On Thursday, February 4, 2021 gold fell into a funk as April gold futures traded at USD $1,788 an ounce, down 2.5% on the day.

Meanwhile, the World Gold Council (WGC) reported that gold-back ETFs increased by 13.8 tonnes in January, 2020 although the price of gold dropped 1.3% that month.

“We believe investment demand for gold will remain strong in 2021 as investors react to inflation, global rates, and risk around budget deficits,” stated the WGC.

On February 4, 2012, Sentinel Resources (SNL.C) exploration team announced that it has completed an extensive program of data compilation and review.

Dr. Peter Pollard, chief geologist, and Danny Marcos, exploration manager lead the team that delineated and prioritized multiple highly prospective target areas for drill testing within the company’s gold and silver portfolio in New South Wales, Australia.

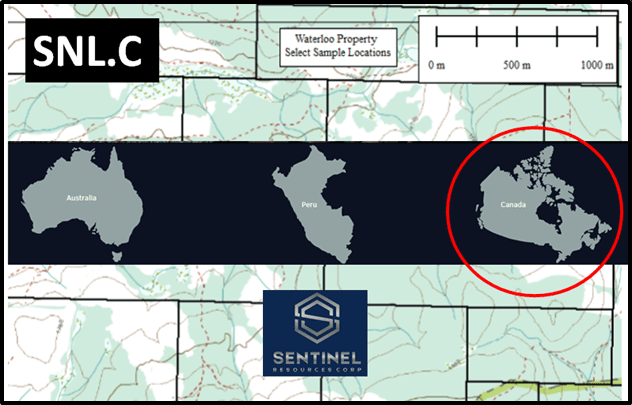

Sentinel’s project pipeline spans three continents. All are highly prospective for precious metals,” reported Equity Guru’s Greg Nolan on November 23, 2020.

“It was an October 6th headline that drew the curtain on a weighty acquisition in the New South Wales region of Australia, an acquisition that immediately took on flagship status,” continued Nolan.

Acquisition highlights:

- At least 198 historic gold mines and gold exploration prospects are present across 8 separate projects;

- Historic production records indicate that gold grades were often multi-ounce (see News South Wales Department of Planning, Industry and Environment);

- The licences are strategically located within the prolifically mineralized Lachlan and New England orogenic terranes;

- Sentinel applied to the Manager of Minerals Titles, New South Wales Department of Mining, Exploration and Geosciences for the concessions. The concessions will be 100% owned with no royalties or back-in rights, upon completion of the acquisition process.

- Sentinel has engaged a highly experienced exploration team to commence a reconnaissance work program on high-grade historic mines and showings this November 2020. The objective: to identify high-grade drill ready targets.

A 2nd acquisition, following fast on the heels of the 1st, bulked-up the Company’s project portfolio considerably.

SENTINEL ACQUIRES SEVEN SILVER EXPLORATION CONCESSIONS IN NEW SOUTH WALES, AUSTRALIA

Acquisition highlights:

- At least 23 historic silver and 3 historic gold mines and exploration prospects are present across the project areas;

- Historic production records indicate that silver grades were generally high-grade, and in some instances, exceeded 1 kg/t Ag (see News South Wales Department of Planning, Industry and Environment);

- Six of the licences are strategically located within the well-mineralized Lachlan orogenic terrane. One licence is located in the world-class Broken Hill region of Curnamona Province;

- Sentinel applied to the Manager of Minerals Titles, New South Wales Department of Mining, Exploration, and Geosciences for the concessions;

- The concessions will be 100% owned with no royalties or back-in rights upon completion of acquisition process. Sentinel will be required to post a refundable performance bond of AU$10,000 per concession and spend exploration and associated expenses on each concession of AU$ 25,000 in Year One and AU$50,000 in Year Two;

- Sentinel’s technical team is currently reviewing historic data in order to fast track a follow-up reconnaissance campaign to identify high-grade drill targets”. – End of Nolan.

“To-date the review of available historic data has identified three gold projects (Golden Bar, Toolom South, Hill End South) and one silver project (Carrington) as strong exploration targets for initial drill testing,” stated SNL.

Four drill target areas have been selected based on detailed review of all geological, geophysical and geochemical data available to the Company.

These prospective areas evidence certain geological characteristics commonly associated with orogenic gold and intrusion-related gold deposits and have been selected based on the presence of historic workings, high gold grades and potential near-term drill targets.

Highlights of Gold and Silver Projects:

Golden Bar – Gold Project

This concession covers an area of 198 km2 and is located in the eastern part of the New England orogen covering the majority of the historic Orara-Coramba gold field. There are at least 50 historic underground mines and prospects – many noted for high gold grades.

Forty-seven of the mines and occurrences in the New South Wales Government database are listed as structurally controlled, low sulphide hydrothermal-metamorphic vein-type deposits. Historic production records cite grades of up to 184 g/t Au. Occurrences are clustered along two east-west trending mineralized corridors with a cumulative strike length of over 40 km.

Of special interest are the historic workings at Bobo and Black Bull where wide and potentially laterally extensive zones of mineralization are reported, together with high gold grades.1

Carrington – Silver Project

Carrington is a 48 km Superscript 2 concession located in the East Lachlan orogenic terrane. Three high grade historic silver/gold mines and prospects are associated with the regional Yarralaw Fault. Although initially included with a group of silver prospects, the presence of high gold assays from historic work make this an equally attractive target.

The historic Carrington mine comprises extensive historical shafts and opencut drifts which exploited laterally extensive mineralized gossans that are up to 6 m wide. Historic rock chip samples returned grades of up to 85 g/t Au, 6037 g/t Ag, 24.8 % Pb and 16.8 % Sb. Interpretation of previous soil sampling results defines two high priority gold-bismuth-antimony anomalies along the historic workings which may be upgraded to drill targets after field confirmation.

Toolom South – Gold Project

Toolom South is located in the historic Toolom goldfield. It covers an area of 165.5 km2 and includes over 60 historic gold mines and high-grade gold showings. There are also potentially significant alluvial gold deposits.

Three groups of historic workings at Bucklands Reef, Reliance Mine and Rileys Lode with reported grades up to 104 g/t Au have been selected for early attention. At Bucklands Reef historic workings are reported to extend for 400 metres and these potentially provide a drill target following confirmatory field inspection.

Hill End South – Gold Project

This concession, covering an area of 84 km Superscript 2, is located within the highly prospective Hill End Trough and lies along the southern strike extension of the Hill End anticline and fault which host the highly productive orogenic lode style Hill End gold trend to the north.

The southern extension of the Hill End anticline has been less intensively explored than the northern part and provides an opportunity to discover unexposed saddle reef-style mineralization similar to that at Hill End. In addition, a substantial outcropping quartz lode has been reported but no gold assays are available. This will be an early focus of fieldwork.

“The high priority targets outlined here are consistent with our aim of using historic information to help define drill targets at an early stage of exploration,” stated Dr. Peter Pollard, Chief Geologist of Sentinel, “The next steps involve obtaining landowner and native title agreements followed by fieldwork to confirm potential these as drill targets.”

“Our technical team has worked diligently and methodically to understand the geology and geophysical interpretations to identify the highest-potential drill targets at our gold and silver projects in order to increase our odds of success for our maiden drilling at these largely untested target areas,” stated Rob Gamley, President & CEO of Sentinel.

Sentinel Resources current portfolio includes these gold and silver projects located in New South Wales, Australia, as well as projects in Peru and British Columbia.

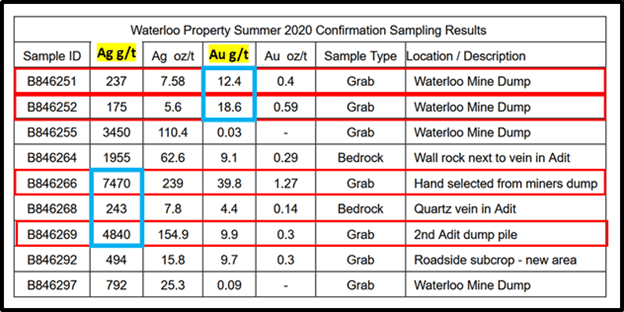

On November 19, 2020 SNL released an eye-popping assay report from the 2020 rock grab sampling program on its 100%-owned Waterloo silver-gold property in British Columbia Canada.

“Prospecting, sampling, and reconnaissance mapping was carried out at several locations on the property,” states SNL, “including the Waterloo mine, the Au Zone, the Park zone and the East Zone.

Significant Results:

- 7,470 g/t Silver and 39.8 g/ Gold sample #B846266

- 4,840 g/t Silver and 9.9 g/t Gold sample #B846269

- 18.6 g/t Gold and 175 g/t Silver sample #B846252

- 12.4 g/t Gold and 237 g/t Silver sample #B846251

The November 19, 2020 release details the results of the best 10 samples which were part of 46 rock samples collected and sent for silver (Ag), gold (Au) and multi-element analysis.

Three Samples taken from the Waterloo Mine Dump confirmed the presence of silver with sample B846255 returning a silver value of 3450 g/t (110.4 oz/), sample B846297 returning 792 g/t silver (25.3 oz/t) and sample B846259 analysing at 752 g/t (24.7 oz/t) silver.

SNL’s guiding principles are acquiring strategic exploration properties in mining-friendly jurisdictions with historical mining industries, low-cost of entry or acquisition, and easy access to infrastructure to minimize capital and operational costs in explorational periods.

With these principals, SNL is trying to remove some of the risk from a infamously risky (and rewarding) business.

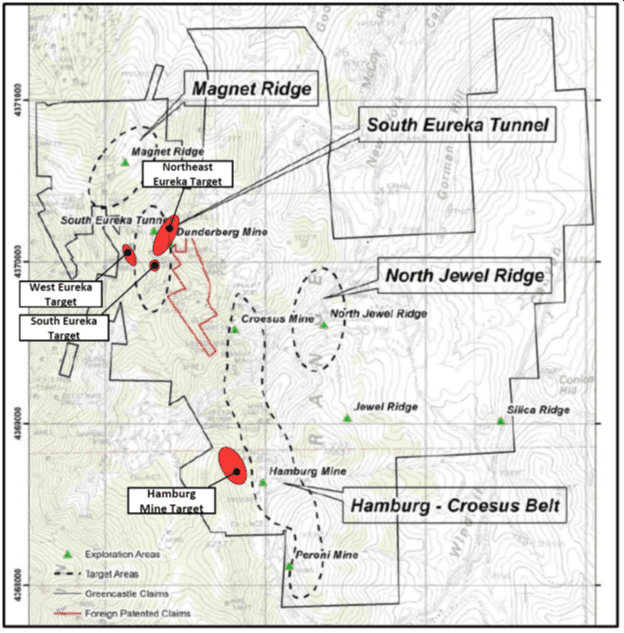

On February 1, 2021, Golden Lake Exploration (GLM.C) reported additional anomalous and significant silver and gold values from surface rock samples from several targets on the company’s keystone Jewel Ridge gold property located near the town of Eureka, Nevada.

“Golden Lake’s flagship asset—Jewel Ridge—is located at the south end of Nevada’s prolific Battle Mountain—Eureka trend,” reported Equity Guru’s Greg Nolan on November 23, 2020, “The property is strategically located along strike and contiguous to Barrick Gold’s past-producing (two million ounce) Archimedes/Ruby Hill mine to the north, and Timberline Resources’ (TBR.V) advanced-stage Lookout Mountain project to the south.

The target at Jewel Ridge is a Carlin-type deposit.

A Carlin-style gold deposit defined

Nevada Carlin-type gold deposits have a combined mineral endowment of more than 250 million ounces, all concentrated along four main trends—Carlin, Cortez (Battle Mountain-Eureka), Getchell, and Jerritt Canyon.

The Company initiated a drilling campaign at Jewel Ridge earlier this summer. The highlight interval from this phase-1 campaign—2.80 g/t au over 22.9 meters, including 4.38 g/t au over 12.2 meters—was delivered via a September 24th press release.

On October 20th, the Company announced the commencement of a phase-2 drilling campaign at Jewel Ridge.

On November 19th, we received the final four holes, wrapping up phase-1.

Drilling Intersects A 2nd Mineralized Zone At The Eureka Tunnel Target, Jewel Ridge Property, Nevada Averaging 1.48 G/T Au Over 10.87 Meters” – End of Nolan.

Highlights:

The Eureka Tunnel mine target is located along the northwest corner of the Jewel Ridge property, with the “Oxide Zone” aka the “Viking Zone” located east and north-east of the main portal.

A new, deeper mineralized zone was encountered at Eureka at a depth of 160.0 meters in a hole that tagged 1.48 g/t Au and 1.3 g/t Ag over a length of 10.67 meters.

This represents a second mineralized horizon hosted in dolomite, in addition to the “Upper Mineralized Zone” that returned 1.25 g/t Au and 5.5 g/t Ag over 16.76 meters.” End of Nolan.

“While we await assays from three diamond drill holes completed in November, the Company is very encouraged to identify additional areas of widespread silver and gold mineralization over the Jewel Ridge property,” stated Mike England, CEO of Golden Lake.

Northeast Eureka Target

The area northeast of the Eureka Tunnel portal was drilled by the Company with five drill holes (four Reverse Circulation (“RC”) holes and 1 core hole (assays pending)). Highlights included RC hole JR-20-06 which intersected two zones of mineralization. An upper mineralized zone (“UMZ”) of 1.25 grams gold per tonne gold (Au g/t) and 5.5 grams silver per tonne (Ag g/t) silver over 16.76 metres was intersected from surface, and a second, lower mineralized zone was intersected at a depth of 160 meters, averaging 1.48 g/t Au and 1.3 g/t Ag over 10.67 meters, hosted in dolomite.

The results strongly indicate a continuation of the Northeast Eureka Zone to the north and northeast.

South Eureka Target

The South Eureka Target is centered approximately 230 meters due south of the Eureka Tunnel adit in in a North-south trending steeply incised valley. Diamond drill hole JR-20-DD13 (assays pending) tested this target. Four rock samples of highly oxidized, gossanous material from dumps and workings in the area have returned good gold, silver and base metal values indicative of Carbonate Replacement Deposit (CRD) mineralization. The area is located just south-west of, and on-trend with the Northeast Eureka Zone.

Hamburg Mine Target

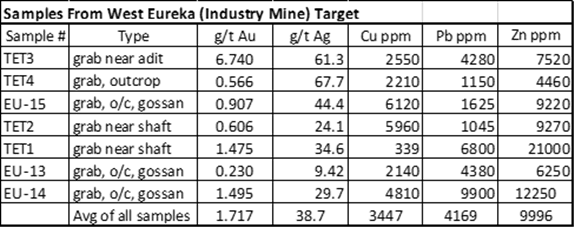

JR-20-02 and JR-20-03 both intersected wide intercepts of anomalous gold values (defined as greater than 0.1 g/t Au). Hole JR-20-02 intersected 0.436 g/t Au over 57.91 metres from a depth of 123.44 metres, and hole JR-20-03 returned 0.161 g/t Au over 106.7 metres from 73.2 metres. West Eureka (Industry Tunnel Mine) Target

The West Eureka Target is located on the west flank of the valley, approximately 200 meters southwest of the Eureka Tunnel adit. The target covers portions of the historic Industry Tunnel mine with extensive workings and dumps, and no known drill holes. Many samples are extensively oxidized and the higher silver and associated base metals are characteristic of CRD mineralization.

While grab rock samples are not representative of the grade of mineralization of an occurrence or target, they are useful in determining prospectivity and geological features. The above rock samples were delivered by the company consulting geologist to the ALS prep facility in Elko, Nevada.

The Company is awaiting assay results from three diamond drill core holes completed in November on the Eureka Tunnel area. Drilling on the Jewel Ridge property during 2020 comprised 10 RC holes 5,200 feet (1,585 meters), and three diamond drill holes 1236 feet (376.6 meters).

Planning is in progress for a spring 2021 drill program on multiple target areas on Federal (BLM) and patented lands, with EM Strategies of Reno, Nevada engaged to lead the permitting process.

“GLM is planning an aggressive and expansive drill program (RC and core) in 2021 to define and expand the targets outlined in 2020,” explained England, “and to test the new targets identified by rock and soil geochemistry, magnetics and induce polarization geophysics and structural mapping.”

- Lukas Kane

Full Disclosure: Sentinel Resources and Golden Lake Exploration are Equity Guru marketing clients.