Harborside (HBOR.C) announced they have secured a $12 million loan from a commercial federally regulated bank pursuant to a senior secured revolving credit facility, due March 2024.

The credit facility has a variable interest rate based on the prime rate charged by the Bank plus a premium, with a floor rate of 5.75%. Harborside was also required to make an upfront cash payment and issue the bank 4,100 warrants, which allow the bank to purchase multiple voting shares (MVS) for $369 CAD each. Each MVS can be converted into 100 subordinate voting shares, subject to certain conditions.

Harborside expects to use most of the loan proceeds to support the purchase of their 47-acre farm later this year, which includes 200,000 sq. ft. of licensed cultivation space, including 155,000 sq. ft. of flower canopy space and 45,000 sq. ft. of nursery space in Salinas, California.

“To the best of our knowledge, Harborside is the first cannabis business in the United States to secure a commercial loan of this kind with a traditional lender,” stated Tom DiGiovanni, CFO of Harborside. “This deal is the culmination of months of effort and reflects the close working relationship and trust that we have developed with our bank. By significantly lowering our cost of capital, we will be able to better serve our customers, provide high-quality products and invest more heavily throughout California.”

Harborside is a vertically integrated cannabis company in a large market interested in pursuing accretive expansion opportunities. They currently operate 4 dispensaries in California and 1 in Oregon and the aforementioned Salinas, California farm.

Recently, Harborside announced a $5 million strategic investment in ‘Loudpack’, who will aim to improve their production efficiency and harvest yields. With deals like these, HBOR has shown their willingness to invest proactively in attempts to grow and make themselves more efficient.

During Q3 of 2020, Harborside generated a total gross revenue of over $19 million USD, representing a 42.9% year-over-year increase.

Last June, HBOR stated they had $12 million USD in the bank, and they also raised $20 million USD in January through a private placement sale of equity units. Combine their existing capital, their fundraising, and the loan, and Harborside has got some serious cash available for investment in themselves.

“We are thrilled to solidify our relationship with our bank as they help support our efforts and growth throughout the state of California,” stated Matthew Hawkins, Chairman of Harborside. “This Loan is a significant milestone for the entire U.S. cannabis industry and testament to the work that Harborside has done over the last four quarters in an effort to deliver for our customers and shareholders.”

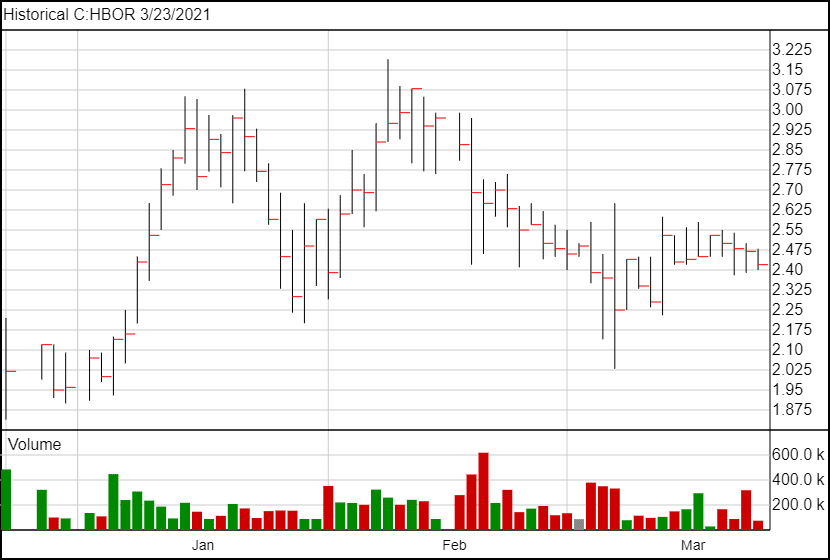

HBOR’s share prices have declined very slightly – from $2.45 to $2.42 – following the news.

Full disclosure: Harborside is an Equity.Guru marketing client.