In this summary report, we will take a quick look at the top 5 gainers and losers up or down double digits on the Canadian stock markets.

Here is a summary of the intraday action of assets:

Top 5 Gainers

Magna Mining (NICU.V)

Market Cap ~ $113 million

Magna Mining Inc. engages in the acquisition, exploration, and development of mineral properties in Canada. The company primarily explores for nickel, copper, and platinum group metal deposits. Its flagship property is 100% owned the Shakespeare Mine consisting of 29 patented claims, 3 leased claims, and 787 mining claims covering an area of 18074.94 hectares located in Sudbury, Canada.

The stock is up 21% on news that the Company continues to intersect high grade massive sulphide from the 2024 exploration program at Crean Hill.

The stock is breaking out on today’s news above the $0.65 zone. We have a broad double bottom pattern triggering here and it looks very bullish. The next resistance comes in around the $0.80 zone.

Aurora Cannabis (ACB.TO)

Market Cap ~ $484 million

Aurora Cannabis Inc., together with its subsidiaries, produces, distributes, and sells cannabis and cannabis-derivative products in Canada and internationally. It operates through three segments: Canadian Cannabis, European Cannabis, and Plant Propagation. The company produces, distributes, and sells medical and consumer cannabis products in Canada. It is also involved in the distribution of wholesale medical cannabis in the European Union (EU); distribution of wholesale medical cannabis in various international markets, including Australia, the Caribbean, South America, and Israel; supply of propagated vegetables and ornamental plants in North America; and distribution and sale of hemp-derived cannabidiol (CBD) products.

The stock is up 29% on no news.

This chart has been noted in past articles. It is playing out as analyzed. The previous lower high has been taken out, and the stock continues its new uptrend. A gap here could be filled with a close above $9.00 which will lead to more bullishness.

Blackrock Silver (BRC.V)

Market Cap ~ $77 million

Blackrock Silver Corp. engages in the acquisition, exploration, and development of mineral properties in Canada and the United States. It primarily explores for gold and silver deposits. The company’s flagship property is the Tonopah West silver-gold project comprising 100 patented and 83 unpatented lode mining claims covering an area of 10.3 square kilometers located in the Walker Lane trend of western Nevada. It also holds 100% interest in the Silver Cloud project comprising 572 unpatented lode mining claims covering an area of 46.9 square kilometers located in Northern Nevada Rift, Nevada.

The stock is up 21% on no news.

We have a new trend beginning with what looks like a cup and handle pattern. This chart is showing a new higher low. The next resistance target comes in at $0.40.

Pan Global Resources (PGZ.V)

Market Cap ~ $56 million

Pan Global Resources Inc., a mineral exploration company, engages in the exploration and evaluation of mineral properties in Spain. The company explores for lead, zinc, silver, gold, tin, cobalt, and copper deposits. It holds 100% interest in the Aguilas project, which comprises nine investigation permits that covers an area of approximately 16,300 hectares, as well as additional mineral rights applications covering an area of approximately 2,803 hectares. located in the provinces of Cordoba and Ciudad Real, Spain; and a 100% interest in the Escacena Project covering an area of approximately 5,700 hectares situated in southern Spain.

The stock is up 31% on news of positive metallurgical test results for tin recovery at the La Romana copper-tin-silver discovery in the Escacena Project, southern Spain.

The stock here is about to trigger a reversal pattern. I see a double bottom pattern here. Watch for a strong close above $0.24 for the trigger.

Silver Dollar Resources (SLV.CN)

Market Cap ~ $16 million

Silver Dollar Resources Inc. engages in the exploration and development of mineral properties in Canada. The company primarily explores for silver, copper, and gold deposits. Its flagship property comprises 100% interest in the La Joya project that consists of 15 mineral concessions covering an area of approximately 4,646 hectares located in the southeastern portion of the State of Durango in the Mexican Silver Belt.

The stock is up 30% on no news.

The stock is set to confirm its first higher low in a new uptrend with a confirmed close above $0.36. This will be key in establishing a new uptrend.

Top 5 Losers

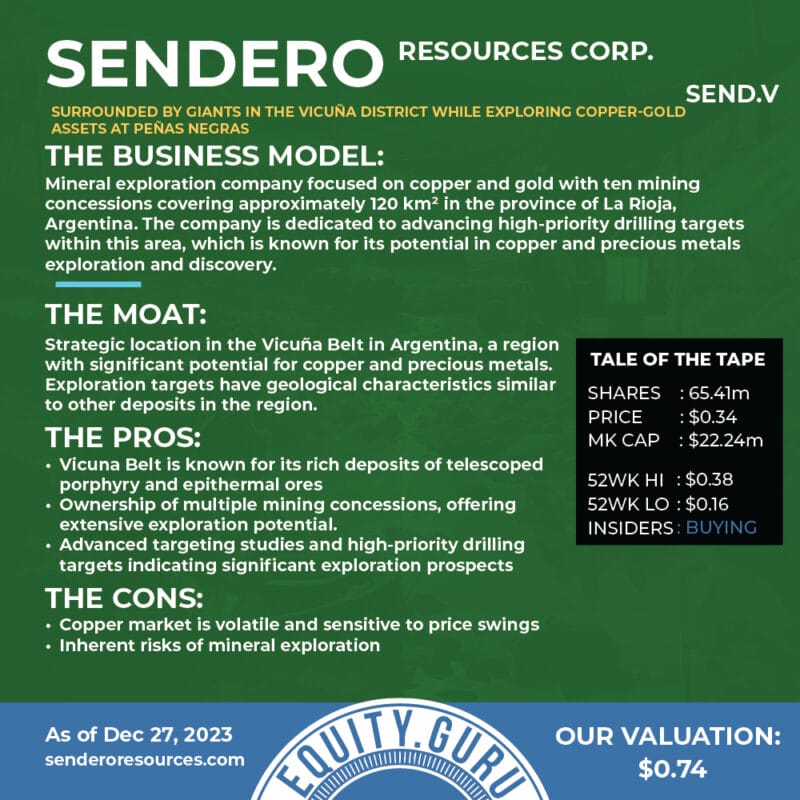

Sendero Resources (SEND.V)

Market Cap ~ $13 million

Sendero Resources Corp., through its subsidiary, operates as an exploration company in Argentina. It primarily explores for copper and gold. The company holds a 100% interest in the Peñas Negras project, it exhibits close geological similarities to neighboring deposits covering an area of 120 square kilometers located in Vicuna district of Argentina.

The stock is down 32% on news of results of the first three diamond drillholes from the ongoing maiden drilling program at its 100% owned Peñas Negras Project in the Vicuña District in La Rioja, Argentina.

The stock is tanking after forming a range after an uptrend. Previous record lows at $0.16 is the next support level to be tested.

Heritage Cannabis Holdings (CANN.CN)

Market Cap ~ $4.7 million

Heritage Cannabis Holdings Corp., through its subsidiaries, operates as a cannabinoid company in Canada and the United States. The company offers medicinal-grade cannabis formulations for the pharmaceutical, recreational, and cosmeceutical markets under the Purefarma brand; CBD, indica, sativa, and hybrid categories under the Pura Vida brand; and high-terpene, full-spectrum concentrate under the Premium 5 brand. It also provides other cannabis products under the ArthroCBD, Opticann, Adults Only, Thrifty, and Dank Drops brands.

The stock is down 50% on news the Company is obtaining creditor protection to pursue restructuring and sales process.

The stock is testing record lows which comes in lower than $0.01 at $0.005. The news is bad and the price of the stock tells you the shape of the Company. Not much needs to be said.

Golden Spike Resources (GLDS.CN)

Market Cap ~ $4.9 million

Golden Spike Resources Corp., an exploration stage company, engages in the acquisition, exploration, and evaluation of mineral properties in Canada. It explores for copper and gold deposits. The company has an option to acquire a 100% interest in the Gregory River property that includes 17 mineral claims covering an area of approximately 3,425 hectares located in Newfoundland.

The stock is down 36% on no news.

The stock attempted a double bottom breakout but failed to confirm a close above the $0.20 zone. Now the stock has pulled back and is testing support here around the $0.12 zone.

Vicinity Motor Group (VMC.V)

Market Cap ~ $42 million

Vicinity Motor Corp. designs, builds, and distributes a suite of transit buses for public and commercial use under the Vicinity brand in the United States and Canada. It offers electric, CNG, and clean diesel buses, as well as electric trucks and spare parts.

The stock is down 26% on no news. Yesterday, the Company announced Q4 and full year 2023 financials.

The stock is gapping down hard after it released earnings. Some support comes in here around the $0.90 zone. Watch to see if bulls can step in here to prop the stock up. A break below $0.90 will see the stock come down to the $0.75 zone.

Power Metals (PWM.V)

Market Cap ~ $54 million

Power Metals Corp., an exploration company, engages in the acquisition, exploration, and evaluation of resource properties in Canada. The company primarily explores for lithium, cesium, and tantalum metal deposits. It holds a 100% interest in the Case Lake property that consists of 475 cell claims located in Ontario. The company also has an option agreement to acquire 100% interests in the Paterson Lake property consisting of 106 cell claims located in northwestern Ontario; and holds Gullwing-Tot Lake property that consists of 112 cell claims located in northwestern Ontario.

The stock is down 22% on news of an exclusive option to acquire the Renard Project.

More of a pullback here with the stock breaking out above the $0.28 zone. A higher low is on watch but a retest at $0.28 could be in the cards. The best way to play these setups is to either watch for the retest, or wait for a break above recent highs.