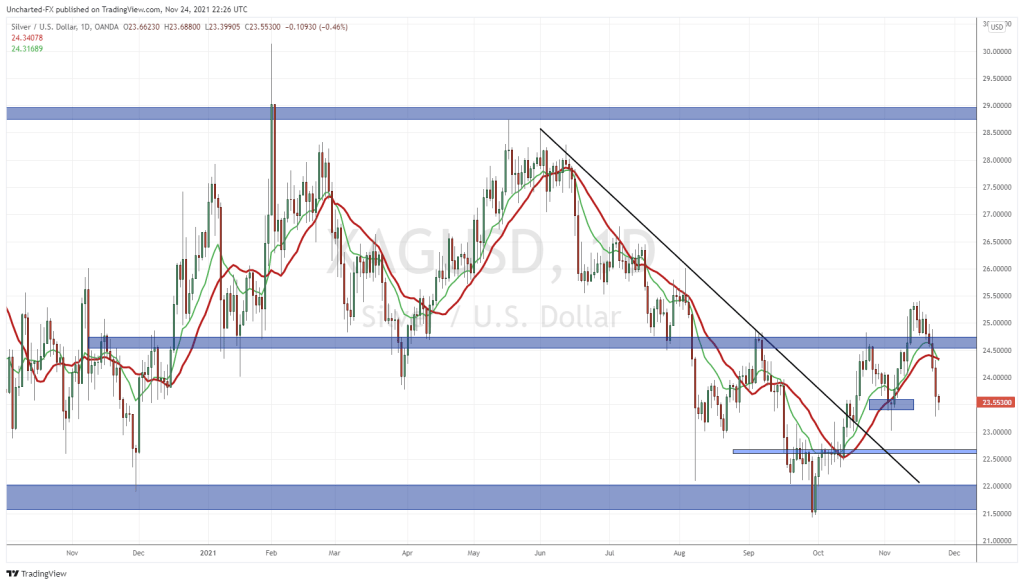

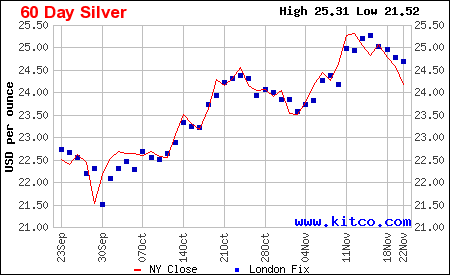

20 months ago, silver was selling for $12 an ounce. After surging briefly to $29/ounce it’s currently trading at $23/ounce.

Silver is considered a hedge against money-printing.

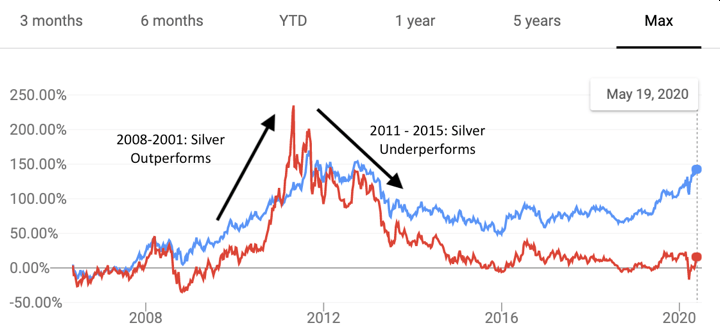

“Referred to as the ‘poor man’s gold,’ silver is generally levered to the price of gold,” states Max Greb, a Shanghai-based portfolio manager, “When gold goes up silver outperforms, and when gold goes down silver underperforms.”

“In the graph below, notice how silver (red) drastically outperformed from 2008 to 2015 when both rose, and loss significantly more than gold (blue) from 2011-2015 when they both declined”.

About 50% of silver comes from industrial use, which means global GDP growth affects the silver price more than gold. Only 15% of gold demand comes from industrial use.

Silver is used to solder and braze alloys, it is also used in batteries, dentistry, glass coatings, LED chips, medicine, nuclear reactors, photography, solar energy, semiconductors and touch screens.

The biggest industrial consumers of silver are US, Canada, China, India, Japan, South Korea, Germany and Russia.

Here are 5 silver companies with aggressive leverage to higher silver prices.

Zacatecas Silver (ZAC.V) is a $55 million company developing The Zacatecas silver property located in Zacatecas state, Mexico. The flagship concession lies within the Fresnillo silver belt, which has produced over 6.2 billion ounces of silver.

25 kilometres southeast of Mag Silver’s Juanicipio mine and the Fresnillo mine – ZAC holds 19,338 acres of ground that is highly prospective for silver-base-metal mineralization and potentially gold-dominant mineralization.

The property shares common boundaries with Pan American Silver claims and El Orito, which is owned by Endeavour Silver. There are four main high-grade silver target areas within the Zacatecas concessions.

Discovery of silver in the Zacatecas area occurred in 1546. By 1548, the Spaniards had begun production from three mines.

By the late 1800’s silver from the Zacatecas Mining District accounted for 60% of the value of all Mexican exports making it one of Mexico’s wealthiest and largest districts of the era.

On November 23, 2021 Zacatecas Silver reported multiple silver and gold assays in its initial diamond drilling program at Panuco Central Vein and the Tres Cruces (Panuco North) Vein.

Highlights:

- Completed 4 angled diamond drill holes in the Panuco Central Vein and 9 angled diamond holes in the Tres Cruces Vein (Panuco North Vein).

- Assay results from the eastern part of the Tres Cruces vein, which has had no previous drilling, include:

- 1.85 m @ 261 g/t Ag Eq (224 g/t Ag and 0.49 g/t Au) from 126.05 m downhole (Hole PAN 2021-008)

- 2.17 m @ 823 g/t Ag Eq (798 g/t Ag and 0.34 g/t Au) from 154.94 m downhole (Hole PAN 2021-009)

- 3.00 m @ 267 g/t Ag Eq (203 g/t Ag and 0.85 g/t Au) from 46.50 m downhole (Hole Pan 2021-010)

- Assay results for the bottom of Hole 2021-010 (which intercepted almost two metres of a brecciated quartz-sulphide vein) and holes PAN 2021-011 and PAN 2021-012 are pending. Holes PAN 2021-011 and 012 were drilled in eastern Tres Cruces and both intercepted brecciated quartz-sulphide veins.

- Three holes targeted a historical high-grade intercept in Central Tres Cruces, over 1 km to the northwest and along strike of the eastern Tres Cruces holes. Assays for hole PAN 2021-013, which intercepted almost 5 metres of sulphidic quartz vein, are pending.

“It is very encouraging that of the five holes for which we have partially received assays — three have intersected silver-gold mineralization over downhole widths of 1.85 to 3.00 m at grades above those of the historical Panuco resource,” stated Dr. Chris Wilson, Chief Operating Officer and a Director of Zacatecas, “It is also significant that mineralization was intercepted near surface at vertical depths of between approximately 30 to 110 metres. This allows for cost-effective shallow drilling during this phase of exploration, with an increased number of holes now planned.”

“What I’ve been emphasizing on FOX and other media outlets is that these short-term moves in the price of silver are not overly important against the big picture,” Zacatecas Silver CEO Bryan Slusarchuk told the National Post.

“What’s important is that silver had value as money a thousand years ago, is money today and will be money a thousand years from now,” added Slusarchuk, “This inherent value coupled with fast-growing silver demand in vehicle electrification and solar panels are the important themes.”

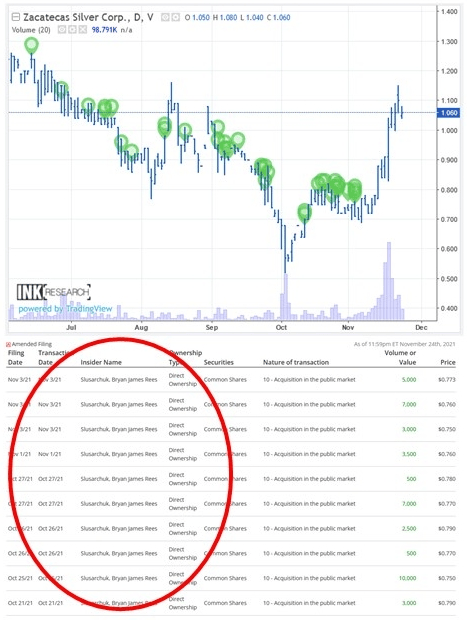

ZAC started trading in March, 2021 at $1.66, the SP fell on October 5, 2021 low of .52. The ZAC share price has since doubled to its current value of $1.06.

During this rollercoaster ride the CEO Slusarchuk has continued to purchase ZAC shares on the open market. (green “tear-drops” are insider buying events).

Sierra Madre Gold and Silver (SM.V) is a $33 million company focused on the acquisition, exploration and development of the Tepic Property in Nayarit, Mexico.

Fifteen kilometers from a regional airport, Tepic includes five mining concessions covering a total of 2,612.5 hectares. At Tepic, a 2,000-meter Phase 1 reverse circulation drilling began on April 15th.

Three months ago, SM acquired an option to joint venture for the La Tigra Project, located 148 kilometres north of the Sierra Madre’s flagship Tepic Project in the mining-friendly state of Nayarit, Mexico.

According to reports published by the Mexican department of geology, about 2,500 gold and silver hand-miners worked in La Tigra prior to 1900.

October 28, 2021 SM provided an update on La Tigra. Assays have been received for 319 reconnaissance samples with values ranging from <0.005 to 18.2 grams per tonne gold (“g/t Au”).

The average gold grade of all samples received to date is 0.48 g/t Au with 32 samples greater than 1.0 g/t Au and 10 samples greater than 3.0 g/t Au. Silver values range from <0.5 to 65.2 g/t silver (“Ag”) and average 3.99 g/t Ag with 30 samples greater than 10 g/t Ag and 4 samples greater than 30 g/t Ag.

Two structural systems have been identified that host gold and/or silver mineralization. A gold rich quartz-barite-hematite system which strikes to the northwest and dips 35 to 45 degrees to the southwest.

On October 19, 2021 Sierra Madre announce the results of the first 11 trenches at its Tepic Silver Gold project located in the State of Nayarit, Mexico.

Highlights of the results received thus far include TZ005 with 10.5 meters grading 91 g/t AgEq, TZ011 with 10.1 meters grading 119 g/t AgEq and TZ011A with 9.2 meters grading 543 g/t AgEq. Sierra Madre is currently sampling trench 33 and the following tabulates the results of the first 11 trenches.

SM has a veteran management team with a reputation for moving quickly. The SM geological team is lead by Gregory Liller (B.SC), who has been operating in Mexico since 1993, playing a key role in the discovery and development of more than 11 million ounces of gold and 600 million ounces of silver.

The CEO Alex Langer considers Liller a key asset to Sierra Madre. “Making one metal discovery could be good luck,” commented Langer. “Making six or seven is not.”

Langer narrates an overview of SM in this video.

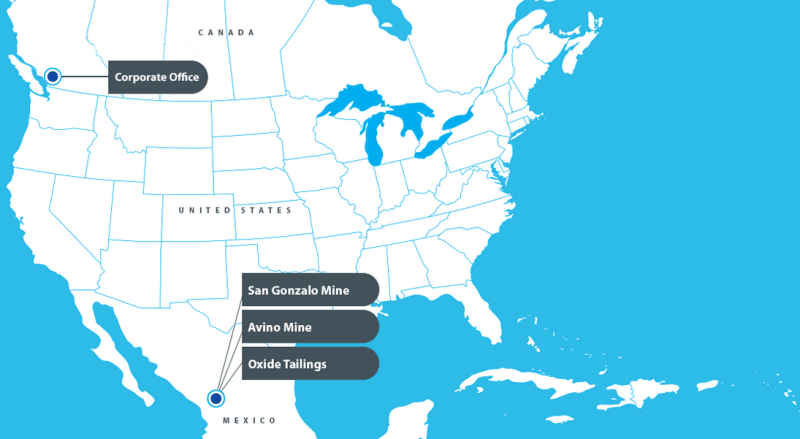

Avino Silver & Gold Mines (ASM.V) – is a $121 million company operating its 99% owned Mine near Durango, Mexico. Year-to date, ASM produced about 3,500 ounces of silver.

Strategic Acquisition of La Preciosa Silver Project from Coeur Mining On October 27, 2021, and subsequent to the end of Q3 2021, the Company announced that it has entered into a definitive agreement (the “Agreement”) with Coeur to acquire the La Preciosa silver project, which is located adjacent to the Avino Mine in the state of Durango, Mexico, for upfront consideration of $29.7 million on closing and $5 million due within 12 months of closing.

Mining Operations Resumed at Avino Mine: On August 3, 2021, the Company announced that mining operations have officially restarted at the Avino Mine. During the three months ended September 30, 2021, mining activities continued to ramp up and management expects to reach previous production levels during Q4 2021 or Q1 2022.

Term Facility Repaid on Schedule: As of September 30, 2021, the Company has fully repaid its $10 million term facility with Samsung C&T U.K. Limited (“Samsung”). The Company remains committed to selling Avino Mine concentrate to Samsung until December 31, 2024.

Exploration Continues: Approximately 5,000 metres were drilled during the quarter. Areas drilled include the existing Oxide Tailings Resource, which is contained within the tailings storage facility (“TSF #1). 200 holes are planned on this program, with over 150 having been completed to date. Additional areas for exploration include the main Avino vein below current mining activities and at the La Potosina vein. Turnaround times for assay results have been slow; however, results are expected to be released prior to the end of 2021.

Q3, 2021 Financial Highlights

- Cash balance of $23.4 million

- Working capital of $28.9 million

- Completed term facility repayment to Samsung

- Revenues of $1.9 million

- Mine operating income of $0.8 million, $1.1 million net of depreciation & depletion

- Cash costs per silver equivalent ounce sold – $6.75 per ounce

- All-in sustaining cash cost per silver equivalent payable ounce of $25.60

- Earnings before interest, taxes, depreciation, and amortization (“EBITDA”)1 of $0.2 million

Bear Creek Mining (BCM.V) is a $171 million Peru-focused silver exploration and development company. The 100% owned Corani silver-lead-zinc deposit is one of the largest, fully permitted silver deposits in the world, and comes with substantial base metal credits.

Corani contains 225 million ounces of silver, 2.7 billion pounds of lead and 1.8 billion pounds of zinc, and is expected to produce over 9.6 million ounces of silver and 165 million pounds of combined lead and zinc annually over a projected 15-year mine life.

Corani projects a $113 million increase in NPV for every $1 increase in silver price with proportional changes in lead and zinc prices.

On October 20, 2021 Bear Creek Mining announced that representatives from the towns and villages of the Corani District were received by the President of Peru, Pedro Castillo Terrones at the Presidential Palace on Friday, October 15, 2021.

During the meeting community representatives formally and unequivocally expressed their support for Bear Creek Mining’s development, construction and operation of the Corani silver deposit.

President Castillo in turn welcomed their statement of support, declared that “investment with responsible companies” is welcome in Peru, and committed to the delegation that he and the Peruvian government will support development of the Corani project in order to bring the project to fruition, stating he “will take Corani as an example for future investment desires.”

Edmundo Cáceres Guerra, mayor of the town of Corani, led the delegation that included the district president of the communities, leaders of the local villages of the area, and representatives from the Rondas Campasinas, and stated on behalf of the group, “The entire people of the province of Carabaya, of approximately 10,000 families, will be happy because a better future awaits them.”

“We are very appreciative of the support we have received from the leaders and residents of communities surrounding our Corani project,” states Anthony Hawkshaw, President and CEO of Bear Creek Mining.

Corani is one of the largest yet-to-be developed silver deposits in the world. The project has been granted all key permits including an approved ESIA, construction permits and accreditation of water availability.

BCM recently raised $34 million, pumping some of that money back into the local community.

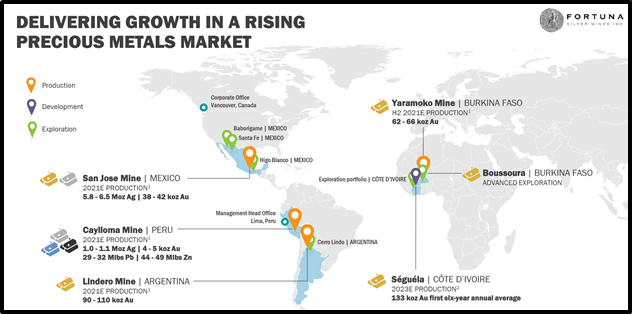

Fortuna Silver Mines (FVI.V) is a $1.3 billion company with precious metals mining company with four operating mines in Argentina, Burkina Faso, Mexico and Peru, and an advanced development project in Côte d’Ivoire.

- Record sales of $162.6 million, an increase of 95% from the $83.4 million reported in the same period in 2020 (“Q3 2020”), due primarily to gold sales from the Yaramoko mine of $49.0 million and from the Lindero mine of $41.8 million.

- Net income of $0.2 million or $0.00 per share, compared to $13.1 million or $0.07 net income per share reported in Q3 2020. Net income was lower due primarily to $10.5 million in transaction costs related to the acquisition of Roxgold Inc., and $9.6 million settlement of the disputed royalty claim with the Mexican Geological Service (“SGM”).

- Adjusted net income1 of $22.5 million compared to $16.1 million reported in Q3 2020.

- Adjusted EBITDA1 of $75.3 million compared to $42.2 million reported in Q3 2020.

- Free cash flow from ongoing operations1 of $33.8 million compared to $30.1 million reported in Q3 2020.

- As of September 30, 2021, the Company had cash and cash equivalents of $135.8 million, an increase of $3.9 million from December 31, 2020.

- Silver and gold production of 1,711,881 ounces and 65,425 ounces, respectively.

- AISC1 per ounce of gold sold of $1,270 for the Lindero Mine and $1,188 for the Yaramoko Mine. AISC1,2 per silver equivalent ounce of payable silver sold of $15.51 and $17.66 for the San Jose Mine and Caylloma Mine, respectively.

“More than $50 billion of green stimulus has been approved by governments,” states BMO Capital Markets. “The Biden Clean Energy plan would see new wind and solar capacity built to displace thermal generation.”

“Silver’s potential exposure to green stimulus is now an important tool in its armory.” continued BMO.

The automotive industry will use approximately 61 million ounces of silver in 2021, according to a report published by The Silver Institute.

Full Disclosure: None of these silver companies are Equity Guru clients.