Doubling down on Cybin

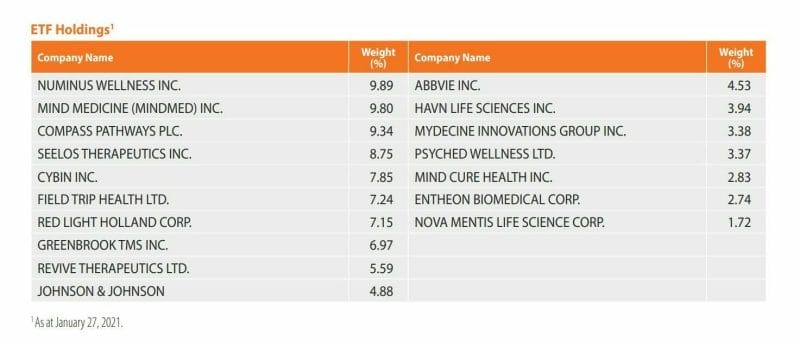

Back in January, Horizons’ (PYSK.NE) ETF held a relatively balanced portfolio of psychedelics companies. No company made up more than 10% of its holdings, with 7 companies sharing the 7-9% range. Those 7 companies were: Numinus (NUMI.V), MindMed (MNMD.Q), Compass Pathways (CMPS.Q), Seelos (SEEL.Q), Cybin (CYBN.N), Field Trip (FTRP.Q), and Red Light Holland (TRIP.C).

Fast forward 7 months to August and PSYK’s portfolio looks completely different. The ETF now contains 26 companies, with Cybin accounting for 18.55% of its total holdings. Field Trip comes in at second with 10.4%, and nly 2 companies are now within the 7-9% range

So where did PYSK take its money out of?

Red Light Holland dropped from 7.15% down to 2.49%. Numinus, Seelos, MindMed, and Compass also lost out a point or two respectively. Revive got a nice bump and the brand new Atai (ATAI.Q) sits at 6.45%.

Obviously, Horizon’s sees something in Cybin that maybe the market is missing, or underestimating. Cybin does have the total package when talking about psychedelics companies. They are well funded, have a qualified team, interesting trials with unique designations within the sector. Retail investors have been high on them all year and many doubled down once news of an NYSE uplisting was announced earlier this year.

See also: Cybin (CYBN.N) finishes its first trading day on the NYSE

Since uplisting to the NYSE, Cybin’s shares have taken a bit of a hit, it’s similar to when MindMed uplisted to the Nasdaq. There was a nice run-up until the uplist date, and then a selloff once it actually happened. The old buy on rumor, sell on news phenomenon in action.

The NYSE story caused a lot of buzz as Cybin became the first psychedelics company to list on the highly coveted exchange, but Cybin has been up to much more than that.

Earlier this year Cybin announced a partnership with Greenbrook giving them access to Greenbrook’s 129 outpatient mental health centers for R&D purposes. They expanded their patent portfolio to 13 patent findings, made good headway in their Phase 2 psilocybin trials, and announced upcoming trials for alcohol addiction.

Oh, and they also raised $120 million CAD, giving them a current cash position of $82.5 million CAD.

Active vs. passive ETFs

The PYSK ETF is passively managed, meaning singular events like an uplisting or trial breakthrough might not tip the scales in terms of weights or holdings right away. That said, even passive fund managers have to make important decisions to deliver value to their shareholders.

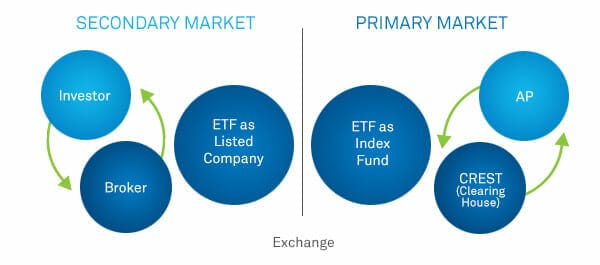

ETFs are kind of like going to a buffet, you get a taste of a multitude of things without having to pay for multiple meals at different restauraunts. That’s the upside. The downside is you don’t actually own any of the securities within the ETF, rather you just own shares of the ETF. While the value of the ETF is heavily correlated to the value of its holdings, supply and demand also factor in, just like shares of a company.

Horizons is focused on psychedelics companies who are:

- a producer and/or a supplier of psychedelic medicines;

- a biotechnology company that is engaged in research and development of psychedelic medicines; or

- a company that is part of the supply chain for, or a distributor of, psychedelics.

ETFs are generally passively managed, like Horizons which adjusts its holdings and weights on the 3rd Thursday & Friday of March, June, September, and December each year.

On the other hand, actively managed ETFs can be riskier than passively-managed ETFs as they depend on the skills of the individual fund manager selecting securities, rather than simply tracking a market. They can also incur higher fees as more management time is required for active investing.

When you invest in an ETF, you don’t own the securities the ETF invests in – you’re simply buying units in a fund. I wouldn’t be surprised in the near future if there weren’t ETFs dedicated to specific drugs like ketamine, psilocybin and DMT.

ETFs operate just like old-fashioned mutual funds, with the big difference that ETFs are listed on the stock market, unlike mutual funds. And because ETFs are index-tracking funds, there are no expensive fund managers or analysts to pay for, only small management fees. Horizons pays an annual management fee to the manager equal to 0.85% of the net asset value of the ETF.

The future

In January, Cybin made up only 7.85% of PYSK’s holdings, which rocketed up to 18.55% in July, a 136% increase over the 7 month period. Cleary Horizons sees something in Cybin that has caused it to essentially unbalance itself with almost a 1/5th of its holdings within one singular company. This seems like a pretty big bet for Horizons, Atai, and Compass whose combined market caps equal $3.77 billion USD only make up 15% of the portfolio. Compare that to Cybin who has a market cap of $314 million USD and accounts for 18.55% of PYSK’s holdings.

For investors taking a look at the PYSK fund they better like Cybin as it currently accounts for almost 1/5th of the ETF’s holdings. Horizons will continue to rebalance as new companies are formed. Atai got a quick 6.45%, but there aren’t any other Atai-like giants posed for an IPO in the coming future.

There are still lots of catalysts coming up for the rest of 2021, and 2022. I previously wrote about the most exciting clinical trials happening right now in the psychedelics space, many of those will likely bear fruit by 2022. For drug developers like Cybin, Atai, and Compass Pathways these trials and their outcomes will be key pieces in defining who will take the lead in the drug development section of the psychedelics sector. Horizons is a passively managed ETF, but I bet they are still waiting anxiously on the truckload of trial results we are poised to see in the coming months and years.

.

Full disclosure: Cybin is an Equity Guru marketing client