Cybin (CYBN.NE) announced that they have received final approval from the New York Stock Exchange (NYSE) to list its shares on the NYSE American exchange.

Beginning next Thursday, on August 5, 2021, Cybin will begin trading on the NYSE American under the ticker “CYBN”. Cybin will continue to trade on the NEO exchange, also under the ticker “CYBN”, and on the Frankfurt Stock Exchange under the symbol “R7E1”. Cybin had announced last week that they received conditional approval to join the NYSE American, although it was not a guarantee until today.

Cybin noted that they expect “OTC quotations for Cybin’s common shares to cease in connection with the NYSE American listing”. Cybin had previously traded on the OTCQB under the ticker “CLXPF”. Cybin advises anyone with shares under the ticker CLXPF to contact their brokers to mark the change.

“We are all delighted to receive this approval from the NYSE American and are thankful to our wonderful team and loyal investor base who have followed us on this journey, so far. As the first psychedelic biotech company that will now trade on this esteemed exchange in the US, we will commit resources to reach the broadest investor audience with our mission and will continue to accelerate our efforts to position Cybin as a leader in the sector,” Doug Drysdale, Cybin’s CEO.

In other news, Cybin also announced an overnight marketed public offering of common shares. The offering will consist of an aggregate of 8,824,000 common shares of Cybin being offered at $3.40 per share, raising a total of $30,001,600.

Cantor Fitzgerald Canada Corporation and Canaccord Genuity Corp. led the syndicate of underwriters together, which included H.C. Wainwright & Co., LLC, Roth Canada, ULC, and Stifel Nicolaus Canada Inc. Cybin has granted the underwriters a 30-day over-allotment option to purchase up to an additional 1,323,600 Shares, representing 15% of the shares issued, which can be exercised in whole or in part.

Cybin says they plan to use the money raised for “general corporate and working capital purposes”. Cybin has four psychedelic molecules at various stages of development. CYB001, a psychedelic compound https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistered using a sublingual film targeting depression, has received approval for a Phase II study in Jamaica. CYB003, which is being developed in partnership with Catalent (NYSE:CTLT), should advance to Phase I studies fairly soon. CYB004 and CYB005 both still require further research, including preclinical studies.

All these explorations have two things in common: they all take time and they all require money. Bringing in more than $30 million is quite the intake, and will allow them to conduct more research and retain more high-quality team members.

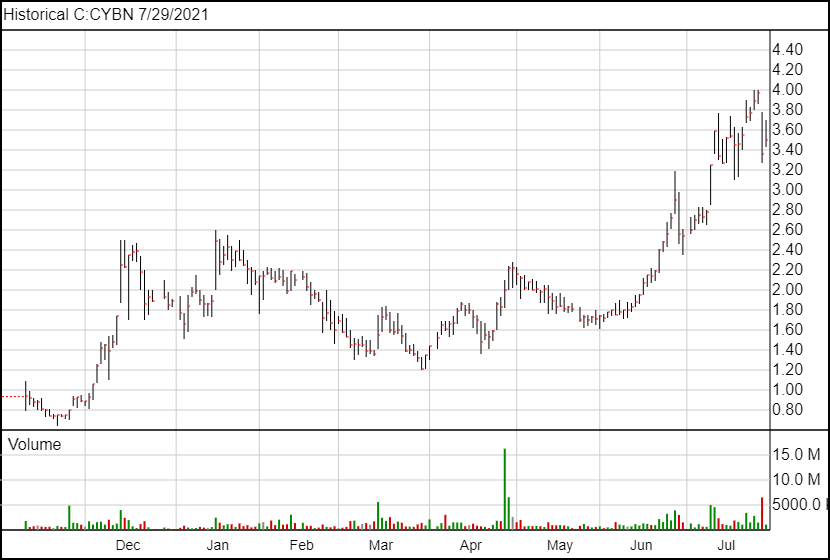

Following today’s news, Cybin shares are up 14 cents and are trading at $3.50.

Full Disclosure: Cybin is an Equity Guru marketing client.