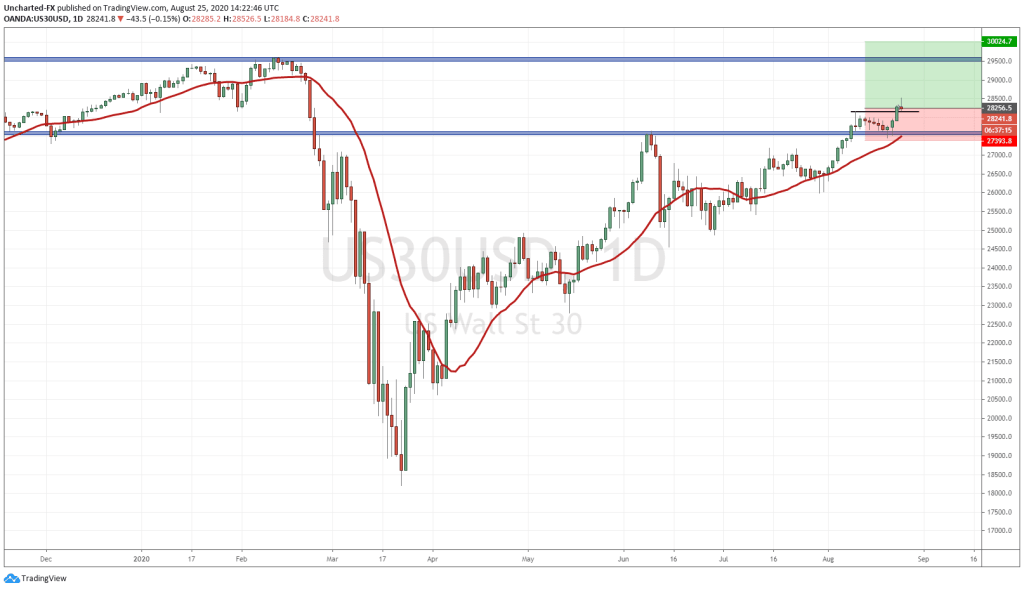

As the world got ready to trade the US opening, we were hit with more vaccine news! This time from Moderna, and their vaccine being 94.5% effective. If you recall, last week Monday, news on Pfizer’s vaccine being 90% effective hit the tapes and saw US Stock Markets pop into all time record highs. But they did not hold to give us record closes. Currently, the markets are selling off once again on the vaccine news. We still have some time to go until the trading day ends, and we get our daily candle closes. This is what we will be watching for over on our free Equity Guru Discord Trading Room, but I want to discuss another chart and idea which was mentioned to our members: Exxon Mobil (XOM) and Oil.

How the mighty have fallen. Exxon Mobil (XOM) used to be the most valuable company until Apple surpassed it. Exxon also used to be the largest US oil company, but that honor now belongs to Chevron.

Analysts estimate Exxon will lose more than $1 billion this year, compared with profits of $46 billion in 2008, then a record by an American corporation. The company’s removal from the Dow Jones Industrial Average in late August, after nearly a century on the index, marked a milestone in its decline.

Exxon Mobil is down -46.08% Year to Date, but is up 12.58% for the month, and still pays a dividend of 0.87 cents. You might be asking yourself why should someone buy their shares with the information presented above from the WSJ article? Well let me lay it out.

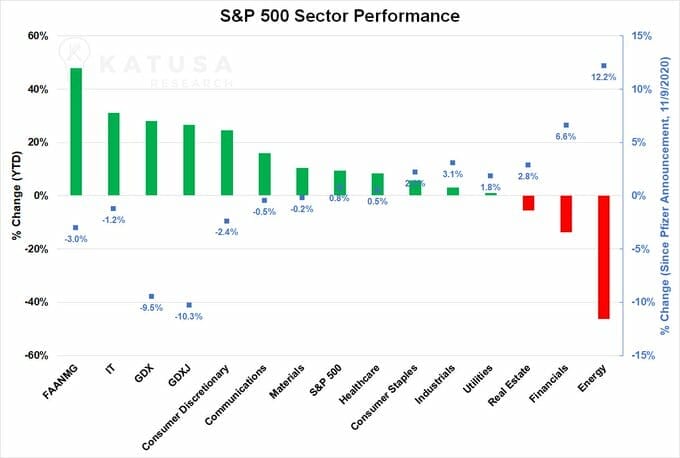

Believe it or not, this is a large part of the reason. Energy, along with Financials, are the worst performing sectors. My readers know my take on equity markets: they will continue to move higher as they are the only place to go for real yield.

We are seeing incredible moves in the blue chips and a lot of the tech stocks. Some would prefer to use the term “bubble”. In this type of environment, many would go bargain hunting.

I have already laid out the case for commodities in the past. They still seem cheap compared to everything else. Energy also seems cheap compared to anything else. Honestly, if you are a fund manager and looking for some bargains right now, would you be buying airlines, cruise ships, financials or energy?

Sure, the energy companies have some ugly balance sheets (Exxon Mobil included), but they can still continue to bring in some profits pumping oil. Not so much for airlines and cruise ships who have had to stop some or all activities, and even the banks are remaining profitable due to their investing/trading business rather than their traditional business of lending money.

As someone who believes in cycles, I think energy will have a turn some day. There are however, two major things to watch for.

Firstly, the idea of more green energy and a shift away from fossil fuels. I do not think this will come overnight. Many people forget that oil is also used for tons of other manufacturing and production activities too. People need to remember that the US has recently become the largest producer and net exporter of oil. In the not so distant future, they will have a say in the oil markets which will surpass the power of Saudi Arabia and OPEC. Some believe we are already there, hence the Saudi and Russian alliance to bring oil prices down to hit American shale production. I do not think the Americans will pass on this opportunity so easily.

Secondly, the push for green energy from a Biden Presidency AND the potential of a second lockdown. When Biden was leading Texas for a bit many were perplexed as Biden is anti-fracking and some say anti-oil. But from what I mentioned above, a shift away cannot happen over night. To be honest, the green infrastructure platform just seems as the best way to increase taxes on the people, which MUST occur due to all the spending to combat Covid. Government can get the tax raises they want and say it will be to build green infrastructure projects which will boost the economy. Most people will not mind paying it for the fear of being labelled a global warming denier. This is getting pretty ramped up here in Canada already.

A second lockdown would see Oil take a hit like it did in Spring, but maybe not to that extreme extent. Back in Spring, pretty much the whole world was in lockdown. Come mid January when Biden takes over, this may not be the case…especially if the vaccine is our by year’s end.

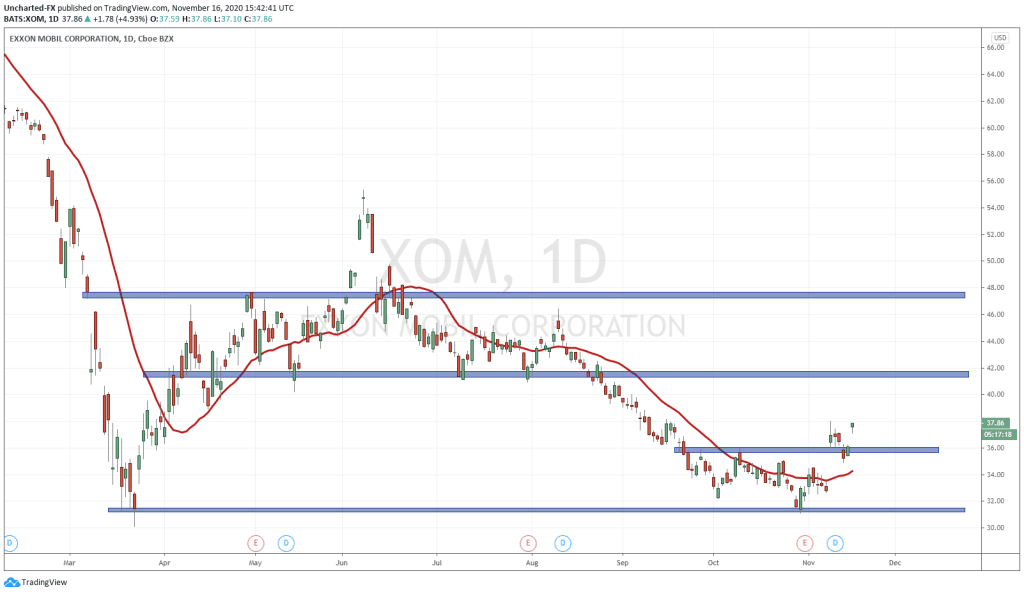

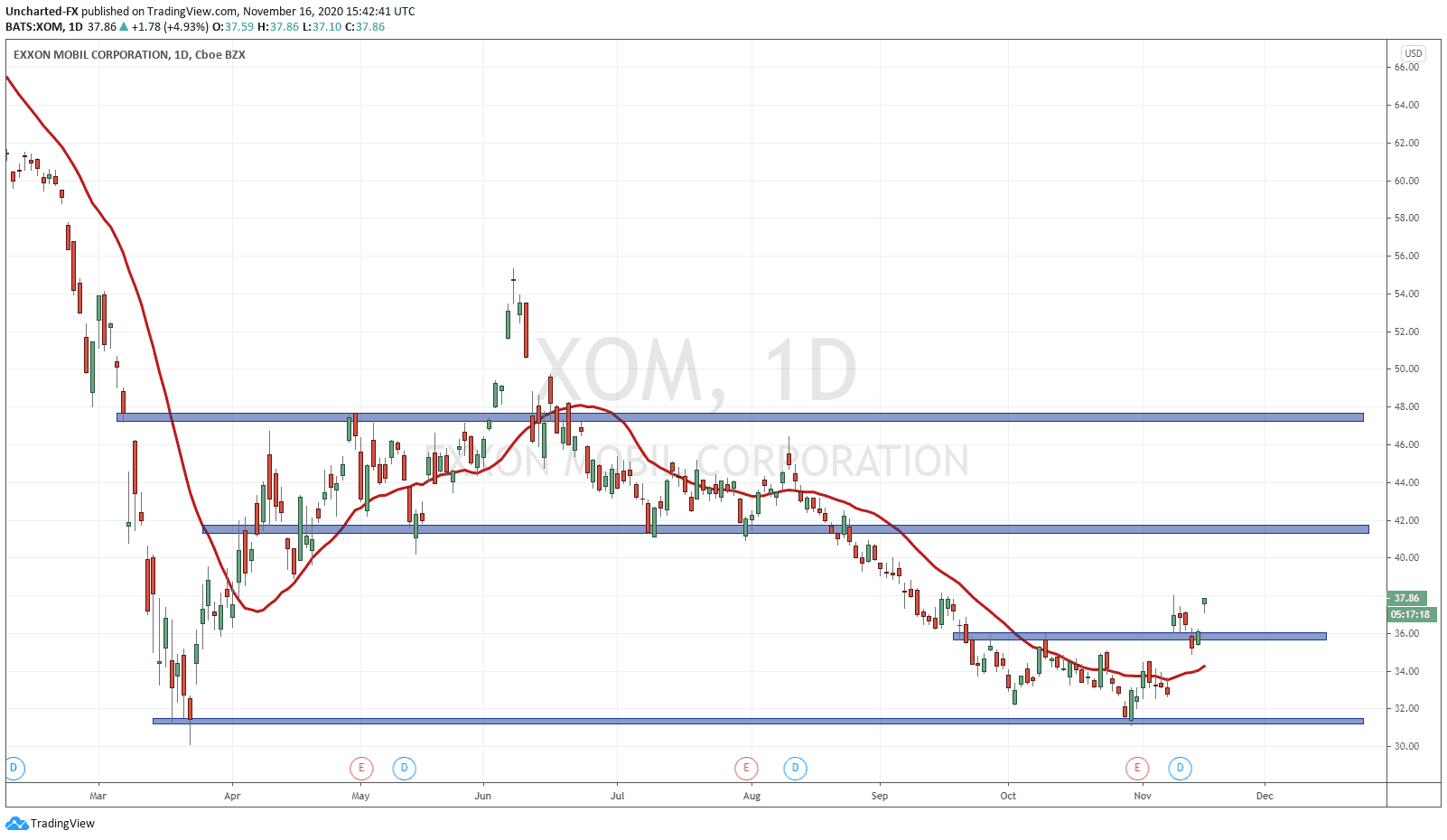

The chart of Exxon Mobil (XOM) meets the Equity Guru Set Up criteria: A long trend (in this case a downtrend) with signs of basing and reversal.

Exxon Mobil hit lows of near $30 back in March with that amazing Oil plunge to 0, and then recently retested those lows this month. This was why we had this on our radar. If price does not make new lows, there is a chance price will base and then bounce higher. What we wanted was a pattern to confirm this.

Discord trading room members know that we were expecting to see an inverse head and shoulders pattern. We were hoping to see the right shoulder form, and this would take us above $36. Instead, we gapped up on the vaccine news last Monday. Price then retraced before finding buyers at support at $36 on Friday, before gapping up once again today on the Moderna vaccine news.

One can enter now frontrunning a higher close above last weeks highs, or just wait for the daily close today to see whether we close above last weeks highs. Since we have a higher low swing now at the $36.00 zone, price will be in an uptrend as long as price remains above $35.38. I am using the lows of the green candle on Friday which saw buyers step in at the support retest.

There is a major resistance at $42. That would be the first take profit level. After that, the second resistance comes in at just under $48.00.