EarthRenew has appeared in my weekly Friday Agriculture Sector Roundup multiple times recently. The chart set up is just too good to ignore. Regular readers will know what I mean when they see the chart. Before we do, let’s take a look at the company.

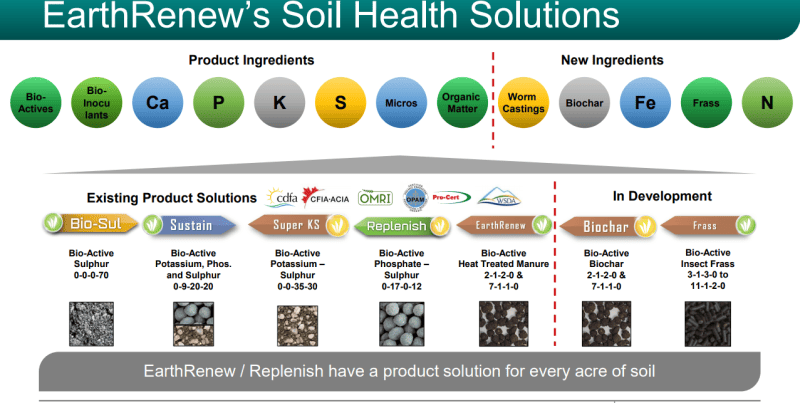

EarthRenew produces and sells organic fertilizers from livestock waste in North America and Europe. It also produces electricity from natural gas using an industrial-sized gas turbine and supplies to electrical grids and cryptocurrency miners. The company sells fertilizers under GrowER and GrowER Biochar names.

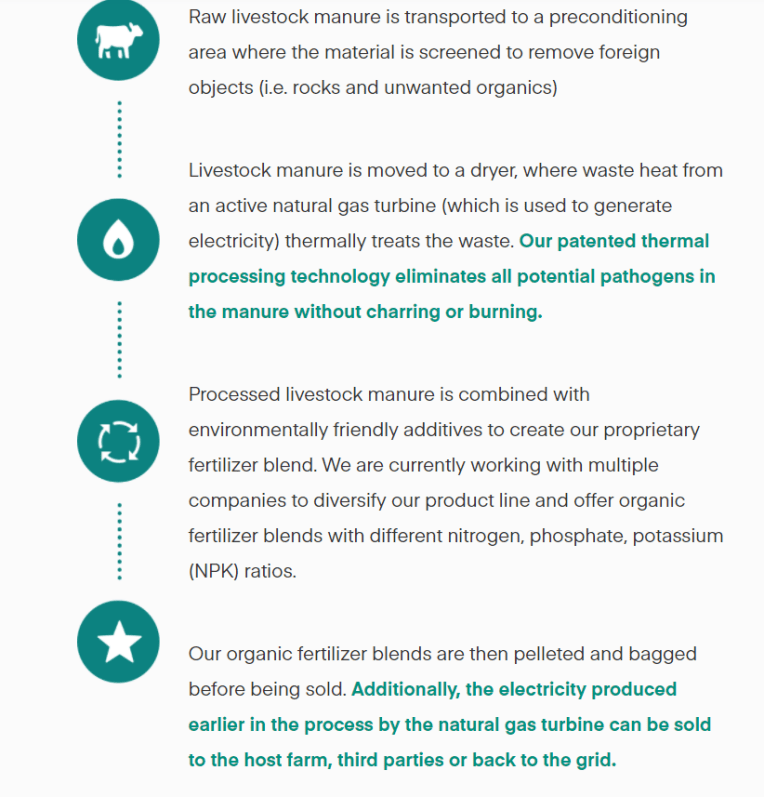

The company produces organic fertilizer production through their patented thermal processing technology transforming livestock manure into the good stuff for plant growth and restoring soil health. This organic fertilizer also offers 20% to 40% higher yields than the equivalent chemical fertilizer! And it’s good for the environment! $70 million has been invested into both the development and commercialization of this technology.

I like the revenue stream with electricity, but I am even more bullish when it comes to fertilizers. Tons of farmers and analysts are talking about fertilizer shortages. In fact, if you read last week’s Agriculture roundup, I discussed what Russia-Ukraine tensions mean for agriculture. Fertilizers can be impacted. It might be a few months old, but the information in my Fertilizers roundup is still relevant when it comes to shortages.

So we have a favourable setting for fertilizers on a macro global scale. But we also have EarthRenew’s recent news of 2021 revenues. The company, alongside its subsidiary Replenish Nutrient, is reporting revenue for January-December 2021 of $14 million, up 106% or $7.2 million from the same period in 2020. EarthRenew is also reporting 2021 revenue from power generation of $1.1 million surpassing 2020 power revenue of $0.4 million. On a consolidated basis, the total combined revenue of EarthRenew and Replenish for the period of January to December 2021 was $15.1 million. EarthRenew is anticipating positive earnings from operations results for Q4, 2021.

The revenue leap is coming from Replenish sales, and the company will be focused on taking advantage of this uptake within the regenerative fertilizer market.

CEO Keith Driver commented, “We are pleased to see the year-over-year growth in revenue from the sale of regenerative fertilizer on track, as predicted. At the same time, we are close to commissioning Replenish’s expanded Beiseker facility, growing our granulated production capacity to 20,000 tonnes from 4,000 tonnes.”

EarthRenew is forecasting growth in revenues from fertilizer to be in excess of $24 million for 2022 (71 per cent growth). This growth in sales will largely be a result of the additional production capacity for granulated fertilizers coming online at the production facility in Beiseker, Alberta, as well as some efficiencies in the blended fertilizer business.

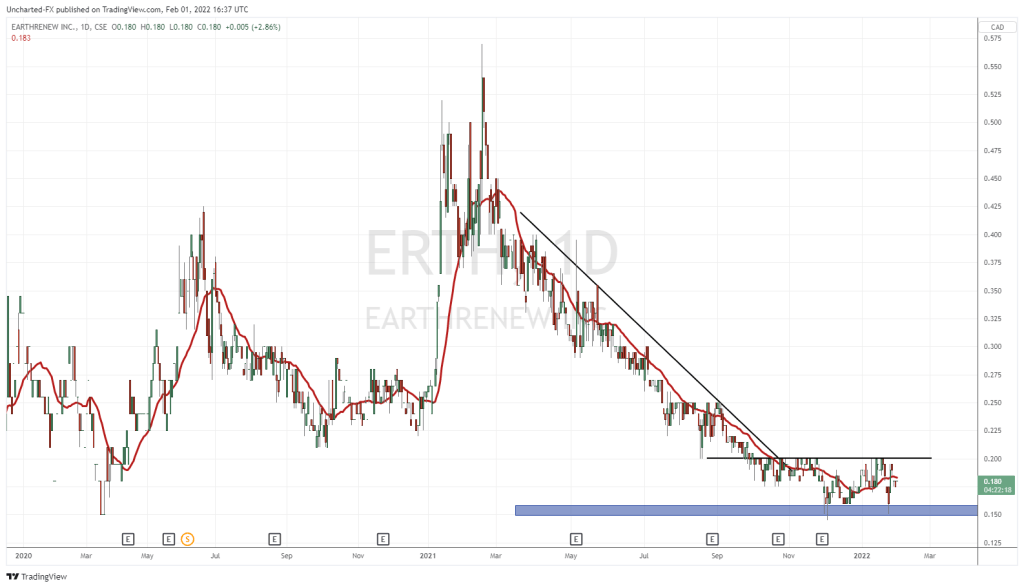

As a technical analyst and trader, this chart gets me super excited. Let me explain why.

All markets move in three phases: a downtrend, a range and an uptrend. EarthRenew has gone through a downtrend. A long one with multiple lower highs and lower lows. The stock then began to range beginning in Fall of 2021, bouncing between $0.15 and $0.20. We have seen days with big volume in this range signaling accumulation. To me, the chart is shaping up to form a combination of a double bottom and an inverse head and shoulders pattern here. For a trend reversal trader like myself, this is looking very good.

What’s the trigger? We need to see a break and close above $0.20. That would signal the break of this range, and the beginning of a new uptrend, with multiple higher highs and higher lows. If we continue to range, and break below $0.15 instead, we would have to step back and reassess.

With a market cap of around $14 million, the stock is looking very attractive in the macro environment where a possible fertilizer shortage is looming. We just need that catalyst to get us above $0.20, and this may come in the form of Q4 2021 earnings. Keep this stock near the top of your watchlist!

if you compare this to other companies like GRN.TO, XBC and NPK ERTH is extremely undervalued.

I agree Adrian! Under the radar and I like the fact we confirmed a breakout and close above our resistance zone! Looking forward to the next few weeks!