On January 20, 2021 Harborside (HBOR.C) announced that it is raising CND $20 million at a price of $2.55 per unit. HBOR stock is currently trading at $2.90.

Entourage Effect Capital is investing $9 million. It is one of the largest shareholders of Harborside.

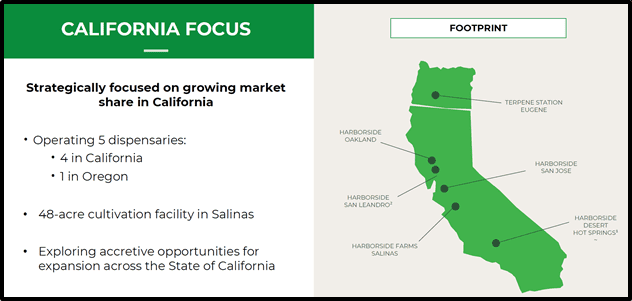

HBOR is a $64 million company that operates three big dispensaries in the San Francisco Bay Area, a dispensary in the Palm Springs, a dispensary in Oregon (more on that later) and a cultivation/production facility in Salinas, California.

On November 18, 2020 HBOR reported its Q3,2020 financial results.

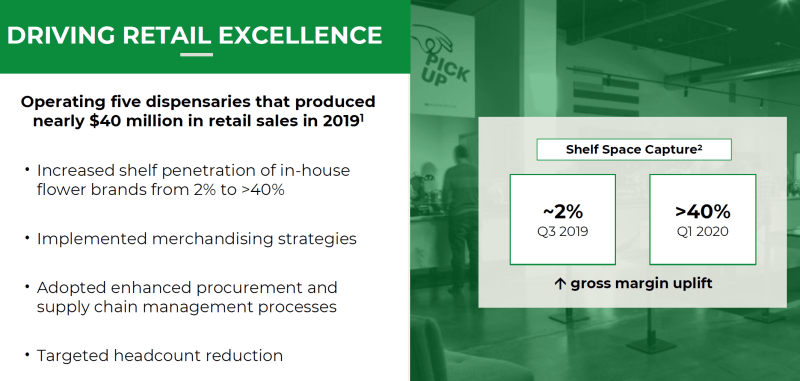

During Q3 2020, Harborside generated total gross revenues of approximately USD $19.6 million, representing a 21.2% sequential growth over Q2, 2020 and a 42.9% year-over-year increase when compared to the approximately $13.7 million of gross revenues reported in the period ending September 30, 2019 (Q3 2019).

Combined gross profit before excise taxes and adjustments for biological assets was approximately $10.7 million, an 85.8% year-over-year increase as compared to the $5.8 million reported in Q3 2019.

On a year over year basis, combined gross margins increased from 42.1% in Q3 2019 to 54.7% in Q3 2020.

Each Unit of the private placement comes with a 36-month warrant, at an exercise price of $3.69.

“We are continuing to expand our footprint in the robust California cannabis market, delivering our best-in-class service and the high-quality product selection that Harborside is known for,” stated Matthew Hawkins, Chairman of Harborside. “California is one of the largest cannabis markets in the world and Harborside has more than a decade of market success for our team to build on.”

“This additional capital will solidify our balance sheet and provide a platform for us to continue to consolidate in the California market through accretive M&A transactions,” added Hawkins.

An example of this consolidation strategy is HBOR’s December 21, 2020 acquisition of 50.1% of FGW Haight (FGW) – which has the conditional use approval necessary “to operate a cannabis dispensary and related businesses in the Haight Ashbury area of San Francisco, California”.

“I’m excited to continue to expand our footprint in California and look forward to serving consumers in Haight Ashbury,” stated Peter Bilodeau, Interim CEO of Harborside.

To close the FGW deal, Harborside paid USD $2,179,350 based on a post-build-out and proforma working capital enterprise value of USD $4,350,000.

Harborside has agreed to purchase an additional 29.9% of FGW to get to an 80% ownership of the Haight Ashbury enterprise, subject to regulatory approvals.

“The cost of these additional shares will be USD $1,300,650. Harborside retains the right of first refusal to purchase the remaining 20% of FGW.

The January 20, 2021 press release declared that HBOR is “expecting gross revenues in line with previously issued guidance of approximately $61 – 63 million, and positive EBITDA”.

“For the full year ended 2021, HBOR expects standalone gross revenues of between $68 – $72 million,” states HBOR, “The increase in revenues for 2021 is expected to be derived from improved pricing in retail along with continued increases in both flower yields and processing efficiencies in Harborside’s wholesale operations.

HBOR is anticipating a 2021 full year of Adjusted EBITDA in the range of 15 – 17% of revenues, compared to the previously disclosed 2020 expectation of Adjusted EBITDA(3) in the range of 8 – 10% of revenues.

Management expects to attain this higher level of Adjusted EBITD in 2021 through more efficient procurement of goods sold and stronger cost discipline on overhead spend.

The January 20, 2021 press release also announced HBOR’s plan to sell Terpene Station in Eugene, Oregon, to focus more exclusively on the California market.

Harborside has not entered into any agreements, binding or non-binding, to divest of the Oregon Assets as of this date.

Further, the Company has not established a definitive timeline to complete such divestiture, and no decisions related to the divestiture have been reached at this time.

HBOR “does not intend to comment further with respect to the Oregon divestiture until it has some hard news about a prospective buyer for the asset”.

Lukas Kane

Full Disclosure: Harborside is an Equity Guru marketing client