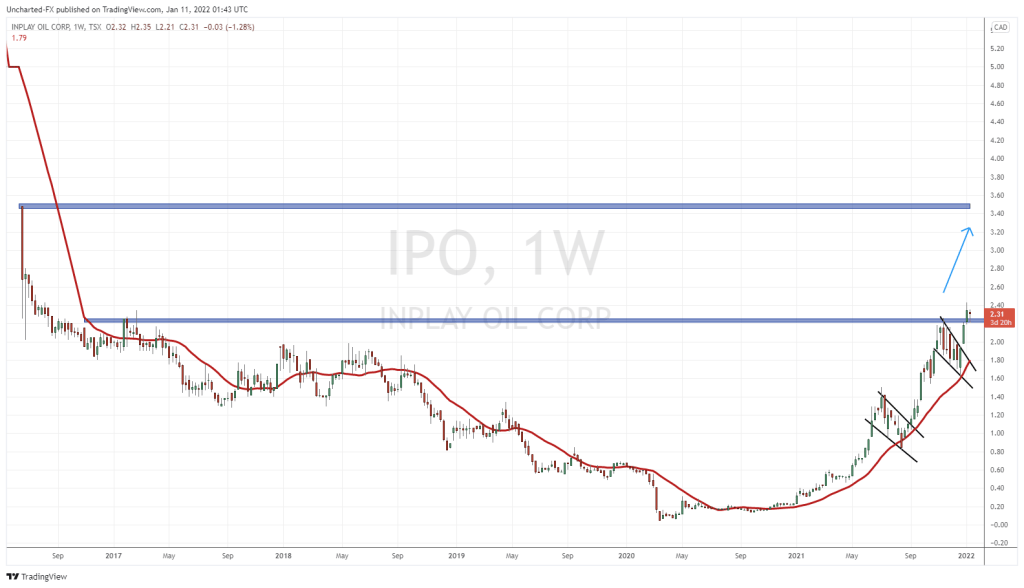

We liked InPlay Oil a few years back when they said they’d use their debt to grow hard, acquire good oil and gas properties in Alberta, and generate enough revenue (even in lean times) to return funds to shareholders.

Many sniffed at that goal, but IPO.T has made it happen, building a cash flow machine that runs hard even if oil prices touch $55 per barrel.

This is the Equity.Guru ‘Core Story’ of InPlay.

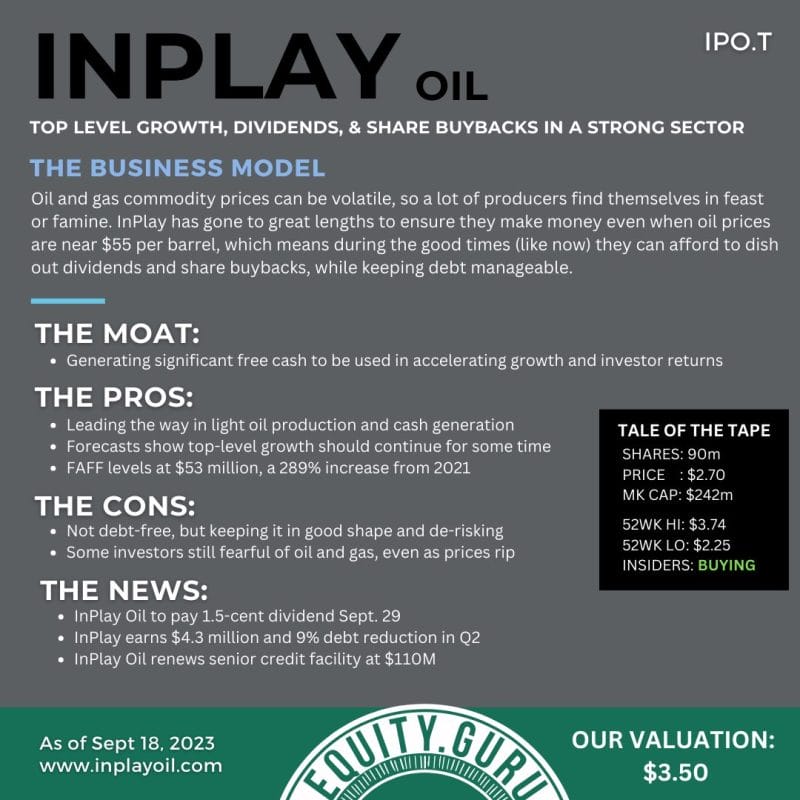

Corporate Strategy:

- Aim for top-level growth in production for each share.

- Generate a lot of free cash (referred to as FAFF).

- Keep debts low and manageable.

- Increase benefits (returns) to the people who own shares (shareholders).

- Use FAFF for:

- Paying dividends.

- Buying back shares.

- Making smart investments.

- Acquiring other businesses.

Past Performance:

- Their forecasts show they will continue this top-level growth and strong cash generation.

- Even if oil prices drop to $55 per barrel, they can still provide returns to shareholders.

- The team, with 8 years of experience, consistently delivers growth.

- They have been among the top performers every year since they started.

- They make strategic purchases and maintain a strong financial position.

- They aim to continue leading in light oil production and cash generation to benefit shareholders more.

Achievements in 2022:

- They achieved top-level growth in production per share.

- Reduced their debt significantly.

- Started giving returns to shareholders.

- Set records in:

- Production: 9,105 barrels per day, mostly oil.

- Production growth: 51% more than 2021 when adjusted for debt.

- AFF: $131 million, a 178% growth from 2021.

- FAFF: $53 million, a 289% increase from 2021.

- Reduced their net debt by 59%.

- Introduced a dividend of $0.015 per share each month (totaling $0.18/year).

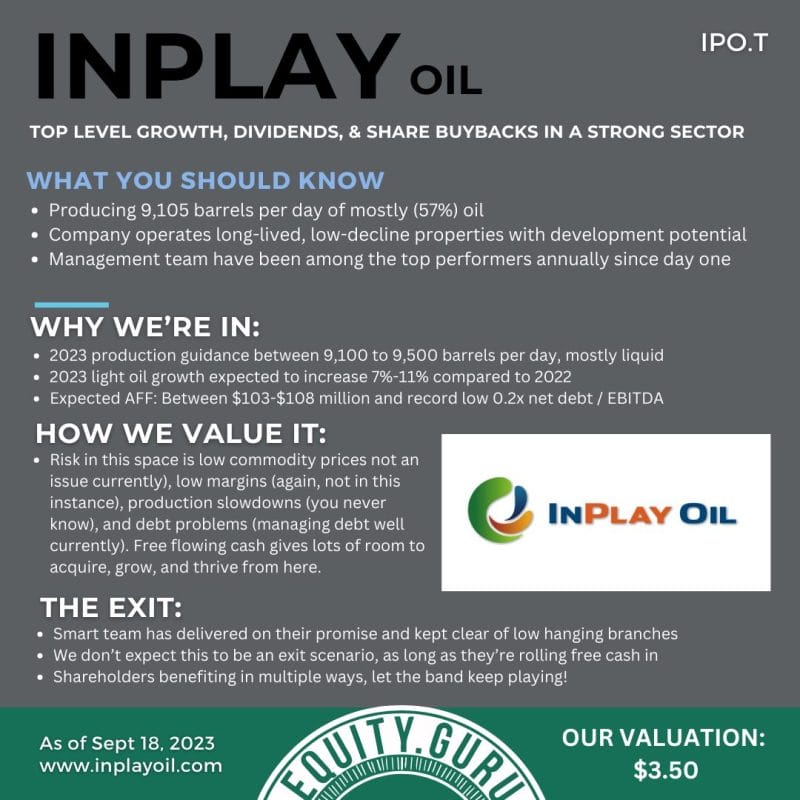

Plans for 2023 (Assuming oil price is $80 per barrel from Aug to Dec):

- Production: Between 9,100 to 9,500 barrels per day, mostly liquid.

- Light oil growth: Increase of 7%-11% compared to 2022.

- Expected AFF: Between $103-$108 million.

- Expected FAFF: Between $23-$33 million.

- In the second half of 2023, AFF is expected to be between $59-$65 million.

- Debt to EBITDA ratio: Between 0.2x to 0.3x.

(Note: FAFF, AFF, and EBITDA are financial terms referring to cash flows and earnings before certain deductions.)

CURRENT SHAREHOLDER PRESENTATION

— Chris Parry