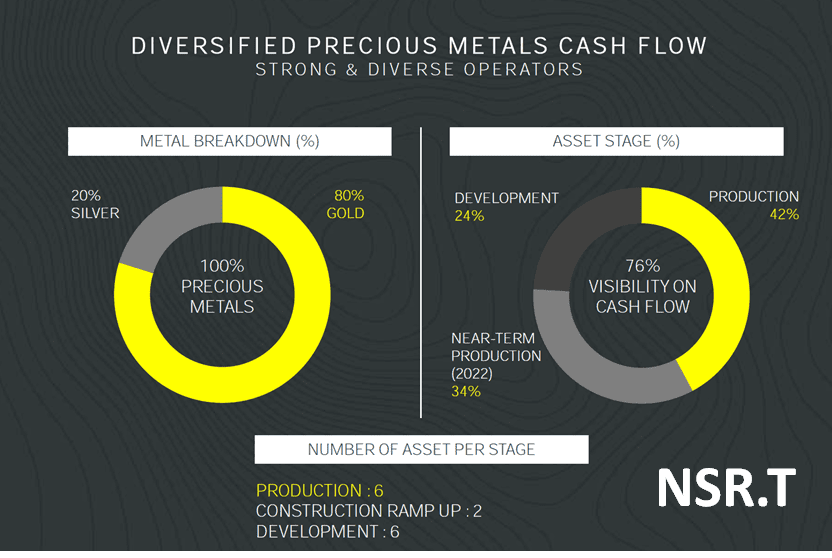

On February 18, 2021, Nomad Royalty Company (NSR.T) published its unaudited Q4 and year-end financial results in U.S. dollars (unless otherwise noted).

Royalty companies give cash to miners in exchange for a share of the mine’s future production.

It’s like lending someone $10,000 to build a bakery – with the baker agreeing to give you 1% of sales. A “streaming company” is similar but they take 1% of the bread produced, instead of the cash.

Royalty & Streaming companies don’t commission airborne surveys or invest in mining equipment. Yes, it is a leveraged precious metal bet. But a royalty company is considered lower-risk that explorers or miners.

That point was underlined last summer when NSR announced that it has entered into an agreement with three banks (Scotia, CIBC and RBC) for a USD $50 million revolving credit facility with the option to increase to USD $75 million.

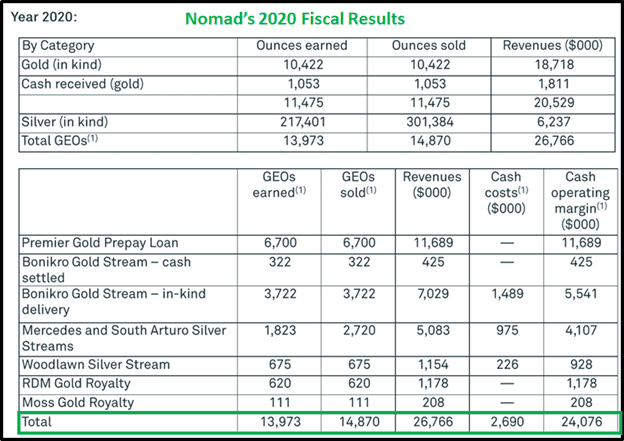

- Gold ounces earned of 2,746 for Q4 2020 (2,450 for Q4 2019) and 11,475 for the year 2020 (9,800 for 2019).

- Silver ounces earned of 64,568 for Q4 2020 (138,209 for Q4 2019) and 217,401 for the year 2020 (292,861 for 2019).

- Gold equivalent ounces(1) (“GEOs”) sold of 3,587 for Q4 2020 (3,084 for Q4 2019) and 14,870 for the year 2020 (12,233 for 2019).

- Revenues of $6.8 million for Q4 2020 ($4.6 million for Q4 2019) and $26.8 million for the year 2020 ($17.4 million for 2019).

- Net income of $11.3 million for Q4 2020 ($1.5 million for Q4 2019) and $20.1 million for the year 2020 ($2.0 million for 2019).

- Adjusted net income(1) of $1.3 million for Q4 2020 ($3.2 million for Q4 2019) and $9.7 million for the year 2020 ($11.7 million for 2019).

- Gross profit of $1.7 million for Q4 2020 ($0.05 million for Q4 2019) and $4.5 million for the year 2020 ($0.1 million for 2019).

- Cash operating margin(1) of $5.9 million for Q4 2020 ($4.4 million for Q4 2019) and $24.1 million for the year 2020 ($16.7 million for 2019). Including cash received at the closing of the RTO Transaction, the cash operating margin(1) attributable to Nomad amounts to $27.2 million for the year 2020.

- Cash operating margin(1) of 86% for Q4 2020 (96% for Q4 2019) and 90% for the year 2020 (96% for 2019).

- $22.5 million of cash as at December 31, 2020.

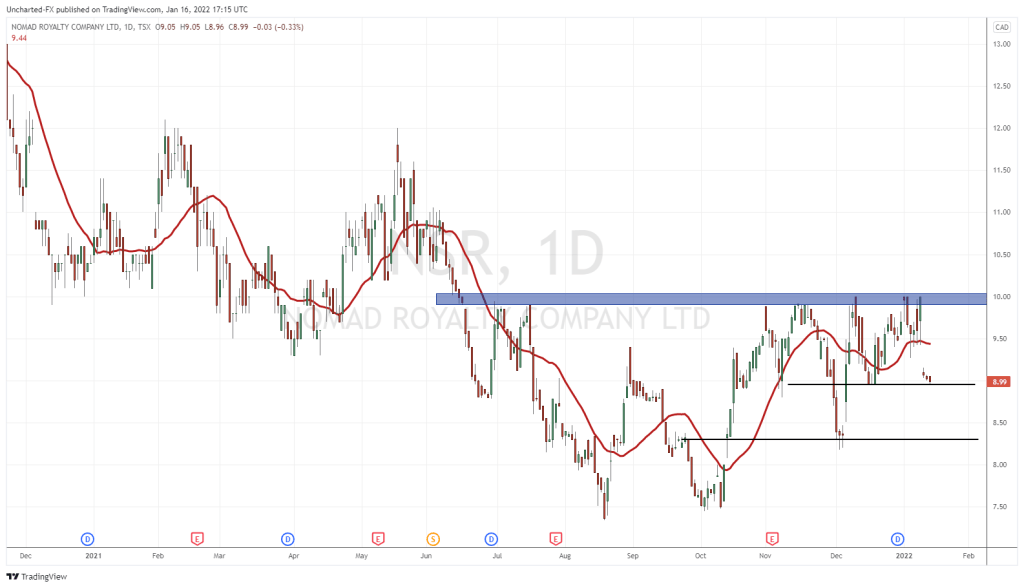

On Thursday, spot gold is hovering at $1,774.85 per ounce – an 11-week low – as investors look to a global economic recovery and raised U.S. Treasury yields which make gold less desirable.

In the last six months, gold has dropped USD $265, from $2,040 to $1,775. The Bitcoin crowd is crowing.

“Gold delivers financial freedom via horse, buggy, & stagecoach,” stated one Twitter user, “Bitcoin is a crypto-powered warp drive.”

One word: tulips.

Metcalfe on 2020: “Nomad was successful in launching and establishing a strong platform, while executing on the business plan of becoming a significant player in the sector.”

Metcalf on 2021: “Nomad expects organic portfolio growth which will allow it to continue to generate strong free cash flow while reinvesting in new opportunities that will support further growth and returns to shareholders.”

On February 8, 2021, Equity Guru’s Madelyn Grace spoke with Nomad’s Chief Investment Officer, Joseph de Plante about the business model and objectives of NSR.

“We own contracts on mines, where we get to receive a percentage of the mine’s metal production, typically gold and silver, for the duration of the mine,” explained de la Plante, “What that allows us to do is have a tremendous amount of cash flow and a revenue within a very small platform.”

“At Nomad we’re actually only six employees. But we were able to generate $30 million in revenues last year because of this business model,” added de la Plante.

“There is a general trend towards more debt for governments and more printing of paper money,” explained de la Plante, “All of the factors that we’ve been tracking over the last 10 years keep piling up and adding up…this lays the perfect groundwork for a prolonged run in the commodity price.”

Other Nomad 2020 Highlights:

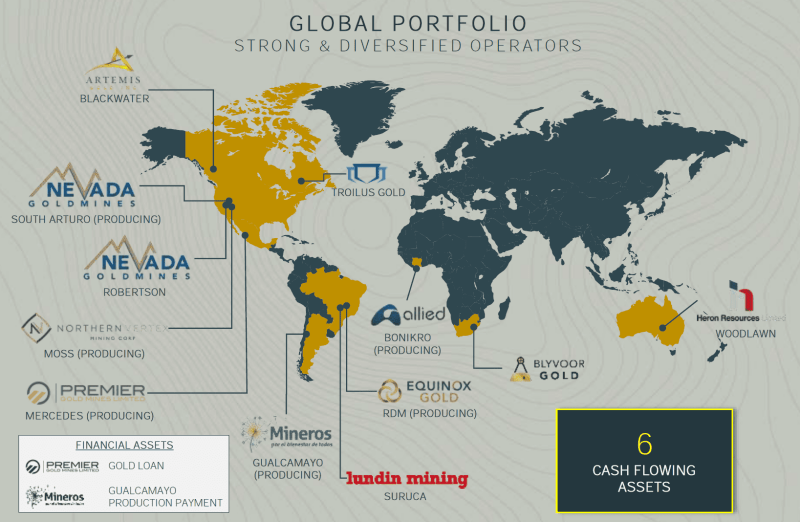

Completed the acquisition of Coral Gold, owner of a sliding-scale 1% to 2.25% NSR royalty on Nevada Gold Mines’ Robertson property located in Nevada, U.S.A., for cash consideration of $1.9 million and the issuance of 39,994,252 units of Nomad.

Completed the acquisition of a 0.21% NSR royalty on the Blackwater Gold Project located in British Columbia, Canada for total $1.8 million cash consideration and the issuance of 1,583,710 common shares of the Company.

Completed a secondary offering by Yamana Gold of 22,750,000 common shares of Nomad.

Declared a second quarterly dividend of $2.2 million.

Joined the United Nations Global Compact committed to voluntarily aligning its operations and strategy with the ten universally accepted principles in the areas of human rights, labour, environment and anti-corruption.

“Nomad had a strong fourth quarter with revenue of $6.8-million as the portfolio continued to demonstrate its strength and reliability,” stated Vincent Metcalfe, CEO of Nomad Royalty.

- Lukas Kane

Full Disclosure: Nomad Royalty is an Equity Guru marketing client.