Filament Health (FH.NE) to release their unaudited financial results for the second quarter of 2021, a period that ended June 30, 2021.

As of June 30, Filament had $7.8 million in cash and cash equivalents. This includes $5 million which was raised through a private placement that closed on June 21. That private placement included a brokered and a non-brokered private placement, with the former bringing in $1,842,000 and the latter netting $3,152,000, which the company said brought in $5,000,000. (It’s not clear if it’s revenue for the brokered and non-brokered placements that’s incorrect or the total reported, or if it’s just the math that’s off there.) $7.8 million may not sound like a huge amount of cash on hand, but Filament has consistently been doing more with less cash, as they have managed to get this far while only doing two rounds of fundraising.

Including the $7.8 million in cash, Filament reported over $20 million in total assets, $11 million of which is unallocated purchase price related to their March 8, 2021 acquisition of Psilo. They also reported just over $930,000 worth of liabilities, which is down from over $1,088,000 in the previous quarter.

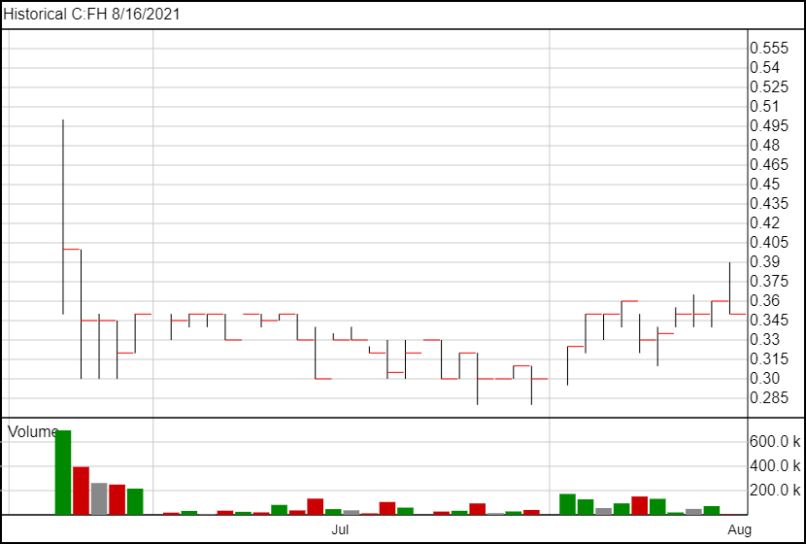

The second quarter also included Filament going public on the NEO exchange, where they debuted at $0.41 on June 24, 2021, and since then has traded between $0.28 at its low and $0.50 at its high. In their expenses for the quarter, the biggest was “Transaction and listing expenses”, which came out to over $3,000,000, up from $79,000 the previous quarter. There’s a good chance that expense comes back down next quarter when they’re not listing on a new exchange, and so their nearly $5 million in expenses for the quarter could come down closer to the $2 million in expenses Filament incurred in Q1.

They also achieved a number of business highlights, including the production of their first GMP batch of psilocybin, including leading drug candidates PEX010, PEX020, and PEX030 for upcoming FDA clinical trials. They also received the first patent for the extraction of natural psilocybin from the Canadian Intellectual Property Office, and have received a Dealer’s License from Health Canada which allows them broad leeway to conduct operations with psychedelics.

Safe to say it’s been a busy quarter.

“This has been a period of significant growth and development for Filament Health,” said Benjamin Lightburn, Chief Executive Officer. “We spent the past year focused on establishing fundamentals and building a scalable platform. Our rapid progress in these areas allowed us to list on a senior exchange, confident in our ability to drive shareholder value. Since listing, we have continued to innovate, with recent accomplishments in intellectual property, licensing, and drug development positioning Filament at the forefront of natural psychedelic research and manufacturing. We are committed to maintaining this pace of innovation in order to support the treatment of mental health conditions with safe, natural psychedelics as soon as possible.”

In other news, Filament announced that Tom Kineshanko will be transitioning from his current role as President to a new role: Founding Advisor. This will allow Kineshanko, one of the company’s Co-Founders, to maintain an active role in operational oversight, shareholder communications, and strategy, while allowing someone else to take over the position of President. They have not yet announced who will take over as President.

Kineshanko is also a Co-Founder and Non-Executive Director for Protos Asset Management and a Founding Member of Argo Blockchain’s Board of Advisors. He is one of five members of the Filament Foundation, which aims to help fund key actors and key initiatives to help the global psychedelics ecosystem thrive and is founded by donated shares from Filament’s founders.

“Having founded Filament and seeing it achieve a public listing and advanced operating platform, it is the ideal time for me to transition to an advisory position,” said Mr. Kineshanko. “Filament is led by both an exceptional management team and committed Board of Directors and I look forward to contributing to Filament’s future strategic roadmap and operational focus.”

Following the news, Filament shares, opened up at $0.39, but have since gone down to $0.35, one cent below where they were when the news was announced.

Full disclosure: Filament Health is an Equity Guru marketing client.