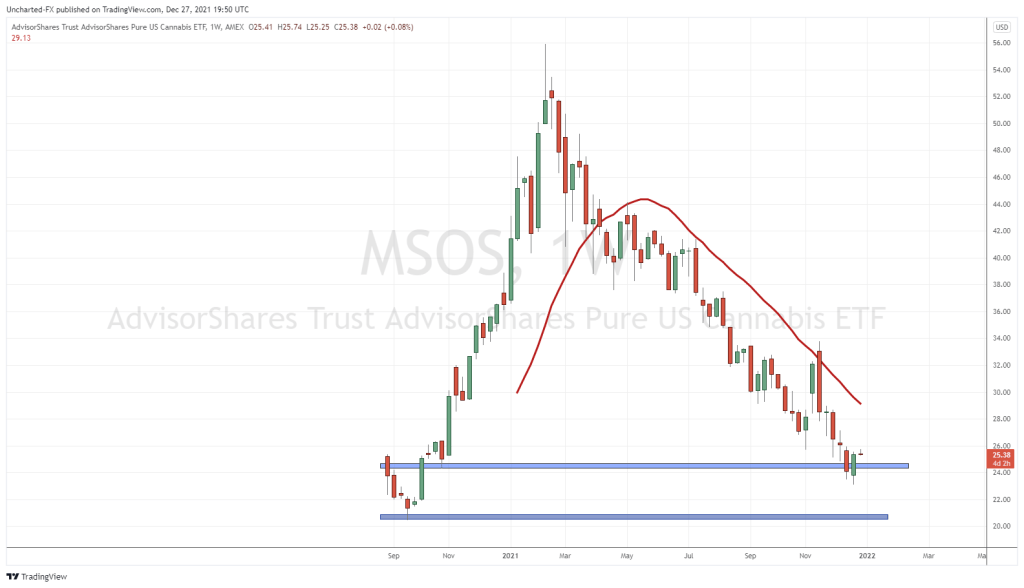

Trulieve Cannabis (TRUL.C) announced they have entered into a definitive agreement to acquire Harvest Health & Recreation (HARV.C).

The deal will send Harvest shareholders 0.117 shares of Trulieve for every HARV share. Based on Trulieve’s share price at the time of the deal, this represents a total consideration of $2.1 billion. This represents an ~34% premium on Harvest’s share price at the time of the deal.

Upon completion of the acquisition, Trulieve will have operations in 11 states, 22 cultivation and processing facilities, and 126 dispensaries for both medical-use and recreational cannabis.

The two companies combined for an adjusted EBITDA of $266 million in 2020, and they expect that to grow to $461 million in 2021, meaning they expect more than 70% revenue growth. By joining forces with Harvest, Trulieve claims they will be the largest US cannabis operator on a combined retail and cultivation footprint basis.

After the deal is completed, Harvest shareholders will own ~26.7% of Trulieve.

“Today’s announcement is the largest and most exciting acquisition so far in our industry, creating the most profitable public multi-state operator. Importantly, our companies share similar customer values with a focus on going deep in core markets. This combination offers us the opportunity to leverage our respective strong foundations and propel us forward with an unparalleled platform for future growth,” stated Kim Rivers, Chief Executive Officer of Trulieve. “Harvest provides us with an immediate and significant presence in new and established markets and accelerates our entry into the adult use space in Arizona. Trulieve and Harvest are leaders in our markets, recognized for our innovation, brands, and operational expertise with true depth and scale in our businesses. We look forward to providing best-in-class service to patients and customers on a broader national scale as we create an iconic US cannabis brand.”

It’s not an overstatement to call this acquisition a huge fucking deal.

The acquisition helps Trulieve strengthen their multi-state presence as more and more states legalize cannabis use, whether it be for recreational or medical purposes. They are especially excited about Arizona, where Harvest recorded the state’s first recreational sale in January after the people of Arizona voted to legalize cannabis in the last election. With 15 locations, they boast nearly double the number of locations as their nearest competitor.

While it is true that Trulieve did have to buy Harvest shares at a premium, they managed to finalize the agreement before Harvest announced impressive financials for the first quarter of 2021. In Q1 2021, Harvest brought in $88.8 million in revenue, representing a 27% increase from the previous quarter and more than double the revenue from the same quarter in 2020.

“We are thrilled to be joining Trulieve, a company that has achieved unrivaled success and scale in its home state of Florida,” said Steve White, Chief Executive Officer of Harvest. “As one of the oldest multi-state operators, we believe our track record of identifying and developing attractive market opportunities combined with our recent successful launch of adult use sales in Arizona will add tremendous value to the combined organization as it continues to expand and grow in the coming years.”

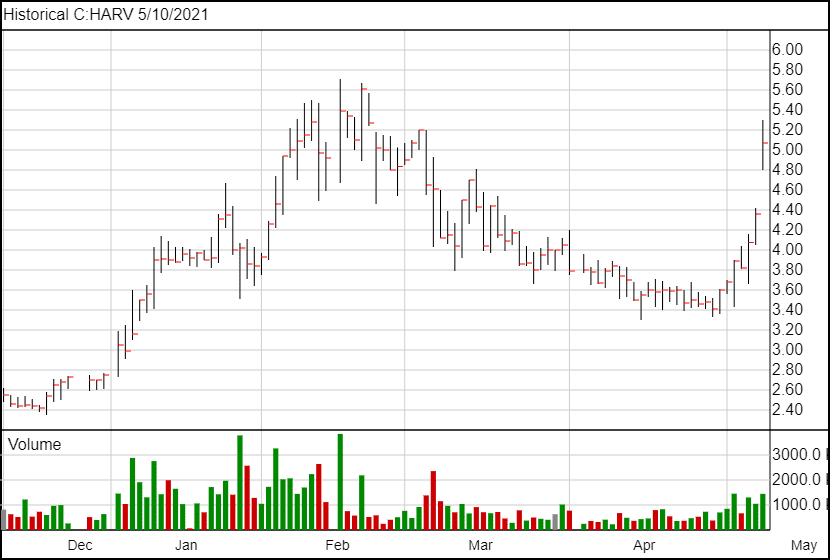

Following the news, Harvest’s share price shot up 15% to $5.02.

Trulieve, on the other hand, saw their share price decline slightly to $48.82.