Some positive news and some negative news for Agriculture this week. However, even though this news is negative, if you are invested in agriculture…your money is in the right spot. Let’s start with the negative shall we? And yes, it has to do with supply chains and inflation. A theme that unfortunately will likely be carried through 2022.

Things haven’t been too kind for the UK. You know, the whole Brexit thing. We have seen shortages in Gas, and shortages in CO2. The latter being relevant to us and covered in a previous sector round up because it impacts food prices. Now, we are hearing that pork prices will be rising due to a shortage of workers. Due to this shortage, pork is being sent from the UK to the Netherlands or Ireland for butchering and slaughtering. The pork is then re-imported back to the UK.

According to the BMPA, the move will cost an additional £1,500 for each lorry load of carcasses. This includes transport fees, as well as Brexit customs requirements, such as an export health certificate for each consignment. Meat exported from the UK currently undergoes checks in the EU, however, the introduction of post-Brexit import controls on food and animals products in the UK has been delayed until July 2022.

There is also news of a Nitrogen shortage. Something that is impacting fertilizers. We have spoken about rising ag commodities and food prices, but when it comes to farmer input costs, we need to talk about fertilizers. Bloomberg this week has been reporting on higher fertilizer prices. What does this mean? More food inflation.

Fertilizer costs have skyrocketed as high natural gas prices forced some European production plants to halt or curtail production. U.S. spot prices for potash and urea, a form of nitrogen fertilizer, have more than doubled this year. The rally is stoking fears farmers may pull back on purchases or shift more acres into crops that require less nutrients. This does mean there is a chance that global crop yields will be cut short.

But all of us here are about positivity. I have stated this in previous posts, but I expect all our food issues to be resolved with human innovation and ingenuity. Climate change is definitely impacting crops and growing cycles, but this is why indoor farming will grow. Clean energy infrastructure that requires access to a lot of sun and wind, will compete with the best agricultural land which requires those similar inputs. This may also speed up indoor plus vertical farming.

Jeff Bezos back in 2019, backed a vertical agriculture start up called “Plenty”. I think Mr. Bezos sees the issues that will impact agriculture and is putting his money to combat this.

He is putting more money towards landscape restoration and food-systems transformation. The Bezos Earth Fund to be exact. The fund will pledge $3 Billion to this effort as part of its $10 Billion commitment to fight climate change, improve nature, and advance environmental justice and economic opportunity.

One billion dollars in funding will support landscape restoration, with an initial focus on Africa and the U.S. Restoration efforts in Africa will include planting trees on degraded landscapes, revitalizing grasslands, and integrating trees into farmland. This work will help drive critical outcomes that include climate benefits, food security, job creation, economic growth, soil fertility, and improved connectivity between protected areas to protect biodiversity. The Bezos Earth Fund will partner with Africa-owned partners, including AFR100, to deliver these benefits at scale. In the U.S., funding will be dedicated to the restoration of more than 20 landscapes that sequester high levels of carbon, protect biodiversity, and deliver community benefits. Forty percent of the funds allocated to U.S. nature efforts will directly engage or benefit underserved communities.

The other $1 billion will help transform food and agricultural systems to support life without degrading the planet. The Bezos Earth Fund will allocate funds to support a range of urgent imperatives, including raising crop yields while shrinking the agricultural footprint, sharply reducing food loss and waste, shifting diets towards plant-based sources, and making agricultural supply chains more sustainable.

I think we will see more and more money from Billionaires, funds, and celebs hit this space. In terms of innovation and technology, it isn’t as hip as say the Metaverse and AI, but is required to keep our species going.

Before we look at some company news and charts, let’s look at some futures.

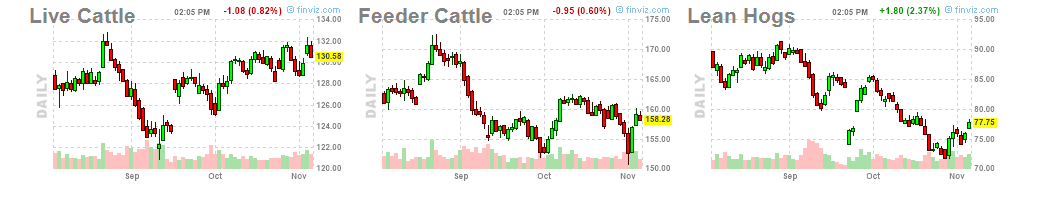

Feeder Cattle and Lean Hogs remain good looking bottoming basing plays. Lean Hogs especially given the recent headlines. It also looks like a cup and handle.

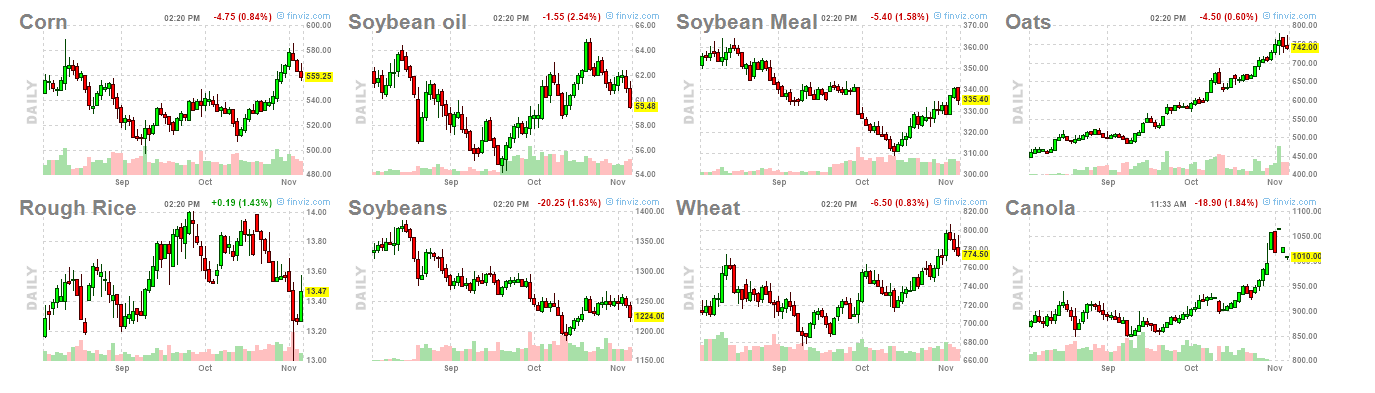

Here is where things get interesting. Last week, I said I took a long on Corn. Again, not a trade recommendation. However, I am really liking the chart of Wheat and Corn. Soybeans has potential too, but needs a breakout above 1250. I like Corn and Wheat heading forward as long as they remain above their breakout zones. What interests me is the broad move into commodities. We have seen moves in Oil, Nat Gas, Lumber, Gold, Silver, Copper etc. Yes, some of it was due to supply and demand issues, but I can’t help but think that some sort of inflation trade may be starting. I would include Ag commodities in that group. Let’s watch this as we go forward. Especially since these commodities are moving higher even with the US Dollar rising.

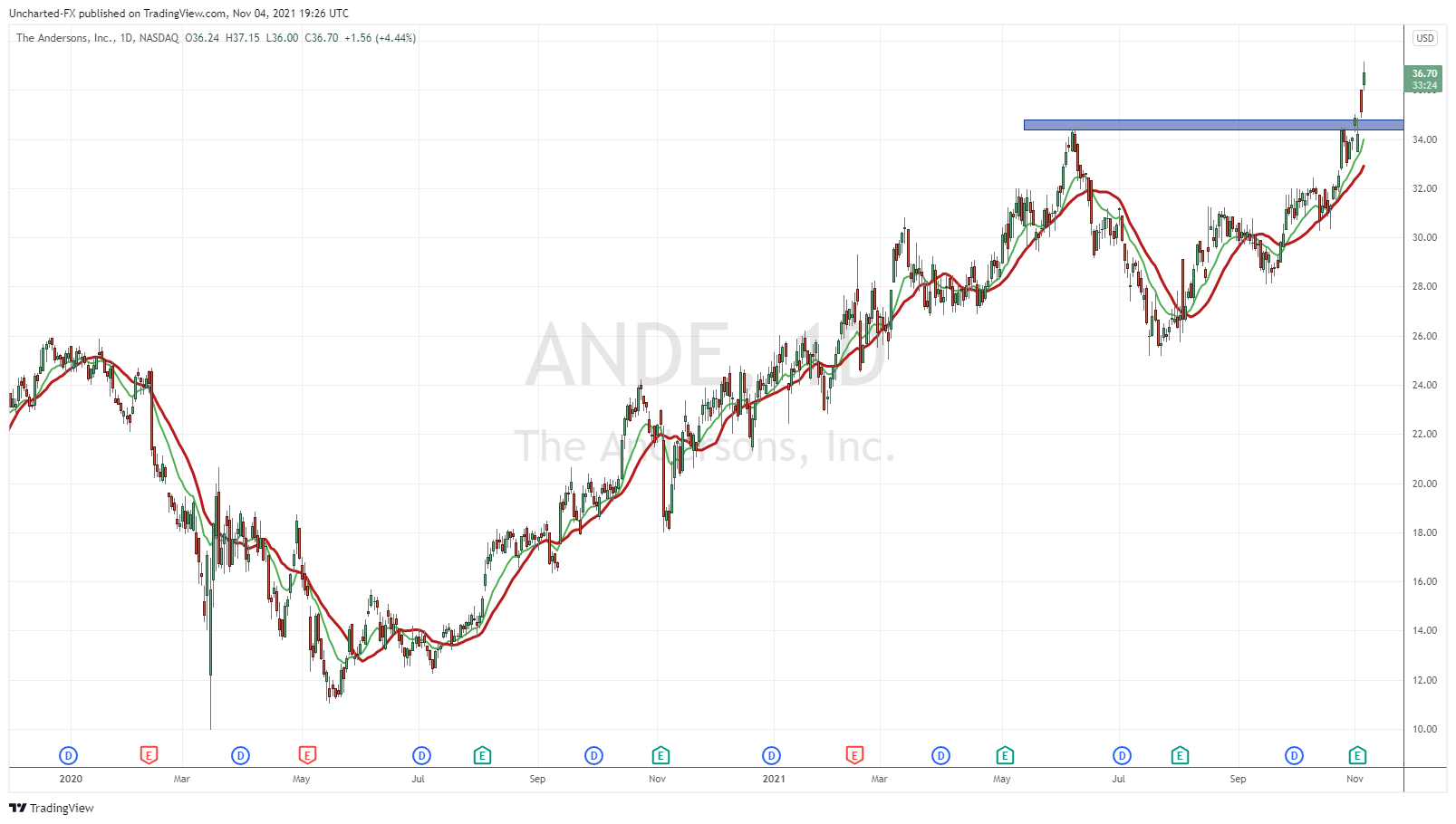

The Andersons (ANDE)

The Andersons, Inc., an agriculture company, operates in trade, ethanol, plant nutrient, and rail sectors in the United States and internationally. The company’s Trade segment operates grain elevators; stores grains; and provides grain marketing, risk management, and corn origination services to its customers and affiliated ethanol facilities. This segment also engages in the commodity merchandising business.

The company’s Plant Nutrient segment manufactures, distributes, and retails agricultural and related plant nutrients, and pelleted lime and gypsum products; and crop nutrients, crop protection chemicals, and seed products, as well as provides application and agronomic services to commercial and family farmers.

The company just put out Q3 results. The best the company has had since Q3 2014. Highlights include:

- Company reported net income attributable to The Andersons from continuing operations of $13.9 million, or $0.41 per diluted share, and adjusted net income from continuing operations of $5.2 million, or $0.15 per diluted share

- Adjusted EBITDA from continuing operations was $56.3 million for the quarter, an increase of $9.3 million, or 20%, year over year; trailing twelve month adjusted EBITDA from continuing operations of $294.0 million

- Trade reported all-time record earnings with pretax income of $42.0 million and adjusted pretax income of $27.6 million on continued merchandising opportunities and strong elevation margins

- Completed strategic sale of Rail leasing assets and used proceeds to reduce debt

“We generated cash flow from operations before working capital changes of $55.6 million for the third quarter and $237.7 million for the year to date,” said Executive Vice President and CFO Brian Valentine. “This strong cash flow, combined with proceeds from the sale of assets, has enabled us to reduce long-term debt by over $300 million since the start of the year. We remain disciplined with capital allocation while ensuring that we are adequately maintaining our physical assets. Short-term borrowings at the end of the quarter have been significantly reduced to $281.2 million from the $915.2 million balance at the close of our first quarter, which is our typical seasonal high. We are now below our key target of 2.5x long-term debt to adjusted EBITDA and have capacity available for growth in our core agricultural businesses.”

A big breakout taking us to new yearly highs. Not record highs though, if you zoom out, there are plenty of levels up ahead. For the sake of highlighting recent price action, I zoomed in. The breakout above $34.00 is big. We are bullish as long as the stock remains above. Remember, typical breakout and retest price action should be expected. The retest would likely see buyers jump in, taking us to new highs. Above, I see a resistance zone at $38.00.

This is one of those stocks to watch for institution money flows in the near future. They pay a dividend and I don’t know about you, but if stock markets pullback, I would want to be in value dividend paying stocks.

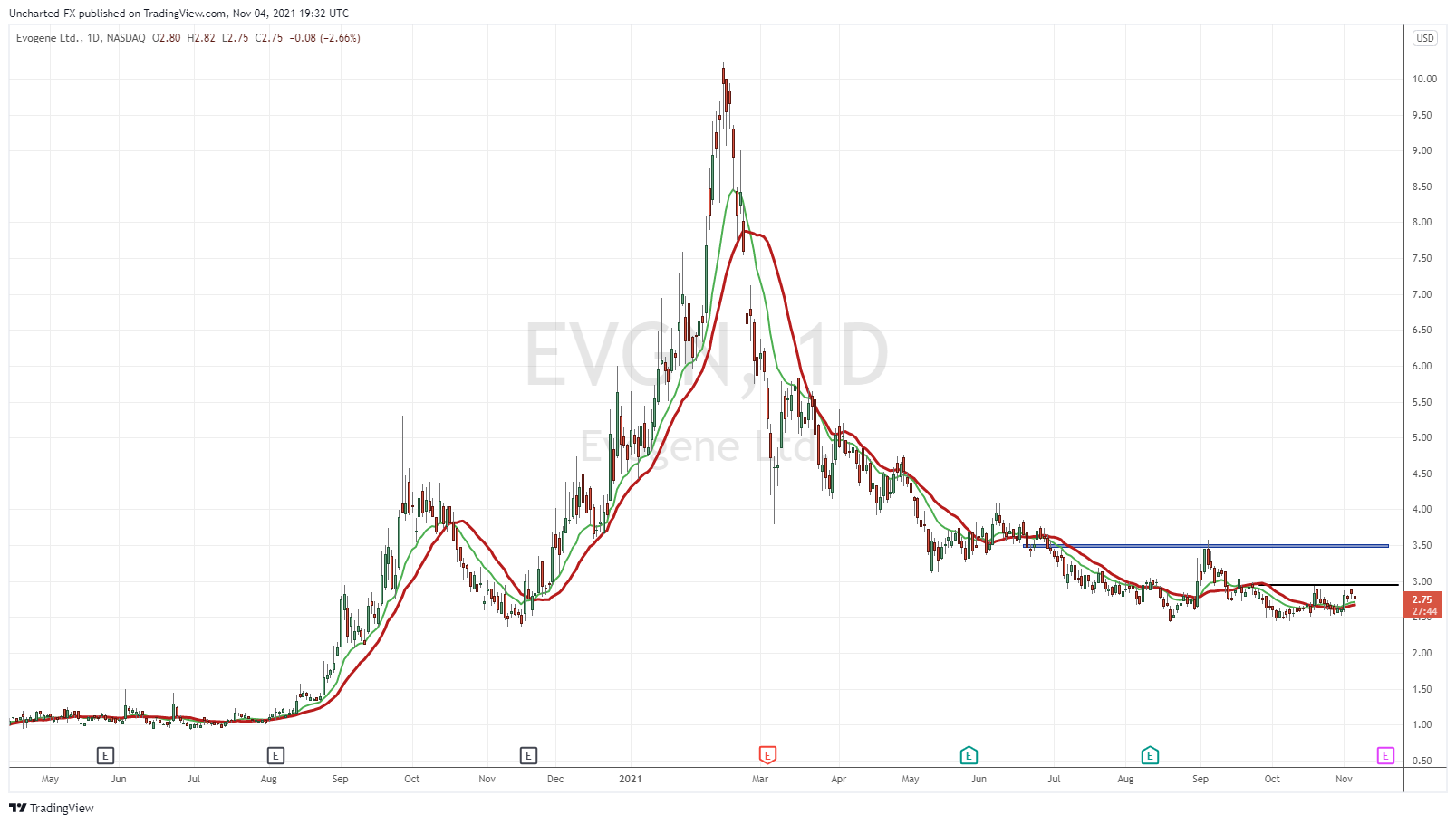

Evogene (EVGN)

Evogene Ltd., together with its subsidiaries, operates as a computational biology company. It focuses on product discovery and development in multiple life-science based industries, including human health and agriculture, through the use of its Computational Predictive Biology (CPB) platform. The CPB platform, incorporating a deep understanding of biology leveraged through big data and artificial intelligence, designed to computationally discover and uniquely guide the development of life-science products based on microbes, small molecules, and genetic elements.

Of course for us, the agriculture segment of Evogene’s business is what interests us. Evogene aims to improve food quality, sustainability and agriculture productivity through the introduction of microbiome-based ag-biological products.

Recent news announced the commercial launch of its first product, LAV.211, an inoculant for yield improvement. First phase of marketing will initiate for the 2022 Spring Wheat season, and be limited to target regions in North Dakota. The distribution agreement will be with United Agronomy, and initial sales will be recognized in 2022. Trials of the product has shown the potential to contribute an additional 3-4 bushels per acre and showed increased yield improvement compared with industry benchmarks. This means more money for wheat farmers. An average of $20 of additional revenue per farmed acre, which could mean a 50% increase or more in profit.

Those of you who follow my work here on Equity Guru, or over on our Discord Trading and Investing channel, know I DROOL over charts like this. This is what we call a basing chart. Let’s just hope we don’t close below $2.50. I have two zones marked above: $3.00 and $3.50. $3.50 is the zone which would trigger the breakout of a broader double bottom pattern. An early entry could be taken with a close over $3.00, frontrunning the break of $3.50. The structure just looks too good.

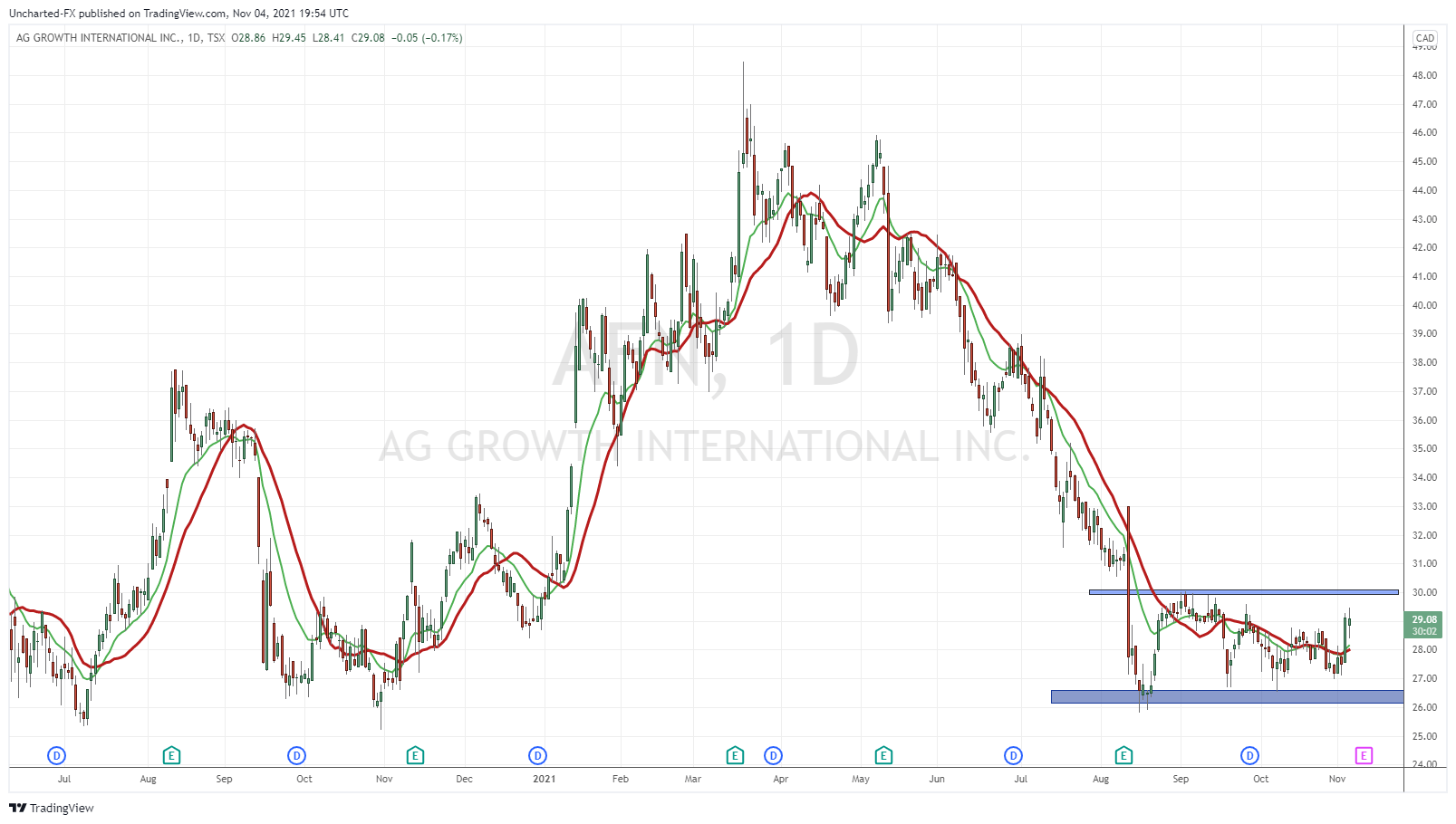

AG Growth International (AFN.TO)

I have covered AG Growth many times in previous sector roundups. AGI is a provider of the physical equipment and digital technology solutions required to support global food infrastructure including grain, fertilizer, seed, feed, and food processing systems.

This week the company announced the closing of a $100 million public offering of convertible unsecured subordinated debentures at a price of $1000 per debenture.

The Debentures have an interest rate of 5.00% per annum, a maturity date of June 30, 2027, are convertible at the option of the holder into common shares of AGI at a conversion price of $45.14 per share, and are listed for trading on the Toronto Stock Exchange under the symbol “AFN.DB.I”.

The chart still looks as appealing as when I last covered it. A nice range here, and we just need that breakout above $30.00 to initiate a new uptrend. AG Growth will make an appearance next week too since earnings will be released on the 11th. Perhaps that is what triggers our breakout.

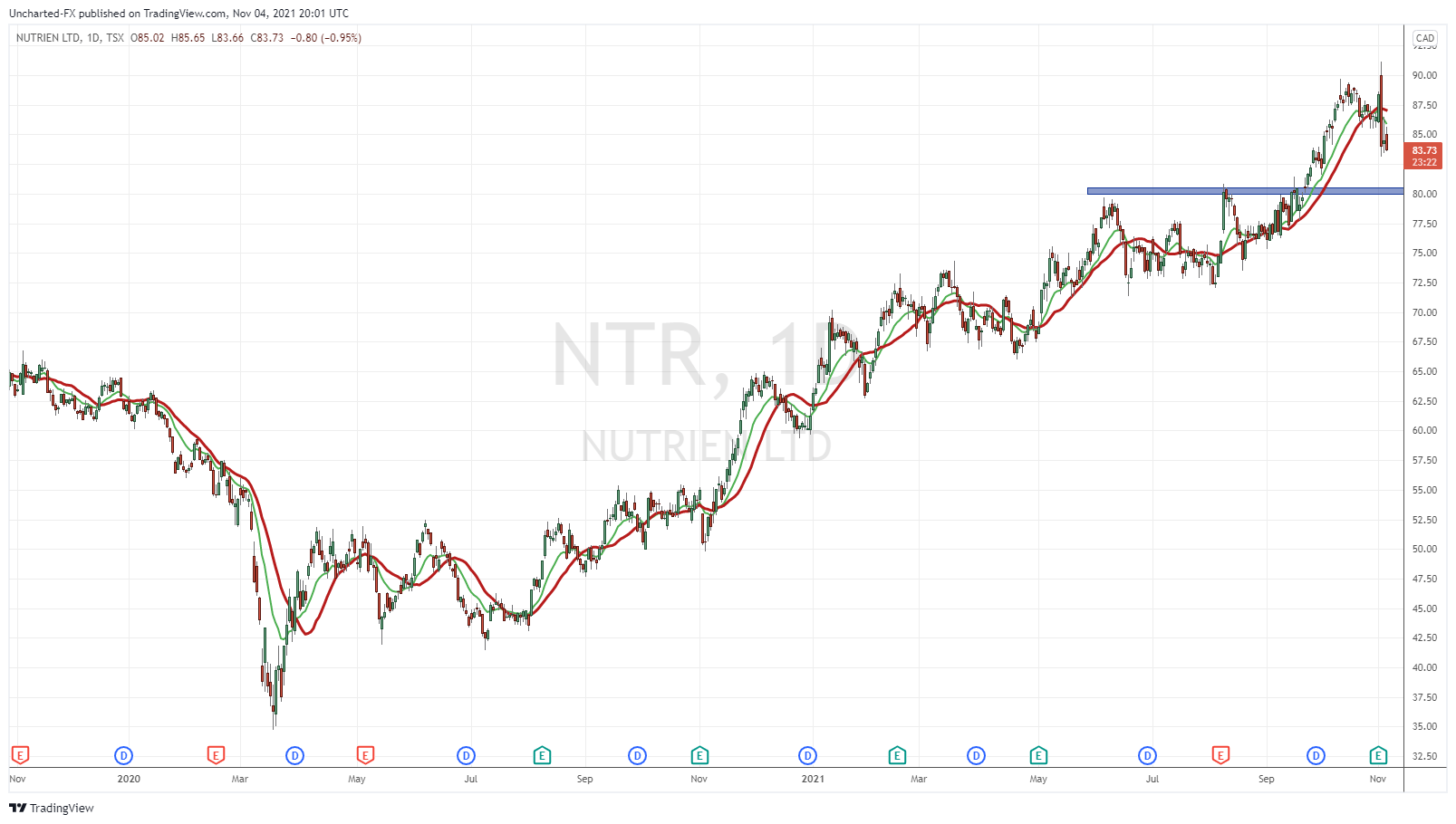

Nutrien (NTR.TO)

More earnings! Nutrien provides crop inputs, services, and solutions. The company offers potash, nitrogen, phosphate, and sulfate products; and financial solutions. It also distributes crop nutrients, crop protection products, seeds, and merchandise products.

Earnings and Sales surpassed estimates. Here are some Q3 earning highlights:

- NTR logged profits of $726 million or $1.25 per share in third-quarter 2021 versus a loss of $587 million or $1.03 in the year-ago quarter.

- Sales rose roughly 43.3% year over year to $6,024 million in the quarter.

- Sales in the Nutrien Ag Solutions segment rose about 22% year over year to $3,347 million in the quarter. Sales of crop nutrients increased significantly in the quarter on record sales volumes and higher prices.

- Potash division’s sales increased around 101% year over year to $1,188 million driven by higher sales volumes and higher net realized selling prices

- Sales in the Nitrogen segment were $973 million, up around 121% year over year.

- Sales in the Phosphate segment were $401 million, up around 51% year over year

- At the end of the quarter, Nutrien had cash and cash equivalents of $443 million, down around 4.7% year over year.

- Long-term debt rose modestly year over year to $10,094 million.

- The company generated $2.8 billion in free cash flow in the first three quarters of 2021

- The company raised its adjusted net earnings per share (EPS) and adjusted EBITDA guidance to $5.85-$6.10 (previously $4.6-$5.1) and $6.9-$7.1 billion (previously $6-$6.4 billion), respectively, for full-year 2021. It expects strong demand for crop inputs in the fourth quarter as well as tight global fertilizer supply and demand fundamentals to continue into 2022.

The stock is making new record highs. This week, we hit a peak of $91.15 before selling off. This stock will be seeing some action especially if the fertilizer shortage story continues. I expect institutional money to look at this given the dividends they pay. We remain bullish above $80 on technical terms.

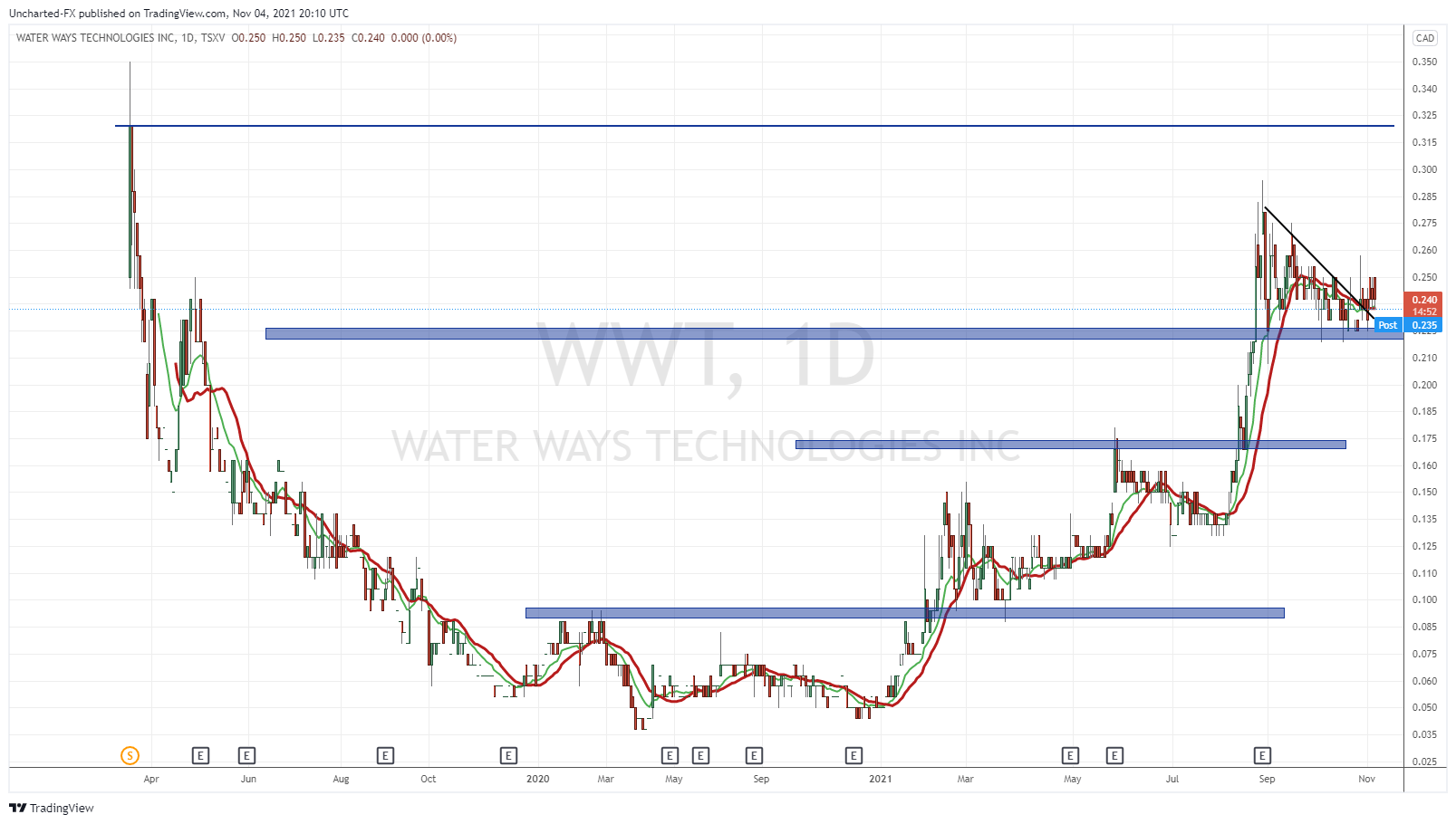

Water Ways Technologies (WWT.V)

One of our favorites. A popular stock among my readers. Water Ways is a global provider of Israeli-based agriculture technology, providing water irrigation solutions to agricultural producers. Water Ways Technologies competes in the worldwide irrigation water systems market, focusing on developing solutions with commercial applications in the micro and precision irrigation segments of the overall market.

The stock has seen a nice move after headline after headline of good news regarding new deals. Think of revenue streams.

News out this week regards several new orders to deliver smart irrigation components to customers in South America. The orders are valued at over C$1,000,000 and includes mainly smart irrigation components necessary to implement irrigation projects for Blueberries, Grapes and Mangoes. The Company expects to deliver the orders during Q4 2021 and Q1 2022.

It has been sometime since I last covered the technicals on Water Ways. But the stock has held above my zone of interest. Support at $0.22 is holding, and we look to be breaking above a triangle. Positive signs so far. The next momentum move should take us up to retest the $0.32 zone before making new record highs. Great company with a great team. The technicals are looking good, and the company has a lot of positive news and deals to back it.

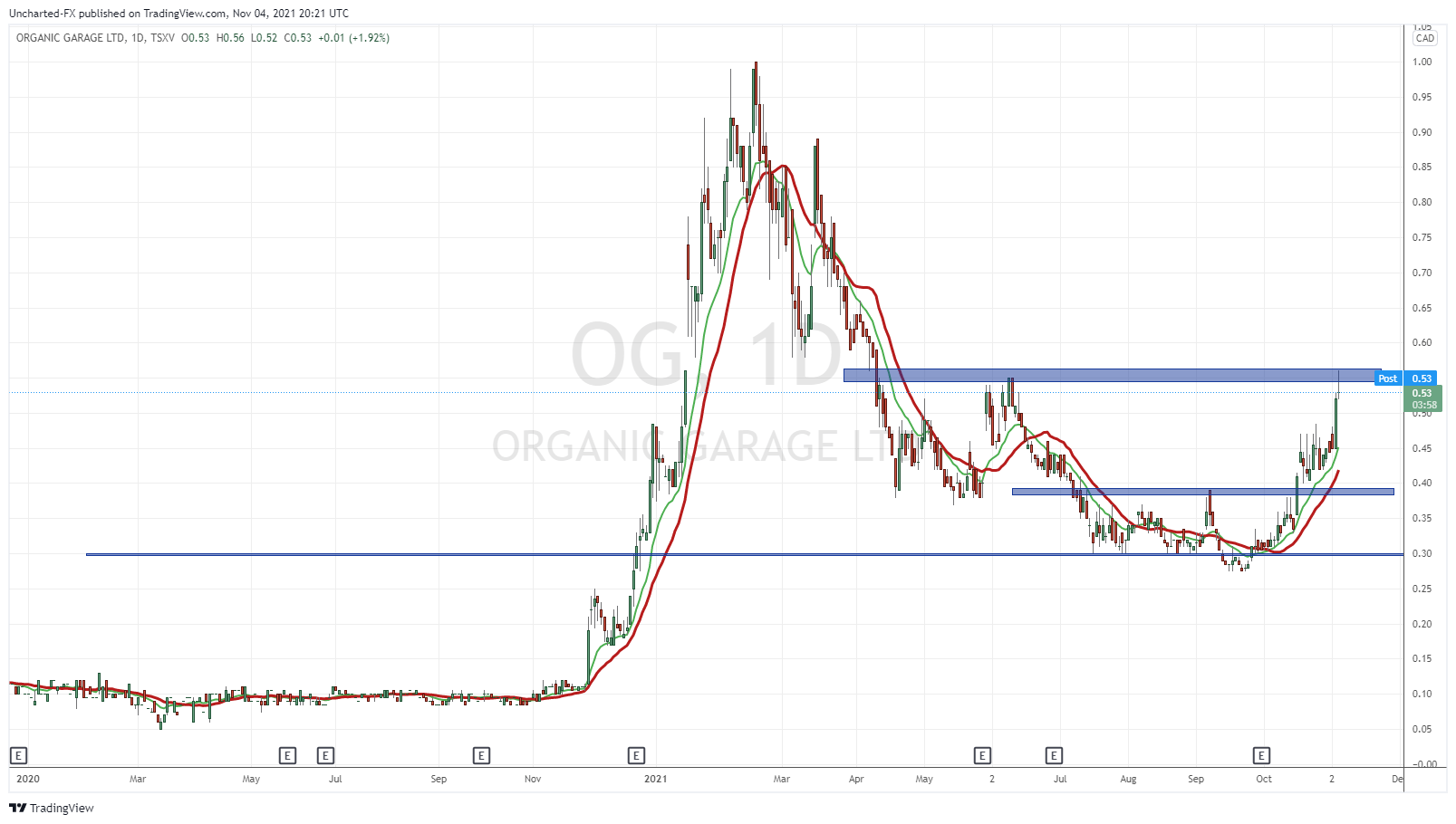

Organic Garage (OG.V)

Organic Garage Ltd. owns and operates grocery stores that sell natural and organic products to consumers in Canada. The company offers produce, dairy, bakery, bulk, grocery, meat, frozen, and prepared foods; and health and beauty products, as well as vitamins and supplements. It operates five stores in the Greater Toronto Area with more stores opening.

Its plant-based food company, Future of Cheese Inc. has signed its first distribution deal in the Ontario market with Cheese Boutique, co-owned and operated by Future of Cheese Maître Fromager and co-founder Afrim Pristine. Cheese Boutique is one of Canada’s most esteemed and reputable cheese retailers and fine-foods distributors, supplying the top retail stores, restaurants, chefs and hotels for 30 years.

“The line-up of plant-based butters, cheeses and spreads crafted by Future of Cheese easily fit within our highly curated portfolio of world-class products that we supply to our clients,” stated Afrim Pristine. “We sold out of the first production run in under 48 hours and the response has been amazing! Our clients want more, and more is on the way.”

Organic Garage looks great on the charts. Over on our Discord group, I highlighted the basing and the breakout above $0.40. Just a few days ago, I was talking about a move to test resistance at $0.53. Boom, we are there right now. We could see a pullback on profit taking, but we remain bullish above $0.40. A breakout and close above $0.53 would trigger another rally up to that $1.00 level!

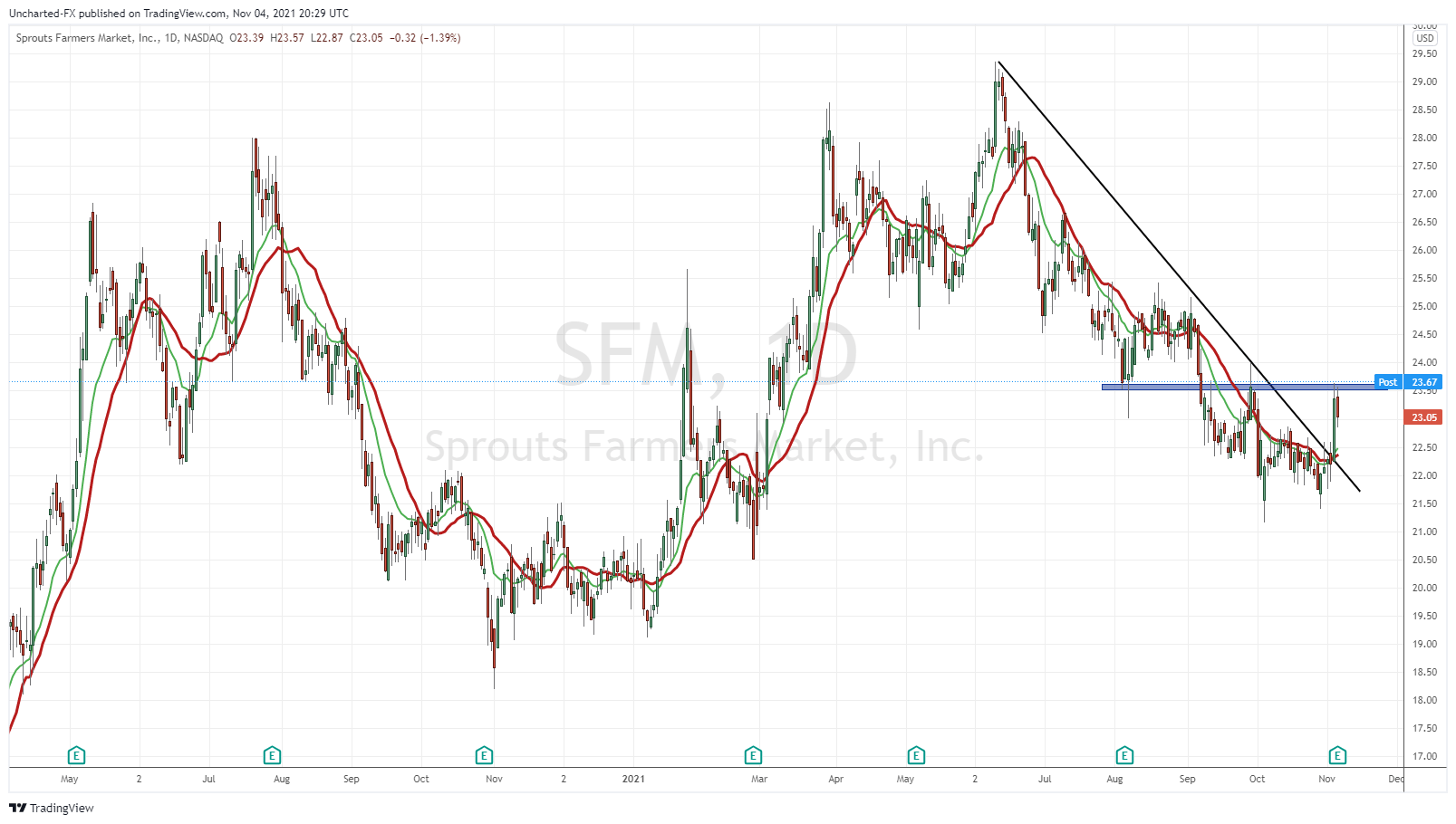

Sprouts Farmers Market (SFM)

Who doesn’t like Organic food? Here is another dose of an organic food retailer. Sprouts Farmers Market offers fresh, natural, and organic food products in the United States. It operates through Healthy Grocery Stores segment. The company offers perishable product categories, including fresh produce, meat, seafood, deli, bakery, floral and dairy, and dairy alternatives; and non-perishable product categories, such as grocery, vitamins and supplements, bulk items, frozen foods, beer and wine, and natural health and body care. As of July 04, 2021, it operated 363 stores in 23 states.

The company released Q3 2021 earnings. Highlights include:

- Net sales of $1.5 billion; a 4% decrease from the same period in 2020 and a 5% increase from the same period in 2019

- Comparable store sales growth of -5.4% and two-year comparable store sales growth of -2.1%(2)

- Net income of $64 million; compared to net income of $60 million and adjusted net income(3) of $62 million in the same period in 2020; and compared to net income of $26 million from the same period in 2019

- Diluted earnings per share of $0.56; compared to $0.51 diluted earnings per share and adjusted diluted earnings per share(3) of $0.52 in the same period in 2020; and compared to $0.22 diluted earnings per share from the same period in 2019

“Our third quarter sequential improvement in sales and robust profits, combined with the early performance of our two newly designed stores, give us confidence we are making progress in transforming Sprouts, built on the long-standing foundation of a farmer’s market heritage,” said Jack Sinclair, chief executive officer of Sprouts Farmers Market. “Moving forward, while there is work to be done, we are supported by a robust unit growth story, passionate team members, a loyal customer base, and our fresh differentiation, providing the ingredients for long-term success as a specialty store destination.”

Now this is a chart with huge potential. A new uptrend may just be beginning. I like the trendline breakout. Depending on how the markets close today (Friday) after earnings will give us even more confirmation on a new trend. I have highlighted a resistance zone right here at $23.50. It is a major flip zone. We close above this, we trigger a new trend by taking out the previous lower high. If we pullback, then perhaps we are setting up for an inverse head and shoulders pattern.

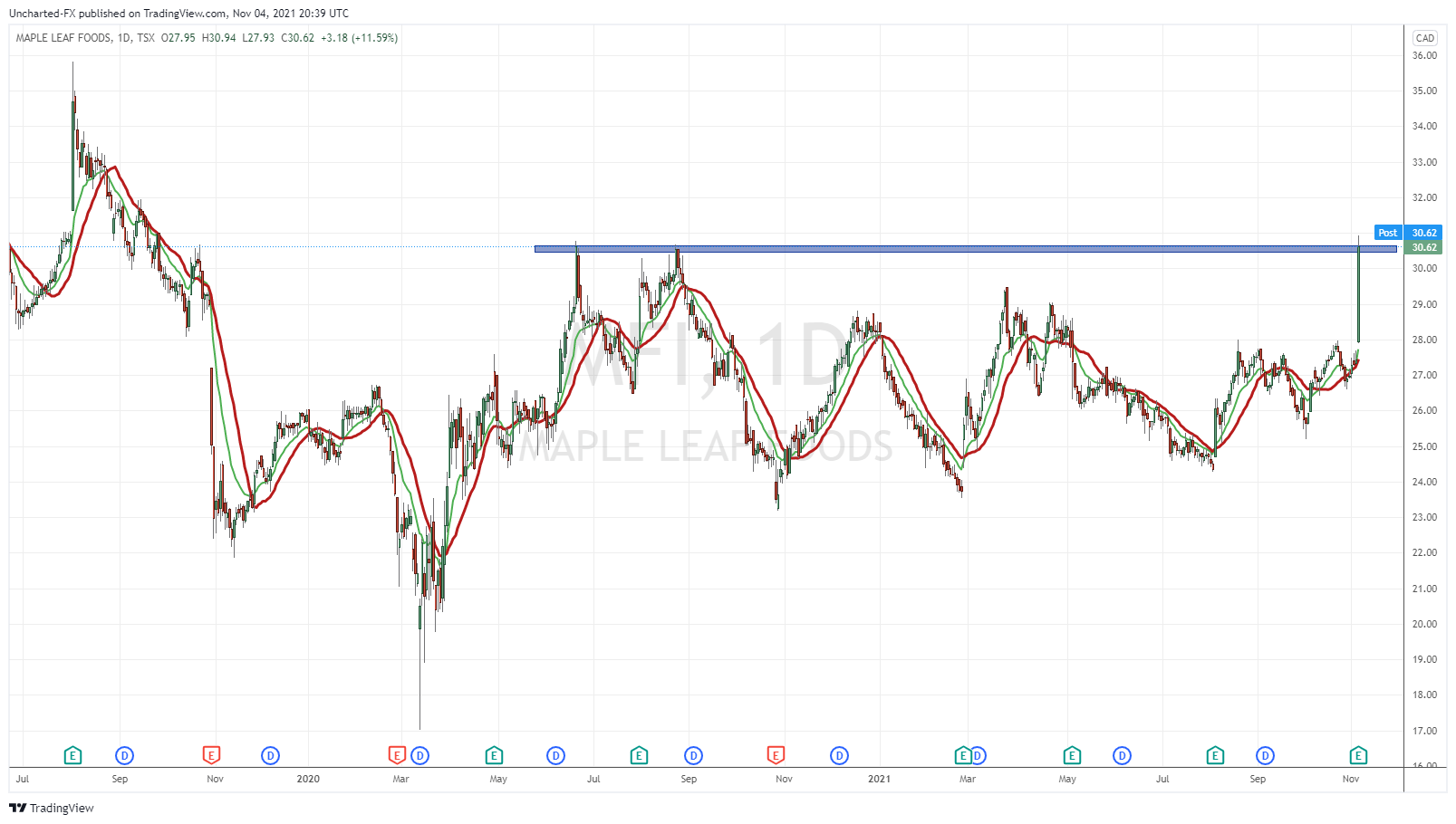

Maple Leaf Foods (MFI.TO)

Speaking about big moves and important technical breaks…Maple Leaf Foods was a monster mover yesterday, rallying 11.59% on earnings. Highlights include:

- Total Company sales grew 12.4% to $1,188.6 million, with an Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”)(i) Margin of 9.7%, up from 7.8% last year.

- Meat Protein Group sales grew 13.4% to $1,150.3 million, driven by higher fresh pork and poultry prices and a favourable mix-shift towards branded products and sustainable meats.

- Meat Protein Group Adjusted EBITDA grew by 21.8% to $149.3 million which is a 90 bps increase in Adjusted EBITDA Margin to 13.0% (13.2% excluding start-up costs related to near completion Construction Capital(i)), compared to 12.1% last year.

- Plant Protein Group sales have declined by 6.6% (decline of 1.2% excluding the impact of foreign exchange) due to declining retail sales within the category, offset by growth in foodservice volumes.

- Net earnings were $44.5 million, compared to $66.0 million last year primarily due to non-cash fair value changes in biological assets and derivative contracts.

- Capital expenditures were $152.9 million and consisted predominantly of Construction Capital of $123.3 million, the majority of which was related to the ongoing construction of the London, Ontario poultry facility and the expansion of the previously announced Bacon Centre of Excellence in Winnipeg, Manitoba.

- Balance sheet remained strong with Net Debt(i) of $1,089.5 million and undrawn committed credit of over $800 million.

- 2021 Outlook: Meat Protein Group targets unchanged – mid-to-high single digit sales growth and Adjusted EBITDA Margin expansion. Driven largely by the lower than expected growth in the plant protein category, the Company does not expect to meet its Plant Protein Group sales growth target for the second half of 2021 and will not likely have a further view on near term sales growth targets until it has completed its reassessment of the category.

I was going to say ‘it would be nice to get a decent close above $28’, but earnings took us much higher than that. Bullish now above $28. A big resistance zone here around $30.50. Let’s see if we can get a nice close above this zone in the upcoming days. All time record highs stands at $37. I don’t really need to breakdown the details on this company. You guys see their products in super products. Big on meats and some plant protein based products now. With earnings and stock reaction like this, I would be watching for institutional buying. The sign for this? More green candle moves in the next few days.