BioHarvest Sciences (BHSC.C) announces today that its Q2 2021 sales orders in Israel have reached USD$409,272 compared to $371,944 in Q1 2021 and $44,600 in Q2 2020.

“As a biotech innovator, our goal is to bring the benefits of our BioFarming platform technology to multiple verticals and geographies. The acceptance of VINIA®, as manifested in the stellar quarter sales orders in Israel and the encouraging performance metrics in the US, are important indicators of the prospects of the Company in general and, specifically, of the broad applicability of the Company’s BioFarming technology platform,” said Ilan Sobel, CEO of BioHarvest.

Its a dark and gloomy day for the investment sector, however, BioHarvest’s latest press release is like a ray of sunshine. According to the Company, its VINIA sales orders in Israel have increased 10% over the previous quarter in 2021 and 840% compared to the same quarter in 2020. Moreover, in Q2 2021, BioHarvest’s customer count grew 5% compared to Q1 2021, with average VINIA sales per customer reaching $182, representing an increase of 5% compared to Q1 2021.

Additionally, 2 months ago the Company launched its direct-to-consumer (D2C) sales of VINIA in the United States, which was a much anticipated move for BioHarvest. Keep in mind, VINIA is the first and only product in the world containing Piceid Resveratrol, a major derivative found in grapes that helps promote heart health, physical energy and mental alertness. After the first six weeks of VINIA’s launch in the US, BioHarvest has reported that several key metrics, including advertising click-through rates and average dollar sales, have been performing at promising levels.

“I am excited about the prospects of Bioharvest, given the opportunities stemming from our pipeline of BioFarming based nutraceutical and Cannabis products. I look forward to another record quarter for Q3,” continued Ilan Sobel.

It is also worth noting that BioHarvest has completed a number of major milestones as part of its journey to explore plant biology and commercialize its cannabis-based products in the first half of 2022. On June 8, 2021, the Company announced its progress in optimizing the density of trichomes, refining the drying process and creating new measurement methods via BioFarming. For context, the Company’s BioFarming method enables the Company to produce cannabis trichomes in liquid media without having to grow the cannabis plant itself.

More recently, on July 7, 2021, BioHarvest announced that its first cannabis cell reservoir has been continuously producing trichomes for two full calendar years. With this in mind, these technological breakthroughs have demonstrated the efficiency and reliability of BioHarvest’s innovative BioFarming technology. Currently, no other company has been able to grow cannabis trichomes in liquid media, making BioHarvest one of the most innovative and disruptive cannabis producers in the sector. Moreover, with a portfolio of popular products including VINIA, the Company is well positioned to capitalize on multiple markets including the cannabis and wellness sectors.

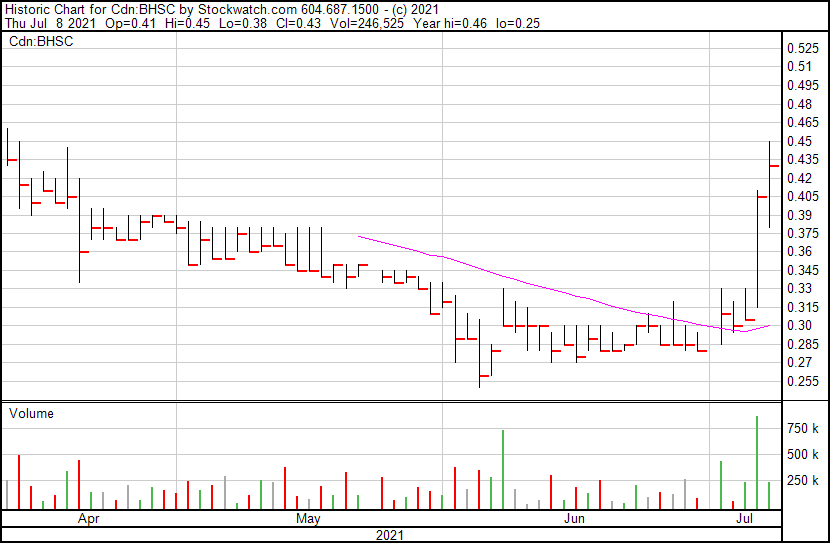

BioHarvest’s share price opened at $0.41. The Company’s shares are up 4.88% and are currently trading at $0.43 as of 10:36AM ET. This indicates that there has been noticeable change following the news.

BioHarvest’s share price opened at $0.41. The Company’s shares are up 4.88% and are currently trading at $0.43 as of 10:36AM ET. This indicates that there has been noticeable change following the news.