Web 3.0, the metaverse, digital payments, software as a service, high-performance computing and the list goes on and on. Tech stocks can be tricky to invest in as most of these growth companies are not profitable. Markets price in future expectations, and investors love betting on the next big thing.

I think we can all agree that amazing technology innovations are going to become mainstream in the next few years. The companies that take these innovations mainstream will provide big gains for investors. Technology will not only improve lives, but could be a factor in deflation. A very interesting topic, and for those interested I suggest you read the book, “The Price of Tomorrow: Why Deflation is the Key to an Abundant Future” by Jeff Booth. Technological advances will bring in advances and efficiency, but will also be highly deflationary.

Tech stocks have taken quite the hit recently. No surprise. In a rising interest rate environment, growth stocks tend to take a hit. The drops have been epic. Case and point ARKK:

Cathie Wood’s fund has fallen from highs at $159.70 to lows at $35.10. All within 15 months. With recession fears, the markets are now pricing in central banks having to reverse policy. If this is the end of the current interest rate hike cycle, then tech stocks could be in for a bounce. My technical analysis superpower senses are beginning to tingle. The type of set up that is developing on ARKK is one that meets my criteria for a reversal. Now I am not saying go out and buy as certain triggers must be met. But things are looking promising, and the same structure can be found on many tech stocks. Is the bottom in?

A lot of people harken the current tech sell off to the dot com bubble. Big names like Oracle and Amazon, which were seen as the next big thing, also fell during the dot com bubble. I don’t need to tell you about their recovery.

In no way am I comparing the current tech sell off to the dot com bubble. For some perspective, the Nasdaq fell over 80% from its highs to the lows during the dot com bubble. The current sell off in the Nasdaq has seen a drop of around 33% from its highs in November 2021 to recent lows in mid June 2022. Bear market yes. But still ways to go if we are to compare this to the dot com bubble.

The Nasdaq is showing some strength at time of writing, something the S&P 500 and the Dow Jones are not showing. This could be another sign of the market’s pricing in a reversal in monetary policy, hence why a return back to riskier growth stocks. The upcoming days will tell us if this is true.

The three companies I will talk about all deal with different things. The charts are showing signs of basing and reversal. The most important thing is all three companies are ones for the future in their own ways.

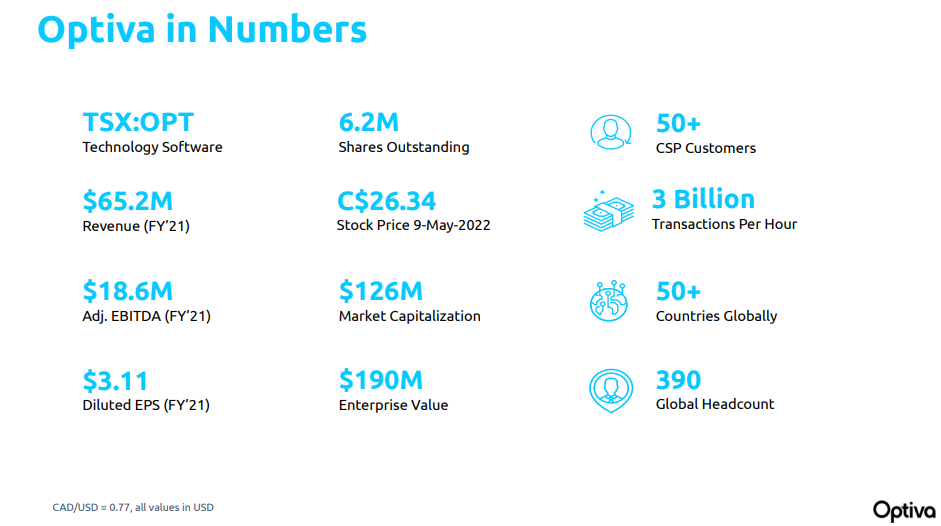

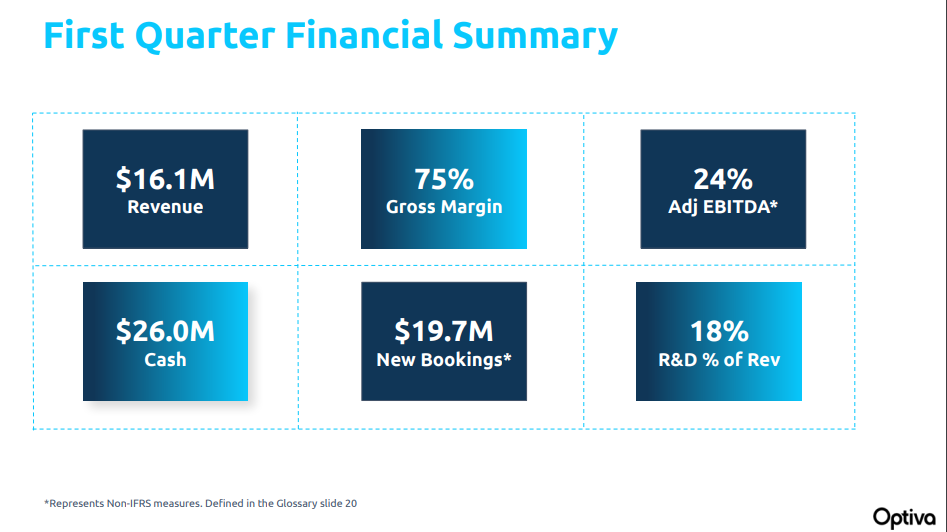

Optiva Inc (OPT.TO)

Optiva is a leading provider of mission-critical, cloud-native revenue management software for the telecommunications industry. Its products are delivered globally on the private and public cloud. The Company’s solutions help service providers maximize digital, 5G, IoT and emerging market opportunities to achieve business success.

The company has a long history, being established in 1999.

The company is targeting the intersection of the cloud and 5G markets. With this comes the transition from a service to a software business model. A new product refresh is expected in 2022 centering on Optiva’s best-of-suite (BSS) platform. I’ll quote the pros about this:

The Optiva BSS Platform is an end-to-end customer and revenue management solution that monetizes innovative services and delivers a high-quality customer experience. The platform allows operators and MVNOs to utilize real-time billing, charging, and fulfillment to differentiate themselves from the competition and maximize profitability.

The suite supports 2G through 5G on a single platform, giving operators the tools they need to deliver a more advanced and personalized user experience cost-effectively.

Optiva BSS Platform is a pre-integrated solution that goes beyond traditional billing. It allows for store-front provisioning, monetization, and cross-service promotions to be delivered in real time. It is designed for the cloud and can be deployed in public and private environments, and it delivers rapid launch and lowers TCO. The suite addresses all the monetization requirements of a service provider.

The stock chart has been on a roller coaster ride in the past two years. Highs of over $50 to lows around $20. Rise and fall and rise and fall. The recent downtrend lasted from August 2020 (post pandemic sell off) to November 2021. I would now say Optiva stock is in the range portion of market structure.

We are holding above $20.00 but the major trigger for the breakout comes with price taking out $30.00.

Is Optiva ready to start a new chapter? The stock is hinting at this. Volume is still quite low, but the long downtrend seems to be over. A range can continue until Optiva releases a catalyst. The stock is still bringing in money, but a new corporate strategy has the market waiting for further guidance.

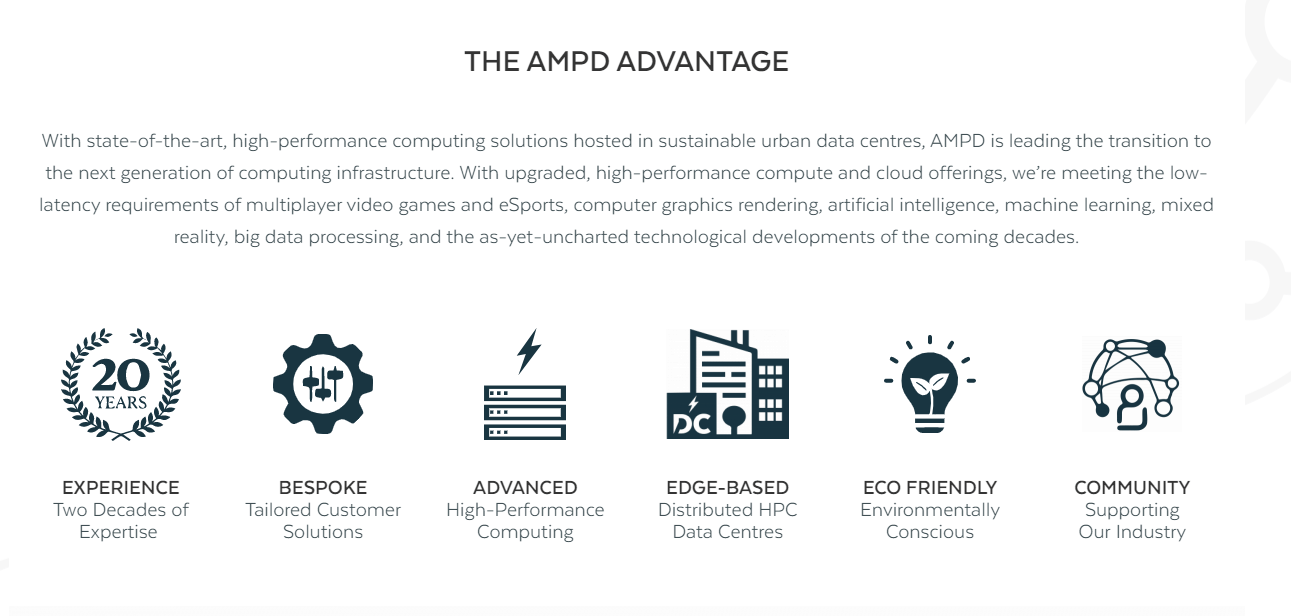

AMPD Ventures (AMPD.CN)

AMPD Ventures is a company Equity Guru readers are familiar with. This is one of those companies positioned with the technology for the future, but needs its story to be told. Chris Parry himself is a big fan and he recently explained AMPD’s high computing solutions and the value proposition in his latest 3 minute hits!

AMPD Ventures Inc is a technology company, providing cloud and computing solutions to gaming and digital media companies in Canada and the United States. The company offers solutions for video games and eSports, computer graphics rendering, artificial intelligence, machine learning, mixed reality, and big data processing fields. It also provides AMPD Virtual Studio, a suite of private cloud-based solutions designed to create infrastructure-less studio; AMPD Virtual Workstation; AMPD Render solutions; AMPD Storage solutions; AMPD Metal, a bare metal server product; AMPD Cloud Plus; AMPD Flexible Edge; AMPD Virtual Production Services; AMPD Machine Learning Platform; AMPD CDN solutions; AMPD Game Hosting; and AMPD Studio.

Joseph Morton sums them up very nicely:

AMPD isn’t like other computer companies. Whereas other computers might provide access to the cloud or even upgrades to whatever shiny new computer or technological what not’s presently making waves, AMPD handles the infrastructure behind all of these front-line applications. They offer high performance computing solutions in sustainable urban data centres, and are at the forefront of the transition to the next generation of computing infrastructure by being the hosting company of the Metaverse.

Note that hosting the metaverse and being a metaverse provider are two different articles altogether. AMPD provides the levers and hydraulics and the workings behind the curtain of the metaverse, but the wizard still needs to run the show.

AMPD virtual production has the potential to revolutionize movie making. Why go to certain locations around the world when you can create it in a studio? Not only does the technology have creative advantages dealing with imagery and principal photography, but allows for smaller crews while reducing scope of location shoots, set builds and crowd scenes. This maintain creative control for producers and cinematographers while reducing costs.

AMPD has consistent press releases, and the most recent has been about the metaverse. Such headlines caused the stock to pop when it tested major support at $0.10.

The stock was initially showing signs of a reversal. We had a nice range developing between $0.14 and $0.185. I say “had” because with the current daily candle, we are set to break this range. Not the break bulls want. We wanted a close above $0.185 for a move higher. Instead, a close below $0.14 sets us up for a test back around $0.10.

I expect the buyers to put in a big fight there. The stock has seen major buying there as evident by the large wick candle on May 12th 2022. If we bounce and hold above $0.10, the stock can then begin to develop a double bottom. The trigger remains the same: a breakout above $0.185.

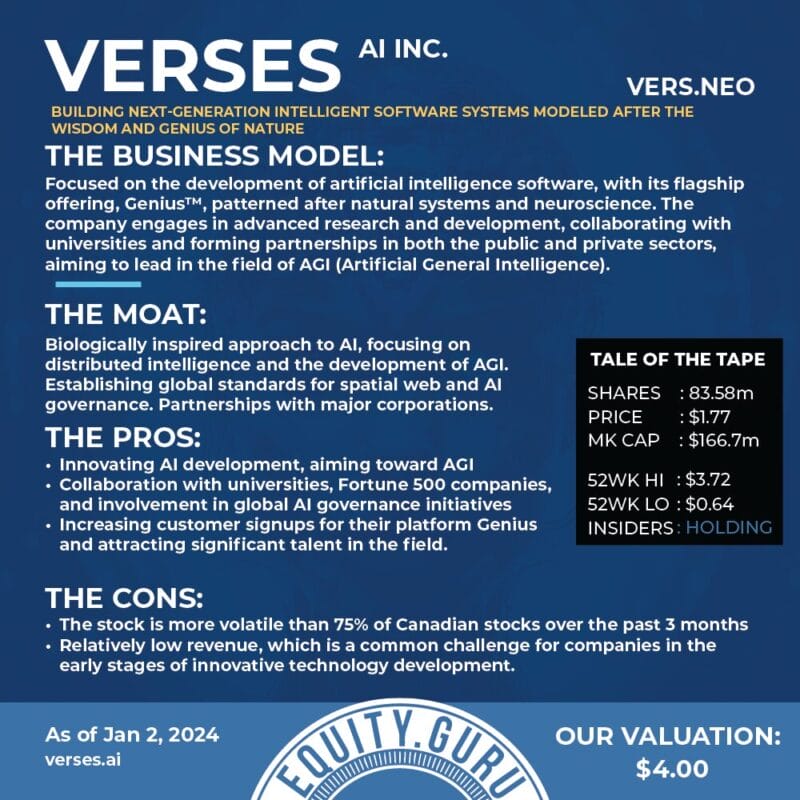

VERSES Technologies (VERS.NE)

Now VERSES is a company that has the potential to be a REAL game changer. The challenge is to explain their technology in simple terms without the tech jargon. Chris Parry does a great job:

A recent IPO with its ground-breaking AI operating system platform, Cosm, that is set to revolutionize such things as supply chain management by allowing managers to see and control all aspects of their supply chain seamlessly from a single dashboard.

But for all of you who want the big breakdown of Verses and their value proposition, look no further than Kieran’s deep dive, VERSES Technologies sets the stage for Web 3.0.

What exactly is Web 3.0? TechTarget defines it as:

Web 3.0 (Web3) is the third generation of the evolution of web technologies. The web, also known as the World Wide Web, is the foundational layer for how the internet is used, providing website and application services.

Web 3.0 is still evolving and being defined, and as such, there isn’t a canonical, universally accepted definition. What is clear, though, is that Web 3.0 will have a strong emphasis on decentralized applications and make extensive use of blockchain-based technologies. Web 3.0 will also make use of machine learning and artificial intelligence (AI) to help empower more intelligent and adaptive applications.

Kieran says something profounding: “If Web 3.0 is like a slab of marble, then VERSES Technologies is the Sculptor“. The Company provides enterprises, organizations, and governments with a suite of integrated technologies built on open standards developed by the Spatial Web Foundation.

VERSES’ flagship product is its COSM™ operating system (OS). The world’s first AI operating system which allows anyone to build intelligent apps for anything. This AI will interact directly on your behalf in the physical world. Data can be measured and tracked, and more importantly utilized to anticipate future data leading to better efficiency and return on investments.

This mixing of reality leading to optimal results and a performance increase is best demonstrated with VERSES’ Wayfinder:

They say a picture is worth a thousand words, well a video must be worth more. The video above does a great job in explaining Wayfinder and VERSES’ technology. VERSES is planning to launch COSM globally in 2023. Expect big things for the remainder of this year as we head into 2023.

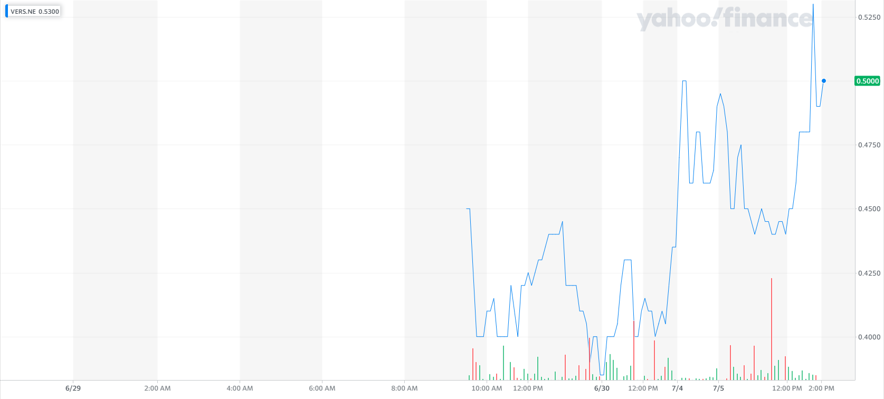

VERSES began publicly trading on June 29th 2022. As with most IPOs, the stock initially saw a drop as long time investor’s took some profits. But what is catching my attention is the price action afterwards. It has been awhile since I have seen a stable price movement post IPO. I am used to major drops in tech IPOs. VERSES is holding up strong.

We had a nice 12% day on July 4th 2022, and the stock continues its uptrend. Support levels can be seen even by the amateur chartists. $0.50 is a major zone also being an important psychological number. The next support comes in at $0.43. And then of course we must work with recent record highs at $0.53 and record lows at $0.3850.

Readers know that I am one who takes a patient approach with IPOs. I tend to wait a few weeks just so I can get some technical levels established and then work with those levels. VERSES has caught me off guard. I really like the current price action and the stock is holding up very well.

As a long term play, this is one I can get behind in establishing an initial position early in its price history. I like the technology, which has all the potential to be a game changer.

Full Disclosure: VERSES Technologies Inc. is a marketing client of Equity Guru.