There’s nothing more terrifying than watching a loved one pause, clutch their throat and start gasping for air. The first time it happens provokes the mad scramble, as she points at her purse and mimes the universal L-shaped hand pattern for an asthma inhaler. She sits while you go digging through spent candy wrappers, old dried out pens and hopefully unused kleenex until finally your fingers wrap around the blue plastic emergency inhaler.

One frantic puff. Maybe two. And then five minutes later you’re on your way.

After a few times there’s no scramble. This is a regular occurrence and you plan for it. The inhaler is segregated away in an inside pocket rather than out in the open, where fingers can fumble over it.

Yes. My wife has asthma and I’m on inhaler duty. Can you tell?

Because I’m Captain Obvious:

According to the Global Initiative for Asthma, asthma is: “a heterogeneous disease, usually characterized by chronic airway inflammation. It is defined by the history of respiratory symptoms such as wheeze, shortness of breath, chest tightness and cough that vary over time and in intensity, together with variable expiratory airflow limitation.”

Attacks are caused by exercise, allergies, various other irritants, weather changes and viral respiratory infections. In our case it was the cat. No cat. No problem. Almost. We still occasionally get flare ups so it’s good that we both know the location of the emergency puffer, just in case. It also means that we need to figure out how much of our monthly funds need to go to making sure my wife can keep breathing. As it turns out, it’s a fair amount.

As an aggregate, folks like us around the world have made this into a USD $17.6 billion in 2020, and it’s expected to grow to $19.13 billion by 2026, which is a compound annual growth rate of 1.60% during 2021 and 2026. Damn.

This isn’t great for us, but is absolutely great for Valeo Pharma (VGH.C), and its asthma-preventative products, Atectura and Enerzair, recently licensed from Swiss multinational pharma-giant Novartis International (NVS.NYSE).

But before we get into what those mean for Valeo (and for you), we should answer a series of questions first.

What is Valeo Pharma?

Valeo Pharma finds companies with drugs in established international drug markets, develop a partnership with said company to license the drug, and then bring it to Canada to market it here. It seems simple, but it’s a really cost efficient way to keep capital expenses down while bringing new drugs to market.

“Valeo Pharma is about creating partnerships, both with International partners and with members of the Canadian Healthcare Industry, to bring innovative products of the highest quality to the market, quickly and efficiently,” according to Steve Saviuk, Valeo’s president and CEO.

Normally, a company needs to get financing, research the molecule, test the molecule in both preclinical (animals) and clinical trials (humans) and then figure out how to do the marketing and commercialization. This way, they can skip the research and testing and get straight to the marketing and commercialization because the drug has been put through its paces in another jurisdiction.

Hesperco, a case study

Hesperco, for example, is a drug highly dosed with hesperidin to help the immune system fight infections. They brought it over to Canada in partnership with its manufacturer, U.S.-based, Ingenew Pharma.

Here’s Reza with a quick explainer:

Hesperdin is a plant-based chemical called a ‘bioflavonoid.’ Found in fruit, vegetables and other food like dark chocolate and wine, bioflavonoids are potent antioxidants. If you’re not down on what exactly antioxidants do, they fight oxidative stress, which is caused by an imbalance between molecules called free radicals and antioxidants in the body.

If you want to auger down further, free radicals are oxygen-containing molecules with an uneven number of electrons, and this number lets them react easily with other molecules.These interactions can contribute to anything from heart disease to cancer, and antioxidants not only counteract this, but help your body deal with allergies and viruses. Hesperco is presently in clinical trials to see if it can aid in the fight against COVID-19, sponsored by the Montreal Heart Institute.

This is the kind of product Valeo puts out.

The value proposition

In previous stories, we set out a series of useable indicators to determine the efficacy of biotech and pharma at the small cap level.

- Avoid share price dilution that’s common to those industries due to high capex costs?

Yes. They avoid the spate of private placements, debt and warrants, required to raise funds for expensive testing.

- Operate in an acknowledged and established market for their product(s)?

Yes. The Canadian pharmaceuticals market is well-established.

- Have a business plan that skirts the risks associated with early stage research trials?

These risks include trial failures, mistakes, which can lead to litigation and massive hits on investments due to preclinical and clinical trial costs or wrong guesses. The wheels of science grind slow and they tend to churn through far more cash than produce drugs, but this is really one of those times when they need to produce one solid product to recoup their costs.

Valeo skips all that buying products that have already proven to work.

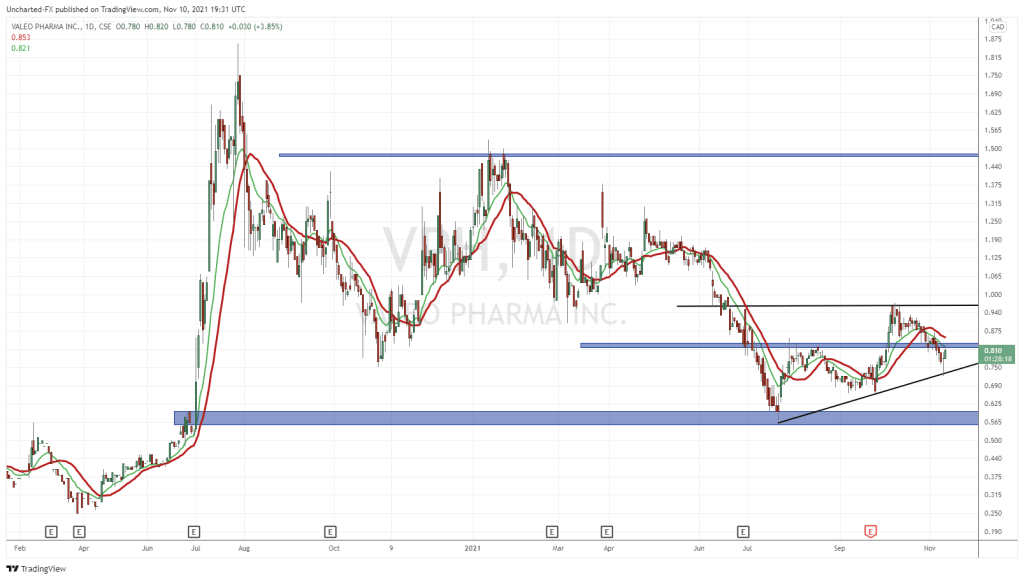

Now let’s look at their chart:

Their closing price for the day this was written was $0.74, which once you consider the top three markers for a successful biotech issue seems a … well, a lot low. It’s down from roughly $1.45 in January, and up from a low of $0.60 last month.

They have viable products already, one of which we’ve looked at and more on the way, and they’re not yet $1.

But I know…

What’s this got to do with asthma inhalers?

Glad you asked.

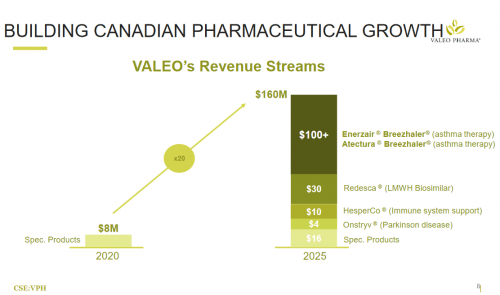

The above information on the asthma-preventative market was for global sales, but the Canadian version is estimated to bring in $700 million and grow annually by 2-3%. Asthma is by far the most common respiratory disease in Canada, complicating the lives of over three million people and adding to our cost of living by a substantial margin in either out of pocket expenses, government subsidies and lost productivity.

In Q2, 2021, Valeo inked a commercialization and supply agreement with Novartis for their asthma-meds Atectura and Enerzair. Now there are initiatives in place to have the products included for provincial reimbursement across Canada, and should be finished within the first few months of 2022. Private insurance coverage initiatives have also started, including up to 80% covered, which is excellent for us on the consumer end. The commercial launch kicked off in June 2021.

Valeo pulled in $2.647 million dollars in revenue for Q2, 2021 on the back of their existing products, but they didn’t have anything like they’ve just gotten their hands on with Novartis. When their repurposed and globally recognized asthma medication starts making inroads in the markets, what do you think that’s going to do to their revenue stream?

If you’ve followed me along through this long winding screed, you’re here for a reveal and I hope not to disappoint.

So here it is:

In sum, Valeo’s enjoys low capital expenditure courtesy of their business model for high yield products (compared to other pharmaco’s) dealing with prominent healthcare issues, and the company is trading at a price that should give anyone pause when the value of the company is laid out.

They certainly won’t be staying there forever.

—Joseph Morton

Full disclosure: Valeo Pharma is an equity.guru marketing client.