A Barley Parley With Guinness

For the longest time, I have subjected myself to drinking Coors Light, which my friends argue is the equivalent of watered-down piss. However, since attending my first Craft Beer Festival in Toronto, my preference for beer has changed drastically. Unlike the forgettable taste of Coors Light, I now find myself craving the hoppy, sour, and refreshing flavor of IPAs. I even enjoy a stoic stout from time to time.

Speaking of which, stouts are fascinating to me. Prior to writing this article, I was unaware of just how many stouts existed, including dry stout, oatmeal stout, milk stout, and imperial stout. With this in mind, Guinness is one of the most successful alcohol brands in the world, defined by its famous Irish dry stout. Guinness stouts are made from water, barley, roast malt extract, and brewer’s yeast.

However, as great as Guinness is, embedded carbon in barley delivered to maltings contributes to roughly 60% of the carbon footprint of the finished malt. In total, the top three main contributors to the carbon footprint of malt production include growing barley, gas, and electricity use. Thankfully, on February 23, 2022, Diageo, parent company to Guinness, announced a new regenerative agriculture pilot program to make its stouts more sustainable.

As the name suggests, the new three-year farming program will grow barley using regenerative agriculture practices. The program is planned to begin in Spring 2022, with at least 40 farms participating, to begin with. Ultimately, Guinness’ initiative is intended to reduce the carbon emissions of its barley production. This program is also intended to improve soil health, carbon sequestration, biodiversity, water quality, work conditions, and farmer livelihoods while reducing synthetic fertilizer use.

Guinness’ pilot program is part of Diageo’s 10-year sustainability action play, which has a goal of bringing the carbon emissions across its direct operations down to net zero. Additionally, the company plans to cut its scope 3 emissions in half by 2030. Keep in mind, Diageo’s sustainability goals apply to its more than 200 brands, including Baileys, Captain Morgan, and Smirnoff, to name just a few. Bearing this in mind, let’s talk about some plant-based companies that may or may not be just as sustainable.

Vejii Holdings Ltd. (VEJI.C)

- $9.15M Market Capitalization

Vejii Holdings Ltd. (VEJI.C) is a North American, online plant-based, sustainable products marketplace, headquartered in Kelowna, British Columbia (BC). Vejii operates its online marketplace ShopVejii.com in both Canada and the US, along with VeganEssentials.com. The Company is committed to providing its customers with easy access to thousands of plant-based and sustainable living products from hundreds of vendors through a centralized, online shopping experience.

By leveraging logistics infrastructure and distribution network technology integrations, Vejii is able to support its vendors and improve customer experience. Furthermore, Vejii utilizes technology to connect buyers with the products and brands they want. To be more specific, the Company uses the data gathered from its marketplace to inform every aspect of Vejii’s business, including expansion plans and investments.

Latest News

On February 17, 2022, Vejii announced the launch of Planet Based Foods’ (PBF.C) hemp-protein products including the HEMP Burger, HEMP Crumble, and the HEMP Sausage Patty product ranges on the Company’s US platform. This will enable Planet Based Foods to reach national exposure via Vejii’s existing infrastructure of data, tech, marketing, and logistics. Planet Based Foods will also have access to the Company’s growing 200,000 social media followers, brand ambassadors, and email marketing lists.

“Our selection of delicious plant-based meat alternatives are a perfect fit for Vejii’s expanding portfolio of sustainable products, and we look forward to introducing Planet Based Foods to their loyal customer base,” commented Planet Based Foods’ President and CEO Braelyn Davis.

On February 23, 2022, Vejii announced record unaudited consolidated revenue of approximately $513,000 in January 2022, representing a growth of 1,158% compared to January 2021. Furthermore, in the same period, Vejii generated a gross profit of $189,000. In just one year, Vejii has built out its marketplace to offer more than 3,500 products from over 500 brands in the Consumer Packages Goods (CPG) space. The Company has also established six points of distribution in North America with plans to add more. For more details, check out this article.

On March 1, 2022, Vejii announced that its wholly-owned subsidiary, VEDGEco USA Inc., will be exhibiting at the Natural Products Expo West. The expo will take place from March 9-12 and will provide Vejii with an opportunity to increase exposure for its B2B platform, obtained through the acquisition of VEDGEco, which services an extensive network of independent restaurants and grocers. For more details, check out this article.

Vejii’s share price opened at $0.08 on March 3, 2022, compared to a previous close of $0.08. The Company’s shares were trading at $0.08 as of 1:29 PM EST.

Full Disclosure: Vejii Holdings Ltd. (VEJI.C) is a marketing client of Equity Guru.

The Planting Hope Company Inc.

- $36.996M Market Capitalization

The Planting Hope Company Inc. (MYLK.V) develops, launches, and scales plant-based and planet-friendly food & beverage brands. The Company’s products are intended to fill key unmet needs in the plant-based market. Planting Hope is a women-managed and led company, focused on three impact pillars, including nutrition, sustainability, and representation. Having now gone public, the Company’s Board of Directors will be one of the first all-women Boards on the TSX Venture Exchange (TSXV).

Planting Hope’s flagship brand, Hope and Sesame, represents the first commercially available sesame milk worldwide. Unlike other dairy alternatives in the market, Hope and Sesame products are nutritionally comparable to dairy milk, containing 8 grams of complete protein and all 9 essential amino acids. Additionally, Hope and Sesame products are an excellent source of Vitamin D and contain 30% more calcium than most dairy milk products.

Latest News

On March 2, 2022, Planting Hope announced the launch of two new RightRice products, including Mediterranean RightRice and Roasted Garlic RightRice Risotto. The Company’s RightRice products are intended to serve as an alternative to traditional rice and flavored rice blends. Every RightRice bowl is made from lentils, chickpeas, peas, and rice, resulting in more than double the protein, five times the fiber, and almost 40% fewer net carbs than a bowl of white rice.

“We are excited to debut these new flavors with Whole Foods Market, with distribution to all major cities and markets across the United States…Whole Foods Market is highly influential in both the natural channel and the food industry at large and has been a great collaborator with RightRice® since 2019,” said Julia Stamberger, CEO and Co-founder of Planting Hope.

Planting Hope’s two new RightRice flavors will debut at Whole Foods Market stores nationwide across the US and will be on shelves early this month. These flavors will be added to Whole Food Market’s existing offering of RightRice products, bringing its total to nine shelf-facing RightRice flavors in the rice category.

On March 3, 2022, just after announcing the launch of its two new RightRice products, Planting Hope announced the addition of three RightRice Risotto flavors, including Creamy Parmesan Style, Wild Mushroom, and Basil Pesto, into Harris Teeter, a wholly-owned subsidiary of The Kroger Co.

“The addition of three more SKUs at Harris Teeter highlights the market acceptance and furthers the momentum of our successful RightRice® Risotto product line rollout,” said Julia Stamberger.

Keep in mind, Kroger represents the largest supermarket chain by revenue in the US, with nearly 2,800 stores in 35 states. With this in mind, Harris Teeter boasts 250 stores in seven states along the Eastern Seaboard and the District of Columbia. The addition of three RightRice Risotto flavors will expand the total number of RightRice SKUs at Harris Teeter to six, adding more than 500 new points of distribution for the brand.

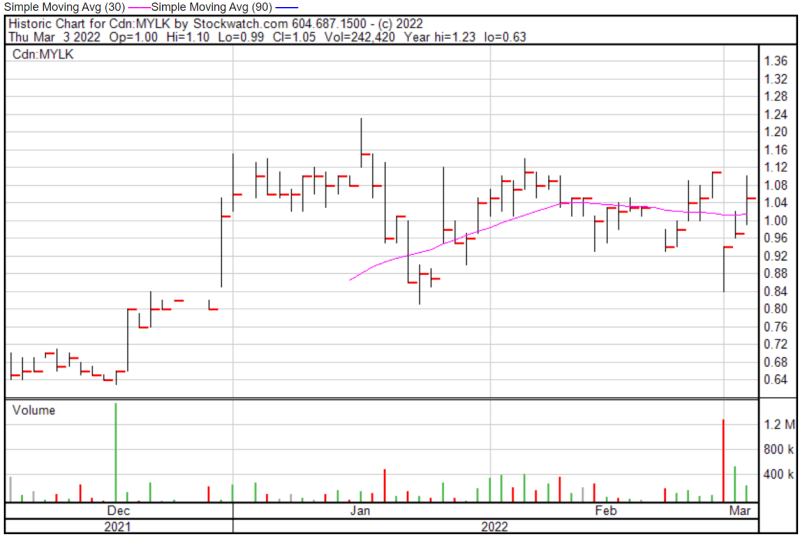

Planting Hope’s share price opened at $1.00 on March 3, 2022, compared to a previous close of $0.97. The Company’s shares were up 5.15% and were trading at $1.02 as of 1:29 PM EST.

Boosh Plant-Based Brands Inc.

- $12.32M Market Capitalization

Boosh Plant-Based Brands Inc. (VEGI.C) is a Canadian plant-based food company offering high-quality, non-GMO, gluten-free, and nutritional comfort foods. The Company was built upon the desire to help health-conscious consumers meet their goals by providing convenient plant-based meals for people who found it challenging to prepare meals from scratch. In total, Boosh offers 24-plant-based SKUs including frozen meals, refrigerated entrees, and shelf-stable products.

With this in mind, Boosh has developed six 100% plant-based, heat-and-serve bowls for one and entrees for two. Additionally, the Company has formed alliances with Beyond Meat Inc. and Buy BC, a province-wide marketing program characterized by marketing activities, retail partnerships, promotional activities, and events. Keep in mind, in the Global Ready Meals Market, frozen and chilled meals held the largest revenue share of more than 50% in 2019 and are expected to maintain their lead over the forecast period.

Latest News

On February 17, 2022, Boosh announced that as of February 16, 2022, the Company has completed the asset purchase agreement to acquire substantially all of the assets of Beanfields Inc. In case you didn’t know, Beanfields produces and sells healthy, gluten-free, non-GMO, and vegan, flavored bean chips. Beanfields’ products are currently in over 7,000 outlets throughout North America. To put things into perspective, there are approximately 57,000 grocery stores in North America. That’s a lot.

“Onboarding a popular US brand like Beanfields is a major catalyst for Boosh. We believe one of the key elements to increasing Beanfields’ revenues is the ability to introduce the products to the club channels and expand our conventional chains. And second, we plan on leveraging the existing 7,000 stores that offer Beanfields products and introduce the Boosh line entrees, pates, and cheese,” commented TJ Walsh, Boosh’s Vice President of Sales.

With this in mind, Boosh intends to capitalize on Beanfields’ popularity in order to rapidly expand its own footprint. Boosh’s acquisition of Beanfields has provided the Company with numerous benefits including:

- increased revenues of approximately $14,500,000

- 271.1 million shares outstanding post-acquisition

- immediate and substantial cost savings

- stores carrying Beanfields/Boosh increased from 600 to 7,000

On February 25, 2022, Boosh provided an update regarding the distribution of the Company’s recently acquired Beanfields brand. Raley’s, a multi-billion dollar grocery and retail company, informed Boosh that it has made Beanfields its primary displayed bean chip, with the Jalapeno & Lime flavor being distributed into 150% more stores, and Black Bean & Nacho flavors into 53% more stores.

Furthermore, Beanfields products have launched into Lowe’s, The Save Mart Companies, Clark’s, and Healthy Edge Retail Group. Loblaws, Canada’s largest food retailer, has also begun testing Boosh’s chilled line of products at select stores in Eastern Canada. To top it all off, Boosh’s first Save On Foods UNFI order came in at 1,500 cases.

On February 28, 2022, Boosh announced that it intends to raise, on a non-brokered basis, aggregate gross proceeds of up to $2,000,000 through the issuance of up to 2,857,142 units at a price of $0.70 per unit. Each unit will comprise one common share and one share purchase warrant. Each whole warrant will entitle the holder to acquire an additional common share at $1.00 per share for 36 months.

Boosh’s share price opened at $0.66 on March 3, 2022, compared to a previous close of $0.65 The Company’s shares were up 10.77% and were trading at $0.72 as of 1:29 PM EST.

Plantable Health Inc.

Plantable Health Inc. (PLBL.NE) is a clinically supported plant-based program committed to transforming people’s health. The Company drives healthy weight loss and an improvement in performance, health, and well-being by bringing together plant-based meals, personalized coaching support, and lifestyle tools to encourage people to change their dietary habits.

The Company recently began trading on the NEO Exchange (NEO) on January 12, 2022. Currently, Plantable offers consumers two programs, namely its Reboot and Quickstart programs. Plantable’s Reboot Program represents the fruit of the Company’s labor and is the first clinically-supported lifestyle program combining plant-based nutrition and behavioral psychology.

Latest News

On March 2, 2022, Plantable provided an update on its clinical trials, which are intended to further validate the Company’s Reboot program as a clinically-proven program for optimizing health. With this in mind, the conclusion of Plantable’s clinical trials will enable the Company to address a variety of chronic diseases, including obesity, high cholesterol, diabetes, and certain cancers.

“Plantable addresses the root cause of disease by changing people’s dietary habits. The successful conclusion of our clinical trials will prove the efficacy of Plantable as a “prescribable” solution for doctors and patients alike, to improve outcomes associated with chronic conditions,” commented Plantable’s CEO Dr. Nadja Pinnavaia.

Following the completion of its clinical trials, Plantable plans to establish partnerships with medical institutions and insurance companies to develop co-branded programs. These programs will support physicians with their patients’ overall treatment and introduce Plantable’s programs as a natural alternative to insulin, statins, and weight loss drugs. Plantable’s current pipeline of clinical trials includes:

- Phase 2 Breast Cancer Trial, expected to conclude by late 2022

- Myeloma Cancer Trial, expected to conclude by late 2022

- Prostate Cancer Trial, recruitment expected in early 2022

With this in mind, each of the Company’s ongoing and planned clinical trials is intended to assess the effects of a whole food plant-based dietary intervention on independent cancer risks such as weight loss, cholesterol levels, blood sugar, and inflammation associated with other major chronic conditions.

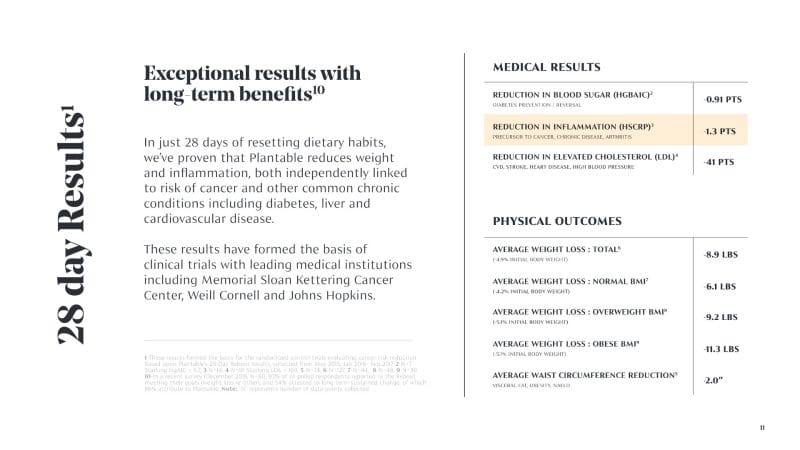

That being said, Plantable’s clinical trials were initiated following the collection of the Company’s initial data samples collected from May 2015 and October 2015 through to September 2017. Titled the Foundational Results, the data collected during this period assessed the impact of Plantable’s Reboot program on participants.

Results demonstrated that participants experienced a reduction in blood sugar, inflammation, and cholesterol. Furthermore, participants experienced an average weight loss of 8.9 pounds, with a reduced waist circumference of 2 inches in the first 28 days. Needless to say, Plantable has a vision, and this vision is backed by clinically supporting evidence, which cannot be said for a lot of other plant-based companies.

Plantable’s share price opened at $0.19 on March 3, 2022, compared to a previous close of $0.19. The Company’s shares were up 5.26% and were trading at $0.20 as of 1:29 PM EST.