to predict the unpredictable.

If my readers keep up with current events, there probably is one major news event that comes to mind when it comes to Oil. The Big Freeze in Texas.

We have heard about the millions without power and the fact that Natural Gas lines have frozen because they are too close to the surface. However, Texas’ Oil patch is feeling the chill with rigs not being able to work in the cold.

4 million barrels a day, the largest ever US production decline, is the result from the Texas Freeze. With Oil prices remaining strong, clearly demand is still there with this reduced supply. This statistic also will play a role in Saudi Arabia’s decision to increase production.

But guess who else is Bullish on Oil?

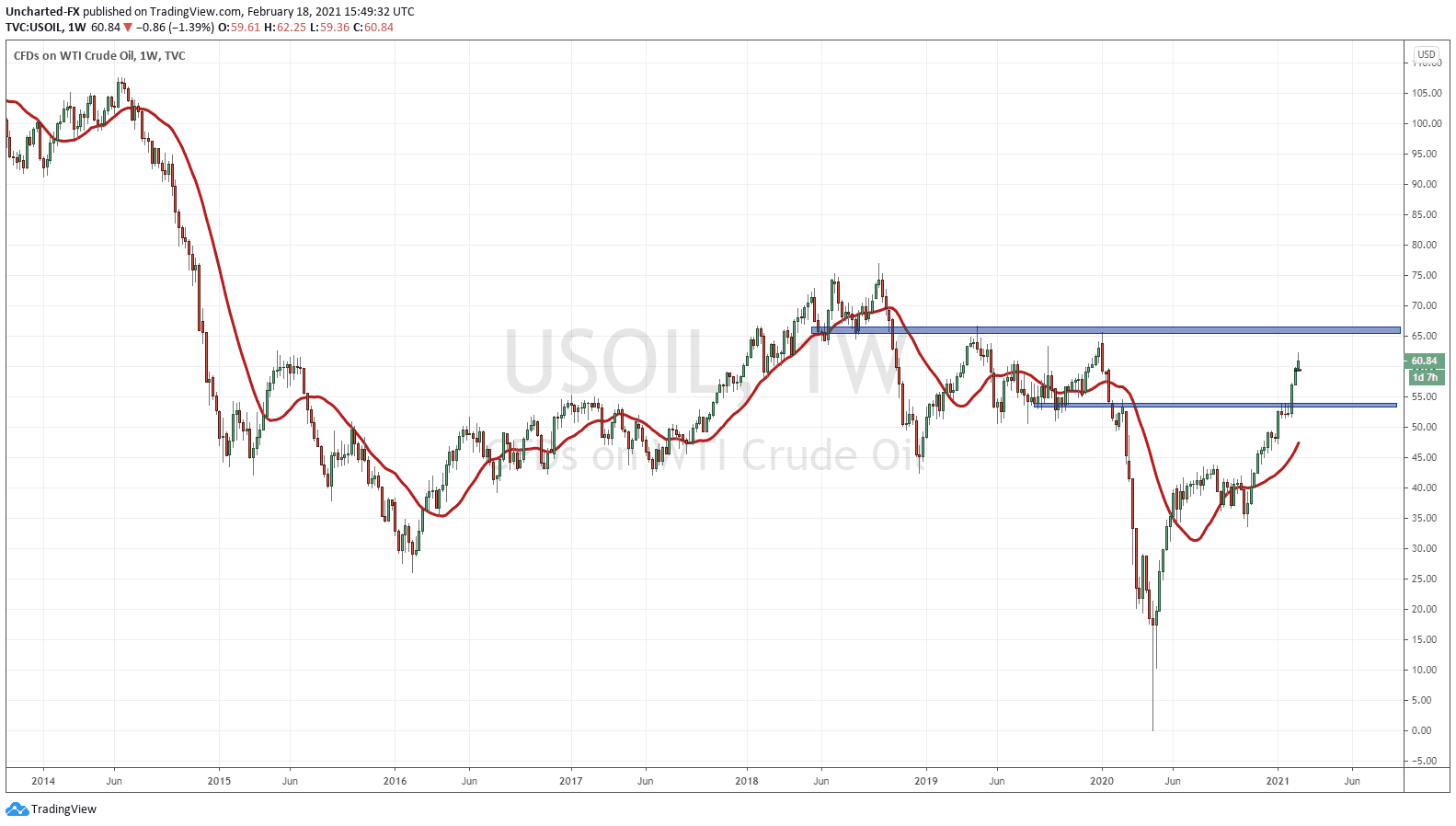

The Oracle of Omaha surprised some when his largest purchase during the Stock Market fall of 2020 turned out to be a Natural Gas company. He is now adding Oil to the mix.

Chevron (CVX) is one of the new positions opened by Berkshire Hathaway, and it has many people talking. I think it is important to remember that Warren Buffett is a value investor. He looks for companies which pay a dividend, and will likely be here 10 years from now.

Not only is Chevron in better shape than Exxon Mobil, but they have plans to diversify for the future. Recent news regarding Chevron’s investment into a Canadian Geothermal company raised eyebrows. Trust me, it will not be the only renewable energy investment that this big Oil company makes.

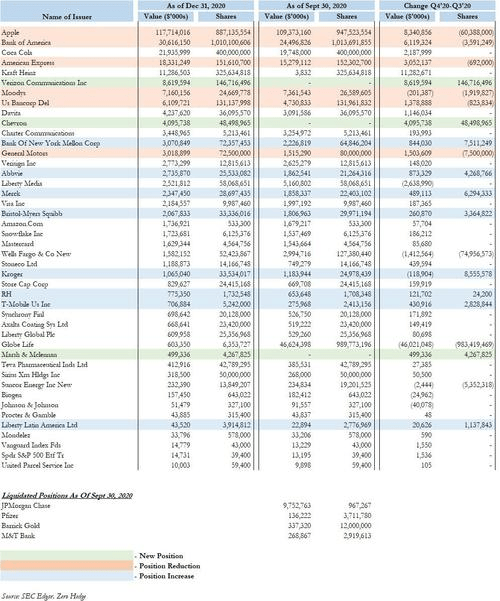

Chevron played a large part in keeping the Dow Jones propped up during yesterday’s price action. However, prices are now currently stalling at the resistance zone of $96.25. Technically, Chevron is in a range. Just await the break.

Technical Tactics

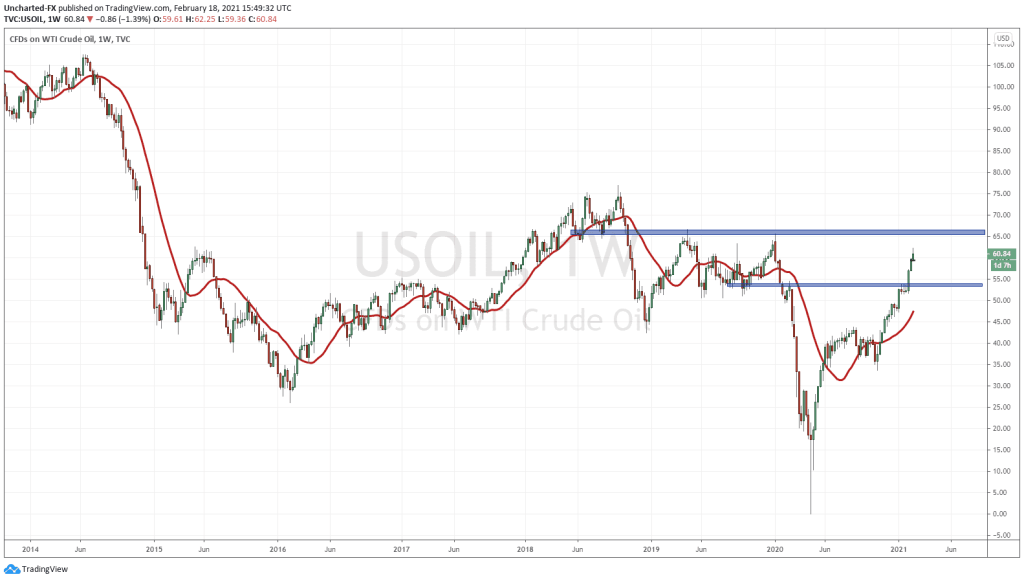

In a previous Market Moment post in the middle of January 2021, I discussed whether Oil was in for a reversal. The key trigger was the pattern breakdown which DID not occur. Fast forward today and USOil/WTI is over $60.00 a barrel.

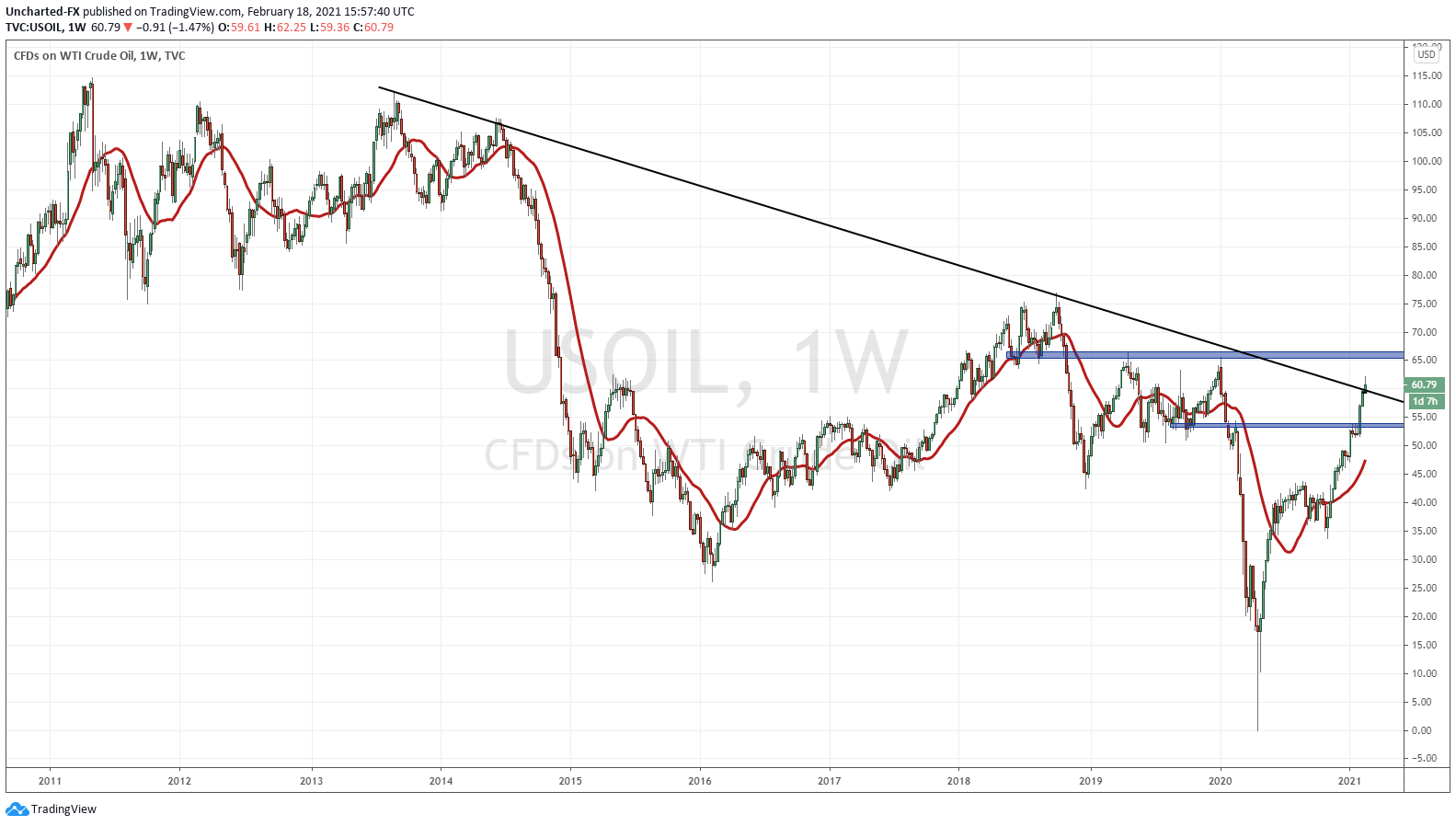

I want to zoom out to the weekly timeframe. Each candle here represents a week’s worth of price action. Notice price action below what is now support at $53. Price struggled for three weeks in an epic battle between the bulls and the bears. Finally, the bulls won and we saw a pop in Oil taking us comfortably above $53.00, and even surpassing $55.00.

On the weekly timeframe, this $53.00 zone remains the major support, or price floor. The other significance of this price zone is that this is where Oil was before the major sell off last year which took Oil to 0. The break above $53.00 meant we recovered all the pandemic losses.

$65.00 is the next major resistance zone. It is a significant flip zone ( an area that has been both support and resistance). You can see that we have had at least 5 touches at this zone in the past where it acted either as support or resistance. These are the type of zones you want to target when you are trading anything be it stocks, forex, cryptos or commodities.

A little bonus.

This technical trigger has been making its way around social media:

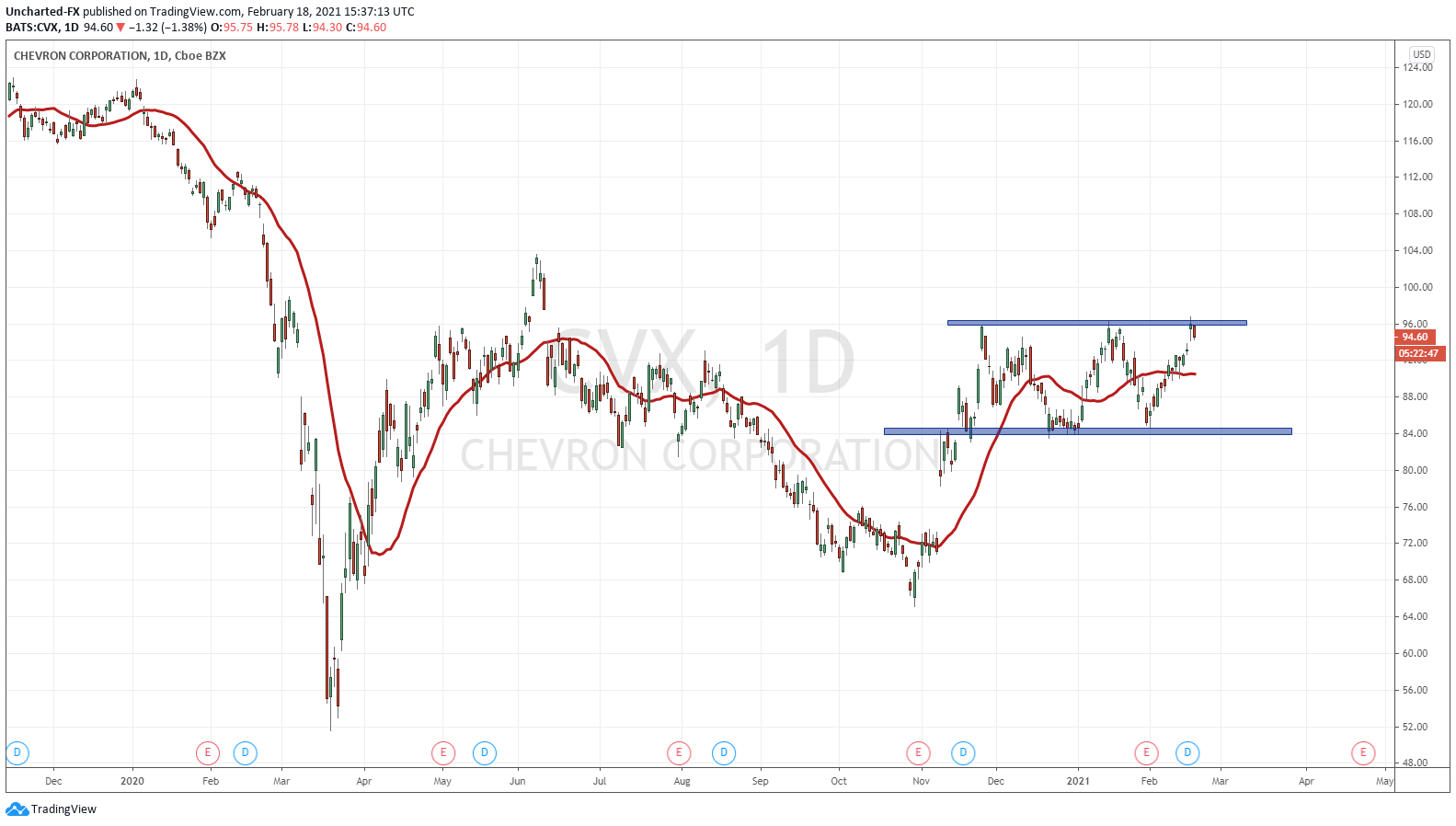

The same weekly chart of Oil, but this time with a trendline connecting the highs. It is a valid trendline because we have 3 touch points.

The significance of this trendline will be amplified by the end of this week…or tomorrow, when the weekly candle closes. If Oil remains strong and we close ABOVE this weekly trendline, it will attract the eyes of many technical traders. Trendline breaks are a popular way of trading for many, as they indicate trend shifts. I prefer my market structure method.

In summary, many are debating which way the supply and demand pendulum for oil shifts. Is demand rising because of the pricing in of a return to normal economic activity? Oil being the vaccine play. Or are other supply issues such as the Biden green energy bill, OPEC production cuts, and now the Texas freeze playing a larger role in the price appreciation of Oil.

I will throw out another thing to consider going forward. Oil rising because it is a commodity, which will do well as central banks devalue their currency with the ongoing currency war. If this is the case, then I would have to agree with some more controversial and outspoken financial commentators who are saying Oil goes back to $100 a barrel.