It has been a wild week for the energy sector these past few weeks. Wild might be an understatement.

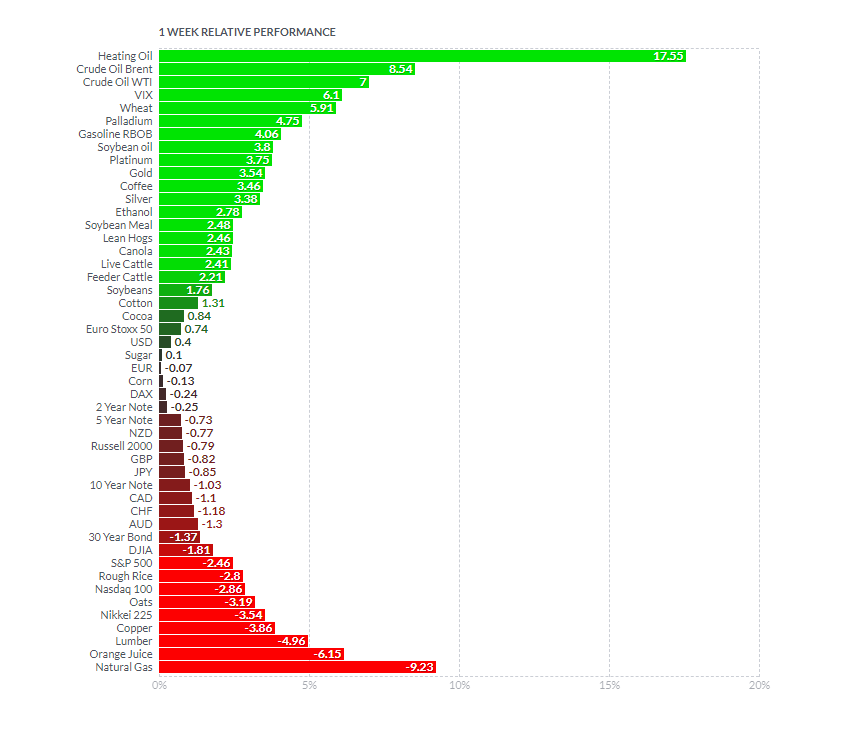

Energy has been at the top of the list for weekly gainers, but this list doesn’t include other commodities such as Nickel. War-fueled supply chain disruptions and sanctions are causing extreme volatility in commodity markets.

The energy impact is obvious. Europe is planning to cut plans to depend on Russian Gas by two-thirds this year. The EU imported 45% of its total gas imports from Russia in 2021. In terms of Oil, the US just announced a ban on Russian Oil. Hopefully they look at domestic production, but apparently the Biden administration will be looking at better behaved nations such as Iran and Venezuela to make up for Russian imports.

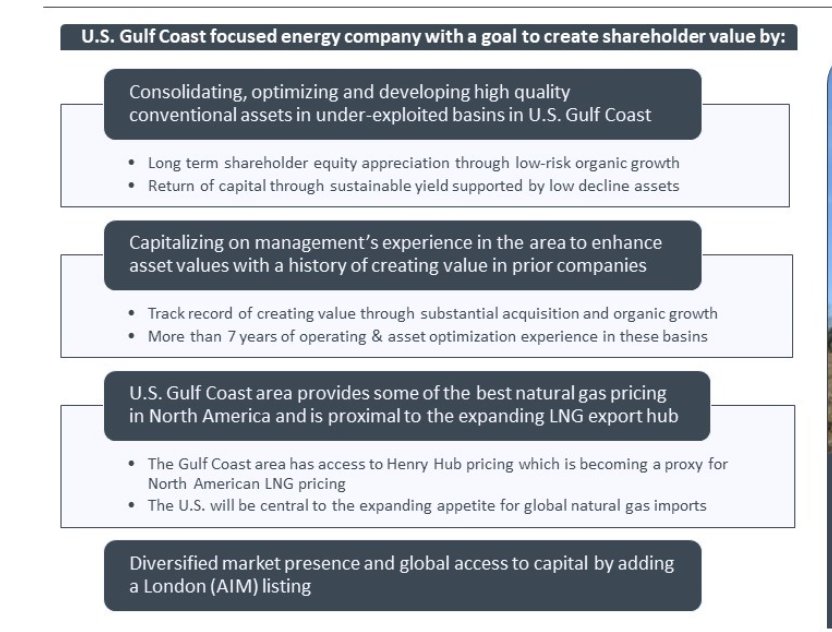

To be honest, the Natural Gas part of the equation is what I am more interested in. Europe seems to be moving from Russian gas to North American (US) gas, which will come in the form of Liquefied Natural Gas (LNG). Will this work in the end? Possibly. I am just wary of what this means: Europeans will have to be paying more for gas. LNG is much more expensive than the Russian counterpart. At a time when European governments are spending a lot of money (will have to spend more) and when inflation is hitting consumers, the goal should be to reduce extra costs. Some say this is why Russia holds a stranglehold over Europe for energy. Let’s see what develops going forward, but Germany is that one nation I would keep an eye on.

In terms of plays, I would look at some Gas plays in North America. Southern Energy (SOU.V) is one I have spoken about in the past.

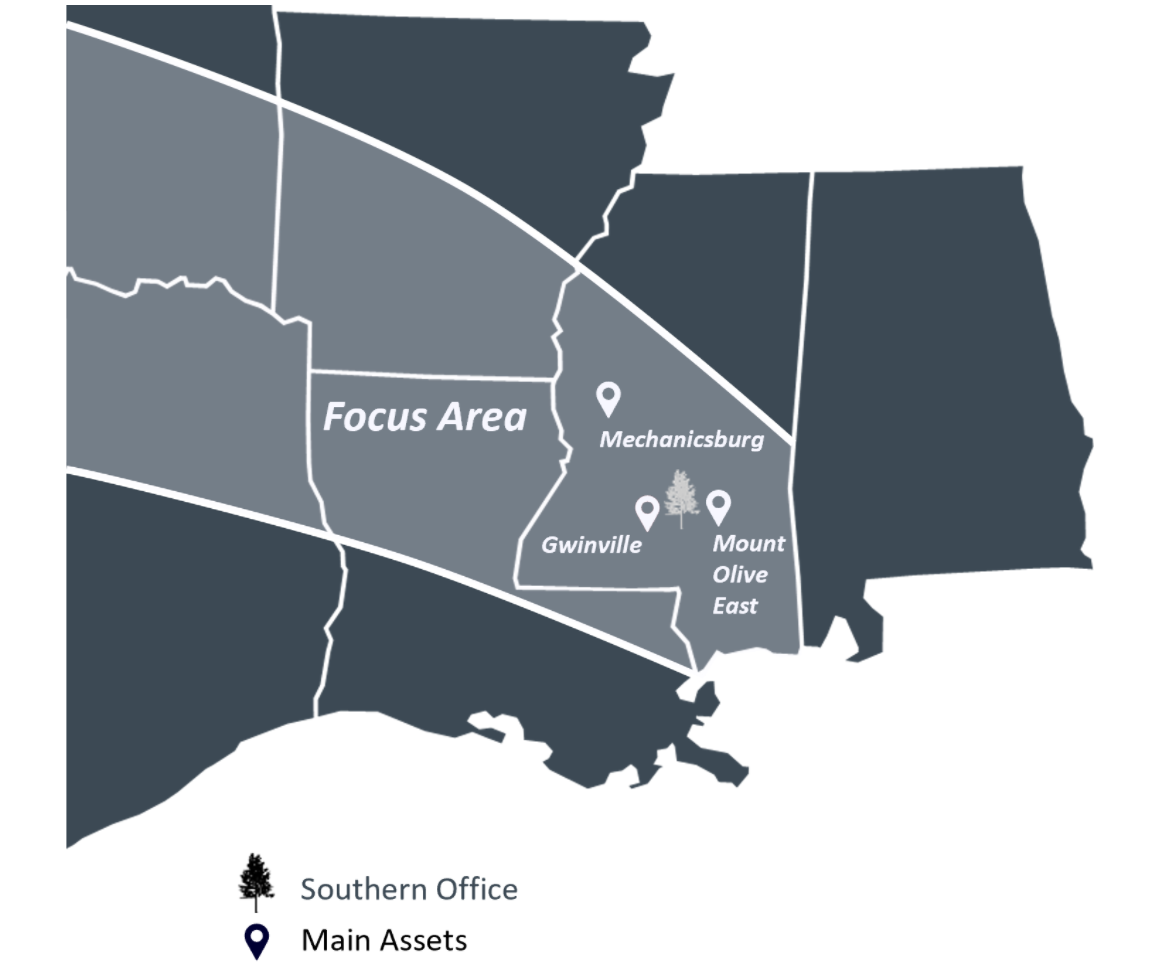

Southern Energy (SOU.V) is a natural gas exploration and production company. Southern has a primary focus on acquiring and developing conventional natural gas and light oil resources in the southeast Gulf States of Mississippi, Louisiana, and East Texas. Its principal properties are Central Mississippi Assets that covers an area of approximately 31,000 acres containing oil and gas production at Gwinville, Mechanicsburg, Williamsburg and Mount Olive, and Mississippi.

The company’s strategy is very simple: use management’s expertise in the South Eastern Gulf Coast area to add proven developed producing assets and execute low risk development drilling to achieve growth in reserves. The end goal is to build a high-margin asset base of sufficient scale with significant low-risk drilling inventory that continues to generate cash flow.

It is definitely the right time for LNG plays. Regular readers of my work on Equity Guru know I have been bullish on the energy sector and commodities since last year. I have been saying this is the inflation trade, not a geopolitical trade. You want to be in hard assets/commodities.

Above is the weekly chart of West Texas Oil. Not much needs to be said. Major resistance zones have been broken. I have $100 marked as new support because it is a psychological important zone, but $110 is another zone to have marked on your charts. Above, I am looking at $135 and then previous all time record highs.

Just me, but I wouldn’t chase Oil. Let us get a pullback before determining whether we go long. The Fed could add a deflationary spark next week.

Natural Gas looks tame compared to Oil. But I think it has a chance to surprise. The Russian nuclear option would be shutting down the gas taps to Europe. It would not only spice things up on the geopolitical chess board, but would cause some extreme volatility in Natural Gas.

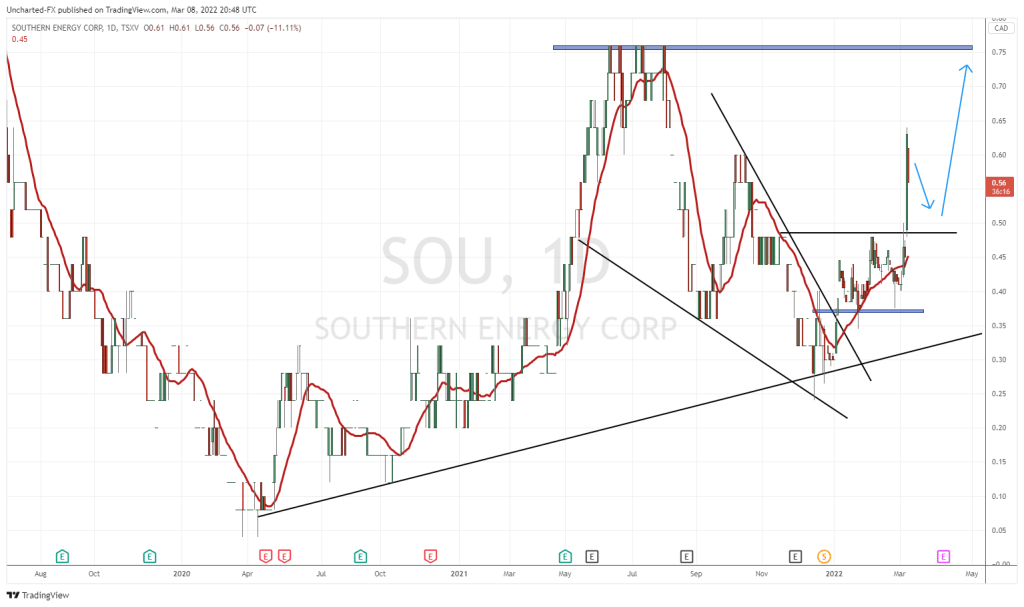

Before we look at the current Southern Energy (SOU.V) chart, let me remind you of the technicals I set up for my readers in late January 2022.

I wrote that the wedge pattern had confirmed a breakout. We were just looking for a higher low as price retested the breakout. Well take a look now:

We got that higher low swing, and the price rocketed on March 7th 2022. A nice 40% day. Recent volume has been nice in the high 6 figures.

What next? Honestly, I don’t want to chase Oil because of what I said about the Fed above, but any geopolitical outlier could cause Oil to spike. I guess I am betting on the situation to resolve in Ukraine diplomatically.

Natural Gas is what I am more interested in with a shift in supply from the US rather than Russia. A company like Southern Gas, which is near North America’s expanding LNG hub, is a great way to play the future of LNG exports to Europe.

On the technicals, I have drawn out a higher low that I would like to see. $0.50 is a major support zone, and I expect buyers to defend this area. The next wave higher would take us to $0.75, and from there, a potential major technical breakout which will take us to $1.00 and higher!