Computing and cloud infrastructure have become integral parts of major businesses in multiple fields. In general, cloud computing enables businesses to communicate and share more easily outside of traditional means. According to Fortune Business Insights, the global cloud computing market is expected to reach USD$791.48 billion by 2028, expanding at a CAGR of 17.9%. That is pretty damn impressive considering this market was valued at USD$219 billion in 2020.

However, current cloud infrastructure is unable to support the intense requirements of the latest multiplayer video games, cutting-edge digital media production, or next-generation enterprises, which continue to push the boundaries of big data analysis and visualization. With this in mind, AMPD Ventures Inc. (AMPD.C) is a next-generation infrastructure company focused on “reinventing the Internet” using the latest servers, switches, firewalls, and storage arrays to overcome the limitations of commodity cloud architecture.

When it comes to commodity clouds, the primary focus is providing cost savings as opposed to being flexible, accessible, or providing strong service. Some examples of commodity clouds include Amazon Web Services, Google Cloud, and Microsoft Azure. In particular, Google Cloud has the potential to save businesses up to 79%. In terms of the actual cost, Google Cloud costs around CAD$215,696 a month and CAD$2.65 million a year. Not bad.

Better Bang for Your Buck

- $29.591M Market Capitalization

On the other hand, AMPD Ventures’ AMPD Remote Render provides superior performance improvements and cost savings compared to other render solutions. For example, compared to Google Cloud, AMPD Remote Render costs CAD$159,900 per month and CAD$1.97 million per year. In total, AMPD’s solution results in an estimated cost savings of CAD$2.0 million across three years while also significantly improving performance.

Aside from cost-effectiveness, what else does AMPD offer? Unlike other infrastructure companies, AMPD’s business approach is collaborative and not prescriptive. Rather than offering a portfolio of products that may or may not provide a solution, AMPD’s team works with clients to suggest ways in which infrastructure can be optimized from a performance, efficiency, and cost of ownership standpoint. Keep in mind, AMPD’s team is pretty stacked, led by its CEO and Director, Anthony Brown.

Anthony has almost two decades of experience as an entrepreneur and digital media infrastructure pioneer in Canada. In 2001, he co-founded Seven Group, a technology integrator with a focus on supercomputing, data management, and digital media. It wasn’t long before Seven Group established itself as a leading integrator for animation, visual effects, and video game studios both in Canada and around the world. Following Infinite Game Publishing Inc.’s acquisition of Seven Group, Anthony secured his position as co-founder and CEO of the company.

Under Anthony’s leadership, Infinite Gaming Publishing published MechWarrior Online, a highly successful free-to-play mech simulation game launched in 2013. It wasn’t until April 2015 when Anthony founded AMPD, a company that now has partner relationships established with Intel, AMD, and Bardel Entertainment, an Emmy Award-Winning animation studio recognized for rendering everyone’s favorite Adult Swim series, Rick and Morty.

Latest News

Most recently, on November 26, 2021, AMPD announced that it had closed the Company’s recently announced non-brokered private placement, for aggregate gross proceeds of CAD$6.94 million. The private placement was initially announced on October 26, 2021, with the Company initially expecting to issue up to 11,666,667 units at a price of CAD$0.30 per unit for gross proceeds of up to CAD$3.5 million.

However, on November 1, 2021, AMPD announced an increase in the size of the private placement, increasing the number of units up to 16,666,777 units for gross proceeds of CAD$5.0 million. With this in mind, the private placements closed on November 25, 2021, with AMPD issuing 23,139,663 units at a price of CAD$0.30 per unit, for aggregate gross proceeds of CAD$9,941,900.

Each unit is comprised of one common share of AMPD and one common share purchase warrant, with each warrant entitling the holder to subscribe for one share at an exercise price of CAD$0.50 per warrant for a period of 24 months following the date of closing of the private placement.

Additionally, on October 26, 2021, AMPD announced that it had signed a non-binding Letter of Intent (LOI) with Departure Lounge Inc. (“Departure Lounge”), and its shareholders. For context, Departure Lounge is a Vancouver, British Columbia-based company pursuing various technology and content initiatives related to the development of the metaverse.

“Part of AMPD’s mission with the development of our High-Performance Edge platform has always been to become the hosting company for the Metaverse…By adding Departure Lounge to AMPD’s growing roster of subsidiaries and having AMPD’s CSO, James Hursthouse, transition to running Departure Lounge as a wholly-owned subsidiary of AMPD, we add significantly to the value of what we are creating through technology and content initiatives that require exactly the type of computing that AMPD specializes in providing. The result is a full 360-degree Metaverse focused organization,” said Anthony Brown, CEO at AMPD.

The transactions contemplated by the LOI are subject to various conditions, including entering into a definitive Share Purchase Agreement, whereby AMPD will acquire all of the issued and outstanding shares of Departure Lounge. That being said, AMPD intends to use $2.5 million of the proceeds from its recently completed private placement to fund the ongoing operations of Departure Longe post-acquisition.

The purchase price for the acquisition contemplated by the LOI is CAD$1,079,458 plus an agreed earnout based on performance. The initial purchase consideration will be satisfied through the issuance of 3,598,195 common shares in the capital of AMPD to be issued at a deemed price of $0.30 per share.

It is worth noting that Departure Lounge recently signed an agreement through its operating subsidiary, 1310675 B.C. Ltd., with Metastage, a leading 4D holographic capture provider. Through this agreement, Departure Lounge will work with Metastage to develop a holographic capture facility in Vancouver, BC. Departure Lounge will build on this initial foundation with a range of metaverse-related technology and content initiatives.

Speaking of, the metaverse has recently begun gaining traction as a hypothesized iteration of the Internet, supporting persistent online 3D virtual environments through conventional personal computing, as well as virtual and augmented reality. Access points for the metaverse include general-purpose computers and smartphones, in addition to augmented reality (AR) and Virtual Reality (VR). Put simply, the metaverse combines multiple elements of technology, including AR and VR, to create a digital space where users can essentially live, if you can call it that.

If you watch anime, think Sword Art Online. If you don’t, then a more mainstream example of a fictional metaverse would be Ready Player One. Fiction aside, Mark Zuckerberg has a very real desire to create a future centered around the metaverse, blurring the line between digital and virtual worlds. Personally, I think I will stick to real life, however, there is undoubtedly a market for the metaverse. Don’t believe me? Just take a look at the volumetric video market.

What is Volumetric Video?

Volumetric video refers to a technique that captures a 3D space in real-time. In doing so, the volumetrically captured object, environment, or person can be transferred to various mediums including the web, mobile, or even virtual worlds to be viewed in 3D. If you haven’t pieced it together already, volumetric video is commonly used to create content for VR and AR, where users can experience a scene using VR headsets or AR glasses.

For example, if we were to use volumetric video to record and upload a soccer match to VR, I could then use a VR headset to enter this scene and run around on the pitch myself. Compared to 360-degree video, volumetric video actually enables the user to control how far in or out they want to explore a scene. Pretty cool, right?

When it comes to video games, volumetric video capture gets even cooler. Currently, volumetric video is the only way to duplicate 100% of human movements and emotions in 3D. Before volumetric video reared its beautiful head, animators would have to work tirelessly to create assets for video games. A lot of the time, this meant meticulously moving each asset and adjusting facial expressions accordingly to create a scene.

Compared to the real thing, the differences are obvious, however, volumetric video comes pretty damn close. Moreover, everything recorded in a space using volumetric video can be uploaded and turned into an asset, including a person. With this in mind, while a short animation can take weeks to complete, a volumetric video can be rendered in just a few hours, saving both time and money.

Volumetric video, VR, and AR are a lot more complicated than they seem. Just trying to explain what volumetric video is has taken a few years off my life, but hopefully, you get the gist of it now. Even if you don’t, all you need to know is that the global volumetric video market is growing at a phenomenal rate, and AMPD, through its agreement with IO Industries Inc. on September 9, 2021, has the tools to capitalize on this market. Keep in mind, VR and AR will play a pivotal role in the realization of the metaverse.

Not convinced? According to Verified Market Research, the Global Volumetric Video market is projected to reach USD$6.7 billion by 2026, expanding at an impressive CAGR of 31.49% from 2019 to 2026. As for AMPD, the Company presents a pretty attractive investment opportunity for those looking to dip their toes in the volumetric video market. In addition to having multiple revenue streams spanning numerous sectors, AMPD has also established strong partnerships with some of the industry’s leading technology and community partners.

Financial Results

According to AMPD’s Annual Financial Results for the years ended May 31, 2021, and 2020, the Company had cash of CAD$1,608,342 on May 31, 2021, compared to CAD$938,661 year-0ver-year (YOY). On May 31, 2021, AMPD’s total assets and total liabilities both increased to CAD$2,939,071 and CAD$1,192,833, respectively.

As of May 31, 2021, the Company’s sales increased to CAD$1,549,741 compared to CAD$1,173,636 during the same period in the previous year. In total, AMPD reported a gross profit of CAD$977,070 on May 31, 2021, compared to CAD$472,304 on May 31, 2020. AMPD’s net and comprehensive loss for the year decreased significantly from CAD$8,230,724 on May 31, 2020, to CAD$3,285,457 on May 31, 2021.

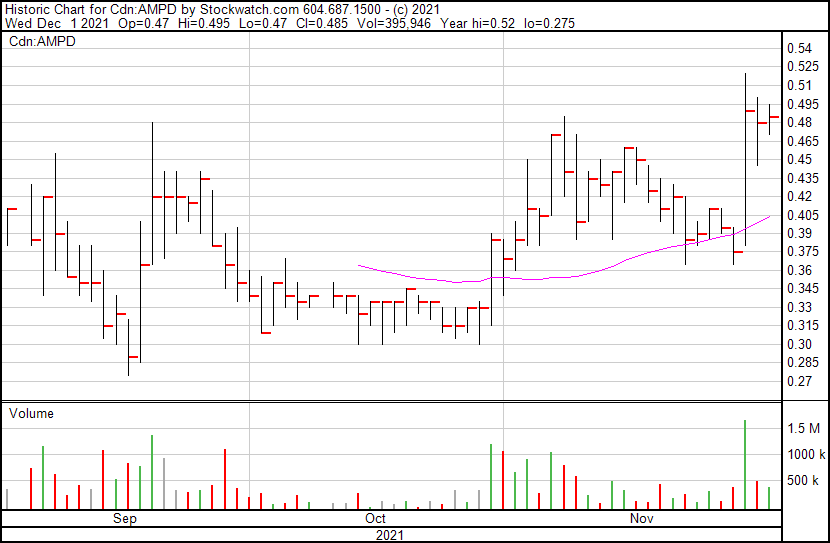

Upcoming, 424,904 AMPD warrants at an exercise price of $0.35 will expire on December 1, 2021. Shortly after, on December 14, 2021, 2,367,750 warrants at an exercise price of $0.35 will expire. It is worth noting that on June 2, 2022, 500,000 warrants at an exercise price of $0.0006 will expire. Similarly, on June 2, 2024, 4,000,000 warrants at an exercise price of $0.0006 will expire.

FULL DISCLOSURE: AMPD is not a client company, but Equity Guru is an investor.

AMPD Ventures (AMPD.C) CEO on capturing a slice of the multi-billion-dollar global content creation market