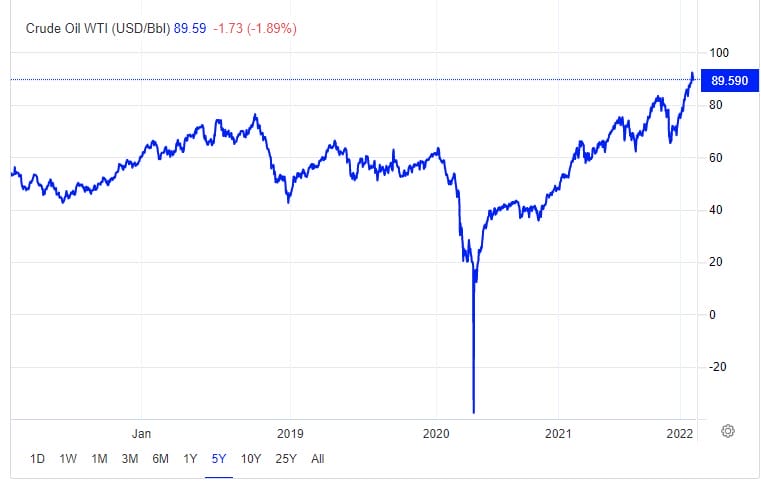

Oil and gas saw some dark days in early March 2020 when WTI crude price dropped by 30% after Saudi Arabia and Russia got into a proverbial pissing match over oil production quotas. Things only got worse for the sector as the pandemic took hold further cutting demand until April when traders saw oil futures drop into negative territory settling at minus $37.63 per barrel on the New York Mercantile Exchange. Investors were crushed and ran from the sector.

The negative price hike impacted both oil exporters and importers, hammering oil and gas explorers in a way many had not seen since 2015 when Saudi Arabia flooded the oil markets to kill American shale producers. Big Oil saw billions wiped off companies’ market caps and many Canadian oil companies scaled back both production and investment to weather the storm.

Oil prices have climbed a bumpy slope for most of 2021 going from ~$49 USD a barrel in early January to ~$89 a barrel as of February 8, 2022. It seems that the good times are back, there’s money to be made and stocks to replenish.

However, the industry has changed since the golden days of “drinking your milkshake”. The EV revolution and ESG considerations have remade many oil and gas participants.

Today, producers focus on optimizing their portfolios, developing goals that align with the coming clean energy transition and adhering to environmental/social requirements. Oil and gas are necessary and even with green energy on the horizon, these commodities will remain cornerstones to our economies and culture for some time to come. However, with the change in guidance and mandate, investors needn’t feel so squeamish placing a producer in their portfolio, it still builds toward a better future.

Canadian small to mid cap oil and gas producers in a post-covid world:

Cardinal Energy is an oil focused explorer developing low decline and medium quality oil production in Western Canada.

The company has operating properties in:

- Alberta

- North Area

- 6,400 BOE per day of 75% Light Oil and NGLs and 25% Natural Gas

- Central Area

- 5,700 BOE per day of 96% Medium/Heavy Oil and 4% Natural Gas

- South Area

- 5,200 BOE per day of 80% medium/heavy oil and 20% natural gas

- North Area

- Saskatchewan

- Midale

- 3,100 BOE per Day of 100% Light Oil

- Midale

An actively producing operator, the company still has a lot of play left as its 2020 reserve report indicated:

- Light and Medium oil

- Total Proved: 36,186 Mbbl

- Total Probable: 14,180 Mbbl

- Heavy Oil

- Total Proved: 21,790 Mbbl

- Total Probable: 6,351 Mbbl

- NGLs

- Total proved: 3,389 Mbbl

- Total Probable: 1,076 Mbbl

- Conventional Natural Gas

- Total Proved: 37,531 Mbbl

- Total Probable: 15,457 Mbbl

Cardinal’s 2020 net present value of proved, developed, and producing reserves was based on an average $50/bbl and is $950.17 CAD million with no discount and $412.82 million with 20% discount. Considering that today’s WTI is nearly twice the price, Cardinal’s current NPV is impressive.

What really tickles me is the company’s financials. We have grown used to insane price ratios when it comes to the tech sector and nearly every publicly traded nascent space since Silicon Valley reared its ugly head and brought us the dot com bubble. Companies like Cardinal fly in the face of that acceptance and recorded a price to earnings ratio of 1.98 during Q3 2021.

The company also pulled in revenues of $120.01 million for Q3 2021 and comprehensive earnings for the quarter totalled $263.33 million. Now before you go, WTF, that seemingly impossible result is due to a $218.34 million impairment reversal. This all resulted in $1.64 of earnings for each diluted share. Shareholders were probably pretty happy with that.

Cardinal Energy traded at $5.04 per share for a market cap of $759.65 million during trading Tuesday.

Crew Energy (CR.T) is a Canadian Natural Gas producer focused on developing properties in the Montney Play located in northeast British Columbia.

The homegrown BC producer’s assets include:

- Septimus / West Septimus

- Tower

- Groundbirch

- Attachie

- Oak / Flatrock

- Portage

Crew Energy’s land base is massive, covering a contiguous 264,000 net acres. What’s more thrilling is only 19% of the Upper Montney lands and less than 1% of the Lower Montney lands had assigned reserves at the end of 2020. There’s a bevy of opportunity for Crew as it has identified over 2,000 drilling locations in the Montney land package

The company pumped out 23,659 BOE (142.0 mmcfe) per day during Q3 2021 and opened three new wells in Groundbirch as well as achieving record throughput of 115 mmcf per day sales gas at the West Septimus gas plant during its peak in October.

Crew reported $176.2 million net income in Q3 2021 again due to a $228.5 million reversed impairment charge. Illustrating the great cost of exploration and development, the company recorded $404.1 million in net debt as of September 30, 2021, but thankfully, there are no covenants or repayment requirements on the $300 million senior notes portion of that until 2024

The company traded at $3.34 per share for a market cap of $519.14 million on Tuesday.

Ensign Energy Services (ESI.T)

Ensign Energy Services (ESI.T) is a Canadian-based oilfield service provider operating in Canada, U.S., Latin America, the Middle East, and Australia.

The company’s service portfolio includes contract drilling, directional drilling, underbalanced and managed pressure drilling, rental equipment, well servicing and production services.

This is a different play than producers and perhaps a bit more fragile as services get hit the worst during market downturns. However, it deserves some notice.

Ensign’s operations are relatively vast for a Canadian player with operations in eight countries, 4,000-plus employees, $3.0 billion in assets, 245 drill rigs and 100 service rigs.

The company is doing its bit to meet ESG requirements and be ready for the new energy age:

- Over half of the company’s fleet is drilling for natural gas

- 28% of fleet equipped with emission reduction solutions with majority capable of upgrading

- 20% women in director level or higher positions

- Metrics tied to executive compensation include safety, financial and strategic targets, shareholder return and return on capital employed

In case you may be worried that operations are a little too far flung and thus riskier, here is the company’s location ratio: 50% of rig fleet in Canada, 36% in the U.S. and 14% international.

As stated before, service companies take it in the neck when oil and gas have a bad day, so the company’s stock chart looks like a vomit-inducing rollercoaster ride and its financials are still righting themselves. Illustrated by the fact, Ensign noted $268.58 million in revenue for the three months ending on September 30, 2021, but a net loss of $34.38 million for the same quarter. Expenses are decreasing, but a positive bottom line would make me feel more confident.

Ensign Energy Services traded at $2.24 per share for a market cap of $365.40 million on Tuesday.

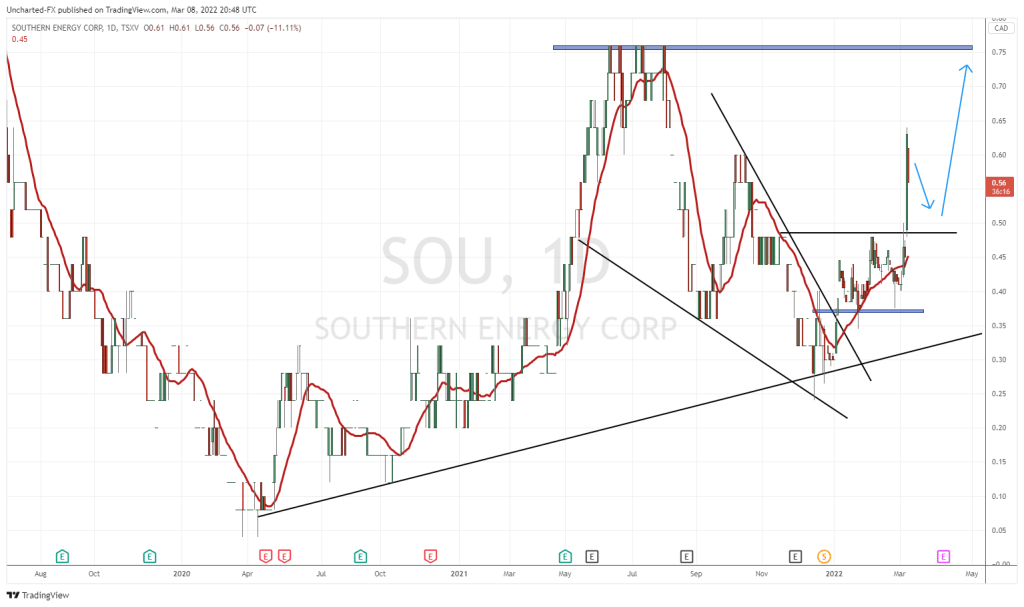

Southern Energy (SOU.V) is a Calgary, Alberta-based oil and gas producer operating in the south-eastern U.S., primarily in Mississippi.

The company has controlling interests in properties covering approximately 30,000 net acres in the Mississippi Interior Salt Basin. Ninety-seven percent of Southern Energy’s licenses contain producing wells and require no additional drilling or operations to maintain the existing interest.

Southern is a going concern, reporting approximately 2,180 BOE per day, proved reserves of 10.4 MMboe and a proved NPV at 10% discount of $38.9 million. The company isn’t resting on its laurels and is targeting a growth of 25,000 BOE per day through consolidation and development.

The gulf coast producer reported $5.22 million after royalty pay out for the three months ending on September 30, 2021 and took home $5.77 million in comprehensive income during the same quarter.

This one ticks all the right boxes in terms of assets, revenue and share value growth potential. Its NPV is worth more than its market cap! Yes, this is a speculative stock as it is under a dollar, but if you have the money, you would probably be able to move the dial yourself and be in for a profitable ride in the long term.

Southern Energy traded at $0.45 per share for a market cap of $35.16 million on Tuesday.

Where to from here?

As geo-political pressures mount between Russia and the Ukraine, natural gas, and oil will figure even more prominently on the public market, quite possibly hitting analyst predictions of $120-plus USD per barrel before the year is out. Regardless, oil and gas are an important and irreplaceable component of our green energy transition, it might be smart to get involved and help guide the revolution while helping prepare for your retirement.

So, please remember to do your due diligence before making any investment decision. After that, pick your winners and help create a better world. Good luck to all!

If you want to a deeper technical analysis of the space and these companies, check out Vishal’s chart breakdown here.

We talk about the pros and cons of the sector and said companies in the latest Investor Roundtable Video. Check it out!

–Gaalen Engen

Full disclosure: Southern Energy is an Equity.Guru marketing client