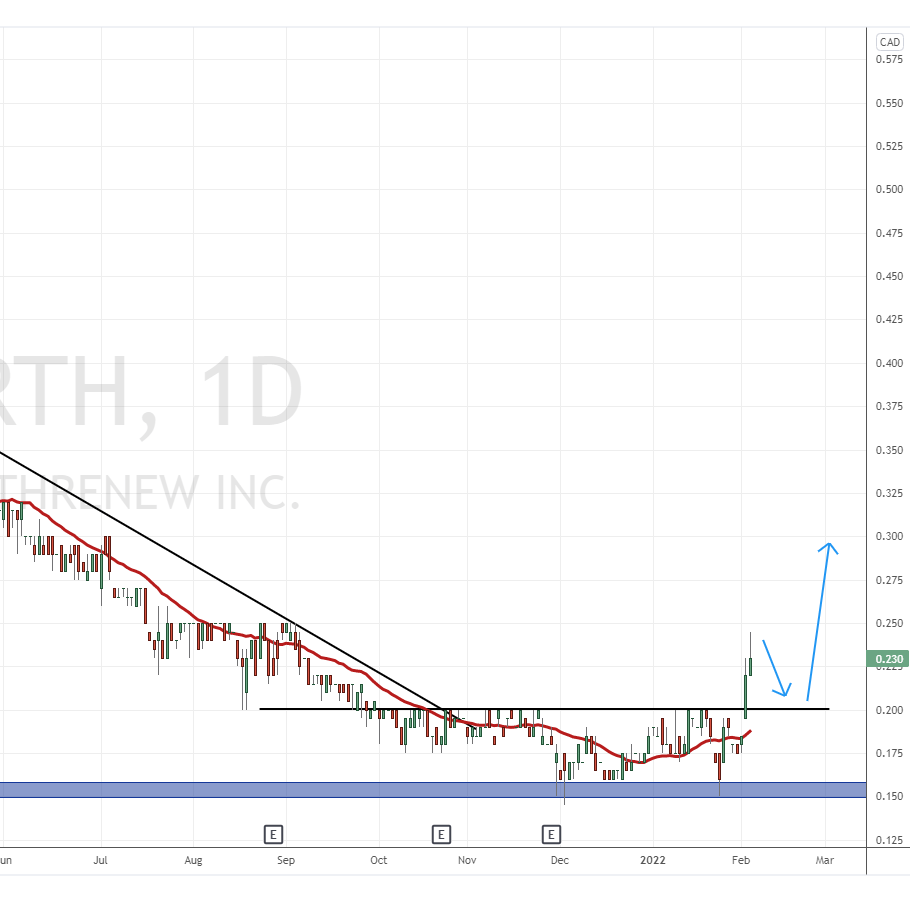

EarthRenew is this week’s featured stock in my Agriculture Sector Roundup. I have talked about the technical chart set up in previous roundups. We have remained patient, awaiting the breakout confirmation trigger. Well readers, I can now say that our trigger has been confirmed this week. I am looking forward to the next few weeks and months!

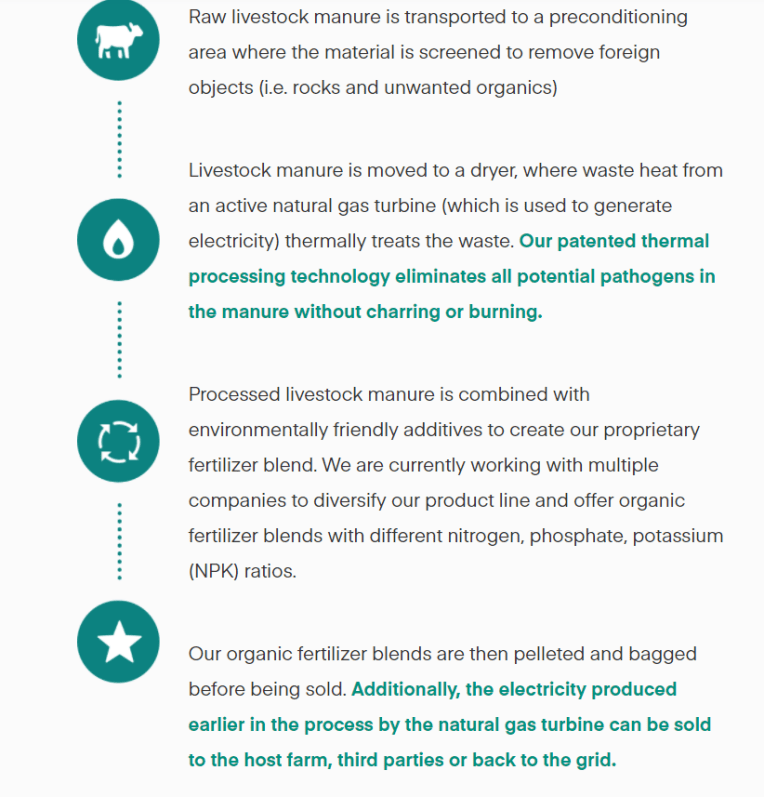

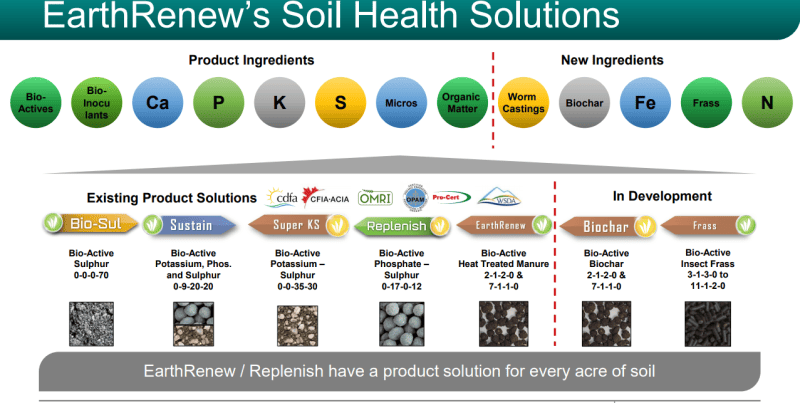

EarthRenew produces and sells organic fertilizers from livestock waste in North America and Europe. It also produces electricity from natural gas using an industrial-sized gas turbine and supplies to electrical grids and cryptocurrency miners. The company sells fertilizers under GrowER and GrowER Biochar names.

The company produces organic fertilizer production through their patented thermal processing technology transforming livestock manure into the good stuff for plant growth and restoring soil health. This organic fertilizer also offers 20% to 40% higher yields than the equivalent chemical fertilizer! And it’s good for the environment! $70 million has been invested into both the development and commercialization of this technology.

One day before the breakout, I published an article titled, “EarthRenew Has the Best Looking Chart Setup in Agriculture“. The stock then moved on news regarding its regenerative fertilizer production. Fertilizer shortage is the real deal, and will be adding to the food inflation. Springtime is when we will start hearing more headlines about this shortage and drastic actions farmers may need to take. I discussed this a few weeks ago in a Fertilizer Agriculture Sector Roundup, and just last week, spoke about how fertilizers will be impacted if Russia-Ukraine tensions escalate. Putin doesn’t just hold the energy card, but some say he even holds a very strong Potash card.

EarthRenew is a fertilizer play that remains under the radar, and I would also say, undervalued compared to peers. We have a macro fundamental environment which is supportive of the stock price, AND a technical break. A combination of fundamentals and technicals is a winning formula when aligned.

Before we jump into the chart, let’s cover EarthRenew’s recent news. EarthRenew will be expanding its pilot facility in Beiseker, Alberta into a full scale facility. Here are key points from the press release:

- Building on revenue growth from the past year, EarthRenew has expanded its pilot facility in Beiseker, Alberta into a full-scale granulation facility capable of producing an additional 16,000 MT/year of fertilizer production, allowing 20,000 MT/year production

- The expansion of the Beiseker facility will supplement the previous capacity for granulated fertilizer production as well as capacity for blended product enabling higher revenue growth for the coming year.

- The ability to granulate the product allows the Company to fulfill its mission of improving on-farm ROI, accessing new market channels and increasing margin on its products.

- EarthRenew, which supports a farm system focused on soil health, has secured off-take agreements with trusted local and international partners to place this additional volume as well as to support off-take from the planned project with K+S in Bethune, SK

EarthRenew previously announced revenue from regenerative fertilizer of $14 million for the period of January to December 2021, an increase of 106% over 2020, and can now leverage the expanded facility to maintain that growth trajectory into 2022.

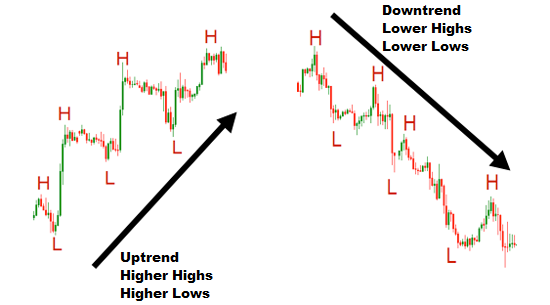

In the numerous articles that I have written, I have described my method of trading and investing as early stage trend reversal. I look for trending markets, usually a long downtrend, and wait for signs of exhaustion. This tends to come in the form of a range, and/or a reversal pattern like the inverse head and shoulders or the double/triple bottom. The key element though is the confirmation breakout. Just because a stock chart is in a range or a reversal pattern doesn’t mean it is a buy right away. The pattern must breakout.

We have been waiting for this breakout for months on EarthRenew. We finally got this on February 2nd 2022. Good follow through yesterday. With current market fear and weakness, I do believe the stock can pullback to retest the breakout zone at $0.20. Perfectly normal. We want to see a wall of buyers ready to step in there. As long as our daily candle closes remain above $0.20, the new uptrend is intact. We expect to see multiple higher lows and higher highs in this new uptrend.

Verde Agritech (NPK.TO)

Verde Agritech is another fertilizer stock that just keeps on going. No news out this week. I discussed the Banco do Brasil financing in last week’s roundup. Access to more cash to advance catalysts.

The stock has broken out of recent highs. Take a look:

The stock began to range a bit around the $4.40 zone. However, it did not break the range. I did say that if the stock broke below, it would be a great opportunity to get in or add shares.

Instead, the stock broke above the range and is now testing the major $5.00 zone. The higher low we are working with in this uptrend is now $3.60.

I want to show you all the weekly chart:

This $5.00 zone is a major resistance zone. If we can get a weekly close above this week or in upcoming weeks, then the next target to the upside would be all time record highs around $6.25. To be honest, with the fundamentals for fertilizers, and the positive press releases Verde has been putting out, I would be surprised if we do not print all time new record highs by the end of 2022!

Bee Vectoring (BEE.CN)

Another one of our favorite Ag tech plays released 2021 fiscal year results this week. Here are highlights:

- 47% growth in revenue in the US on a constant currency basis. 100% retention of customers in the key blueberry market of Georgia. First revenues in Michigan, New Jersey and the Pacific Northwest.

- First commercial activity in California, the largest agriculture market in North America. New territory manager in place and first successful trials (almonds, berries) underway following regulatory approval at the beginning of the year.

- First commercial agreement with a major industry partner. CBC Biogard granted BVT use of its proven biological insecticide through BVT’s bee vectoring system. This is our first path to revenue in the EU and validates the business as a platform, not a single-product system.

- Memorandum of Understanding with BioSafe to explore pairing BioSafe biologicals with BVT’s bee delivery systems and using CR-7 for applications outside of bee-vectoring.

- Regulatory approval progress in multiple global markets including the European Union, Mexico, Canada, and Peru, which will be the beachhead for our South American expansion.

- Successful trials of CR-7 for seed treatment of soybeans, a 300-million-acre worldwide crop.

- Growing recognition of leadership in the agriculture industry as shown by the Bronze Award at the Annual Biocontrol Industry Meeting (ABIM) and the IHS Markit’s Crop Science Award for best precision application technology innovation. In addition, many news articles and podcasts covered BVT in 2021.

The stock chart has been a play every time we test major support at $0.235. The stock has seen a bounce from here five times since August of 2021. It continues to be our major support zone. The stock recently bounced above this support and has held up well. A nice couple of days this week. The stock is looking ready to once again retest $0.33.

Water Ways Technologies (WWT.V)

Another reader favorite releasing historic news this week.

Water Ways Technologies signs the largest smart irrigation projects in the company’s history totaling $6,700,000 CAD with a recurring customer. The customer runs two cotton drip irrigation projects in Uzbekistan. This is a recurring customer who ordered a $4,000,000 CAD system in 2021, validating Water Ways products, service and customer relations.

Water Ways broke into new record high territory after taking out $0.35. On the retest, buyers stepped in. The largest contract news caused the stock to gap up on Monday of this week. We also printed new all time record highs hitting $0.445. The uptrend continues, and we keep making higher lows and higher highs. A breakout close would be super bullish, closing above $0.43. Support remains at $0.35.

AppHarvest (APPH)

High-tech indoor farming company AppHarvest announced preliminary FY 2021 net sales and adjusted EBITDA this week. Three more of the company’s indoor farms are currently under construction and are expected to be operational by the end of 2022. AppHarvest produce is sold in 1,000 stores across six States. Q4 2021 and Full Year 2021 results are due out on February 24th 2022.

Here are highlights from the press release:

AppHarvest now expects to report 2021 net sales in the range of $8.9 to $9.1 million, versus a previously announced outlook of $7.0 to $9.0 million. AppHarvest also expects to report a net loss in the range of $170.0 to $172.5 million and now expects an Adjusted EBITDA loss in the range of $69.3 to 72.5 million, versus a prior outlook of an Adjusted EBITDA loss of $70.0 to $75.0 million.

AppHarvest also announced the 15-acre Berea, Ky., salad greens facility and the 60-acre Richmond, Ky., tomato facility are both approximately 65% complete and expected to be fully operational by the end of 2022. A 30-acre Somerset, Ky., berry facility is more than 50% complete and is also expected to be operational by the end of 2022.

For the fourth quarter, the company expects to record a non-cash charge of approximately $59.9 million to impair the carrying value of goodwill and definite lived intangible assets related to the recent acquisition of Root AI, Inc. (now AppHarvest Technology, Inc. (ATI)), an artificial intelligence and robotics company.

Not much to say on the chart. We recently printed new record lows, and more might be in the cards. The stock really needs to climb back above $3.80 to begin to neutralize the downtrend. Maybe earnings are what can cause the reversal. I do like beaten down stocks, because eventually, a reversal pattern will take place. But not just yet. Still waiting for signs of exhaustion.

Sprout AI Inc (BYFM.CN)

Sprout A.I. S.A. engages in the planning, designing, manufacturing, and assembling vertical urban and controlled environment agriculture and farming cultivation equipment. It offers multi-level rolling racks with self-contained and environment-controlled habitats.

The company announced the initial sales order for a new client in Western Canada. 30 Sprout AI V2 habitats have been purchased and are scheduled to be delivered in Q3 2022 for a value of $450,000 US. The client is building a new facility that is specifically being designed to hold up to 450 Sprout AI Habitats. This purchase order represents the first order of the full build out.

Chris Bolton, CEO of Sprout AI, notes, “Sprout AI’s technology was selected by TheraCann for its Client because of its superior product quality in producing nutrient-rich, contaminant-free, straight-to-table produce. Due to the unique nature of Sprout AI being able to manage multiple crops within the same location, TheraCann’s Client, as well as any clients who adopt our technology, will be able to produce specialty crops on demand for their consumers. Our stackable and scalable technology is a great solution for any traditional farming operation looking to embrace the benefits of indoor vertical farming. We are thrilled that TheraCann’s client is so forward-thinking and recognizes the opportunity to take their current traditional outdoor farming operation from seasonal to year-round using our technology. Moreover, we are excited that TheraCann will be planning, designing, implementing and managing this facility together with their client as a “Discovery Center”

The Stock made headlines back in October 2021 when it dropped like a rock. The company even put out a press release stating they are not aware of any material, undisclosed corporate developments and had no material change. Basically, they did not know why the stock dropped. It is very likely that the drop occurred due to long term holders dumping for massive profits.

So is it time to get in? The news is good, but delivery is still a few months away. There is a chance of a bottoming pattern here. The stock has been ranging, and I am watching the $0.19 zone. This could be a chart with a long range and an upcoming breakout. It is on my list.