Cybin (CYBN.NE) announced they are filing a new non-provisional patent application, their 14th patent application.

The decision comes after what they called “a favourable international search report” relating to their Patent Cooperation Treaty (PCT) application from May 2021. Because of this favourable report, in their US non-provisional patent application, they are claiming priority to the May 2021 PCT application.

The International Patent Searching authority has provided a written opinion supporting novelty, inventive steps and industrial applicability to multiple claims within Cybin’s patent application. The PCT already claims a library of psychedelic derivative drug development candidates, and a successful patent would grant Cybin the right to file future national applications into treaty member jurisdictions.

The patent Cybin filed includes claims to compositions and methods to support certain elements of the company’s pre-clinical and research programs.

“Cybin’s portfolio now consists of 14 patent filings, 50+ proprietary molecules, 50+ pre-clinical studies, 4 active drug programs targeting major depressive disorder, alcohol use disorder, anxiety and therapy resistant psychiatric disorders. We continue to progress our IP portfolio across novel molecules, delivery mechanisms, processes and protocols as we continue to find new and novel discoveries through our pre-clinical findings thus expanding and strengthening IP,” stated Doug Drysdale, CEO of Cybin.

In other news, Cybin announced their unaudited first-quarter financial results and business highlights.

At the end of the quarter, Cybin had $55,075,000 in cash and cash equivalents, on top of more than $25 million in non-current assets, bringing their total assets to over $82 million. This is compared to under $6.6 million in liabilities. However, CYBN began the quarter with just over $64 million in cash and finished with $55.075 million, meaning they had nearly $9 million less at the end of the quarter than they had at the beginning.

The financial disclosure also showed that expenses for the company are up. In the three months ending on June 30, 2021, Cybin incurred nearly $14 million in expenses, compared to just $4 million in the same period the year before. This brought the net loss for the period to a total more than three times higher than the same period from the year before.

“During the past several months, Cybin has garnered a great deal of attention as an emerging leader in the psychedelic therapeutics space. We believe the molecules we have under development may have the potential to transform the treatment landscape and fill current unmet treatment needs for various psychiatric and neurological conditions. We look forward to sharing updates as we advance our pre-clinical and clinical programs and continue the scientific exploration that we believe will ultimately provide safer and more effective treatments for those suffering with mental illness and addiction issues,” stated Drysdale.

In other other news, Cybin held a shareholder meeting which resulted in Theresa Firestone being elected to the Board of Directors, the appointment of Zeifmans LLP as Cybin’s auditor, and the adoption of the Shareholder Rights Plan, among other things.

The shareholder meeting, held on August 16, 2021, was attended by 53 shareholders in person or by proxy who hold 45,681,073 common CYBN shares, representing 30.77% of Cybin’s total issued and outstanding common shares.

The shareholders voted to expand the Board of Directors, increasing the number of Directors from 5 to 6, allowing Theresa Firestone to be elected to the Board without any current Directors having to leave. She was voted in by the largest margin and will be the only woman on the Board of Directors.

The Shareholder Rights Plan, which Cybin entered into with Odyssey Trust Company, aims to ensure shareholders and board directors have adequate time to consider takeover options and are fairly compensated if a takeover does take place. In the press release, Cybin said that:

“The objectives of the Rights Plan are to ensure, to the extent possible, that all shareholders and the board of directors have adequate time to consider and evaluate any unsolicited take-over bid for the Company, provide the board with adequate time to evaluate any such take-over bid and explore and develop value-enhancing alternatives to any such take-over bid, encourage the fair treatment of the shareholders in connection with any such take-over bid, and generally assist the board in enhancing shareholder value.”

Details of the Shareholders Rights Plan and the Equity Incentive Plan adopted can be found on Sedar.com.

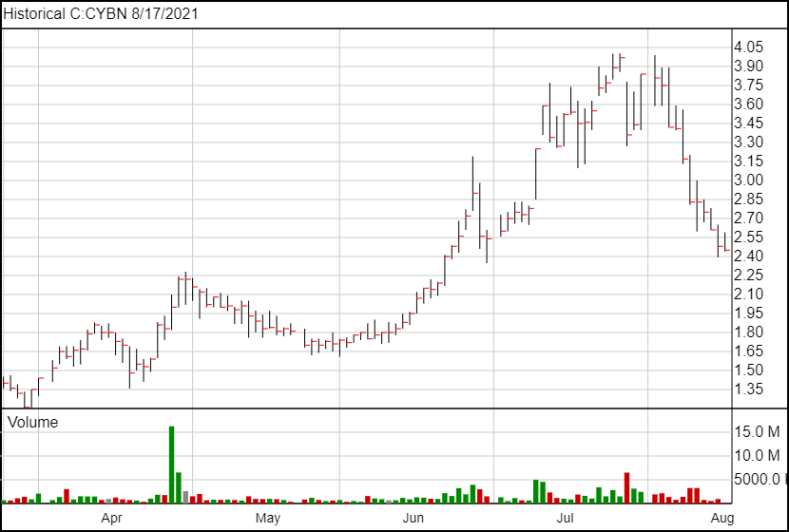

Cybin shares continued their downward slide today after rebounding slightly in the morning, and are currently trading at $2.45.

Full disclosure: Cybin is not an Equity Guru marketing client, although they have been in the past.