For weeks, we’ve been talking about how Gold Mountain Mining (GMTN.V) CEO Kevin Smith (not my old movie writer/director boss Kevin Smith, but the ‘dig ore out of the ground’ Kevin Smith) has his head set on getting GMTN to low level production sooner rather than later.

It’s a different business model from many in the gold exploration field where, instead of endlessly drilling and flying helicopters over and chipping rocks and sending them to labs in an effort to expand their marketability to financiers, the company will instead seek to go where they already know the shiny stuff is and start, you know, pulling it out of the ground.

That novel model isn’t unique – it’s been done before, to some success – but it does add some risk as a trade-off against a shortened timeline to revenue.

The indicator that this isn’t all talk would be, as I’ve said since the start, seeing the company put actual pieces of that business model together.

- Like identifying a target – check

- And finding someone to do the mining – check

- And finding someone to process the ore… as of this morning, check

Under the terms of the [Ore Purchase Agreement], Gold Mountain will deliver 70,000 tonnes of ore per annum, approximately 200 tonnes per day, to the mill located at New Gold’s New Afton Mine situated 130km from the Elk Gold Project, in Kamloops, British Columbia. The OPA has a term of three years, giving Gold Mountain sufficient time to scale its business accordingly.

Getting this agreement in place means saving the company the cost of building its own ore processing mill, slashing a bunch of upfront costs away.

For those looking to invest in companies based on the current high gold prices, this make a lot of sense. The usual habit of investing in gold explorers who will be only exploring for several years and start looking at production only if they can find a a big enough target to warrant the tens of millions it would cost and several years it would take to build a mine, mill, infrastructure etc., doesn’t apply here.

GMTN’s project is a stone’s throw from Kamloops proper, the mill they’re using is a manageable 130kms away, infrastructure is already available, and historic drilling and production data is at hand.

Note: This isn’t how you build a mega-mine. But it is how you get to the starting line quickly and cheaply, and how you let the project itself tell you where it wants you to go, as you dig into it.

The work required to make this happen isn’t over, by any stretch. Permits are needed, among other things.

By securing a world-class toll milling partner in New Gold, along with the previously announced mining contract executed with Nhwelmen-Lake LP, Gold Mountain has the operational partners in place to increase shareholder value.

[..]

The OPA is effective upon the first delivery of ore to the New Afton Mine. Prior to the first delivery of ore, the parties must settle on a sampling procedure for tracking the tonnes and grade delivered, Gold Mountain must receive the Permit [..] and New Gold must obtain a permit amendment to allow for the processing to occur.

What I will say is, GMTN is showing its work. Kevin Smith could drag out his employment for years with endless drilling and news releases detailing long range promises, but he’s legit forcing his company down the road to production instead because I have to believe he thinks the story will be bigger when it’s producing ounces instead of talking about ounces.

There will be doubters, undeniably, as there should be. If mill agreements were a guarantee of success, every explorer would have one. But if you were running a standard Howe Street explorer play, you wouldn’t be talking to mills for years at this stage of GMTN’s life.

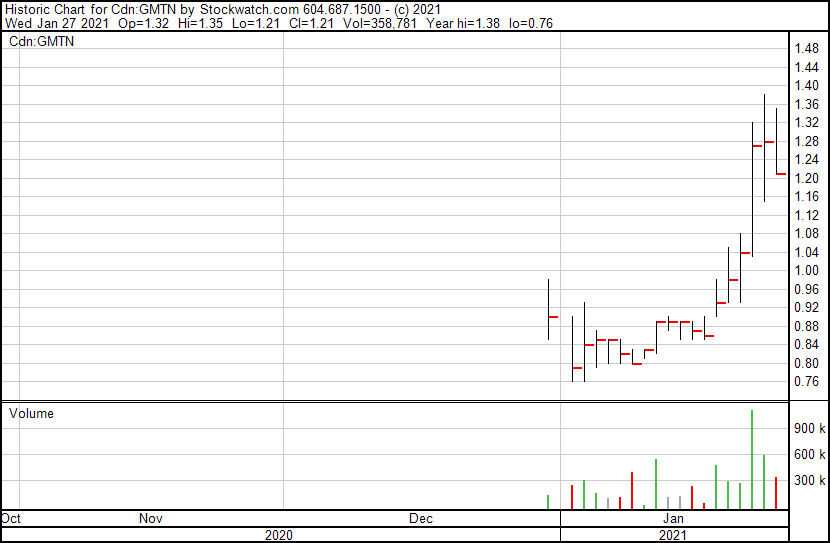

One foot in front of the other. You love to see it. And apparently others agree, as the stock is up 50% from when we started covering it a month ago.

— Chris Parry

FULL DISCLOSURE: Gold Mountain is an Equity.Guru marketing client, and we are buying stock on the open market as opportunities present.