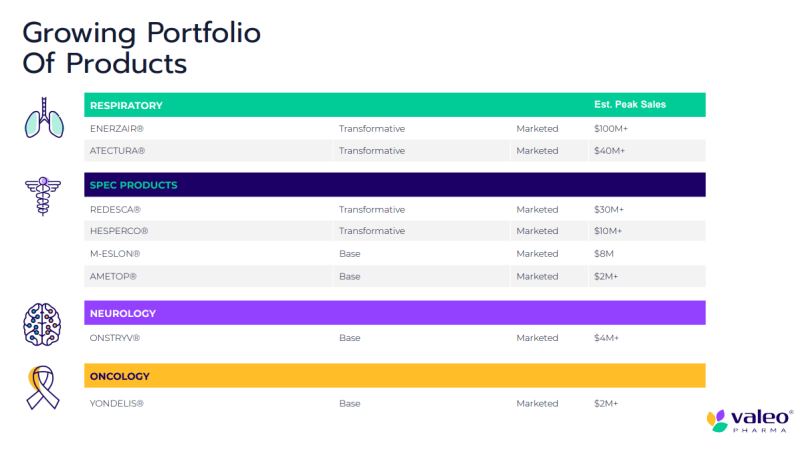

Valeo Pharma (VPH.C) is a specialty pharmaceutical company, engages in the acquisition, in-licensing, and commercialization of pharmaceutical products with a primary focus on neurodegenerative diseases, oncology and supportive care, and hospital products. You might also notice the whole revamp on their website.

Here is their product portfolio:

I should note that Valeo is a fully integrated company. Meaning Valeo Pharma has all the required capabilities and the full infrastructure to

register and properly manage its growing product portfolio through all stages of commercialization. Licensing, regulatory affairs, technical operations, medical affairs, commercial market access, warehouse shipping and finances.

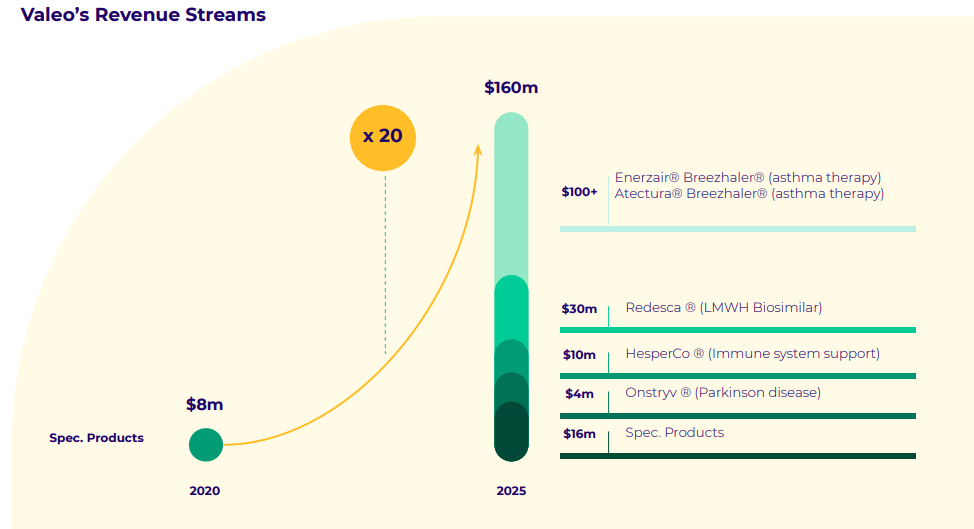

Speaking about revenues, be prepared to see the word ‘record’ a lot. Most of the revenue stream is projected to come from Valeo’s asthma therapy products.

I promised the word record. Valeo had an epic Q3 2021. Here are some highlights:

- Record revenues of $5.7 million for Q3 2021, up 280% over Q3 2020 and 114% over prior quarter.

- Record gross margin of $2.2 million, up 1602% over Q3 2020 and 204% over prior quarter.

- Record 9 months revenues at $10.2 million, up 94%.

- Private and public reimbursement coverage expanding for Redesca®

- New corporate structure completed with full commercial activities ongoing for

Redesca®, Enerzair® Breezhaler® and Atectura® Breezhaler® - Valeo launches new corporate image, logo and website

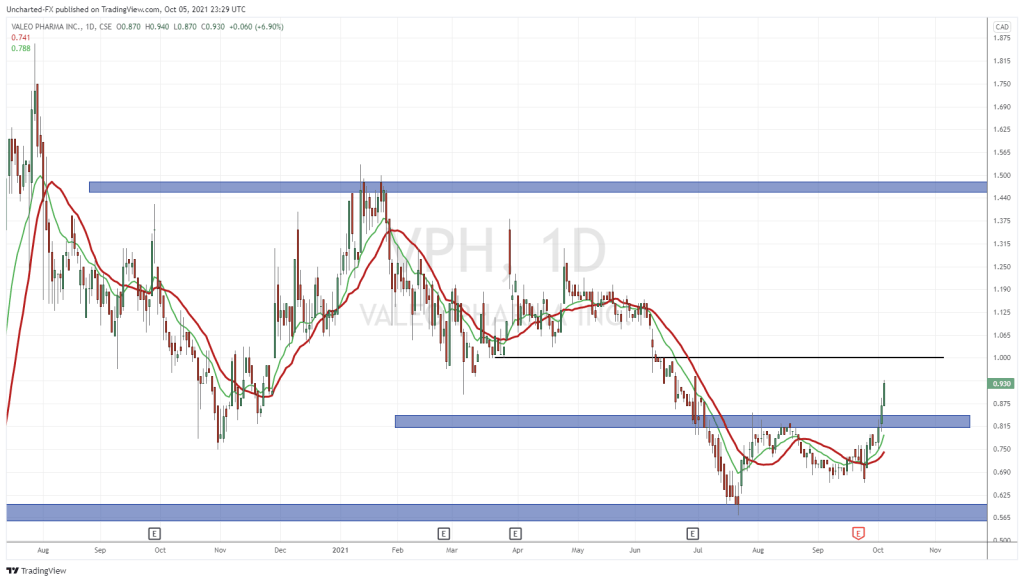

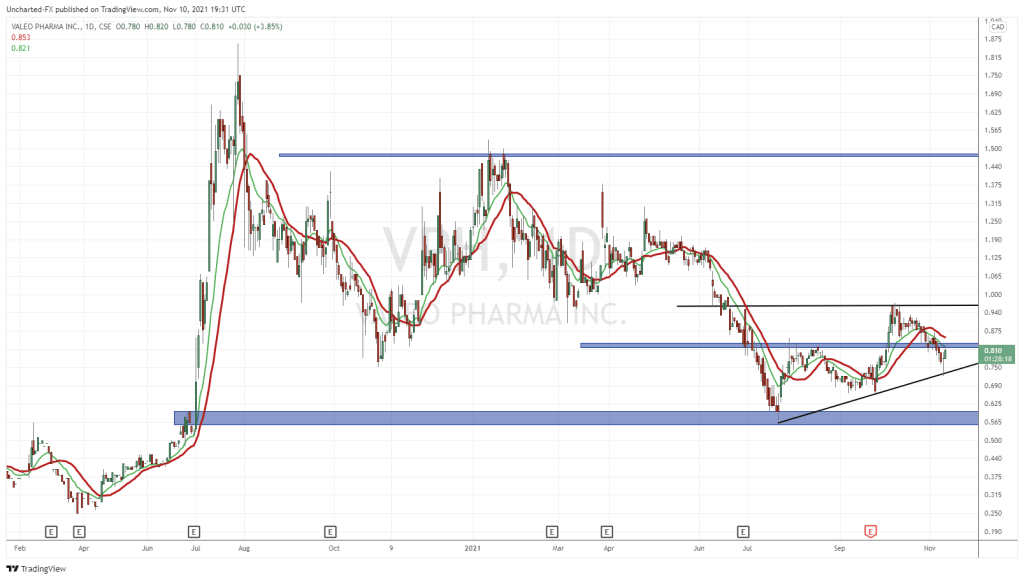

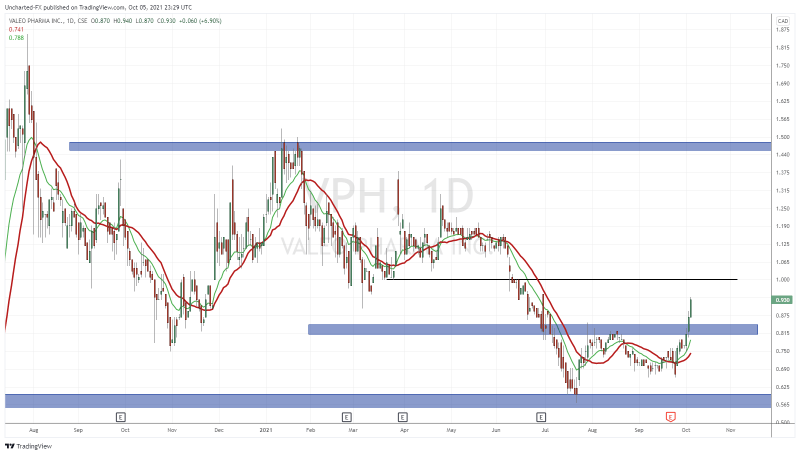

Chart wise I am liking what I see on Valeo. A breakout was just triggered two days ago. For those into technical patterns, we can even say a cup and handle pattern was triggered. The body of the cup might not look the best, but structure is what is important.

We broke above the $0.815 resistance zone with a nice strong green candle body. On volume of 326,124 shares traded. Definitely more than their average volume, and volume levels not seen since July 2021. We like to see breakouts with heavy volume. It gives us more momentum, which you can see on Tuesday.

Going forward, $0.815 now becomes new support. As long as we remain above this level, the uptrend remains intact. You can see I have a horizontal black line above. Right at the $1.00 level. A huge psychological important price zone for stocks trading under a dollar. I want to see how price reacts here, and if we can climb over, a very positive sign for the stock.

Positive signs on this one: record revenues, new company revamp, and a technical breakout. Keep your eyes on this one.