Chinese stocks were making headlines a few weeks back. Or should I say, the Communist Party of China (CCP) was making headlines. The crack down on Chinese tech companies listing overseas made some traders worried. Read my past article titled, “What the heck is going on with China stocks“, for more info. Basically, US markets have been free money for Chinese companies. Access to US capital markets is the goose that lays the golden egg, so traders rightly got worried when Beijing killed it.

It seems that a deal is now in place between the government and big tech. The fear is subsiding, and when we look at charts in a sec, you will see this.

BUT the CCP has been putting out some more controversial control measures that aren’t linked to financial markets. We had the education crackdown earlier, and recently, Beijing has imposed a time limit on minors playing videogames, and have banned ‘sissy’ and effeminate men from tv. Lot of crackdowns and regulations when it comes to video games, but this kind of power will keep investor’s on edge.

Now I am not claiming to be a China expert by any means, but there are some investors who think investing in China is not worth the risk since the government can do what they please, whenever they want.

George Soros is one of them. News out this week has been about Soros and China, and him ripping on BlackRock for launching mutual funds and other investment products for Chinese consumers. Soros called this a ‘tragic mistake‘ and believes this will damage the national security interests of the US and other democracies. The debate goes on with BlackRock replying, and even Ray Dalio, a major China bull, responding to Soros’ comments.

This debate will go on for months and years to come.

Chinese stocks were taking a hit: Baidu, Ali Baba, JD, Tencent Music to name a few. But they are now showing signs of a recovery. Is it time to buy China?

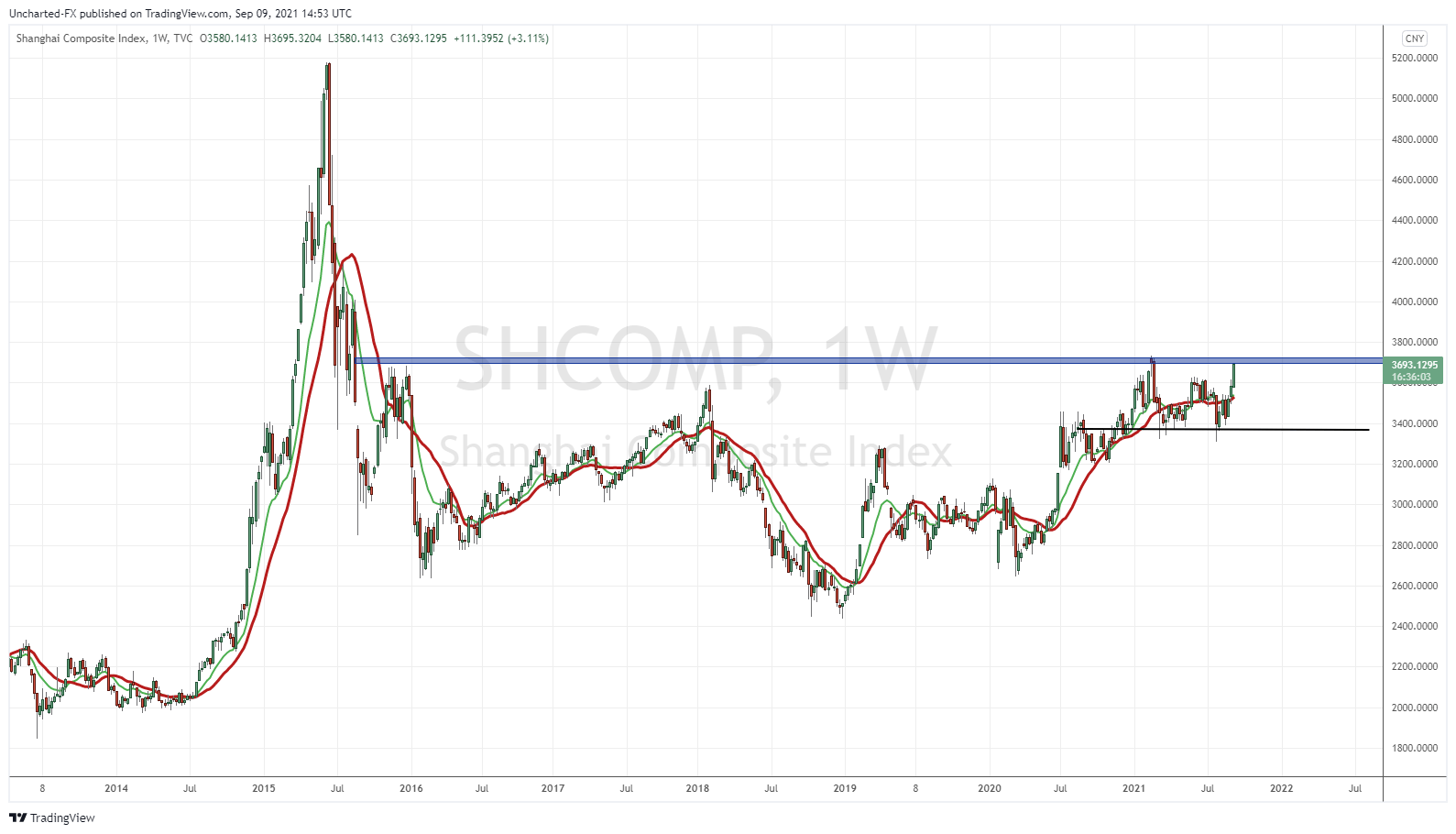

Let’s take a look at the Shanghai Composite Index and the Hang Seng.

Above is the weekly chart. We have been ranging for months between 3371 and 3720. There were some worries the Shanghai Composite Index was going to break down and drop…which probably would be bad for all equity markets worldwide, but instead, we have bounced to test the 3720 zone once again.

A bit different from US markets which have just been making record high after record high. There is a possibility the Shanghai Composite is about to rip on a run with a weekly breakout above 3720.

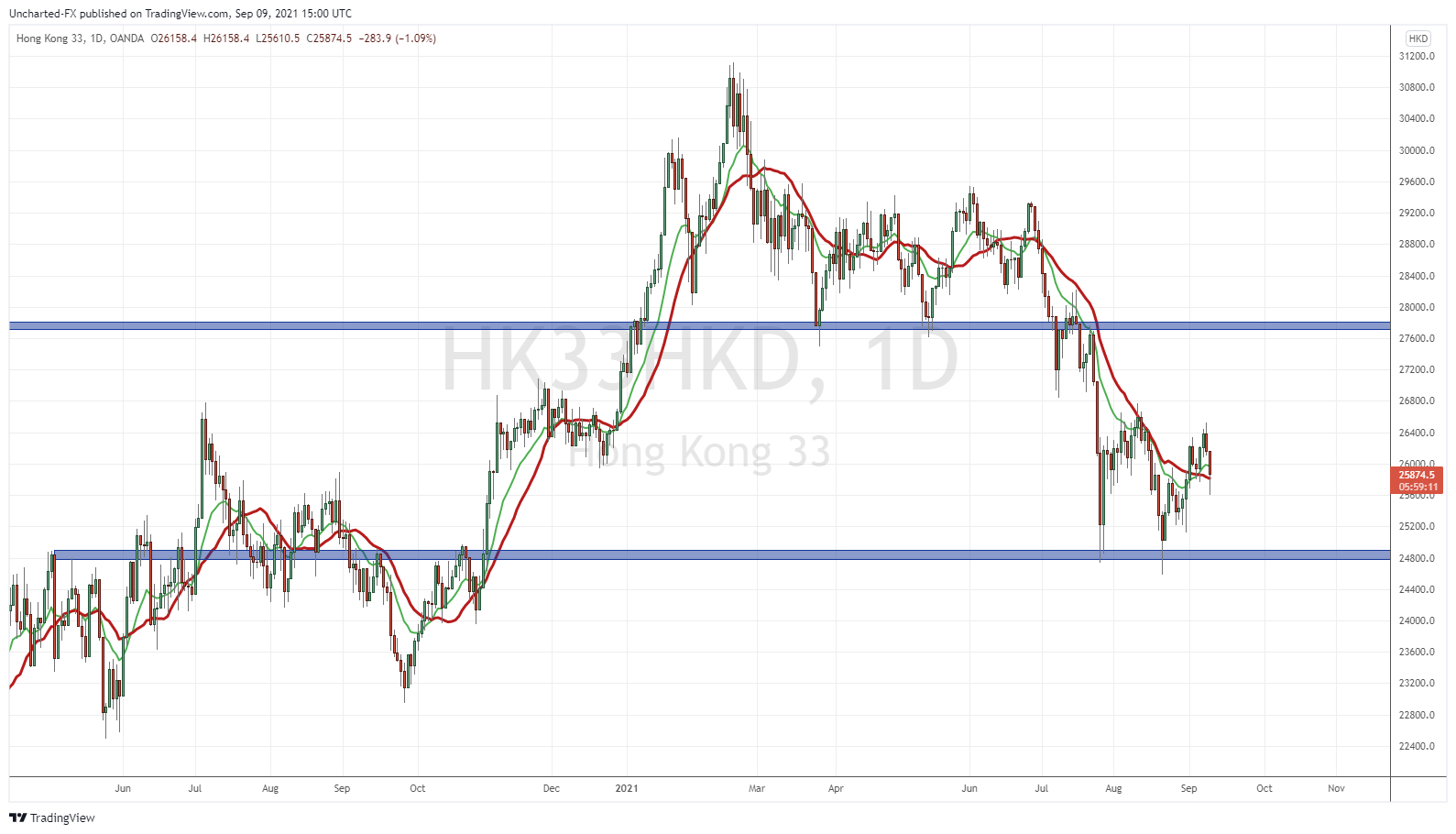

The Hang Seng is what you really want to follow on the China tech scare. This index is tech heavy, and was impacted on the CCP crackdown. So much so, that the Hang Seng declined 20% and officially entered a bear market.

With a compromise between the CCP and big tech, the Hang Seng is finding some bottoming here. A major support at 24800 has been held. What I want to see is a break and close above 26655, or the previous lower high on the daily chart. We break above this, and the downtrend is over.

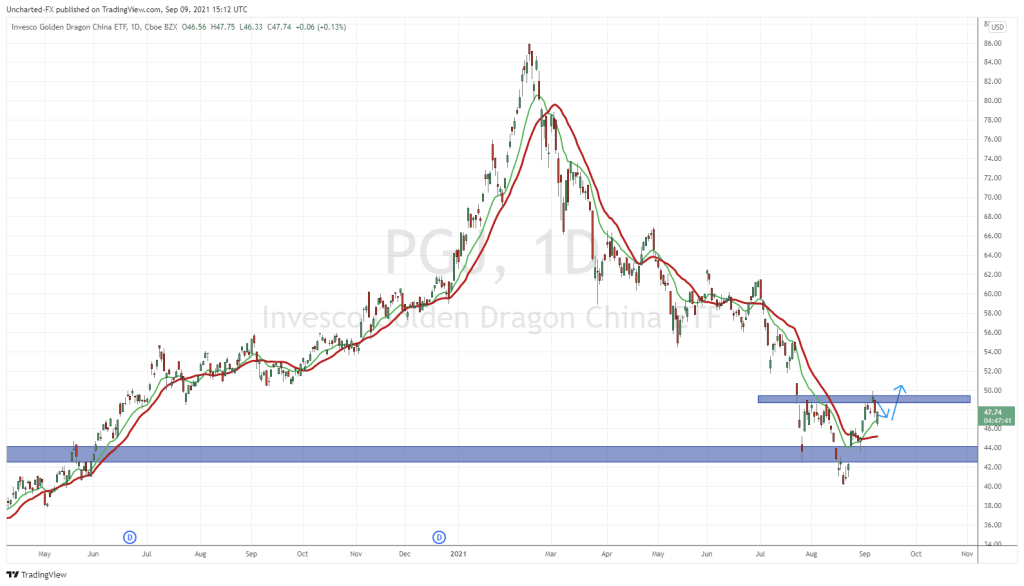

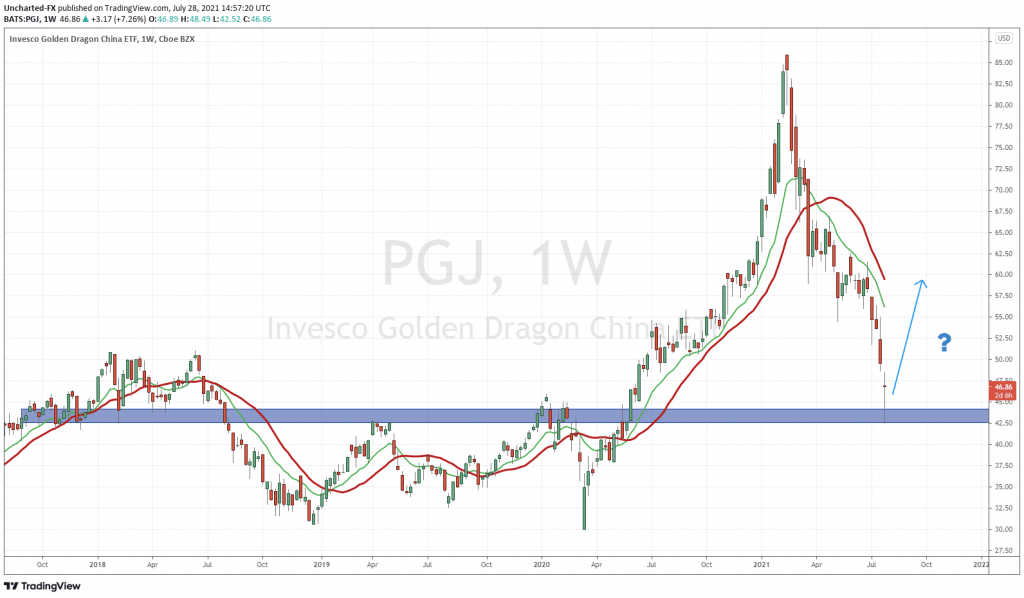

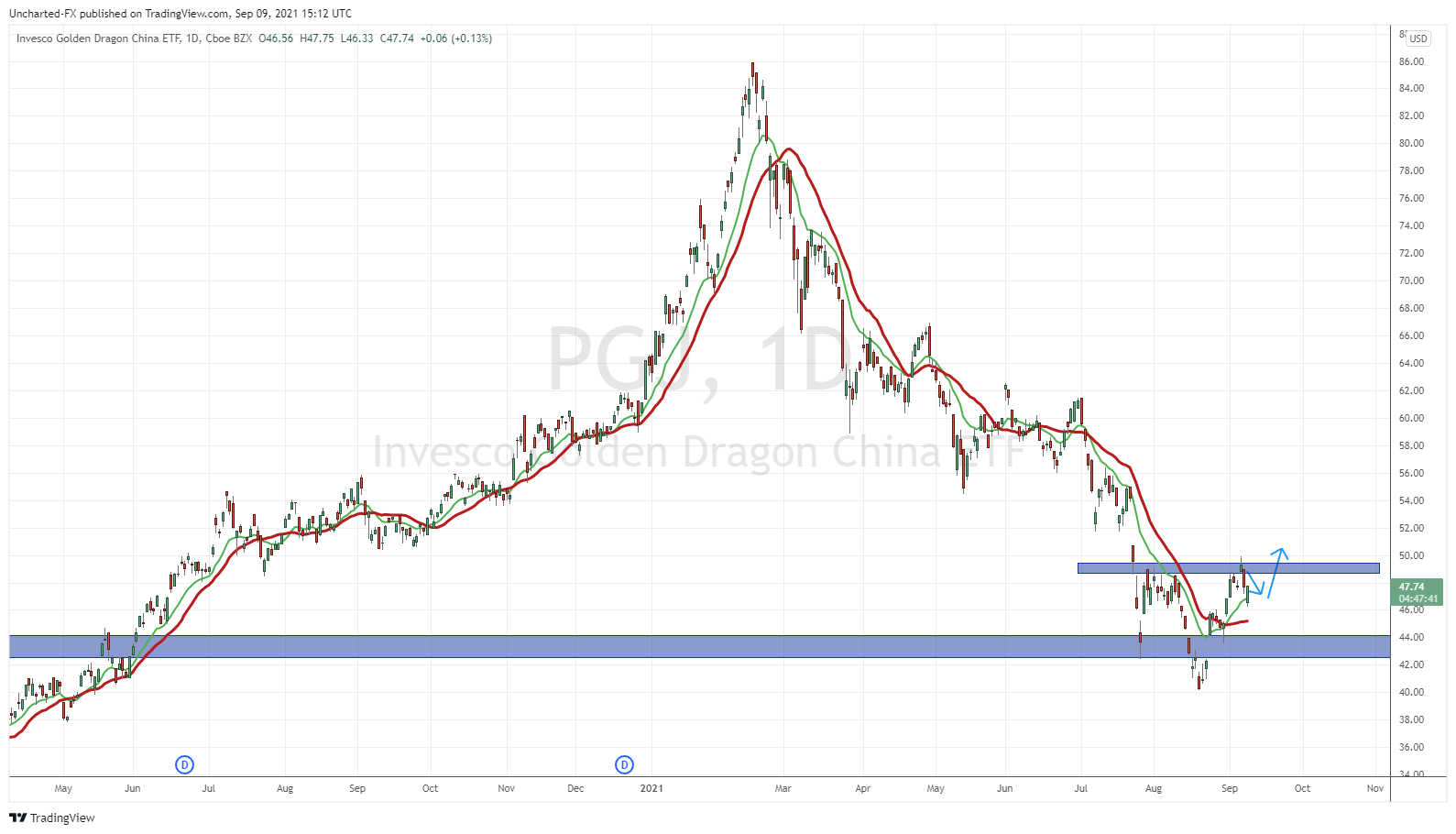

But the biggest technical reason for going long China has to do with the Golden Dragon ETF, ticked PGJ. This ETF holds all Chinese companies listed on US markets as American Depository Receipts. Baidu, Ali Baba, JD, Tencent they are all here.

In the previous article I wrote and linked above (“what the heck is going on with China stocks), I highlighted the PGJ and the major support zone we were approaching. This support zone initially broke, but it turned out to be a fake out, with buyers buying the dip and taking price back over $42.

Now technical astute eyes might see what I see. Yes folks, we seem to be printing a reversal pattern known as the inverse head and shoulders. This is being printed after a long downtrend with multiple swings AND at a major support zone. Great confluences hinting at a successful reversal pattern. What we need though is the confirmation. That is a breakout above the $49.50 level and this reversal is triggered.

One can play this, or any single China stock such as Baidu or Ali Baba if you prefer.

So in summary, the technicals are indicating a reversal on China stocks. But as many analysts have said, you never know what the CCP could do. That risk keeps me away from most China stocks.