“Medicine is a science of uncertainty and an art of probability.” – William Osler

I think it’s appropriate I start the article by saying that I get it, biotech is not an easy industry to understand. The jargon used by those writing about the industry often takes away from the ingenious business models of some of these companies. But knowing that many investors don’t appreciate or understand what goes on in this specialty industry means there are many opportunities to profit from market inefficiencies.

These market inefficiencies can be described as a disparity between the intrinsic value, or net worth, of a business and its current market price reflecting the uncertainty of investors.

Having said this, the stock we’re talking about today is up approximately +6% as investors take in a new valuation and price target by Mackie Research.

My stock pick of the day is Medexus (MDP.V), a Canadian–based specialty pharma company with a solid portfolio of products in autoimmune disease, hematology, and specialty oncology, plus its traditional pediatrics, allergy, and dermatology business in Canada.

As of the 6 months ending September 30, 2020, MDP was able to generate a total of $51 million in revenue, utilizing an average of around $24 million in net tangible assets. Their rapid growth in revenues recently has blessed the firm with a total market valuation of about $90,000,000.

Pushing their revenue growth are their Canadian and U.S. subsidiaries. For its Canadian business, MDP is selling a variety of products, including Metoject, a methotrexate pre-filled syringe for rheumatological conditions.

Rheumatology is a branch of medicine devoted to the diagnosis and therapy of rheumatic diseases that mainly cause pain, stiffness, and swelling in the joints. But the diseases can also affect internal organs.

Their second Canadian product is Rupall a second-generation antihistamine for allergies. Typically, people take antihistamines as an inexpensive, generic, over-the-counter drug that can provide relief from nasal congestion, sneezing or hives caused by pollen, dust mites, or animal allergy with few side effects.

For its U.S. business, MDP is selling Rasuvo a methotrexate autoinjector for rheumatological conditions…

…and Ixinity a recombinant Factor IX treatment for hemophilia B in adults. Hemophilia B is a hereditary bleeding disorder caused by a lack of blood clotting factor IX. Factor IX is made in the liver. This protein circulates in the bloodstream in an inactive form until an injury that damages blood vessels occur.

You see, I told you it wasn’t too difficult to understand.

Now we can look a little deeper into the research report and try to understand the assumptions made about their drug commercializing business model.

To be clear, MDP is not directly involved with the manufacturing of their products. Instead, the company relies on third-party manufacturers. Failure by MDP’s partners to meet the FDA’s and Health Canada’s standards with manufacturing would have a negative impact on the company, which lays on a level of risk.

That said, this does give them a competitive advantage when it comes to the cost of producing the products, which can be seen in the fact their gross profit margins have been consistently above 50% for the last five years. Although operating margins are still in the negative because of higher fees paid to third-party manufacturers, over time there are hopes the firm will cut corporate inefficiencies and improve its operating position.

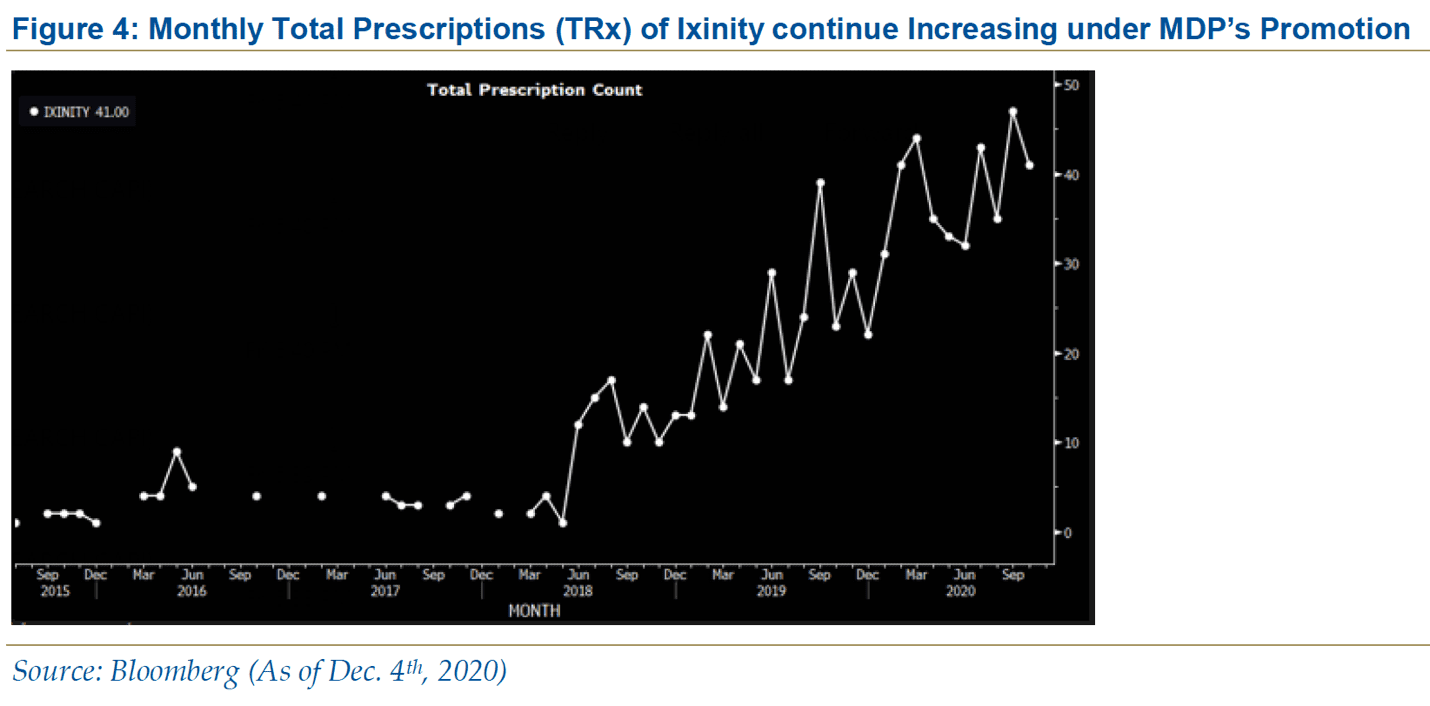

Mackie believes that the Ixinity and the Rasuvo brands will be the main catalyst for their target price of $9 being realized. They argue that Ixinity sales volumes are increasing over time because of the demand for the product and current trends imply that this demand will continue.

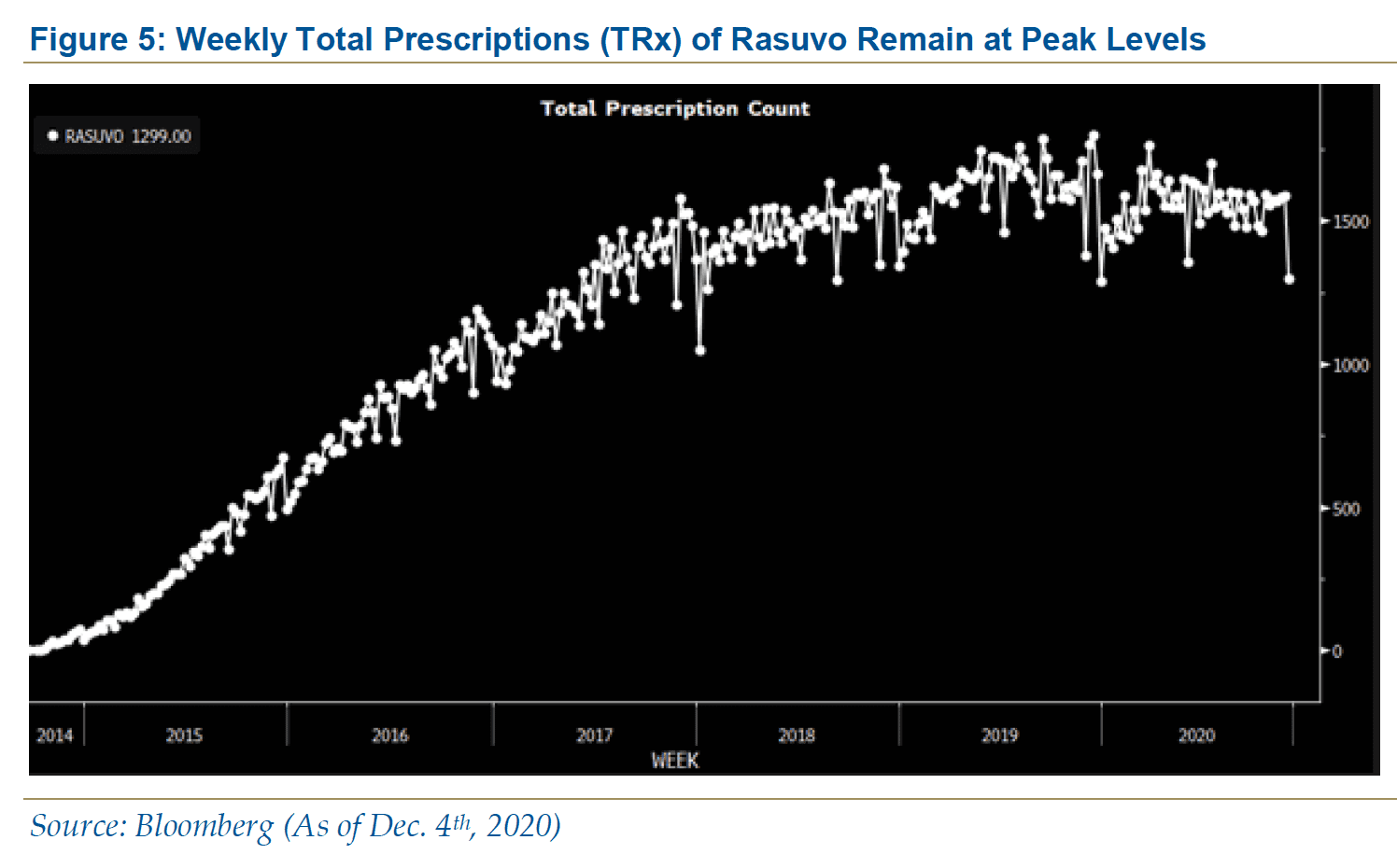

Supporting their top line, the Rasuvo brand has a steady volume and has maintained that volume for almost 4 years. This steady demand for their brand showcases an interest by its target market that can be sustained over time whilst the management team focuses on increasing corporate efficiencies.

The revenue catalysts are pretty simple to understand and it is pretty clear why the consensus average for 2021 revenues for MDP is around $100,000,000 compared to their 2020 $76,000,000 revenue.

Mackie does however issue a warning of the competitive nature of the industry specifically mentioning Cumberland (CPIX.NASDAQ). This competing firm launched a methotrexate auto injector product in Nov and they feel investors should keep an eye on it.

“It is the biggest risk factor we see in the MDP story- Mackie Research”

Having gone through their main thesis for their valuation we can take a look at their assumptions about the future of MDP.

|

The quote above is the main valuation model used by Mackie for MDP. My assumption is that they used a peer analysis valuation instead of a run of the mill discounted cash flow because of how uncertain the cash flows for the business are.

Having done a quick discounted cash flow of our own, using the forecast from Mackie Research, we do get a price range between $6.30 and $8.77 per share. This is somewhat close to Mackie’s researchers past and present analysis.

For simplicity, we won’t go through the entire analysis but should take away the reasoning behind this choice. Essentially what they did was take the average exit multiples, using sales of the Canadian and US specialty industry, and assume an implied valuation for MDP.

The assumption being that if MDP has the ability to materialize revenues like its peer group its valuation would be around the average EV/Sales multiple or EV/Adjusted EBITDA.

Mackie Issues a speculative buy recommendation. A SPECULATIVE BUY is when a stock’s total return is expected to exceed 30% over the next 12 months; however, there is material event risk associated with the investment that could result in a significant loss. In our case, the martial events are the introduction of a competing drug by Cumberland and a reduction in the profitability of certain brands in the product portfolio.

This should not deter the purchase of the securities but would warrant a discounted purchase price of the common stock. Currently that stock is trading at a discounted price using the valuation implied by Mackie.

When they published their report the price at the time was $6.11 but as of today, the stock is trading at $6.50 well below the implied economic value calculated by Mackie( at $9 per share). Their next most significant event would be the up and coming Q3 earnings in February 2021. Analysts are expecting the earnings per share to be around -0.05 an improvement from -0.33 in Q1.

The significance of this event is not if or when MDP will beat earnings estimates, but the question on everybody’s mind will be by how much. As for today, A speculative buy seems appropriate when alternative investments in the industry are considered.

FULL DISCLOSURE: Medexus (MDP.V) is an Equity.Guru marketing client

HAPPY HUNTING!

Click this link, to subscribe for your weekly finance updates! https://takundachena.substack.com.

Thank you for reading and subscribing.

Legal Disclaimer The information on this article/website and resources available or download through this website is not intended as and shall not be understood or constructed as financial advice. I am not an attorney, accountant, or financial advisor, nor am I holding myself out to be, and the information contained on the website or in the articles is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation. We have done our best to ensure that the information provided in the articles/website and the resources available for download are accurate and provide valuable information for education purposes. Regardless of anything to the contrary, nothing available on or through this website/article should be understood as a recommendation that you should consult with a financial professional to address our information. The Company expressly recommends that you seek advice from a professional.