Bryan Slusarchuk’s Zacatecas Silver (TSXV:ZAC) trades Tues Mar 2, 2021, with over $9 million in cash, only 52.3 million shares out and no warrants.

Few mining entrepreneurs ever took advantage of a bear market better than Canadian Bryan Slusarchuk in 2015.

He and an elite team of mine-builders picked up a Papua New Guinea gold mine from Barrick Gold, the world’s number one producer, for an initial deposit of $2 million as Barrick refocused on essential assets. The Kaintantu project Slusarchuk acquired had already been developed and seen $300 million of historical investment prior to the deal.

Timing is everything…

Fast forward six years and K92 Mining, the company Slusarchuk co-founded, has a valuation in excess of $1.3 billion following new discoveries and outstanding results.

Slusarchuk’s Hunt For More Discoveries

The millionaire founder wasn’t done there. He never stopped looking for new opportunities and the success of K92 brought him more deal flow. He co-founded two more companies from scratch: Turmalina Metals (~$60 million market cap) and Fosterville South (~$110 million market cap) focusing on copper in South America and gold in Australia respectively.

In an interview, Slusarchuk once said, “I believe everyone gets 5 to 10 ‘once in a lifetime’ opportunities in their career.”

Zacatecas Silver (TSXV:ZAC)

The province of Zacatecas, Mexico is the world’s most prolific high-grade silver producing region with 6.2 billion ounces of historical production.

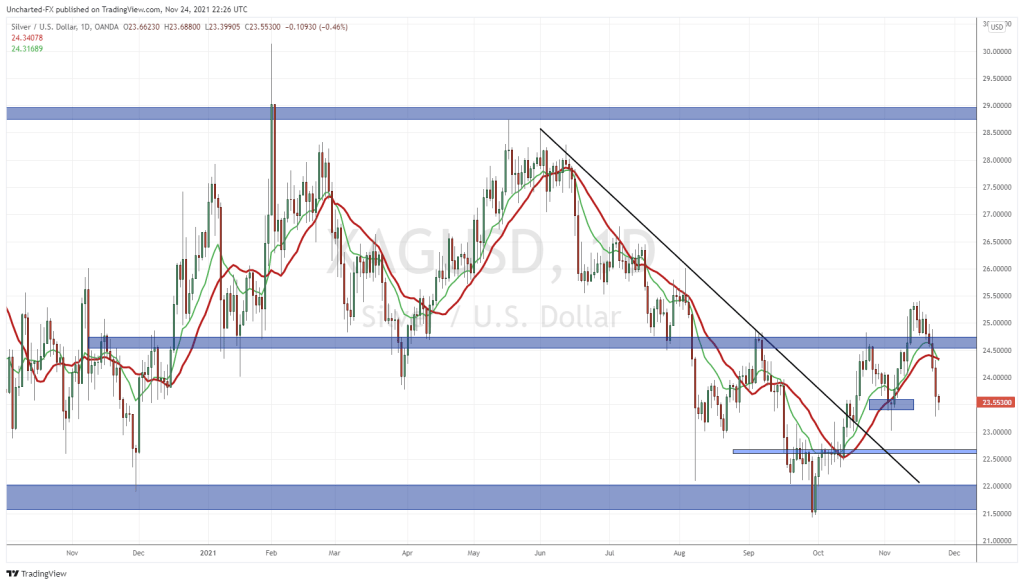

With an incredibly bullish outlook on silver globally, Sluaschuk formed Zacatecas Silver, which commences trading on the TSXV tomorrow as “ZAC” to capitalize on opportunities there.

ZAC acquired significant land holdings from Santacruz Silver, one of the local operators. The Properties include the Panuco Deposit, which has an inferred mineral resource of 19,472,901 ounces from 3,954,729 tonnes at 153.2 g/t Ag Eq with significant resource expansion potential and high-grade silver exploration upside (see news release dated August 29, 2019). Mineralization at the Panuco Deposit remains open along strike and down dip.

ZAC intends to start work “immediately to target resource confirmation and expansion at the Panuco Deposit, and exploration and target generation at the Muleros, El Cristo and San Manuel-San Gill prospects.”

Along the way Slusarchuk assembled an elite team of explorationists and mine builders and attracted investment from famed billionaire silver investor Eric Sprott, among others.

“We are big believers that macro conditions for silver have never been better,” Slusarchuk commented. “It is also undisputable that Zacatecas is one of the world’s best addresses for high grade silver. To acquire a project with historic high-grade intercepts, an inferred mineral resource with expansion and exploration upside is very timely. Our team has created significant shareholder value for precious metals investors during the bear market and now with a precious metals bull starting, we are ideally positioned in terms of technical expertise and capital markets ability to continue delivering excellent potential upside going forward.”

Look for Zacatecas Silver’s IPO on Tuesday under the ticker symbol ZAC:TSX Venture. For more information and updates on the company visit their website.

See SEDAR for important risk disclosures on Zacatecas Silver. Author is a shareholder in Zacatecas Silver and has a conflict of interest in writing about the company. Always do your own due diligence and consult a licensed investment advisor prior to making investment decisions.

FULL DISCLOSURE: This article is reposted by Matthew Nelson from https://www.matthewsmillions.ca. Zacatecas Silver has no commercial arrangement with Equity.Guru