In this summary report, we will take a quick look at the top 5 gainers and losers up or down double digits on the Canadian stock markets.

Here is a summary of the intraday action of assets:

Top 5 Stocks

Gold Flora Corporation (GRAM.NE)

Market Cap ~ $23.7 million

Gold Flora Corporation engages in the cultivation, manufacturing, extraction, distribution, and retailing of cannabis products in California. It offers disposable vape pens and gold flora flowers.

The stock is up 33% on no news.

The stock is in its range/consolidation phase and today’s pop is taking the stock up to its resistance zone. A close above $0.22 gets the breakout and potentially, the start of a new uptrend.

Neotech Metals (NTMC.CN)

Market Cap ~ $128 million

The Company is a mineral exploration company based in Vancouver, B.C., which owns 40 rare earth mineral claims (the “TREO Property”) and holds an option on the EBB nickel-cobalt property, all of which are located in British Columbia, Canada.

The stock is up 33% on no news. Four days ago, the Company announced a strategic option for the Thor REE Project.

The stock is in parabolic move. Major gap up and pop higher. We don’t have set resistance so in this case, one should watch the $3.00 zone.

KDA Group (KDA.V)

Market Cap ~ $40 million

KDA Group Inc., together with its subsidiaries, provides solutions and services to pharmacies and pharmaceutical companies in Canada. The company operates through three segments: Pharmacy Services, Pharmaceutical Solutions, and Technology. It provides pharmacy staff replacement services, professional and continued medical training services, pharmacy re-engineering services, and pharmaceutical training services. The company also offers PREDICTIVE e-Prescriber software for assisting doctors; and KRx, a cloud-based solution that analyzes each user’s prescription pattern and displays the appropriate expected medication.

The stock is up 31% on news that shareholders approved the completion of the Asset Sale, to the shareholders of the Corporation all or part of the Consideration received in the Transaction of June 23, 2023, at a presumed market value at the time of the Distribution payment and the Board of Directors of the Corporation has been authorized to proceed with the distribution, on December 22, 2023, of 5,000,000 Class A ordinary shares of KDA Group Inc.

A major breakout which has taken out the $0.225 resistance zone. The next resistance zone comes in at the $0.40 zone.

Edison Lithium Group (EDDY.V)

Market Cap ~ $3.2 million

Edison Lithium Corp., a junior mining exploration company, engages in the procurement, exploration, and development of mineral properties. It primarily explores for cobalt, lithium, and other energy metal properties. The company holds a 100% interest in the Lake Kittson Cobalt property comprising of 160 unpatented mining claims and a single patented claim totaling 68 units covering an area of approximately 1,090 hectares located in the northeastern Ontario, Canada; holds 100% interest in the Lexi property, that consists of 26 mining claims located in the province of Catamarca, Argentina; and holds 100% interest in the Pinac property comprising 11 mining claims located in the province of Catamarca, Argentina.

The stock is up 22% on news that it has entered into a LOI with Meteor Energy for the sale of 100% of the Company’s interest in its Argentina subsidiary, Resource Ventures S.A.

A reversal pattern in development? After a long downtrend, the stock is showing signs of exhaustion of selling pressure. Watch for a candle close above $0.25.

VIQ Solutions (VQS.TO)

Market Cap ~ $7.9 million

VIQ Solutions Inc. operates as a technology and service platform provider for digital evidence capture, retrieval, and content management in Australia, the United States, the United Kingdom, Canada, and internationally. It operates through two segments, Technology and Related Revenue, and Technology Services. The Technology and Related Revenue segment develops, distributes, and licenses computer-based digital solutions based on its technology.

The stock is up 21% on no news.

The downtrend is apparent with the slope of the trend. Today’s price action is promising but note the large wick candle indicating a sell off. Watch for a daily close confirmation above $0.175 for a close above the current lower high.

Top 5 Losers

Juggernaut Exploration (JUGR.V)

Market Cap ~ $4.4 million

Juggernaut Exploration Ltd. engages in the acquiring, exploring, and evaluating mineral resource properties in Canada. It explores for precious and base metal deposits. The company has an option to acquire 100% interest in the Midas property covering an area of approximately 16,671 hectares located in the Skeena Mining District, British Columbia; and the Empire property covering an area of approximately 16,399 hectares located in the Omineca Mining District, British Columbia.

The stock is down 46% on post drilling news. The Company has drilled 1.56 gpt AuEq Over 5 Meters on Midas and Confirms Extensive Mineralized Gold Rich VHMS System, Golden Triangle, B.C.

Not a good looking chart. The stock has gapped down hard breaking support at $0.12. Not only this, but the breakdown confirmed a head and shoulders pattern. The stock looks likely to test support down at $0.055.

Filament Health (FH.NE)

Market Cap ~ $18.2 million

Filament Health Corp. operates as a clinical-stage natural psychedelic drug development company. The company propagates psychedelic plants and fungi; conducts genetic research; develops manufacturing technology; generates intellectual property; conducts in-house trials; and distributes drug candidates to drug developers, researchers, and other licensed parties.

The stock is down 48% on news of a termination of a shareholder meeting.

A breakdown after ranging for a few days. The stock is breaking down below the $0.10 support. The next support comes in at the $0.05 zone.

Touchstone Exploration (TXP.TO)

Market Cap ~ $180 million

Touchstone Exploration Inc. engages in the exploration, development, acquisition, production, and sale of petroleum and natural gas properties in the Republic of Trinidad and Tobago. Its primary exploration focus is the Ortoire exploration block and development production on four onshore lease operatorship properties.

The stock is down 19% on news of its annual 2024 capital budget, preliminary 2024 guidance and an operational update.

A break of support and a gap down. The stock did recently break below the $0.80 support zone but recovered. Can it do it a second time? Watch to see how today’s close turns out. But the gap down points to a more bearish tune.

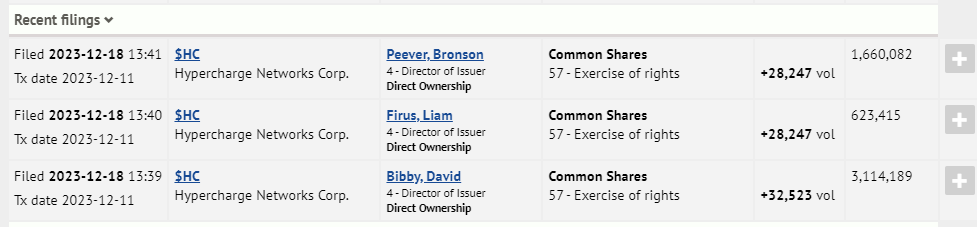

Hypercharge Network (HC.NE)

Market Cap ~ $10.5 million

Hypercharge Networks Corp. supplies electric vehicle (EV) charging stations and solutions light and medium duty in Canada and the United States. The company provides turnkey EV charging solutions for light and medium duty EVs through a managed charging network of EV charging stations. It serves multi-unit residential buildings; commercial locations, such as retail, workplace, hospitality, parking, municipal; and fleet operators.

The stock is down 19% on no news. However, there was a SEDI filing today:

The stock has been in a consistent downtrend printing new all time record lows. Perhaps the insider buying can show some confidence for a turn over.

LQWD Technologies (LQWD.V)

Market Cap ~ $5.8 million

LQWD Technologies Corp., a technology applications company, focuses on lightning network products in Canada. The company operates coincurve.com and buybitcoincanada.com, a virtual currency platform. It also provides infrastructure to facilitate payments under the Lightning Network name. In addition, the company focuses and develops various web-based platforms.

The stock is down 18% on no news.

Not much volume the past few days but the drop is taking the stock close to the $0.45 support. However, $0.50 is a major psychological number the stock is testing.