In this chart attack, I will be breaking down the technical charts of the companies Chris Parry has highlighted in his E-Sports Wrap up. But let’s start with a simple question. What is esports?

eSports describes the world of competitive, organized video gaming. Competitors from different leagues or teams face off in the same games that are popular with at-home gamers: Fortnite, League of Legends, Counter-Strike, Call of Duty, Overwatch and Madden NFL, to name a few. These gamers are watched and followed by millions of fans all over the world, who attend live events or tune in on TV or online. Streaming services like Twitch allow viewers to watch as their favorite gamers play in real time, and this is typically where popular gamers build up their fandoms.

It is no doubt that competitive video gaming has become a global phenomenon. Large stadiums are sold out, and finals attract more views than the Superbowl. Investment opportunity. Streamers over on Twitch see consistent viewers in the tens of thousands. Again, an investment opportunity. Just flicking to Twitch as I am writing this article, I see that the recently released Halo Infinite is getting a lot of eyeballs. To be honest, I am sort of surprised I didn’t know it was even out. Was a big Halo fan growing up, but alas, after Xbox 360, I went the Playstation route. But I expect to see more Halo content on gaming streams this holiday period.

According to a new market study published by Global Industry Analysts, the global market for gambling was valued at USD$711.4 billion in 2020. This market is expected to expand at a compound annual growth rate (CAGR) of 3.6%, reaching an estimated valuation of USD$876 billion by 2026. Don’t even get me started on online gambling. Valued at USD$64.13 billion in 2020, the global online gambling market makes up a large proportion of the global gambling market. Moreover, this market is projected to reach an impressive CAGR of 12.3%. Why so much growth? Following the onset of COVID-19, the online gambling market was positively impacted. A study conducted by Lund University, Sweden, revealed that due to restrictions surrounding live sports events, consumer interest in online gambling platforms increased substantially.

A little aside while I am speaking about the Holiday period. The Omicron variant has caused governments to either shut down entire countries again (Netherlands), or impose more restrictions (Canada). Things such as esports and sports betting saw a rise in popularity when people were stuck at home. As much as it sucks to say it given the circumstances that are happening, this sector might see more interest in the upcoming few weeks.

I gave the definition of esports above, but for this article, we are exploring companies that touch on betting, sports betting and fan interactions. A broad selection of companies using online and mobile entertainment based products designed for sports betting, esports and casino games. Something for everyone in a sector that will continue to garner more interest. Personally, I like to combine pop culture, anime, and video gaming all under one umbrella. Call it the Otaku sector trend if you must.

AMPD Ventures (AMPD.C)

AMPD’s mission is to ‘reinvent’ the Internet to properly support low-latency applications in environmentally conscious ways. Current cloud infrastructure doesn’t properly support the intense requirements of the latest multiplayer video games, cutting edge digital media production, nor the requirements of next-gen enterprises as they push the boundaries of big data analysis and visualization.

The company is one of our favorites here on Equity Guru, and was recently featured on December 2nd 2021. You can Chris’ deep dive and all things fundamental here. Let’s just say he is a big fan and bullish on the company.

How does AMPD fit in with esports? AMPD game hosting. The AMPD team has over two decades of experience in technology solutions for video game studios and digital media production houses around the world. They supply high-performance computing solutions for the studio, and in the data centre.

AMPD GAME HOSTING blends dedicated core infrastructure with the flexibility to work with any public cloud – including our own high-performance AMPD Cloud Plus – for higher performance and better pricing than other cloud providers. Any company with a multiplayer game at scale should talk to AMPD and let us work with you to propose a fully right-scaled architecture that represents the best combination of price and performance, tailored precisely to the needs of your game and your players.

In terms of technicals, the chart still adheres to my analysis on December 2nd. The structure is still holding. The uptrend trendline remains intact meaning the stock remains bullish. Recently we have been consolidating between $0.40 and $0.50. The latter price being a huge psychological resistance zone for stocks traded under $1.oo. Going forward, we require a close above $0.50 for a breakout and further push to the upside. The company though has a bright future and a lot of things going for it right now. Any dips would be seen as buying opportunities.

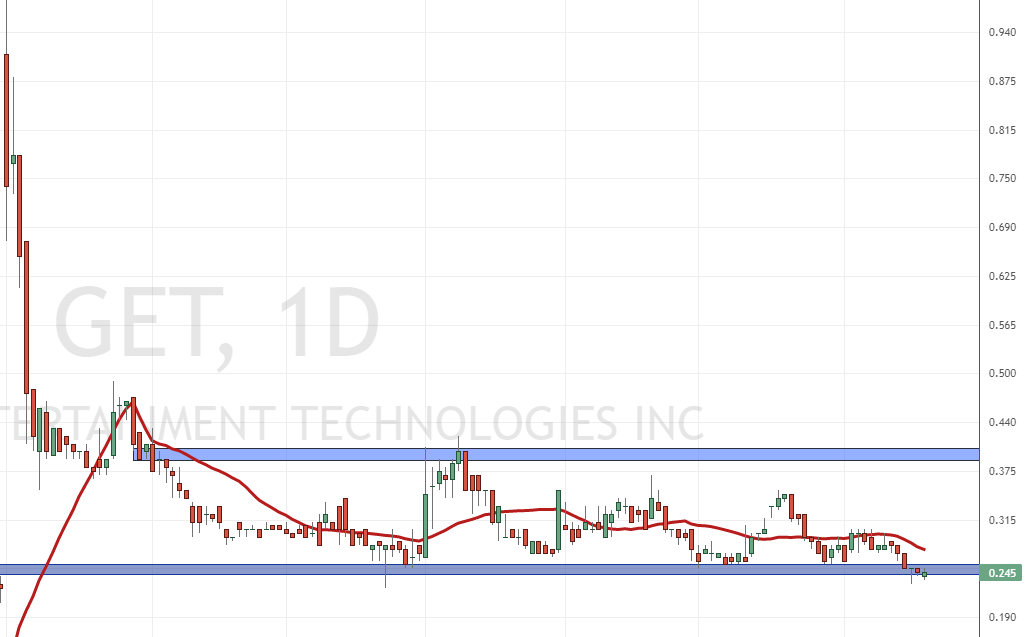

GameOn Entertainment (GET.C)

GameOn Entertainment is different from the rest. This company is not about sports betting in the gambling sense of things. Instead, it is about fan interaction while the sport or tv series is going. Engaging the superfan. GameOn powers the biggest sports, media and entertainment companies with the most innovative white label game technologies. GameOn provides broadcasters, TV networks, streaming platforms, leagues, tournaments, sportsbooks and NFT projects with white label prediction games, fantasy games and NFT-based games. Backed by Techstars, Times Internet and Polygon, GameOn has secured revenue-generating partnerships with global companies including NBCUniversal, Bravo and MX Player.

The company has been making waves in the Indian market. Gameon’s cricket predictor for MX player surpassed 2 million predictions in two weeks, and is on track for six million predictions and 200,000 active users by January 2022. Gameon and MX player have also confirmed three more games for cricket, soccer and kabbadi.

MX player is an Indian super app, and MX’s Cricket Predictor, powered by GameOn, surpassed 1 Billion downloads. By correctly predicting events like who’ll win and how many runs will be scored, fans move up the leaderboard. Top-ranked players earn status, recognition and rewards including money-can’t-buy experiences and cash. That in a nutshell explains GameOn’s super fan engagement model.

Technically, GameOn is at a very pivotal zone. A major support zone. The stock has effectively been in a range from June 2021 to now. Currently, we are testing the bottom limit of the range. If we get a STRONG candle close below $0.25, the range will be broken, and we possibly take out previous record lows of $0.225.

For forward guidance, GameOn CEO Matt Bailey recently provided a Q4 corporate update and what’s in store for the future. Highlights include key investments ( Brand Capital International, the investment arm of India’s largest media conglomerate The Times Group, investing up to $6 Million US in GameOn over three years), new customers (Chibi Dinos, Kevin Garnett backed Gaming Society and more) and NFT games (Polygon).

“These investments represent a watershed moment for GameOn,” said GameOn CEO Matt Bailey. “A moment when a small, relatively unknown company became backed by India’s largest media conglomerate and a leading blockchain with a US$20 billion market cap. This is strong validation of the mission, products and committed team that fuel our business each day.”

“2022 is set up to be the year of scaling customers and revenue, with all the right people and resources in place” said Bailey. “If you’ve followed us since our listing on the CSE, you’ll know we execute on what we say. We expect the next 12-24 months to be no different. The first inning is over. Batter up for the second, now with the likes of Times Internet and Polygon on-deck.”

With a great year in the bag, and an exciting 2022 to look forward to, investors may pick up shares at this support. I will be looking for evidence of this with a nice strong bullish green candle, or a large wick candle like we had on August 24th 2021, plus large volume.

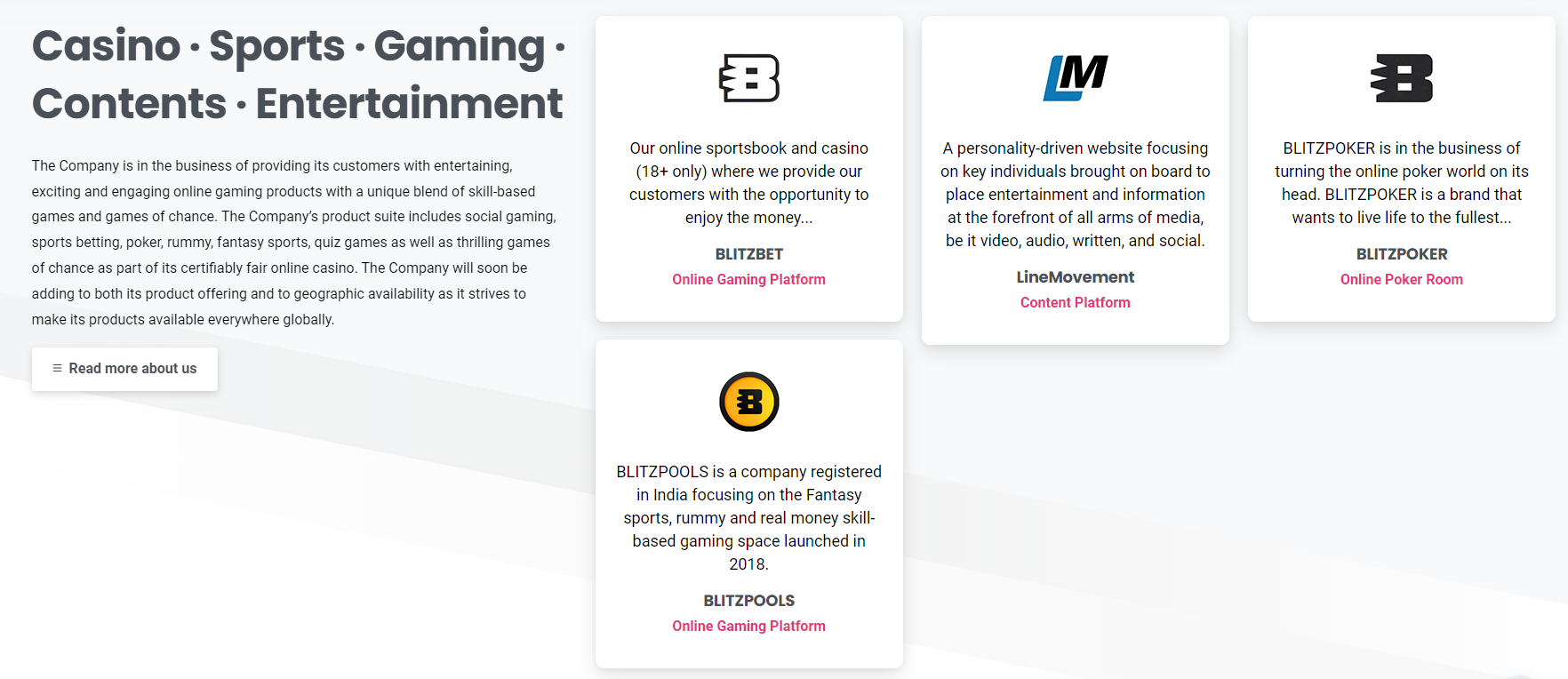

i3 Interactive (BETS.C)

i3 interactive is all about transforming the future of online and mobile gaming with entertainment-based products designed for sports betting, poker, and casino players. The company is fully supported by a network of digital content and affiliate web properties.

The stock may appear on some trading lists because it has resumed trading after a long 8 months. Yes that is right, the stock was halted after April 9th 2021, and resumed trading last week on December 17th 2021. The question is, have all the legal issues been solved? Or will it continue to deter investors?

The stock had a 50% drop on its return, expected after a halt, but formed a large green candle to close the day. Over 3 million shares were traded, and we are now at a major resistance zone at $0.19. A key zone here, because long time shareholders may decide to dump their shares after the trading halt. Today’s price action will be interesting to see if we see sellers pile in here at this resistance, or if we can get a daily candle close above $0.19, which sets us up for a move above $0.30.

The company has been doing things while the stock has been halted. Management has acquired the remaining equity of Livepool, and have entered into a non-binding letter of intent to acquire an industry leading online gaming operator with a well established brand. More news on this transaction in the coming weeks.

A big day for the stock on Monday and in the next few weeks as we close out 2021.

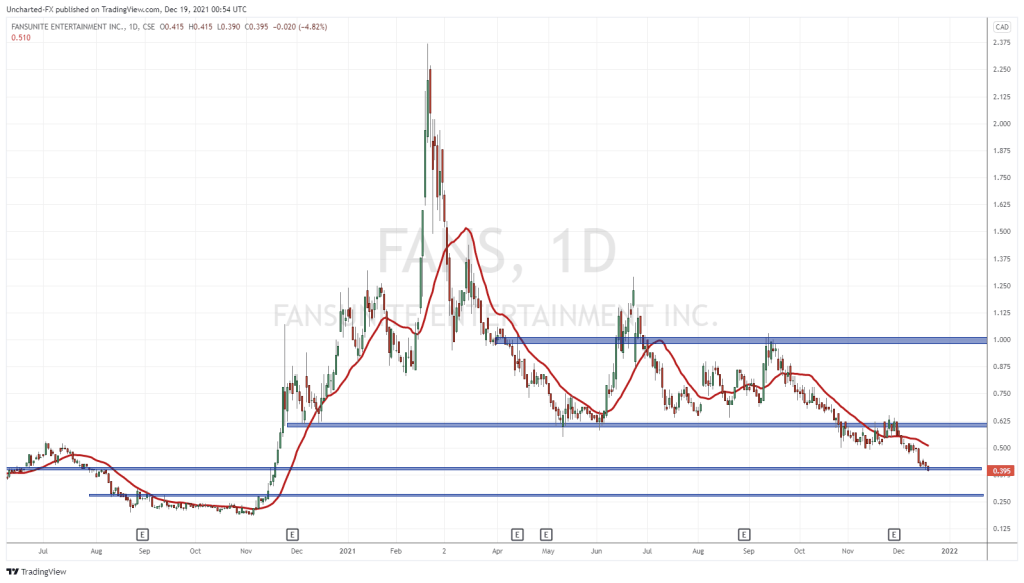

FansUnite (FANS.C)

FansUnite is a sports and entertainment company, focusing on technology related to regulated and lawful online sports betting, esports betting, casino and fantasy. Their mission is to be a leader in the gaming industry by providing their partners and players the industry’s most versatile and vertically integrated platforms with a portfolio of unique products and a focus on esports, sports betting, casino and the next generation of bettors.

For a breakdown on this company’s organization, I will be quoting Kieran’s recent article on FansUnite which can be found here.

Chameleon is a complete business-to-business (B2B) sports and esports white label iGaming platform offering turn-key and API solutions. Currently, Askott Games, Askott Entertainment’s newest division, is responsible for the development of exclusive casino-style RNG games with esports and video game themes. In addition to offering its solutions to partners via the Chameleon platform, Askott games also licenses its games to external casino aggregators, connecting the division with hundreds of online casinos and sportsbooks.

Let’s not forget about FansUnite’s acquisition of McBookie, a leading provider of regulated betting services in the United Kingdom (UK). McBookie has been operating in the UK market since 2009 and is recognized for its sports betting, casino, and virtual sports offerings. At the time of acquisition, McBookie boasted approximately 10,000 active members and handled a total of CAD$340 million in betting since its inception. Additionally, in the last three years, McBookie has taken over CAD$135 million in betting volume onto its platform.

A lot of eyes perk up on the McBookie part. Yes, revenues.

The stock started off 2021 with a bang. Hitting all time record highs of $2.37 in February 2021. Here’s hoping for the same start in 2022! But first, the stock needs to find some support and base.

FansUnite has given up all of 2021’s gains year to date as it looks to find support. I had a zone at $0.40 marked, but it looks like we got a red candle close below it to end last week. Today will determine whether the sellers pile in, or if buyers can cause a false breakout by getting a green close back above $0.40.

If there is more downside, then the next support level would be around the $0.28 zone. I would be a bit surprised if the stock drifts that low. The company has revenues and continues to announce positive press releases. There were a lot of winners on this stock, and perhaps profits are being taken for tax implications before the year ends. Until then, let’s wait to see a range form to indicate the base is in and the selling is done.