Enthusiast loses $12 million in Q3 Earnings

EGLX is a $C600 million firm that operates an online network of approximately 100 gaming-related websites. They own and operate Enthusiast Gaming Live Expo, a video-gaming expo that provides management and support services to players involved in professional gaming. On top of this, they also own and manage their own esports teams which cover games comprising Call of Duty, Madden, Fortnite, Overwatch, Apex, and Valorant.

The company released its financial results on November 11, 2021, for the three and nine months ended Sept. 30, 2021, reporting a loss of 12million. In response, the common stock shot up +27% from a previous close of $C3.77 to $C4.76 per share. Yeah, this is defiantly the efficient market at work. I think a dive into the key highlights will shed some light on this unique price action.

Third Quarter 2021 Financial and Operating Highlights:

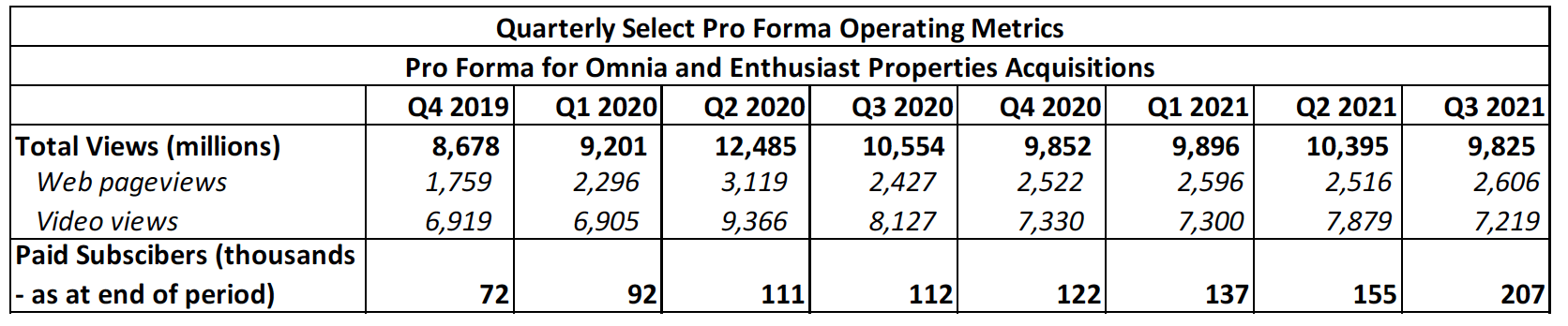

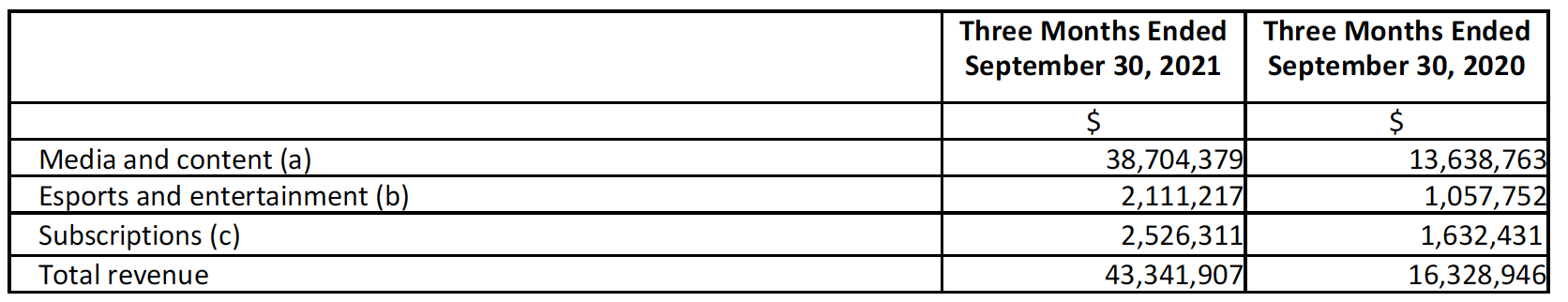

Sales of $43.3 million in the quarter or roughly 165% increase compared to revenue of $16.3 million in Q3 2020. From this, they made direct sales of $6.8 million, a 580% increase vs direct sales of $1.0 million in Q3 2020.

The Paid subscribers of 207,000 as of September 30, 2021, 85% increase vs paid subscribers of 112,000 as of September 30, 2020. The KPIs for the business improved significantly and their mix of sales dollars all experienced growth in the quarter.

The firms had a Cash balance of $33.5 million at the end of September 30, 2021, as compared to $4.3 million as of December 31, 2020. This cash is on top of the completed acquisitions of GameKnot (about 3 million) and Addicting Games (about 34.4 million).

“This has been an outstanding quarter for Enthusiast Gaming across our key categories,” commented Adrian Montgomery, CEO of Enthusiast Gaming.

“Ongoing momentum in direct sales, the acquisition of Addicting Games, and the renewal and addition of key partners continue to power revenue and gross profit numbers that demonstrate the strength of our strategy. Our team’s ability to continue acquiring accretive properties, attract quality partners and deliver the best fan experience through our flywheel of content, creators, and communities continue to deliver against and exceed expectations.”

Canaccord Genuity analyst Matthew Lee has reaffirmed his “speculative buy” recommendation for Bragg Gaming Group

BRAG offers a turnkey solution for retail, online, and mobile iGaming platform, as well as casino content aggregator, sportsbook, lottery, marketing, and operational services. The firm is currently trading at $9.97 per share meaning there is a 100% upside if we take Canaccord’s price target. The average price target on the street is $14.90 with a sales estimate of $53million for 2021 and 60 million for 2022.

Mr. Lee says in a note: “While we don’t expect to see meaningful revenue contributions from markets like Canada, Italy, and the U.K. in the near term, given the success the company is seeing in the Netherlands (25-per-cent market share within one year), we believe the long-term potential for growth in these markets is substantial. We maintain our rating on Bragg given our expectation for robust growth and increasing market penetration but lower our target to $21 to reflect the broader sell-off in comps over the last six months.”

The Globe reported on Feb. 3 that Mr. Lee said Bragg Gaming offered “an attractive combination of growth and profitability in the iGaming space while exposing investors to the rising tides of legalization worldwide.” He rated Bragg “speculative buy” in new coverage. The shares could then be had for $2.18.

Victory Square to acquire 1.05M Shop and Shout shares

Victory Square Technologies Inc. signed a share purchase agreement on Oct. 13, 2021, to invest in Shop and Shout (doing business as Creator.co), a Vancouver-based technology company.

Creator.co is an ecosystem where brands and creators collaborate to drive mutually beneficial growth. The firm is only 3 years old and has already earned the No. 4 spot on Influencer Marketing Hub’s top influencer platforms in 2021 and has attracted over 110,000 creators to their community that reaches over 100 million individuals.

Creator.co CEO Vinod Varma says, “the creator economy and social commerce is in only in its infancy and will continue to grow exponentially with the expansion of the metaverse – creator.co will be there to serve our communities as more creators and brands become accustomed to how powerful NFTs can be to drive revenue, fandom, and data.”

Varma adds, “Victory has been amazing partners and supporters of us. We’re excited to work with them and become the first public influencer marketing platform that allows investors to participate in the creator economy like never before.”

Terms of the Investment

- the Company will purchase and subscribe for 1,052,941 common shares in the capital of Creator.co in consideration for $1 million, with 352,941 SNS Shares purchased at a deemed price per SNS Share of 85 cents and 700,000 SNS Shares purchased at a deemed price per SNS Share of $1.

- Victory will pay for the Purchase Price by the issuance of one million common shares in the capital of the Company at a deemed price per VST Share of $1.

- the Company will also grant certain top-ups payable in additional VST Shares or in cash in the event the value of the VST Shares as determined by the market price of the VST Shares at certain future milestones does not meet $1.

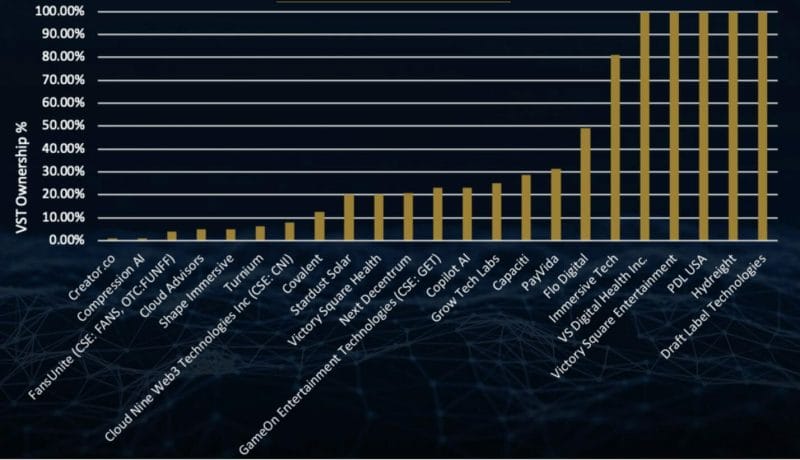

This sort of deal is a right fit for Victory who focuses on building, acquiring, and investing in promising start-ups in the tech space. The firm then provides the senior leadership and resources needed for fast-track growth. Victory sweet spot is cutting-edge tech that’s shaping the 4th Industrial Revolution. Their current corporate portfolio consists of 20+ global companies using AI, VR/AR, and blockchain to disrupt sectors as diverse as fintech, insurance, health, and gaming.

The most notable of their investments are in FANS (less than 10%), CNI (about 10%), GET (just over 20%) bringing their total market-to-market valuation of these holding to $C20 million. Victories current market cap is $C41million and they have 6million in cash, 3 million in total liabilities, and 20+ other investments carried at 33 million in the books (this includes their FANS, CNI, and GET at historical cost).