“In business, cash is oxygen” – Gary Vaynerchuk

Psychedelics is a cash-intensive business. Earlier in the week, I wrote about how clinical trials alone cost companies tens, sometimes hundreds of millions of dollars. And that’s only part of the picture. According to Tufts Center for the Study of Drug Development, bringing a new FDA-approved drug to market costs $2.6 billion USD on average when all things are said and done.

Only a few psychedelics companies have been able to raise enough dough to really put a serious dent in the drug development component of their business. That said, not all psychedelics companies are reliant upon drug development and expensive clinical trials results to drive value creation. Some companies are avoiding drug development altogether by focusing on technology/data, functional mushroom supplements, and clinics. Others have a couple million in the bank and are in the pre-clinical phase.

But the vast majority of psychedelics companies are either full-time drug developers or have drug development as a pillar of their business. And these are the companies that have raised the most money and where the institutional money has flown. As of 2021 most these upper echelon psychedelics companies have all migrated onto the Nasdaq and NYSE stock exchange. The sector, while slow right now in the summer months has garnered some serious capital raises in 2021.

So far this year Atai (ATAI.Q) raised roughly $225 million USD in their IPO in June. Compass Pathways (CMPS.Q) raised $144 million USD in May, and Field Trip (FTRP.Q) raised $95 million CAD in March.

All currencies below are in Canadian dollars and are based on the company’s most recent financials. I tried to include recent capital raises in the figures not yet accounted for.

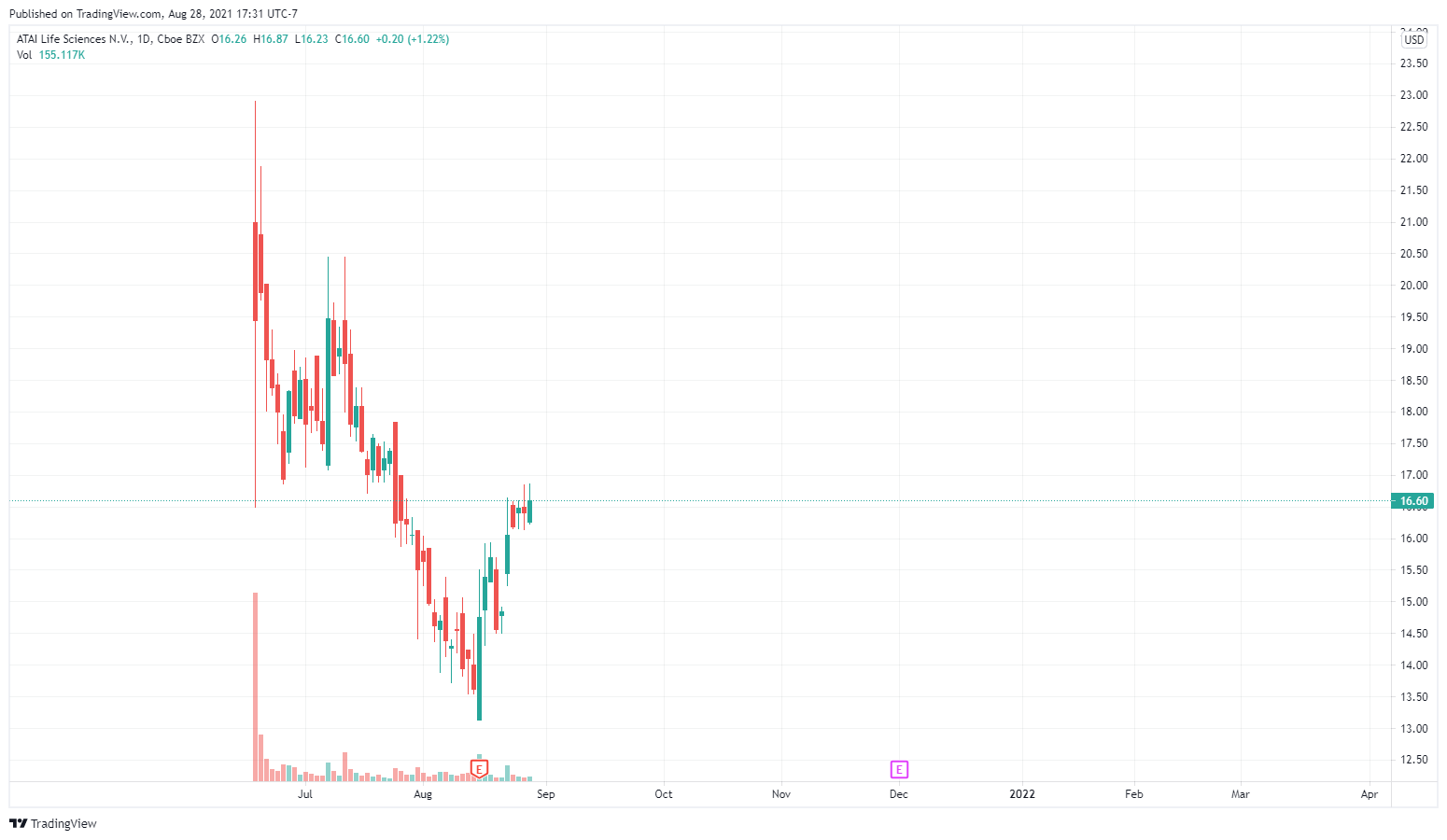

1. Atai (ATAI.Q) $576 million

The current kingpin of the psychedelics sector, Atai was formed in Germany in 2018. In its early stages, Atai relied on small convertible note round financing rounds which got larger every quarter leading up to the Nasdaq IPO in June. The IPO netted the company around $225 million USD, and was oversubscribed despite being slightly disappointing.

Atai has 10 therapeutic programs, including five psychedelic compounds in their pipeline including DMT, ketamine, salvia, and ibogaine. They are focused on multiple mental health disorders, including depression, initially TRD, CIAS, SUD, initially OUD, anxiety, initially GAD, mTBI, and PTSD. Atai also states it’s not seeking any kind of near-term revenue or product launches.

One of Atai’s companies, Recognify Life Sciences, has initiated a Phase 2a trial. The company also expects to initiate Phase 1 trials for three more programs in 2021 and an additional four in 2022. Atai currently has an ownership stake in 5 companies.

Atai is projected to have around a $40 million USD R&D budget this year as its pipeline is one of the most diverse in the sector. Atai is competing with Compass Pathways when it comes to IP, but also owns roughly 20% of the company and has some of the same financial backers.

See also:

Atai (ATAI.Q) announces it’s studying Salvia, a legal psychedelic in 20 US states

How did Atai’s (ATAI.Q) Nasdaq IPO go? Not as expected

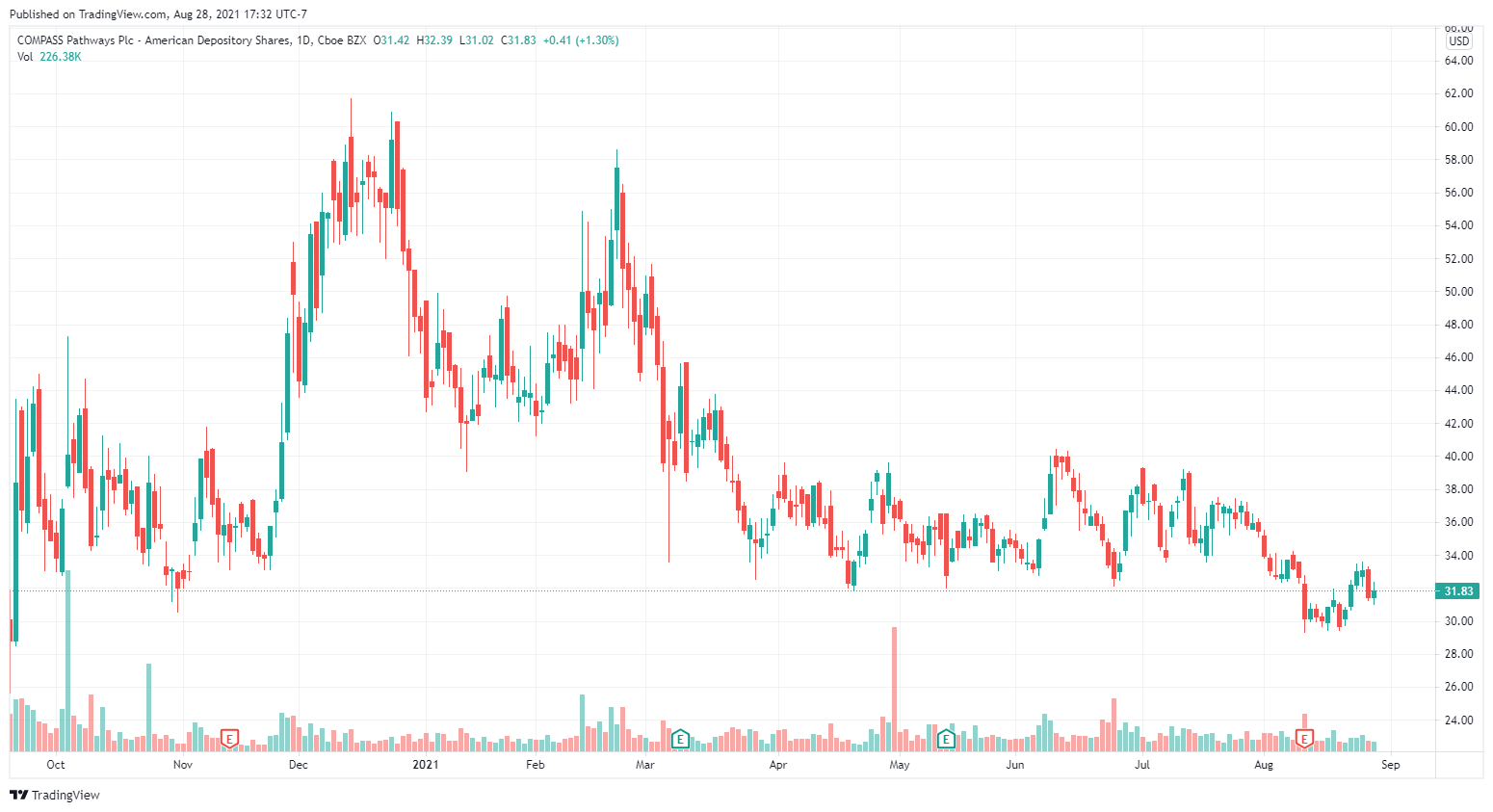

2. Compass Pathways (CMPS.Q) $402 million

Compass Pathways is the somewhat controversial second biggest fish in the pond. Compass raised $144 million USD in May and is looking forward to Phase 3 of the COMP360 clinical trials expected to start next year.

The company is spending around $3M USD on R&D per month with those numbers likely to jump as their trials progress into deeper stages. As of June 216 patients had been through Compass’ Phase 2 psilocybin trials. It’s currently the world’s largest psilocybin therapy trial, taking place in 22 sites across 10 countries.

The company is hopeful it can have a psilocybin monopoly by 2023, but other companies in the space like Cybin may have something to say about that.

Compass got into hot water for trying to patent things in the therapy process like touching a patient’s hand and certain breathing exercises and even furniture choices.

Compass first registered as a charity, then its founders set up a for-profit corporation working towards the same ends just one year later, and closed their non-profit less than two years after that. Compass has blocked potential rivals’ ability to purchase drugs, slowing down research into psilocybin.

3. Mindmed (MNMD.Q) $200 million

MindMed (MNMD.Q) has 17 current and upcoming clinical trials with an R&D budget of roughly $8M CAD per month. The company closed a $92M CAD financing earlier this year and purchased HealthMode, a machine learning company that allows MindMed to run clinical trials remotely, among other things.

MindMed is studying 18-MC – an Ibogaine derivative, LSD, MDMA, peyote, and several other drugs and NCE’s. They started the first-ever MDMA/LSD trial earlier this year and are expanding their LSD microdosing division fresh off a $92M CAD financing in January. They announced a DMT intravenous study last month, and the first-ever peyote study earlier this year.

One of the reasons angel investor Kevin O’Leary likes MindMed is its dedication to taking several swings at-bat. MindMed probably has the most experimental pipeline around, while also not skimping on the classics like MDMA and LSD. It’s actually a really nice balance that gives investors exposure to a buffet of psychedelic options.

MindMed has had a pretty eventful year, they got uplisted onto the Nasdaq which caused a nice bump in their stock, all the while their former CEO Jr Rahn went rogue selling 90% of his holdings without warning. The company appears to have recovered nicely.

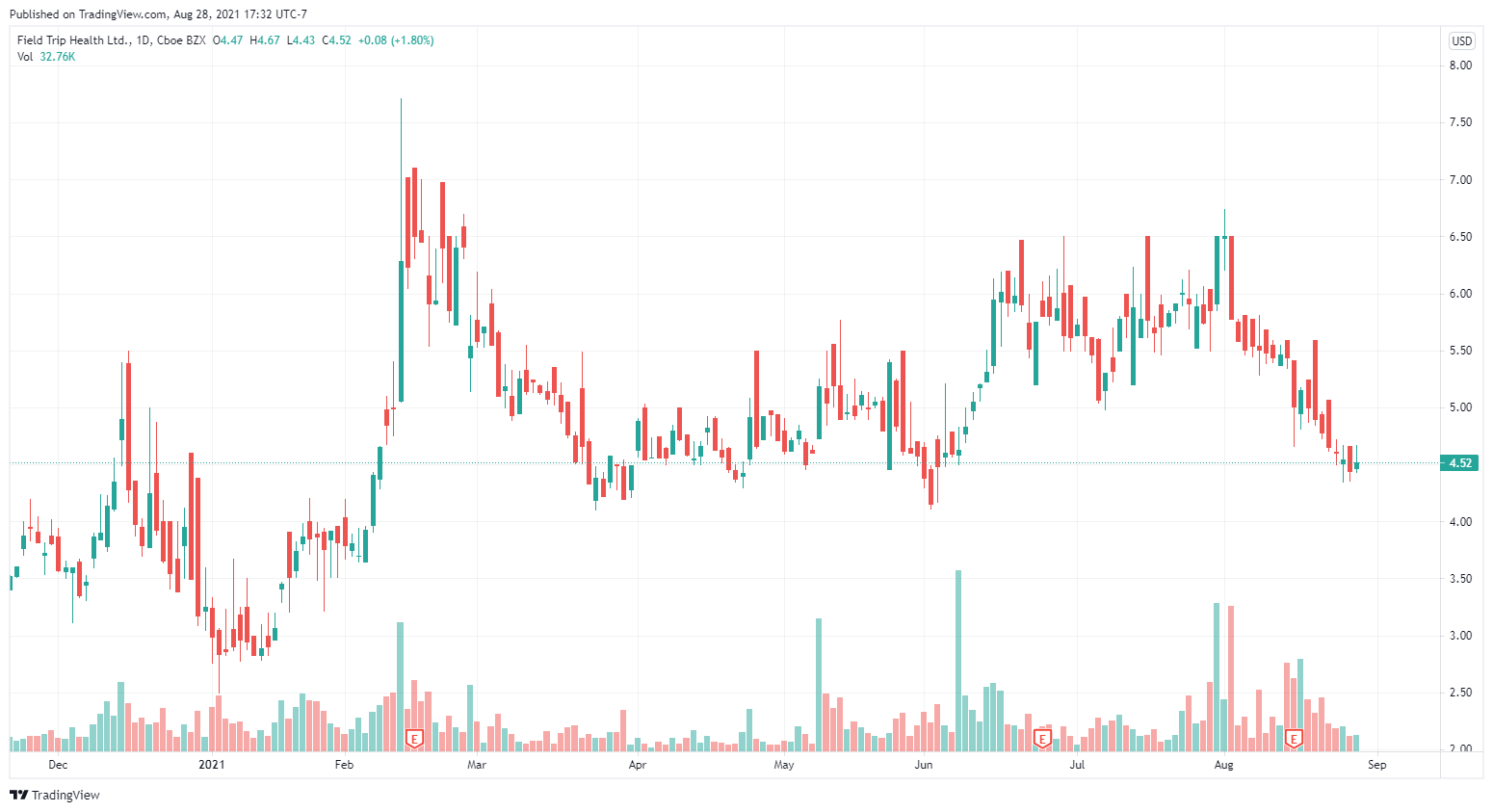

4. Field Trip (FTRP.Q) $111 million

Field Trip is a psychedelics company that went for the clinic model as it was a good source of early revenue, and matched the company founders’ previous business – a chain of cannabis clinics they sold to Aurora (ACB.Q) in 2016. So it only made sense that they would take another familiar swing at-bat.

Field Trip did $960,000 CAD in revenue last quarter from its clinics alone. The company plans on having 20 clinics operating by 2022, which the company projects will cost $4.1 million CAD according to their recent MD&A.

But, Field Trip is also in the drug development game and is working on FT-104, a compound the company says mimics psilocybin.

What gets Field Trip jazzed about the potential of FT-104 is its 2-hour lasting time, as opposed to a 4-8 hour psilocybin trip. The company

expects to spend $2 million CAD to complete its Phase 1 studies for its FT-104 compound by calendar Q1 2022. FT-104 mimics a psilocybin trip but is much shorter in duration, typically around 2 hours.

Phase 2 for FT-104 is set to cost $9.3 million CAD, with Phase 3 coming in at $23.4 million CAD. Last year Field Trip spent approximately $885,000 CAD on the pre-clinical development of FT-104.

Earlier this month Atai announced it would be studying the intense psychedelic Salvia as they see potential in its short 5-10 effect window for people wanting convenience rather than a hero’s journey. But, I actually like Field Trip’s approach to this idea of cutting down trip times more as my experience with Salvia was rather horrifying, and I couldn’t imagine that being like an easy or convenient psychedelic trip.

See also: How Field Trip (FTRP.CN) is scaling its ketamine therapy operations following a giant raise

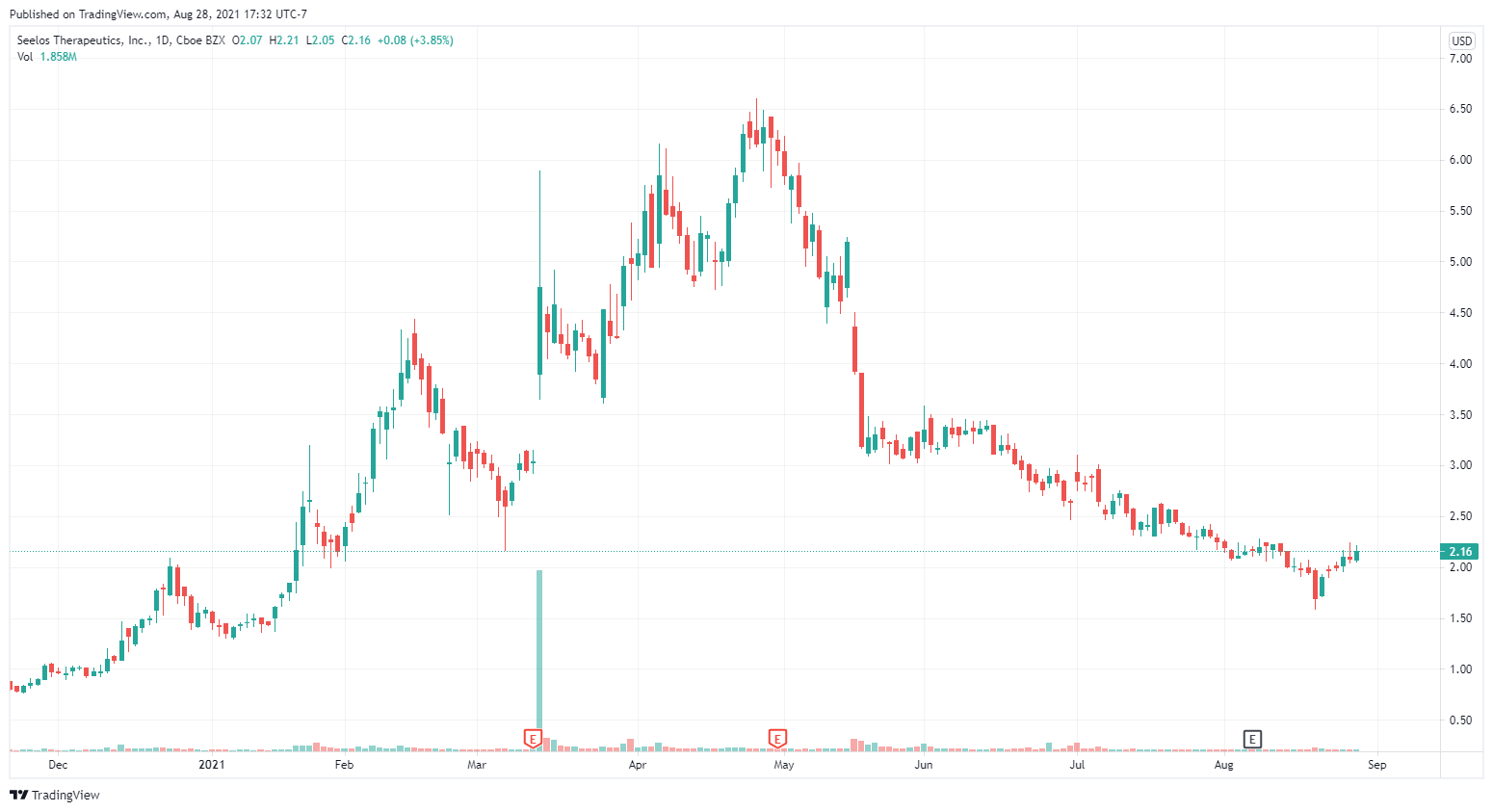

5. Seelos (SEEL.Q) $90 million

Seelos (SEEL.Q) isn’t your typical psychedelics company as ketamine is the only psychedelic drug it’s working with, along with other non-psychoactive drugs unrelated to psychedelics. Seelos wants to get ketamine into hospitals as a tool for suicide prevention in real-time. The company says there are no other effective options for doctors currently, and patients are sent to the psych ward, or given opiates instead. Ketamine has been proven to quickly reduce depressive symptoms, and esketamine – one part of ketamines structure has been approved by the FDA for depression.

Seelos has completed multiple raises already this year with a $65M USD raise in May and a $4.3 million USD raise in February. The company also completed a $10 million USD raise in December 2020.

See also: Seelos Therapeutics (SEEL.Q) is showing how ketamine could be useful in dealing with suicide

One of Seelols’ lead drug candidates is SLS-002 for the treatment of acute suicidal ideation and behavior (ASIB) in patients with major depressive disorder (MDD). In March 2020, the FDA awarded SLS-002 Fast Track Designation for ASIBin patients with MDD, to support the further clinical development of the drug candidate. Seelos believes this puts them in a strong position to pursue the FDA’s expedited programs for drug development and review.

The company also believes it has an advantage working with ketamine as there are fewer regulations and red tape than substances like MDMA or psilocybin for example.

See also: Ketamine vs. esketamine, why has the FDA only approved one for depression?

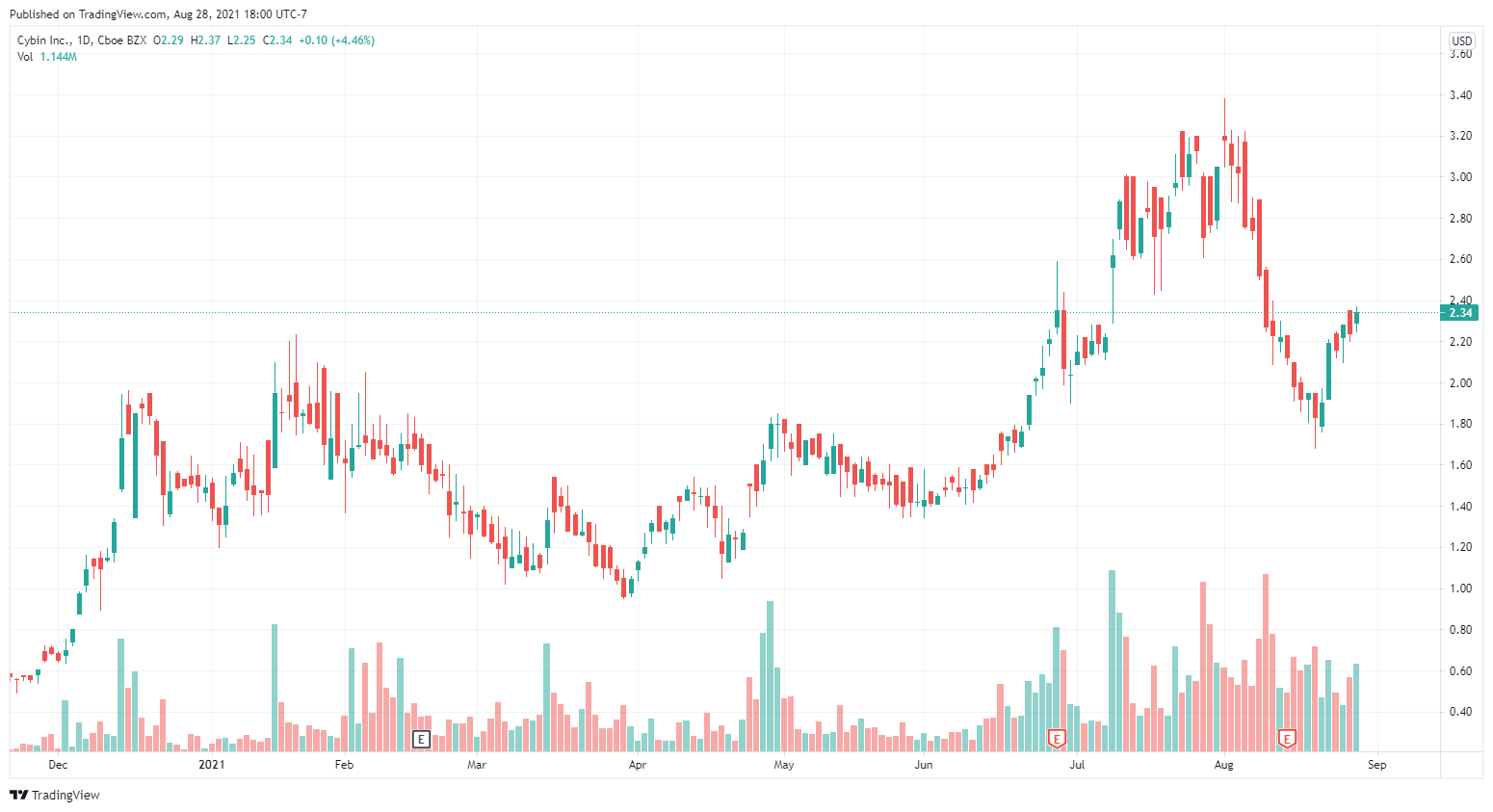

6. Cybin (CYBN.N) $81 million

Cybin (CYBN.N) is a psychedelic drug developer with several technology projects and partnerships related to psychedelics. The company is invested in its sublingual film delivery system for psilocybin that will remove the onset period for a psychedelics trip. Cybin is run by a 30-year industry vet Doug Drysdale and has some interesting studies targetting alcoholism, MDD, and anxiety.

The company is currently in Phase 2 of its psilocybin trials for MDD. If the Phase 2 study yields positive results, the company will conduct a randomized, placebo-controlled Phase 2b study of the formulation in 120 MDD patients. Many investors are eagerly anticipating who will win the psilocybin race, Compass or Cybin.

They also announced a partnership with clinic giant Greenbrook TMS which will give Cybin access to 129 clinic locations for R&D purposes.

Cybin uplisted to the NYSE earlier this year and while the companies stock has taken a bit of a post uplisting hit, overall it has been on a tear for most of 2021. Many retail investors loaded up on the stock when it was first announced it would be uplisted and weren’t surprise at the sudden drop off after its first trading day on the NYSE.

I have seen several ‘Cybin is my only green stock again this week’ posts and comments across the investor forums

See also:

Cybin (CYBN.N) is now the Horizons psychedelics ETF’s (PSYK.NE) largest holding by an 80% margin

How Cybin (CYBN.NE) is integrating new brain imaging technology with psychedelics

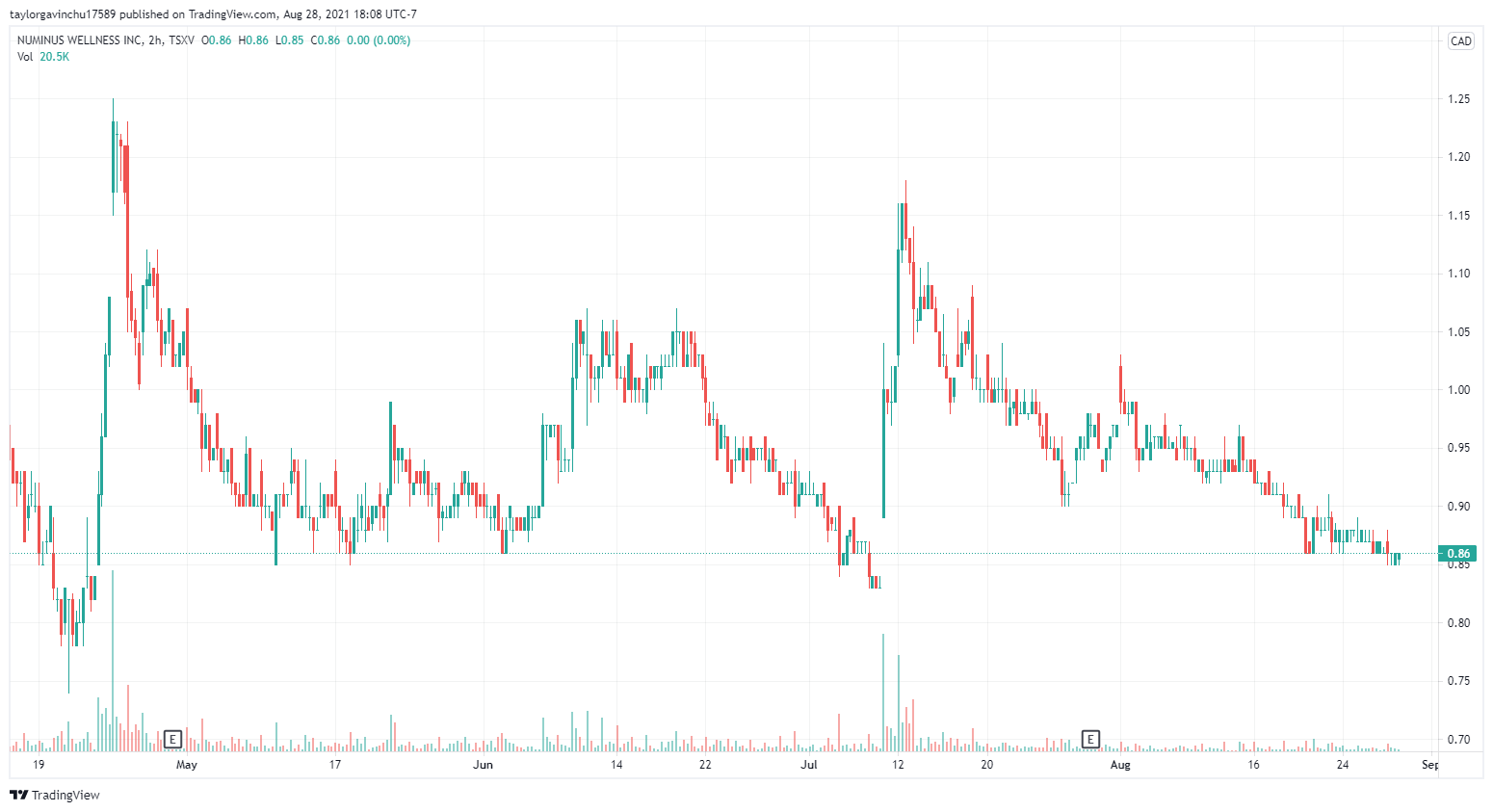

7. Numinus (NUMI.V) $63 million

Numinus (NUMI.V) is an interesting spot as they have the capacity to become a vertically integrated psychedelics company. With their laboratories and dealer’s license Numinus can create, study and even sell a series of compounds like MDMA, LSD, and psilocybin to name a few. Health Canada added DMT to this list earlier this year. While the opportunities to sell psychedelics now are limited to clinical trials and research, Numinus would be in a favorable position if and when psychedelics become commercialized.

Numinus also have a partnership with a MAPS subsidiary MPBC that uses MDMA in treating PTSD and other indications. MPBC is currently establishing a network of clinics to provide MDMA-assisted psychotherapy.

The company’s stock has had a rough year but has a pretty dedicated army of retail investors who believes the company has the potential to be on a higher tier than it is currently. Health Canada awarded Numinus with both a Dealer’s License and the ability to run their study with MAPS. I think relationships with regulators are going to be huge, especially if we see a legal rec market in the future.

See also: Results are in for the MAPS phase 3 study of MDMA-assisted therapy for PTSD

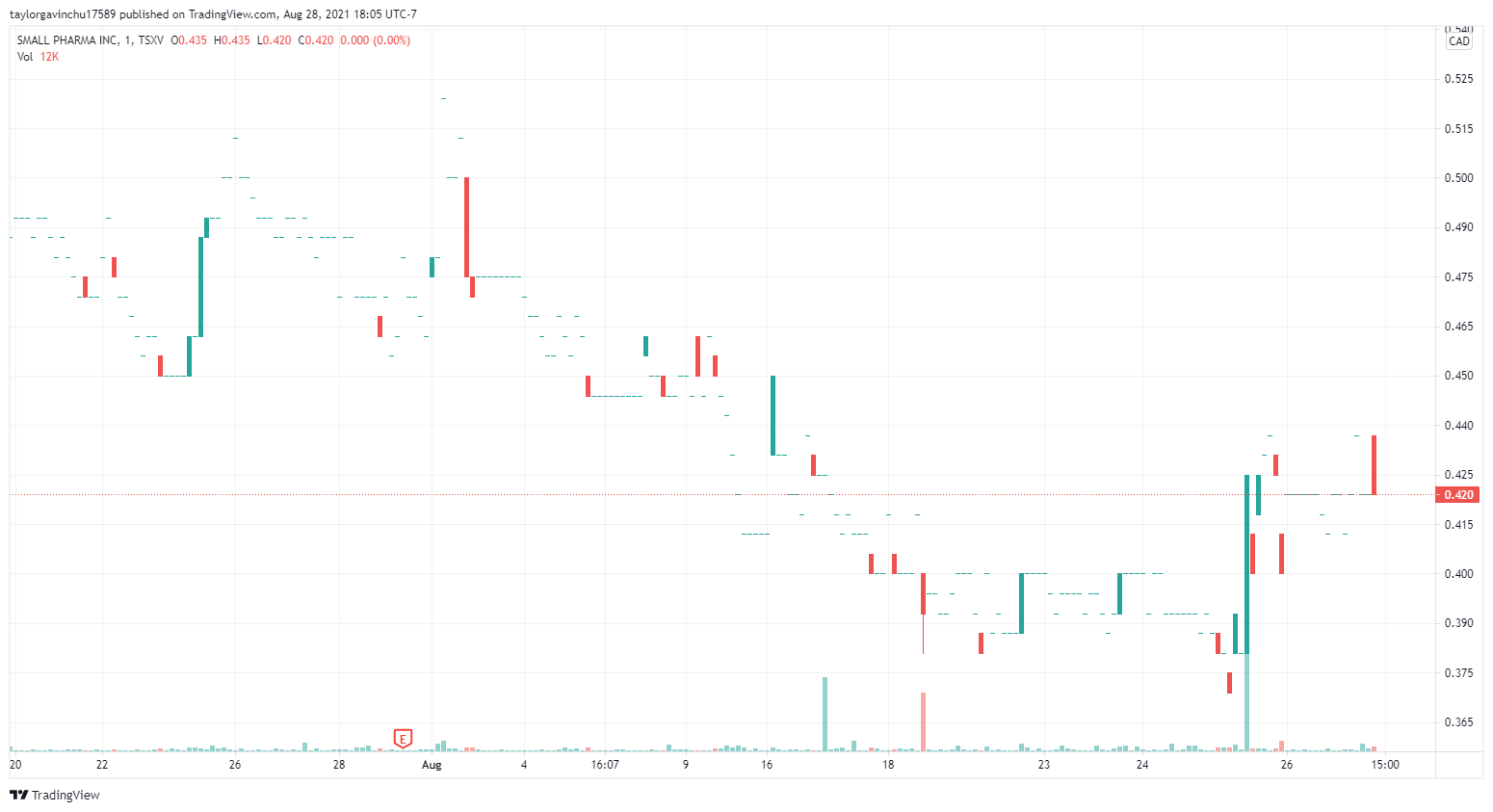

8. Small Pharma (DMT.V) $52 million

Small Pharma (DMT.V) is a UK-based biotech company primarily focused on DMT. The company recently partnered with the Centre for Psychedelic Research at Imperial College London for a Phase 1/2a trial of DMT for the treatment of depression. To date, there have been no recent clinical trials testing the efficacy of DMT, so the company is set up for some potential unique and exciting discoveries.

Small Pharma initiated Phase 1 of their clinical program into DMT-assisted therapy in February 2021. Phase 1 sounds early, but many of Small Pharma’s peers are still doing pre-clinical work and don’t yet meet the necessary requirements to even move into Phase 1. Like many companies in this space, Small Pharma is confident it can take a chunk out of the SSRI market.

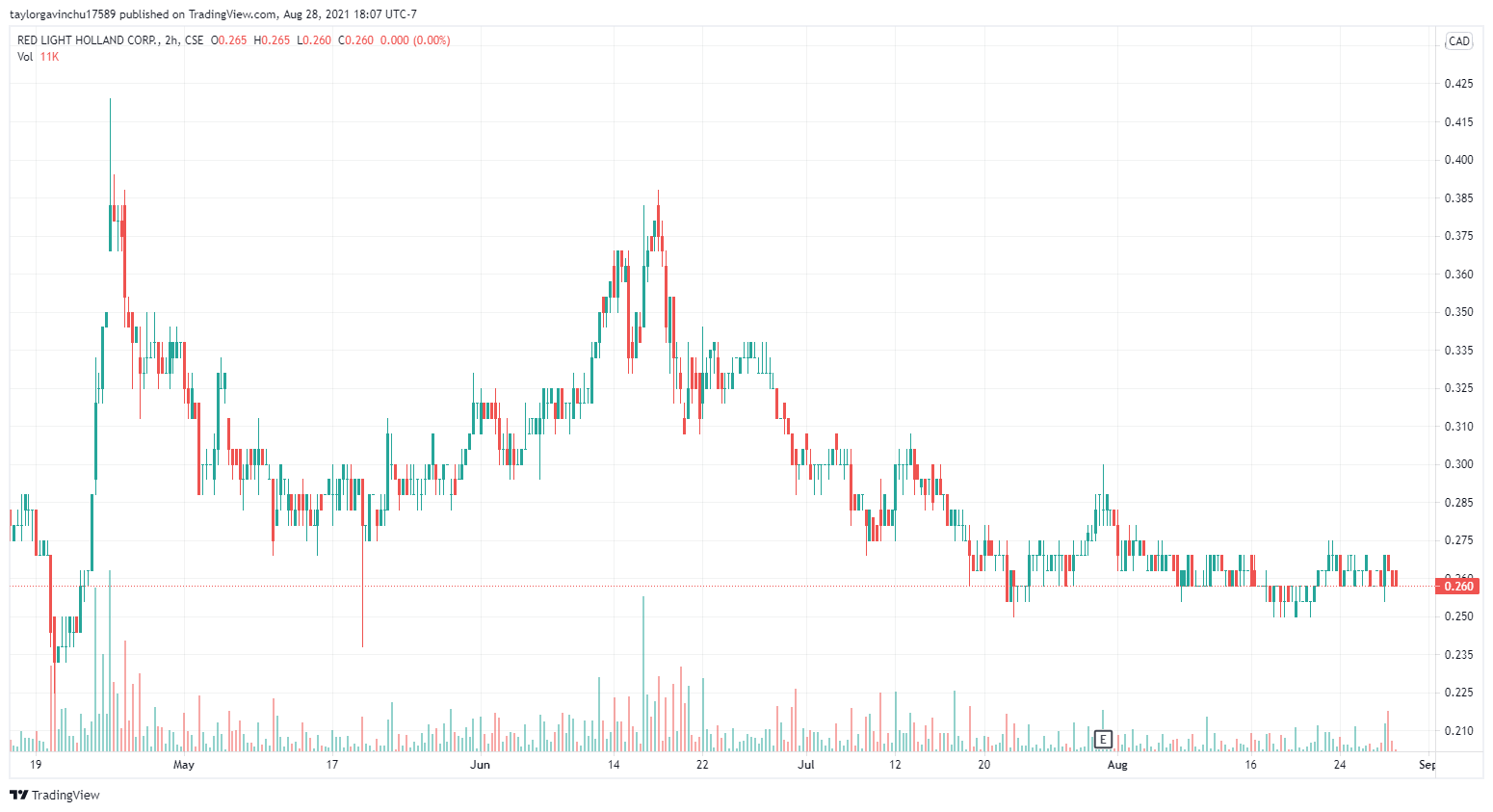

9. Red Light Holland (TRIP.C) $32 million

Red Light Holland (TRIP.C) is a rare company in that it’s not focused at all on clinical trials, and is instead centered around a potential future rec market to justify its valuation. It currently sells products in Brazil and the Netherlands and is merging with Creso Pharma (CPH.AX) to create the HighBrid Lab.

Creso is an Australian-based cannabis company with in-roads into Europe. Creso’s board is comprised largely of ex Canopy (CGC.Q) executives, and Canopy’s former CEO Bruce Linton will be HighBrid’s Chairman of the Board.

The HighBrid Lab is expected to be organized into four business units, allowing it to aggressively pursue high growth markets, while also focusing on near-term cash flows. These business units are expected to comprise recreational cannabis (THC), CBD, recreational psychedelics, and psychedelic research. The new company is expected to have a cash balance of approximately $45 million CAD.

Red Light is confident that psychedelics will be legalized in major markets and that it will have the products and visibility to capitalize on that opportunity. With not many companies focused on this side of the sector, Red Light could be in an interesting position as an acquisition target for a drug developer looking for a robust distribution network, if Red Light can build it.

See also: Red Light Holland (TRIP.CN) selling psychedelics in Brazil?

10. Bright Minds Biosciences (DRUG.C) $26 million

Bright Mind’s (DRUG.C) drug pipeline targets therapeutic areas of the central nervous system (CNS), pain, and neuropsychiatry. Within these therapeutic areas, their lead indications are pharmacoresistant epilepsy, fibromyalgia, chemotherapy-induced neuropathy, major depressive disorder, and substance abuse disorders. Bright Mind’s chemistry team designed novel analogs of psilocin that they believed would retain 5-HT2A activity. Following this, the company has filed two patents that cover psilocin analogs with the goal of maintaining desired 5-HT2A activity.

Bright Minds drugs hope to advance the therapeutic aspects of psychedelic and other serotonergic compounds while minimizing the side effects, thereby creating superior drugs to first-generation compounds, such as psilocybin.

They also have a really tight share structure.

See also: Bright Minds Biosciences (DRUG.C) is actually really tight

These companies were close but didn’t quite crack the list

11. Mindcure (MCUR.C) $21 million

12. Revive Therapeutics (RVV.C) $19 million

13. PsyBio (PSYB.V) $13 million

14. Havn Life Sciences (HAVN.C) $13 million

15. Braxia Scientific (BRAX.C) $11 million

16. Levitee Labs (LVT.C) $11 million

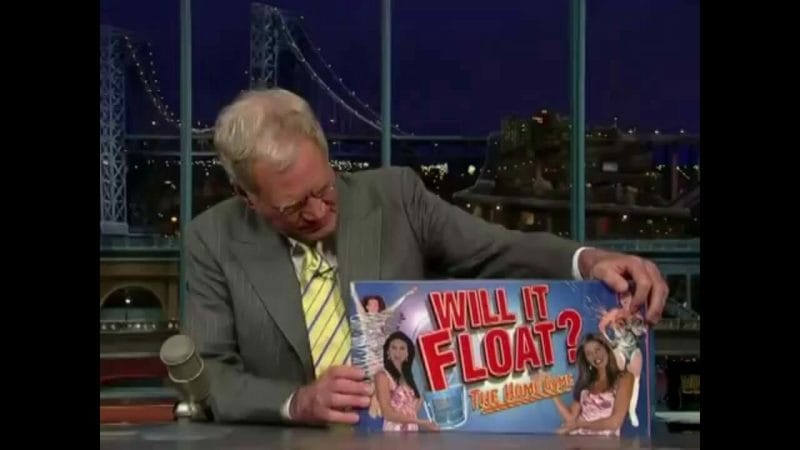

Will it float?

The top 5 companies on this list have a combined cash position of $1.4 billion CAD with Atai and Compass almost hitting the $1 billion USD mark by themselves. This is a top-heavy sector right now with a few companies at the top positioned to last for a long expensive haul of clinical trials and bringing new and experimental drugs to market.

Not every psychedelics company will be able to keep afloat, and in business cash is oxygen. I have written previously about avoiding investing in companies with a lot of debt, which, to my surprise, the psychedelics sector was actually severely lacking.

Almost every single psychedelics company with a market cap above $30 million CAD had healthy current and debt/equity ratios, meaning these companies have a high chance of paying back their debts in the short, and long term. This is a sign that the sector is in a healthy spot financially, we aren’t seeing $130 million CAD convertible note raises from Caribbean hedge funds as we did in cannabis, but rather more legit biotech funds.