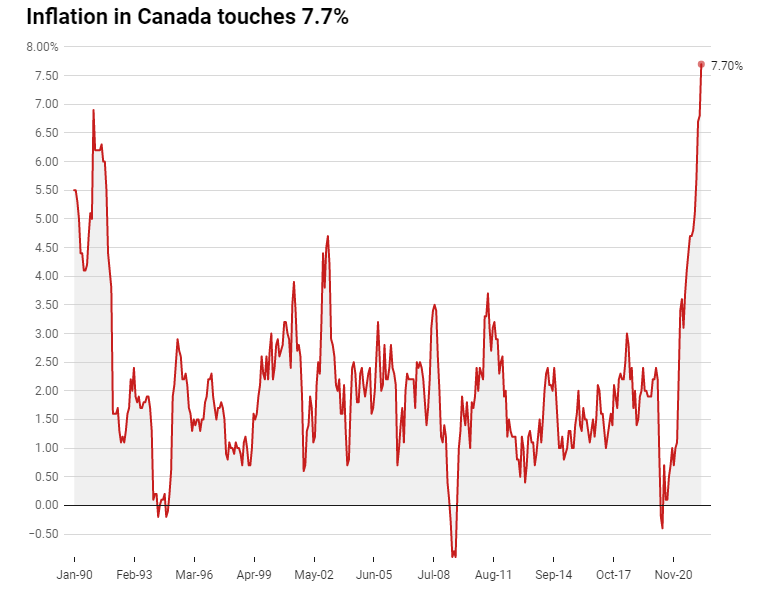

Peak inflation is a term that you are hearing a lot. Every analyst is trying to predict when inflation levels begin to reverse. Canada released its inflation data for May 2022. We aren’t seeing peak inflation yet with the cost of living rising to the highest seen since 1983. Nearly 40 years.

Statistics Canada said Wednesday its consumer price index in May rose 7.7 per cent compared with a year ago, the fastest pace since January 1983 when it gained 8.2 per cent. That’s up almost a percentage point from April’s 6.8 percent gain.

I actually laughed at this line from a CBC article:

If there is anything we’ve learned over the past year it’s that central banks are pretty bad at predicting inflation. Which may be a reason for hope.

Oil has been the main culprit, and Equity Guru readers might be relieved to know that I spoke about peak inflation signals earlier this week. Oil charts are showing signs of reversal. I lay out the cause and shocks in this article. Oil is the lifeblood of the economy. The costs of transporting goods, such as groceries, have risen due to higher oil prices. As a result, businesses have had to increase prices to make a profit. Higher energy costs are being passed onto the consumer.

When it comes to food inflation in Canada, here are the numbers:

In May, Statistics Canada said the price for food bought at stores rose 9.7 percent compared with a year ago, matching the April increase, as the cost of nearly everything in the grocery cart went higher.

The cost of edible fats and oils gained 30.0 percent compared with a year ago, its largest increase on record, mainly driven by higher prices for cooking oils.

Fresh vegetable prices rose 10.3 percent.

The Canadian Dairy Commission also approved a second milk price increase this year. The Crown corporation, which oversees Canada’s dairy supply management system, said Tuesday farm gate milk prices will go up about two cents per litre, or 2.5 per cent, on Sept. 1. This comes after a milk price increase of 8.4% (6 cents per litre) on February 1st.

However, let me share some hope. As I said above, oil prices are showing signs of a reversal. A good initial sign, but major support levels still need to be taken out before we can say a downtrend begins. We need to factor in China, Russia, OPEC+ and possible recession, but the technicals are hinting at downside.

Lower oil prices will aid in increasing the probabilities of NON-monetary inflation to drop (monetary inflation is a different story!!). This could see peak inflation occur sooner rather than later. But it isn’t just oil prices dropping:

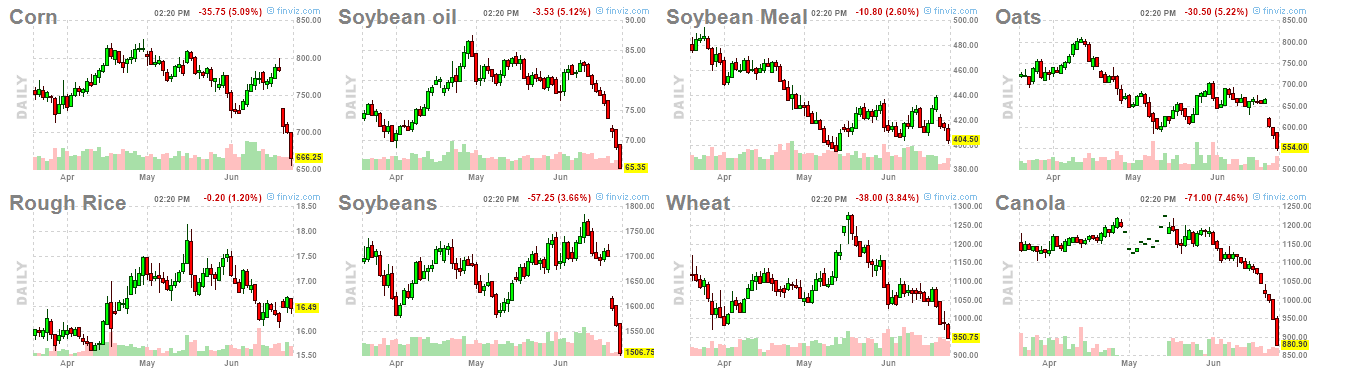

Very big breakdowns on some agricultural commodities and meats. The charts of coffee, sugar, and orange juice aren’t on the charts above but these are commodities I trade and follow and I am seeing major breakdowns.

The big technical breakdowns are on soybeans and wheat. Corn is on the verge of breaking down. Major supports have been broken after a ranging pattern for months. I see more downside for these commodities which would help see inflation peaking. Mind you many contracts for commodities are made months in advance so it would take some time for the lower prices to be reflected in the real economy.

So what do you all think? Are these breakdowns signs of inflation peaking? Or is it just a sign of an impending recession? Yes, a recession would slowdown demand which would lead to non-monetary inflation slowing down. Let me know by commenting below, or hitting me up on Twitter.

Here’s some news that came out this week:

Beyond Oil (BOIL.CN)

This is a company that I recently came across. This is a company which provides solutions for food-service companies who are striving to reduce their oil costs, decrease waste and save the planet. I am talking about Beyond Oil.

Beyond Oil is a developer and manufacturer of an innovative proprietary and patented formulation which reduces the free fatty acids from cooking oil to as low as 0.1% while preserving the oil’s quality and nutritional values. Beyond Oil’s unique technology and methodology integrate into customers’ existing oil filtration systems by extending the life of frying oil, reducing costs and waste.

Recent news out this week regards Beyond Oil entering a definitive distribution agreement with TEJA Food Group to market and sell Beyond Oil’s product to restaurants in Canada and the US.

Cooking oil prices have risen dramatically since the beginning of the COVID-19 pandemic and are continuing to rise, causing increased cost pressures for restaurant owners and other food producers around the world.

“We have been searching extensively for a technological solution that will help our customers cope with the increasing cost pressures of frying oil, without compromising the quality and the taste of their food,” said Tom Grande, President of TEJA Food Group. “Our customers remain our top priority and we are always driven by the desire to give them the best and healthiest product. We are pleased to have entered into this distribution agreement with Beyond Oil and to have found a unique product that will give restaurants and food processors the ability to cut costs and provide healthier food to their valued consumers”.

The stock IPO’d recently on May 25th 2022. Big mover. The stock has seen highs at $2.25. Not too shabby given what has happened with stocks recently with the broader market sell off. I’m not someone who jumps in early on IPOs. I like to see a few weeks and months of price action to establish price levels. We have some development right now. There is some support at $1.85, but the major support level is at $1.15.

Any pullbacks would get me interested in entering a position from a technical perspective. But on the fundamental side of things, Canadian inflation data showed that the cost of edible fats and oils gained 30% compared with a year ago, its largest increase on record. If restaurants are looking to reduce their costs, Beyond Oil has the products to do so. One company I will definitely be following closely.

CO2 GRO Inc (GROW.V)

CO2 GRO is a company on a mission to transform 600-billion sq. ft. of protected fruit & vegetable growth facilities so they can increase yield by 30% and feed half a billion more people around the world. Their proprietary technology mists an aqueous CO2 solution directly onto plants in protected growth facilities. This enriches crops with CO2 , suppresses the growth of micro-pathogens, and increases high-yield, high-quality varieties of produce.

In terms of trial data, we received some positive news from the first Colombia Rose trial which commenced in December 2021. CO2 GRO is proud to share that in the four months that the study initially ran for, a total rose production increase of 8% has been observed. More importantly, high-grade high value roses realized a 21% production increase. High-grade roses are over 55 cm in stem length and have 6 cm wide flower buds. Treated rows of rose plants in the greenhouse facility also saw a 75% reduction in powdery mildew spread compared to the control group.

“The trial has proved that our value proposition goes beyond simply increasing plant yields. Our CO2 Delivery Solutions technology helped increase the percentage of high-grade high value roses also. Our technology could benefit protected growers of other types of flowers, fruits, vegetables and other plants such as medicinal, to realize greater value for a higher percentage of high-quality plants grown – enabling higher gross margins,” said Aaron Archibald, VP Sales and Strategic Initiatives.

“We expect results from the second phase of this rose trial to improve with refined protocols. We also look forward to replicating these initial results at our second Colombian rose trial and a first Ecuador rose trial that we expect to commence soon.”

The stock price remains the same structurally since the last time I highlighted this company this month. Major support at $0.14-$0.15 is still holding. Look how important this support has been going back to 2020, and here we retest it once more in 2022. Waiting for a nice large green candle and/or large volume to indicate the bulls are holding the line. Major support zones like this are great areas for building a base which could lead to a new uptrend. I would also note the downtrend line I have drawn out. If we can get a bounce from here and a nice close eventually above the trendline, that would be a very strong indicator that a new uptrend is beginning!

Water Ways Technologies (WWT.V)

More deals for Water Ways. The company announced a new purchase order to install a smart turnkey blueberries irrigation project in Ethiopia. This is the second phase of a project started in 2020 that was delayed due to the political turmoil in Ethiopia. The Order is expected to be delivered and installed during Q3 of 2022. The total expected revenue from the Order is approximately C$200,000 which the Company expects to recognize during Q3 of 2022.

In one of the most recent Agriculture Sector roundups, I highlighted the major support at $0.17. Look at the bounce. We had buyers step in on June 14th right at this support level. This is the type of reaction you want to see at major support zones. So far so good, and my next resistance level comes in at $0.27. One interesting point is that the stock is breaking above my moving average. This is usually a positive sign that the trend is reversing, but a lot of it depends on the momentum that develops from here. We had a moving average cross over in April, but no momentum. The stock just ranged and then broke down. That is what we don’t want to see in this cross over.

EarthRenew (ERTH.CN)

EarthRenew is a popular company among readers. We recently had CEO Keith Driver over on Maddy’s Five easy questions. Be sure to check it out!

Big news out this week is EarthRenew announced the successful closing of the issue and sale of 41,804,500 units of the company at a price of $0.25 per unit. Gross proceeds from all units are $10,451,125. For more info, you can check out this press release.

The Company intends to use the net proceeds of the Offering (i) to complete preparatory stages with respect to the development of its fertilizer blending facility in Debolt, Alberta; and (ii) for general corporate working capital.

Some people don’t like the fact that the financing was done at a discount at $0.25 when the stock was trading around $0.30 when financing was announced. You see the gap down reaction on the chart below. I say though that the company now has the funds to create and advance catalysts for shareholders. At a time when the world will be hearing more about food and fertilizer issues.

You can see the reversal on the charts. A recent roller coaster. We told readers about the breakout above $0.20 back in February of 2022. We rode the move to prices above $0.40. Unfortunately, the stock now broke below $0.20, which was the previous breakout zone. Whenever a chart confirms a breakout, we expect a move back to the breakout zone which provides an opportunity for investors to enter. Buyers did not step in and we closed below. EarthRenew stock must reclaim this $0.20 support otherwise we will be testing major support at $0.15, which we don’t want to see break!

Farmmi (FAMI)

Farmmi, an agricultural supplier in China, announced an expansion of its reach into North America with a sales order for dried shitake mushrooms to Mexico.

Ms. Yefang Zhang, Farmmi’s Chairwoman and CEO, commented, “This is very exciting and underscores the increased momentum we are seeing in our business. We have always had a solid presence in North America led by the U.S. and Canada. Our latest sale to Mexico represents a further expansion and reflects the strong global demand for high-quality agricultural products. Food safety is a growing focus for governments, businesses and end consumers. We are in a great position with our large scale capacity, certified production and handling processes and track record of excellence. While this is just one order it is strategically important and we will work to increase our shipments to Mexico as we move forward.”

The stock has gradually been sliding down. We hit all time lows at $1.02, but the stock has been printing new all time record lows for quite some time. The big question is whether we reverse. I am seeing some signs of range which is an initial positive sign. Price is testing my moving average but needs a breakout above it. I will be watching to see if we can develop a blast off from this range in the next few trading days.

AppHarvest (APPH)

And to end of this week with a bonus. No news this week, but the stock is making a big move!

We have had a nice 60% popper on the stock in less than 8 trading days! A major bounce at support at $2.40. This is why we watch these major support and resistance zones. They are prime places for a new trend to be made or break. Check out the green engulfing candle which was printed on June 13th. Prudent investors or traders would have entered the day after this engulfing candle with a stop loss below it. Great risk vs reward set up.

What gets me excited is the breakout pattern. We did confirm a double bottom reversal pattern with a close above $3.20. Pretty nice follow through so far. As long as we remain above $3.20, the new uptrend continues. Look for an entry on pullbacks. Targets ahead include $4.60 and $5.50.