Gold Mountain Mining (GMTN.V) closed a brokered private placement, lead by Cannacord Genuity and Gravitas Securities, issuing 10,310,000 units at $0.97 per unit, and pulled in $10,000,700.

The company intends on using the cash raised to advance their Elk Gold Project and for working capital and general corporate purposes.

“Through successfully completing this offering, we have secured our Equinox property payment and the capital required to advance our exploration and production ambitions. Despite headwinds from a consolidating gold market, this offering was oversubscribed with a lead order from Crescat Capital and orders from our long-term shareholders. With drills turning and a clear path to production, we look forward to continuing to build shareholder value by developing B.C.’s next high-grade gold mine,” said Kevin Smith, CEO and director of Gold Mountain.

Each unit consisted of one common share and one-half of a common share purchase warrant, exercisable to the further acquisition of another common share at $1.25 per warrant share, for the years after the closing of the placement.

This private placement is the money raising step towards this company getting drills in the ground and bringing up gold. Equity Guru’s own Chris Parry and Greg Nolan have been covering this company at length over the past few months.

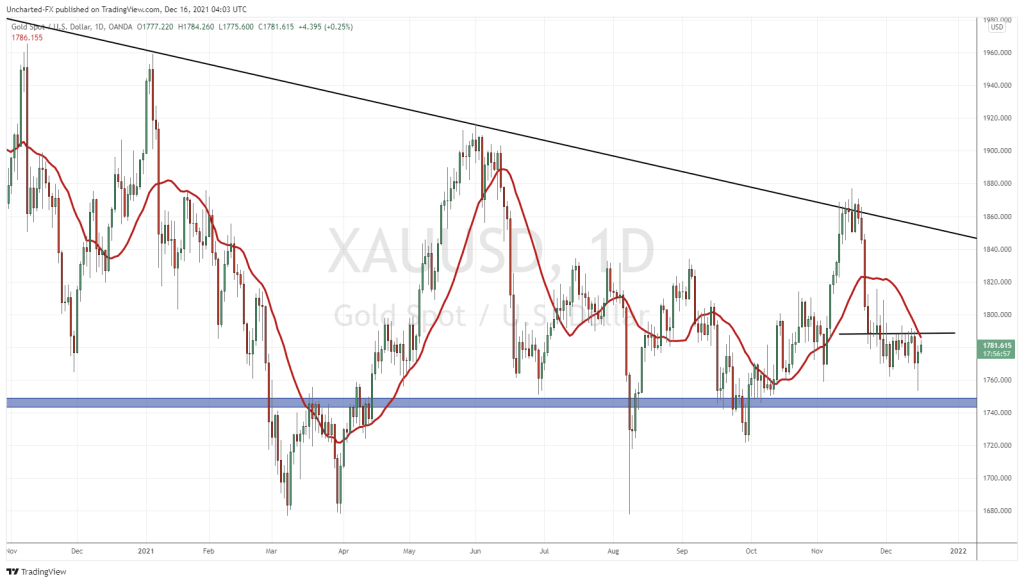

Here’s the general gist of the upward trajectory of this company, according to Parry:

“Gold Mountain continues to demonstrate that they’re serious about moving to gold production in the short term, not the long term, with a small project zeroing in on where they already know gold is and getting there as quickly and inexpensively as possible to take advantage of the surging global gold price.”

And if you’re looking for something a touch more technical, Greg Nolan has you covered:

- A 2020 Preliminary Economic Study (PEA)—factoring in a US$1,600 Au price—shows:

- A Post-Tax NPV of $191M;

- A low OPEX – AISC of US$735 per oz;

- A low start-up CAPEX at CA$6.9M;

- An expansion CAPEX of CA$26M once the Company decides to scale the project;

- A 50,000 ounce per year mine plan by Year 4;

- A payback period of 6 months, from the start of production

Gold Mountain’s shares are flat at $1.16 today.

—Joseph Morton

Full disclosure: Gold Mountain is an equity guru marketing client.