On March 29, 2021 Predictmedix (PMED.C) announced that it has appointed Kingswood Capital Markets to facilitate the transition to becoming a NASDAQ-listed company.

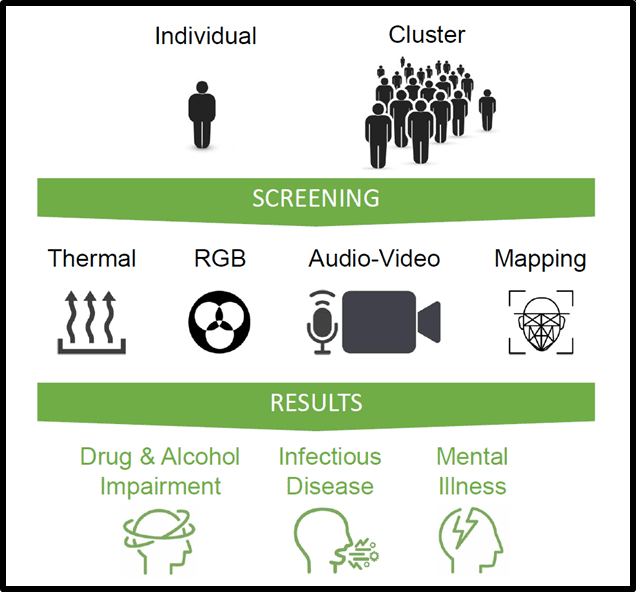

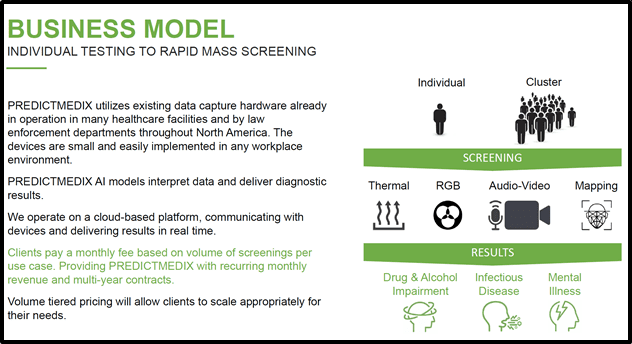

PMED provides AI-powered healthcare solutions including cannabis and alcohol impairment detection tools and screening for infectious diseases including COVID-19.

“Predictmedix’ solution involves multispectral imaging, which captures image information along specific wavelengths on the electromagnetic spectrum,” confirms Equity Guru’s Chris Parry, “There is no need for any bodily fluids and there is no human exposure, as the screening is carried out using multispectral cameras, which can be installed at any facility”.

Predictmedix has filed a Patent Application in the U.S. for its AI-driven rapid screening system for infectious diseases and impairment detection.

Predictmedix has appointed Kapil Raval to be the Chairman of its Advisory Board. Kapil is currently a director at the $1.4 trillion Microsoft (MSFT.NASDAQ).

The Nasdaq Exchange has 3,300 listed stocks including giants such as Apple (AAPL.Q), Google (GOOG.Q), Microsoft (MSFT.Q), Oracle (ORCL.Q), Amazon (AMZN.Q), and Intel (INTC.Q).

Being listed on the NASDAQ would expose PMED to a new class of investors.

NASDAQ listing prerequisites:

- Shareholders Equity of at least $2 million.

- At least 100,000 shares of public float.

- A minimum of 300+ shareholders.

- Total assets of $4 million.

- At least two market makers.

- Public float market value of $1 million

- $3 minimum bid price of the company stock.

Predictmedix’ current market cap is CND $37 million, with 104 million shares outstanding, shares trading at .35.

To meet the USD $3 share price minimum, PMED will have to consolidate shares about 10 to 1.

This isn’t a bad thing.

If you own 4.3% of PMED now, you’ll still own 4.3% after consolidation.

Kingswood Capital Markets is a global full-service investment bank that helps clients raise money, and improve corporate structure.

It has collectively financed over $50 billion in public and private capital markets, provides strategic solutions to clients across a wide spectrum of industries.

Kingswood will be assisting in Predictmedix’s NASDAQ up-list and also its business growth.

“The pandemic has shown us clearly how underprepared we are in dealing with crises,” stated Dr. Rahul Kushwah, COO of Predictmedix, “Our mission at Predictmedix has always been to eliminate the systemic cracks in our system to become the first line of defence in workplace health and safety.”

“We appointed Kingswood for its track record of being a strategic partner for companies in the technology and healthcare verticals,” confirmed Kushwah, “A strategic round of financing and an anticipated NASDAQ listing will be monumental in enabling Predictmedix to execute on its vision and get access to greater capital markets with influential investors.”

Last week, PMED signed a Letter of Intent (LOI) to acquire AI and IoT tech suite, Symp2Pass.

“The acquisition will help bolster PMED’s growth prospects and will align the product’s company sales with their stated goal of being the first line of defense in improving workplace health and safety,” reported Equity Guru’s Joseph Morton.

“Not only does this mean that all of our existing technologies become better,” stated said Kushwah, “but also that we’re ramping up revenue generation and building toward sustained, growing profitability with a broader, more robust client base and product offerings.”

Symp2Pass offers an artificial intelligence and internet of things technology suite originally developed by SmartCone Technologies.

“The product suite brought in $2.27 million in generated revenues for the fiscal year ending December 31, 2020 with earnings before taxes of $205,000,” reported Morton, “Their present clients include an agency within the Canadian government and a large US utility provider”.

On January 13, 2021 Equity Guru’s Chris Parry spoke with Kushwah about PMED’s macro business objectives.

“A lot of A.I algorithms that we are developing, are being trained on patient data,” confirmed Kushwah, “But the eventual goal is to deploy our no touch technology, where there are no biological agents involved. Can use this into a diagnostic tool for a whole subset of infectious diseases?”

“That’s where this partnership at McGill University comes into play,” added Kushwah, “So we can take it to even a bigger level, and become a true disruptor in the healthcare market.”

On August 12, 2020 PMED announced that it will be deploying its COVID-19 screening technology along with alcohol and impairment screening technology at Indian Oil Corporation (IOC.NS) – an Indian Public Sector Undertaking FORTUNE 500 company.

In India about 40% of work accidents have been attributed to alcohol use.

Identifying impaired employees before they punch in, can save a big factory a lot of money.

Indian Oil company profile:

- Ranked 1st in Fortune India 500 list (2016)

- 117th in Fortune Global 500 list (2019).

- India’s largest downstream oil company

- Workforce of more than 33,000 employees

- 2019 revenue of $85 billion USD.

“The deployment of our COVID-19 screening and impairment technology at IOCL marks our entry into the Oil & Gas sector,” stated Dr. Kushwah, COO of Predictmedix, “and it further highlights the market need for the suite of technologies developed by Predictmedix”.

“Nasdaq up-listings increase opportunities to attract institutional and retail investors,” reports BNN Bloomberg, “It’s a sign that the company has hit a key milestone”.

“An up-listing on a senior stock exchange like the NYSE or Nasdaq provides public companies with a broader investor base,” continued Bloomberg, “This in turn aids companies in attracting new shareholders and investments that they would not otherwise have”.

“Companies that can meet the senior U.S. exchange’s listing requirements have a chance to demonstrate that they meet the markets financial stability metrics and value to a much larger audience. Moreover, the larger volumes of stock traded on those exchanges also open up the possibility of better liquidity for a company’s stock”.

There can be no assurance that NASDAQ acceptance will be granted should PMED submit its listing application.

– Lukas Kane

Full Disclosure: Predictmedix is an Equity Guru marketing client.