I’ll be honest, I haven’t had a lot of conversations with people about what a great investment oil and gas is over the last three years. For the most part, Canada’s favourite resource has been denigrated, ignored, beaten, and damned for a while now, but a funny thing happened when the world reopened post-Covid restrictions.

We all started filling our cars again, and gas suddenly got expensive.

I mean, sure, everyone aspires to buy a Tesla but, oddly, we’re all still driving gas-driven cars, even though gas prices are higher now than ever before. We’ve eliminated drinking straws and 7-11 gives you paper instead of plastic but, here we remain, paying more and more for oil and gas.

You wanna know why?

Because we’re not using less of it, even though North American oil and gas is undervalued to the extreme, and those who’ve decided there’s a long term investment future in the oil sector are locking in at lower prices than we’ve seen in, well, decades.

It’s taken a hot minute for the memo to get out that oil is a thing again. Companies that were drilling in 2019, generally weren’t in 2020. Companies that were selling what they produced for a decent price in 2019, generally weren’t in 2020. And companies that were running at a loss in 2019 were getting group euthanasia discounts in 2020.

But it’s 2021 and a new dawn is upon us. Not a Great Thunberg approved 2021, admittedly. We haven’t ditched the car for a sailboat just yet. We still have places to be – in fact, after a year of hiding in the basement to avoid getting the plague, many of us are kind of keen to get to Disneyland.

That’s not happening just yet – most air travel isn’t expected to hit its stride until later this year – but what that tells me is, you think gas prices are high now? Just wait until the airplanes need gassing up. You ain’t seen nothing yet.

We’re in that weird phase where we move from doom and gloom to opportunity – where, if you can find that rare company that uses calamity as a means of retooling for excellence, you’ve not only got a good investment opportunity, you’ve got the potential for profit multiples.

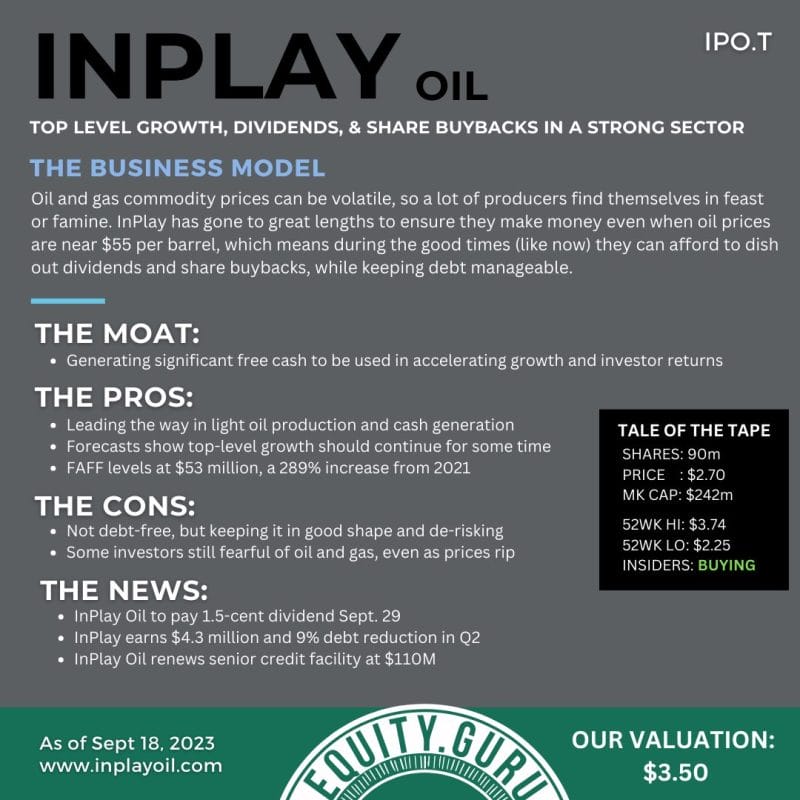

Take InPlay Oil (IPO.T), a big board resource producer that did some quick math during the pandemic and set themselves up for glory while the plague was setting upon us, by picking up cheap assets, hedging their sales, and streamlining operations.

They used the Big Panicas a time not to stick lots of drill holes in the ground in the search for profitable oil reserves, but rather pick those assets up on the cheap and get the paperwork done while everyone else was in lockdown.

That’s usually not a cheap practice – unless – and stay with me here because this is the big point – unless the empire is burning and the populace is fleeing and the plague is coming and oilmen will now sell you their legacy for a bag of potatoes and a Seadoo with an iffy transmission.

- Oil and gas: A timeline

2017: Chaos but nobody’s selling because the downtimes can’t last forever

2018: Still chaos but nobody is selling because, come on!

2019: Armageddon, but nobody is selling because prices are just too low.

2020: Literal plague. Potatoes and a Seadoo you said? DEAL.

2021: Record prices because, where is everybody?

InPlay didn’t have a 2020 you’d write home about, but they did have a year of austerity and reworking and positioning and exploiting available financing and readying themselves for a comeback at JUST THE RIGHT MOMENT to go snap up some properties with short term upside for not a lot of dough.

They didn’t buy scrappy assets because the price was cheap, nor good assets at higher prices than they’d like, they waited for the right moment for the right asset at the right price and NOW THEY BE BALLING.

The Globe and Mail:

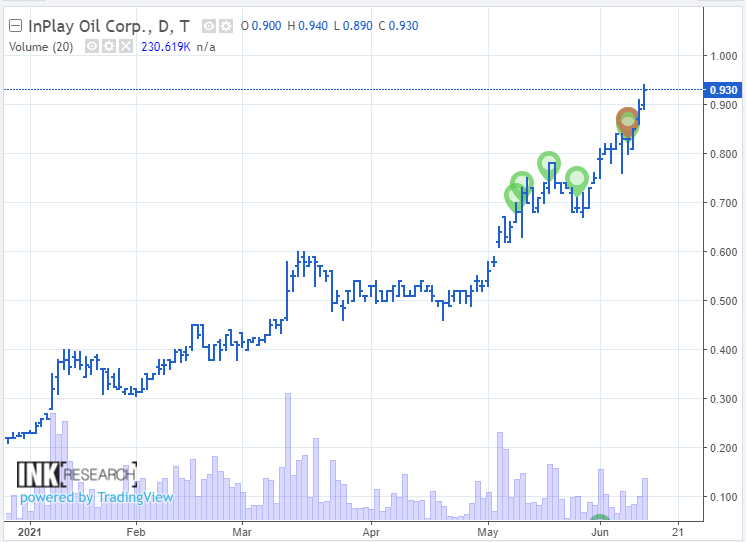

Canaccord analyst Anthony Petrucci believes InPlay Oil has “more room to run.” [..] Mr. Petrucci continues to rate InPlay “speculative buy” [..] That was in March when the stock was at $0.58. IPO’s share price today hit $0.93, which is up 5x where it was last November.

“Mr. Petrucci says in a note: “Despite a challenging macro backdrop in 2020, we believe the company has positioned itself for success in 2021. This includes improved financial liquidity, a return to an active drilling program, and forecasted production growth within cash flow. With the release of the company’s year-end reserves, our conviction continues to grow. The company grew reserves per share across all categories in 2020 at favourable FD&A costs, aided in part by a small but impactful acquisition in the Pembina area. IPO’s capex and production guidance remains unchanged for the year, with forecast spending of $23-million and targeted production of 5,100-5,400 barrels of oil equivalent per day. With the improvement in commodity prices, the company is now forecasting free funds flow this year of $16.5-million, which represents a FCF yield of 42 per cent on the current market cap.”

If you look at the real market dominators, they work in the same way Wayne Gretzky famously worked when he was setting every NHL record.

They don’t skate to the puck, they skate to where the puck is going.

InPlay timed their run through the worst of times in the oil and gas sector absolutely perfectly.

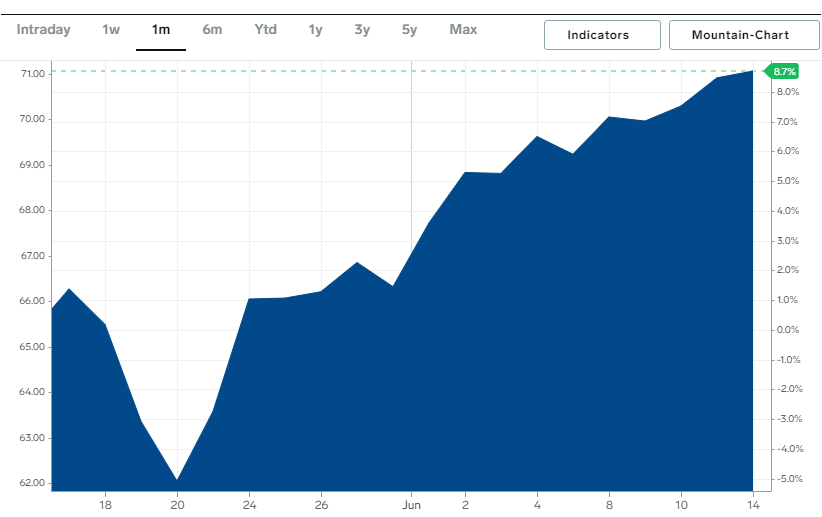

Currently the company is a little laggy on revenues, but that’s not a bug, it’s a feature, because last year they locked in hedge contracts in order to keep their heads above water.

For the layman, when you know the market for oil prices is heading down and selling oil is what you do, you sign contracts to lock in the price you’re getting at a rate that keeps you afloat. If oil prices continue to drop further, your downside is protected. Then again, if oil prices go back up, you’re going to miss out on those sweet sweet profits.

InPlay’s 2020 wasn’t great, but the downside wasn’t terminal because those hedged contracts protected their ass. They did what was necessary, and now those contracts are expiring with oil prices roaring up and seemingly headed higher still.

Give or take a month, and InPlay couldn’t have timed it better.

This means InPlay is just about to experience a revenue adrenaline surge.

As those hedges expire, InPlay starts to become a lot more profitable, and while that’s happening they’re bringing on new wells that will shift production numbers well above their conservative estimates.

Here’s what the pointyheads at Acumen Capital had to say:

IPO completed a three (3.0 net) well ERH program at Pembina in Q1/21 along with one (0.2 net) Nisku horizontal. The three wells are in the early post completion clean up stage and have produced at a combined IP30 rate of 890 boe/d (75% light oil and 5% NGL’s). Production from the three wells is expected to peak this month at a rate well above the IP30.

If that’s nerd-talk to you, here’s the breakdown: IPO produces around 5000 boe p/day. They’re about to toss 890 boe/d on top, and they have five more potential wells moving forward.

The company expects those three wells to have paid for themselves within six months. After that, it’s all cream.

Acumen thinks IPO is a rocket:

We are maintaining a SPECULATIVE BUY [..] IPO remains one of the best valued names in our coverage universe on most metrics.

Don’t trust Acumen? Maybe you prefer Noble Capital Markets, who like that IPO is being conservative with their estimates and beating them handily:

Management reiterated production guidance of 5,100-5,400 Boe/d even as it has surpassed exit rate capacity of 5,000. With the 3 first-quarter wells producing 890 and 5 more wells planned in 2021, production is well on track towards guidance.

As to the value therein:

Based on a two-stage discounted cash flow analysis that incorporates a terminal year based on long-term oil and gas price assumptions of $50/bbl and $2.75/mcf, we estimate a fair value for InPlay’s enterprise value to be C$200 million and its equity to be worth C$135 million, or approximately C$2.00 per share.

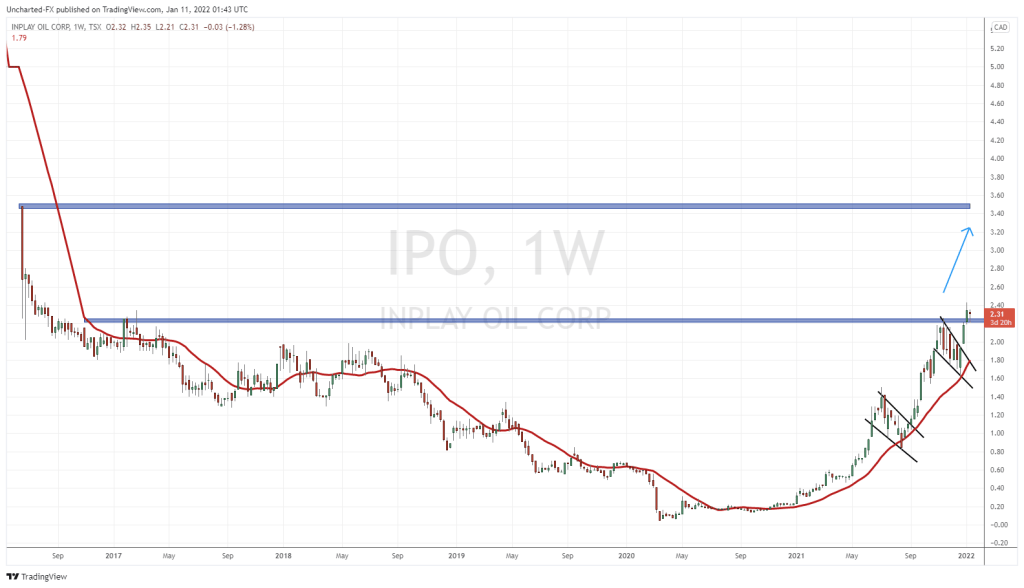

Currently you can buy IPO at $1.25 per share, even after it’s being doing this on the charts.

If you look at that chart and think you’ve missed the boat, guess again.

Here’s the insider trades chart – note the green buys a month ago, showing insiders think there’s a lot of upside from here.

InPlay lost money in 2020, there’s no getting around that. I mean, who didn’t? But the guys at the wheel, who are purchasing their own stock on the regular, never flinched through that period. Yes, they utilized some financing options to get through the dark times but they didn’t go into hibernation, they instead made this a downturn-proof business model.

Should oil prices drop back to $55 per barrel, IPO can be okay. If it stays at $70+, IPO cleans up.

Now, I know some of you are thinking, ‘But Parry, the oil industry is a dinosaur!’ and in a literal sense, you’re right. But just because you aspire to buy a Tesla doesn’t mean you’re ditching the minivan tomorrow, or next year, or even in the next five.

Hell, as I type this, here’s what’s right in my field of view and it’s ALL made from oil.

Oil-based products all over my desk.

If you’re planning to make my keyboard out of wood and my desk mat out of satin and my printer out of aluminum, you go ahead and let me know when the sale happens, otherwise we’re going to be drilling oil out of the ground for a while yet, and the guys who managed to be strong through the near end of the world to be stronger coming out of it, they’ll be getting my dollars in trust.

Every time I fill my tank, and grit my teeth watching the price go up, I come back to my desk and look at the IPO stock chart. If I’m going to give up cash on one end of this, I’m damn sure going to try to make it back on the stock.

— Chris Parry