[image credit: https://weedit.network/]

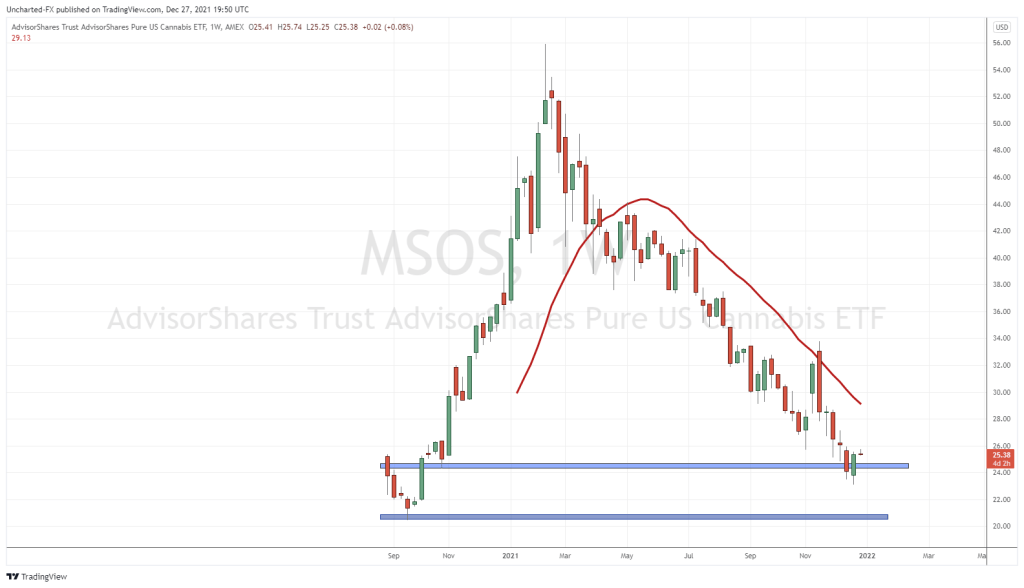

The overall health of the cannabis sector still isn’t good. Think crypto and blockchain in the winter of 2018 and you get an idea of what we’re looking at. Getting into the weeds on this one eliminated a few of my suspicions about what might be causing it—there isn’t an exorbitant amount of companies drowning in debt (although there are quite a few), and the other pitfalls from capital raising don’t necessarily seem to be as heavily represented as one might suggest.

Let’s have a look at a cross-section of what the sector has to offer.

Tetra Bio Pharma

Tetra Bio Pharma (TBP.T) represents the medical research angle for cannabis. They’re searching for orphan drug designation for their investigational medicine QIXLEEF, itself a cannabinoid-oriented medicine, for regional pain syndrome, which is a chronic neuropathic pain condition.

The curious bit is that they’ve gotten a positive nod from the EU’s Committee for Orphan Medicinal Products (COMP), and it’s highly likely they’re going to get their designation within the next month.

“The positive opinion issued by the COMP is excellent news as Tetra continues to execute its regulatory strategy in Europe. An ODD brings several unique advantages, from a cost reduction in drug development, to an accelerated review process and market exclusivity for 10 years. Such strategy is cost- and time-effective, and allows the company to easily gain market shares in a competitive free environment. If granted, this would represent QIXLEEF’s second ODD as a potential treatment for CRPS, in addition to the ODD granted by the U.S. FDA in March, 2018. We firmly believe that QIXLEEF will be a safe and effective medicine for pain management and an alternative to opioids,” according to Dr Guy Chamberland, CEO and chief regulatory officer of Tetra Bio Pharma.

The COMP’s decided that QIXLEEF qualified for the orphan drug designation for complex regional pain syndrome based on three different reasons:

- the medicinal product is intended to treat a chronic debilitating condition,

- the estimated prevalence of this rare condition is 4.4 in 10,000 persons in the European Union, and

- available data from published literature show improvement in peripheral neuropathic pain in patients treated with cannabinoid-based medicinal products.

The problem (and why this is curious) is that they recently put up an at-the-market offering of company shares and then had to close it because nobody came to their party. Right now, even when cannabis companies do good things and make strides, nobody cares because nobody’s watching.

Shares out: 401,667,409

Price: $0.215

Market Cap: $84 million

Heritage Cannabis v. High Tide: A Trajectory and Comparables Short Story

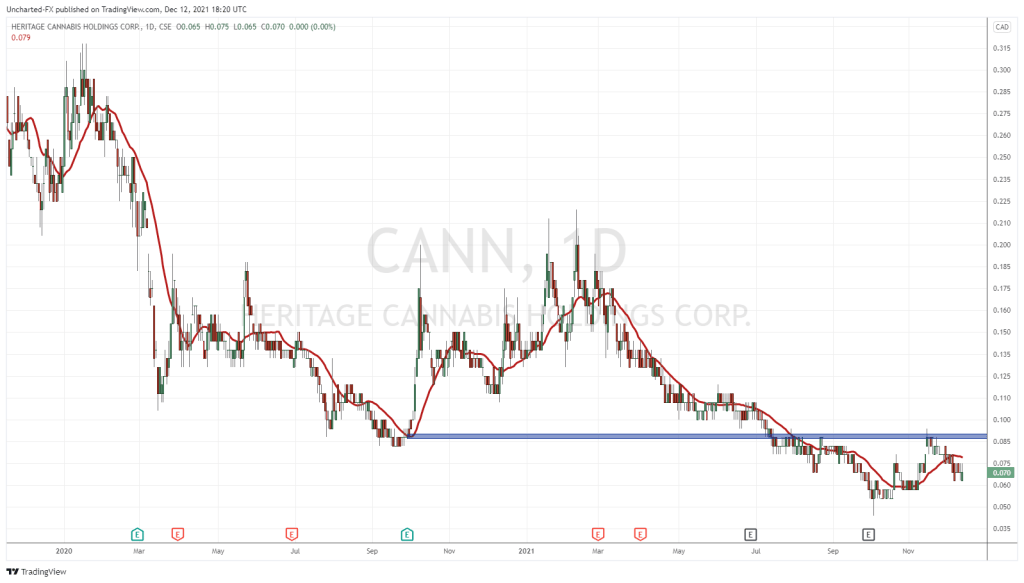

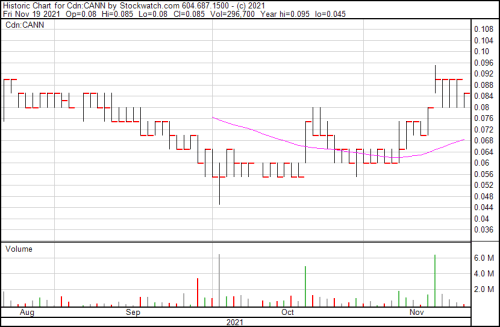

There was a time when a company like Heritage Cannabis (CANN.C) getting a commercial agreement with Canopy Growth (WEED.T) would have been a cause for celebration for Heritage bag holders. Nowadays? Not so much.

Heritage Cannabis can be contrasted with High Tide here in that they’re both in the distribution phase of their life cycle. They both have buildouts, various deals for supply and distribution, and they’re both in the process of getting product to market.

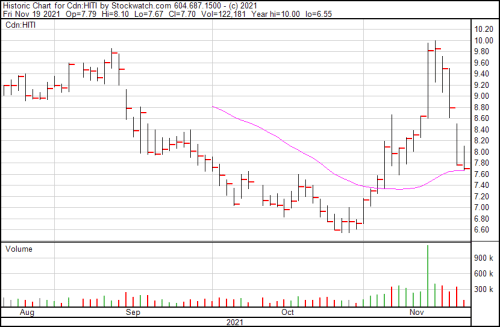

High Tide is handling their own distribution. Whenever one of us cracks a joke about a cannabis company opening up their 82nd no-name dispensary in Cookiecutter, Alberta, we’re probably talking about High Tide (HITI.V). And to some extent Curaleaf (CURA.C) in the United States. But the difference between the two companies is that it’s working for High Tide and it’s just… not for Heritage.

Shares out: 786,128,570

Price: $70.7 million

Market Cap: $0.085

Financially, Heritage is a better bet than High Tide if you compare them at their relative sizes.

Heritage is trading at $0.085 with a $70.7 million market cap. They have a respectable cash position at $2.1 million for a company that’s not heavy into M&A right now, and $133 million in total assets, and $36 million in liabilities with no debt. They’re due for a breakout if they can somehow get the word out. The noteworthy point here is no debt, given how hard it is right now for cannabis companies to raise funds without taking on convertibles or other revenue-eating vehicles.

High Tide comparatively is trading at a little under $7 at the time of writing ($9 during the roundup), and sports a $519 million market cap. Their cash position is $26 million, with a shareholder equity is in the $146 million range. The difference is of course market cap, price, and debtload, because Heritage has none and High Tide has millions of dollars worth of convertibles.

Contrast that with High Tide.

The difference is optics. High Tide is as close to visible as Health Canada allows. People actually know who they are because they won’t shut up about themselves and the most minor of victories. Heritage – not so much. But big flashy promo was never Heritage’s thing. They’re more of a follow the plan until the end kind of company, but it doesn’t mean they don’t need someone to tell investors what they’ve got going on.

Shares out: 54,677,528

Price: $7.76

Market Cap: $424,844,000

New Leaf/Vivo and plenty others

The largest impediment to growth in this sector is that we have a lot of small scale companies doing the same things with the same products, and they’re almost virtually indiscernible from each other. We’re not going to see anyone break out until one of these companies finds a way to stand out, and putting out another CBD cooling cream and getting it onto department store shelves ain’t gonna cut it.

New Leaf Ventures (NVL.C) tried to raise $5 million in a recent private placement and came away with a million and a half. The suggestion here is that they should be lucky they got that.

Shares out: 51,429,584

Price: $0.225

Market Cap: $11,829,000

Meanwhile, Vivo Cannabis (VIVO.T) has another mixed THC and CBD product in their Lumina product on shelves on their own ecommerce portal, which is another product that you and I wouldn’t ever know about if I hadn’t found the press release online.

This might be something we can lay at the feet of Health Canada’s no-advertising curse, but companies like High Tide have still managed to get their name out there despite doing the exact same thing. So why can’t these smaller guys? Again – it comes down to visibility.

Shares out: 370,896,867

Price: $.10

Market Cap $38,944,000

—Joseph Morton