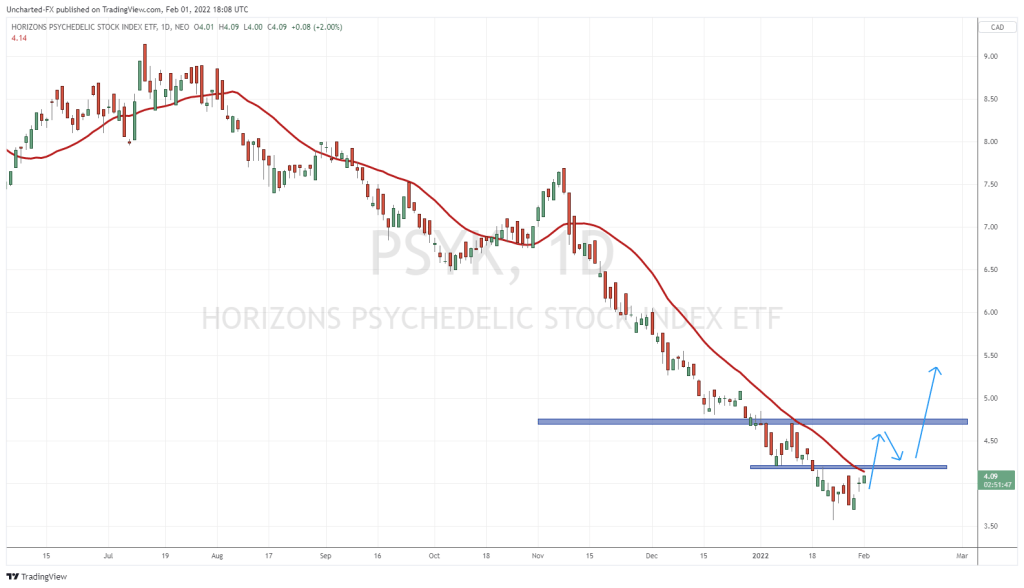

We’re not out of the woods yet, but the major indices are turning green again and psychedelics, recently a relative investment pariah, are getting some love from investors. The appreciation isn’t absolute, but many companies in the space are experiencing a much-needed bump. I want to focus on four psychedelics companies, each pursuing a different drug class toward similar ends:

DMT

Also known as N,N-Dimethyltryptamine and Dmitri, is a potent serotonergic compound found in Ayahuasca, a South American ritual brew containing various local psychedelic plants. The effects of DMT induce near-death experiences (NDEs) in the individual ingesting it. These NDEs were used as ceremonial rites of passage and holy healing experiences for over 30,000 years by shamanic figures.

These subjective states are thought to lead to ego-dissolution as well as physical transcendence into an alternative mental realm while increasing baseline trait absorption. The death trip has resulted in long-term positive psychological changes as well as reduction in stress related to one’s mortality, an increased appreciation for nature, self-worth, and a reduction in the need for material possessions and ego-driven needs.

GH Research (GHRS.Q) is a clinical stage bio-pharmaceutical company focusing on psychiatric and neurological disorders based in Ireland. The company works primarily with a novel and proprietary DMT drug candidate, GH001.

GH001’s chemical name is: 5-Methoxy-N,N-Dimethyltryptamine. GH Research intends to use their flagship inhalable compound for therapies in treatment resistant depression (TRD).

Phase I/II volunteer trials resulted in 87.5% of TRD patients experiencing ultra-rapid remission with no serious adverse events.

The company is following their lead candidate up with two other compound injectable and intranasal variations known as GH002 and GH003 which will be used in specialized cases where inhaling isn’t possible.

GH Research reported $280.7 million USD in cash as of September 30, 2021, with a net loss of $1.8 million for the quarter.

The DMT drug developer traded at $17.64 per share during trading on Tuesday 26.44% down for the YTD with a market cap of $917.65 million.

Ketamine

First synthesized in 1962, Ketamine, also known as 2-(2-chlorophenyl)-2-(methylamino)-cyclohexanone or Special K, is a general anesthetic using for short term pain relief. It is mostly used in veterinary medicine since it is known to produce hallucinogenic effects in humans.

Because it doesn’t suppress respiration or other important CNS functions, Ketamine is considered to have a relatively wide margin for safety. The drug works on altering neural activity in the brain as it inhibits the uptake of various neurotransmitters, including serotonin, glutamate, and dopamine.

Ketamine basically severs the communication between the thalamus and the cerebral cortex, which impacts the activities of memory, motor function, sense perception and emotion. This allows proper clinical application of the drug to assist in both psychotherapeutic treatment of such neurological conditions as depression as well as chronic pain indications.

Seelos Therapeutics (SEEL.Q) is another clinical stage biopharmaceutical company focused on central nervous system and rare disorders. Seelos’ lead treatment candidates utilize novel ketamine compounds.

The company’s development pipeline includes:

- SLS-002

- Intranasal ketamine for treating Acute Suicidal Ideation and Behavior (ASIB) in Major Depressive Disorder (MDD) and PTSD

- Well-tolerated with minimal adverse events

- Patients showed significant improvement in symptoms at 24 hrs of ketamine treatment

- Currently in Phase II trials

- SLS-003

- Sublingual ketamine wafer licensed from iX Biopharma for Wafermine™

- Proprietary fast-dissolving wafer-based drug delivery

- Plans for evaluation in complex regional pain syndrome and PTSD

- SLS-004

- Gene therapy targeting the regulation of the SCNA gene which encodes Alpha-synuclein a major constituent of Lewy bodies and Lewy neurites, protein clumps that are pathological hallmarks of conditions such as Parkinson’s Disease and dementia with Lewy bodies and multiple system atrophy

- Currently in Phase I trials

- SLS-005

- Trehalose is a low molecular weight disaccharide that penetrates muscle and cross the blood-brain barrier.

- Treatment of Amyotrophic lateral sclerosis (ALS)

- Trehalose has been shown to increase the clearance of TDP-43, decrease SOD1 and SQSM1/p62 aggregates and monomers, delaying the disease progression

- Currently in Phase II trials

- SLS-007

- Peptide inhibitor targeting the NACore for Parkinson’s Disease

- Inhibits protein progression in patients with Parkinson’s Disease

- Currently in Phase I trials

The company reported $76.83 million in cash as of September 30, 2021, with quarterly expenses of $10.91 million, but they managed to raise $20.0 million in a PP offering of senior secured debenture notes at the end of November.

Currently trades at $1.15 per share up $1.15 per share, 33.04% down for YTD with a market cap of $117.24.

Psilocybin

Psilocybin is a psychedelic prodrug found in nature in more than 200 species of fungi. The tryptamine alkaloid has hallucinogenic, anxiolytic, and psychoactive properties. Psilocybin activates serotonin receptors in the CNS, copying the effects of serotonin.

The Schedule 1 controlled substance is also known as N,N-Dimethyltryptamine and has been a ritual healing component in shamanistic practices since we painted our hand prints on cave walls. Post 1960s Leary experiments and beyond tribal use, the drug has remained a grey market fun time product.

The tide began to change after a 2016 study at Johns Hopkins University which determined that two doses of the drug, given with supportive psychotherapy, produced rapid and large reductions in depressive symptoms with half of study participants experiencing remission through a four-week follow up.

Field Trip focuses on the development and delivery of technology-enabled psychedelic therapies

The company has three business segments:

- Field Trip Health

- Mental health care clinic arm

- Nine operating clinics in the U.S. and Europe (ketamine in U.S., psilocybin truffle in Amsterdam)

- 11 more proposed clinics in U.S. and Canada

- Goal to open 75 clinics by 2024

- Field Trip Discovery

- Developing FT-104 synthetic psychedelic molecule like psilocybin

- Patent has been allowed and expected to be granted in February 2022

- Phase I trials during 2022 with Phase III expected to commence in H2 2026

- Field Trip Digital

- iOS and Android app

- pairs with online site Field Trip Portal

- To assist, record and monitor the recovery process

Field Trip recorded $88.0 million CAD in cash, cash equivalents and short-term investments as of September 30, 2021, but also reported $15.64 million in quarterly expenses. It isn’t a surprise that the company filed a net loss of $13.02 million for the quarter.

The company suffers from a shotgun approach, and I feel it has spread itself too thin with the brick-and-mortar clinics. It may succeed, but it isn’t as focused as I would like it to be.

Field Trip currently trades at $2.52 per share during trading on Tuesday and is 16.05% down for YTD with a market cap of $127.81 million.

MDMA

A synthetic compound more commonly known as Ecstasy. MDMA was developed in 1912 by Merck chemical company. Originally marketed as a psychiatric aid, the therapeutic benefits were considered to be limited. As such, the drug became an illicit party drug.

MDMA is the abbreviated version for its chemical name, methylenedioxy-methylamphetamine. The drug acts as a CNS stimulant with weak hallucinogenic properties that has been described as enhanced sensory awareness. You may remember the Neil Patrick Harris character in Harold and Kumar licking the back of the passenger seat.

Recent research has pointed to the benefits of MDMA-assisted therapy for severe PTSD, where those conducting the study determined that MDMA along with guided psychotherapy represented a potential breakthrough treatment that merited expedited clinical evaluation.

Vancouver-based psychedelics company focused developing proprietary, psychedelic-centred, therapeutic products and services through lab research and development, and distribution through physical locations as well as digital solutions.

Numinus holds a Health Canada Controlled Drugs and Substance Dealer’s License as well as Analytical Testing License. The company is currently partnered with MAPS for a Phase II, single arm, open label, compassionate access trial to study the safety and efficacy of MDMA-assisted psychotherapy for PTSD.

The company is also partnered with Syreon Coporation to pursue a single arm, open-label, compassionate access trial of Psilocybin Research Intervention with Motivational Enhancement (PRIME) for substance use disorders.

Numinus has locations in Vancouver, Montreal and Toronto for psychedelics assisted therapy for mental health and neurological conditions

The psychedelics venture reported $789,617 in revenues for the quarter ending November 30, 2021, with a net comprehensive loss for the quarter totaling $5.35 million and quarterly G&A expenses of $3.74 million.

With $53.88 million in the till as of November 30, 2021, Numinus traded at $0.70 per share during trading on Tuesday up 14.75% YTD with a market cap of $142.02 million.

As I stated earlier, the markets are still not out of the woods and this sector-wide bump is fueled by the optimism more than real results. Therefore, we could see a further deflation in share value. There is also the argument of recreational psychedelics versus medical. Well medical is more vital, recreational presents the greatest growth potential but relies on legislation that is still reticent to grant widespread medical access.

It will be interesting to see how this sector plays out over the next six months. Whatever your play, it is doubtful that psychedelics will continue to be a day trader’s paradise and any investment should be geared toward real or potential value for the long-term. Please do your own diligence before making any investment decision, but after you have consulted an investment professional and weighed your research, pick your winners, and make this a better world. Good luck to all!

–Gaalen