Prime Mining (PRYM.V) is helmed by a top-shelf crew, a combination of successful capital markets mining executives and experienced local operators.

This team has multiple wealth-creating exits under their collective belts. You can peruse their resumes here.

The Company is targeting near term gold production at its 6,300-hectare Los Reyes Project located 43 kilometers southeast of Cosala, in the mining-friendly state of Sinaloa, Mexico.

“Decades of extensive fieldwork and technical studies have positioned Los Reyes to be an advanced, cost-effective opportunity poised for rapid advancement.”

Prime’s CEO, Dan Kunz, has been operating in the Sinaloa region for the better part of 18 years. He knows the region, the political landscape, and the local communities (this is a hugely important consideration).

The Transaction

Los Reyes was acquired from Vista Gold (VGZ.T). Last summer, the Company closed the acquisition in a transaction that also clawed back two separate 2% net smelter royalties and a back-in right for a 49% non-carried interest in the project.

Prime now owns 100% of this highly prospective chunk of Sinaloa terra firma.

About Los Reyes

This is a project steeped in mining history. High-grade gold and silver were first discovered at Los Reyes by the Spanish in the late 1700s—a discovery that sparked a production run of over 150 years.

From the 1950s through the 1980s, there was limited activity in the project area—mostly reconnaissance exploration.

From the 1950s through the 1980s, there was limited activity in the project area—mostly reconnaissance exploration.

In the 1990s, drill rigs were mobilized to the project, targeting the shallow, lower-grade material surrounding the Los Reyes underground workings.

During that time, over 50,000 meters of RC and core drilling probed Los Reyes’es subsurface layers. This generated an extensive area-wide database.

Los Reyes was on track to become a heap leach mine in 1998, but low precious metals prices sidelined the project.

Since then, the region has evolved into a prolific gold-silver producing camp. Los Reyes is proximal to a plethora of deposits operated by the likes of Americas Gold and Silver (USA.T), Minera Alamos (MAI.V), First Majestic (FR.T), McEwen Mining (MUX.T), and Chesapeake (CKG.V).

Right from the get-go, members of the local Ejido (Ejido Tasajera) voted unanimously in support of Los Reyes’s development.

Right from the get-go, members of the local Ejido (Ejido Tasajera) voted unanimously in support of Los Reyes’s development.

To set the stage for seamless advancement of the project, the Company secured a 30-year surface access rights agreement ensuring continued exploration, development, and the timely receipt of mining and construction permits.

The project has direct access to roads, line power, abundant H2O, and a local labor force immersed in the culture of mining.

The Resource and the Upside

Back in February of this year, the Company dropped an in-pit oxide gold resource estimate of 833,082 equivalent (AuEq) ounces in the Measured and Indicated category, and 261,132 AuEq ounces in the Inferred category.

The current (oxide) gold resource is open along strike and at depth (historic drilling was limited to a depth of 200 meters below surface).

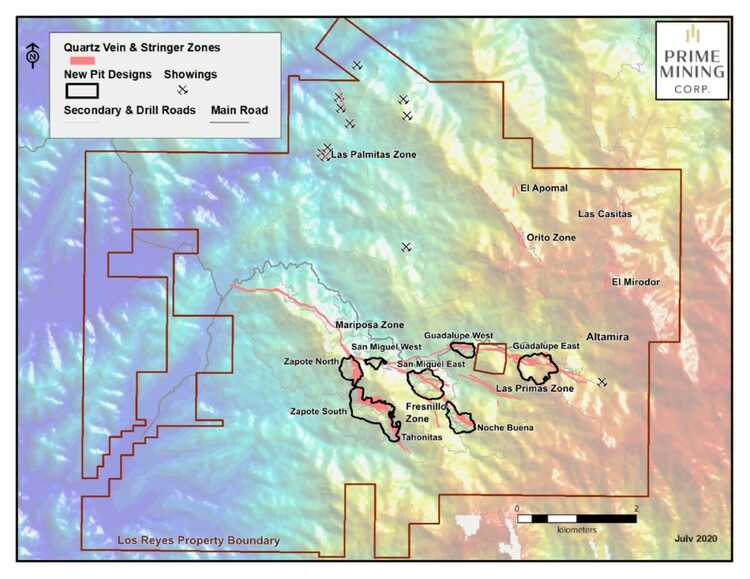

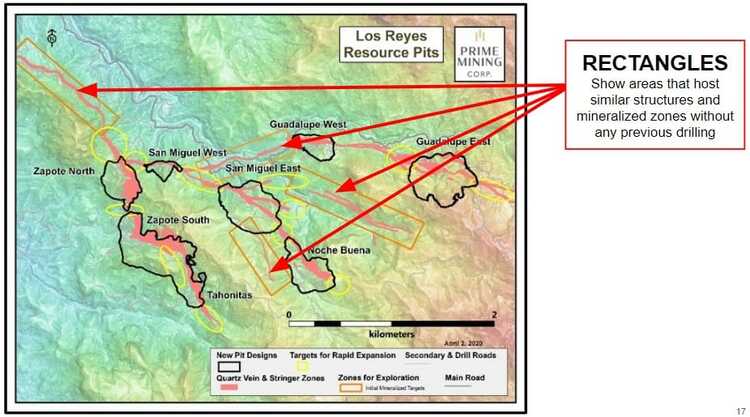

The global resource at Los Reyes is contained within a cluster of tightly spaced deposits (note the scale on the maps featured above and below).

The global resource at Los Reyes is contained within a cluster of tightly spaced deposits (note the scale on the maps featured above and below).

With a solid resource base already in hand, the real upside is in the project’s resource expansion and exploration potential.

This is a low sulphide epithermal system with over 17.5 kilometers of mineralized strike.

This is a low sulphide epithermal system with over 17.5 kilometers of mineralized strike.

A full 10 kilometers of this strike length remains untested—multiple high-grade surface showings are slated for a proper probe with the drill bit.

Outcrop sampling and trenching over the past year generated the following highlights:

- 34.5 meters grading 4.2 g/t Au (Main road cut samples) reported Dec 12, 2019;

- 30 meters grading 3.9 g/t Au and 40 g/t Ag (trench sample between Zapote North and Zapote South) reported January 21, 2020;

- 37.5 meters grading 3.9 g/t Au and 36.5 g/t Ag (Zapote South trench samples) reported February 5, 2020;

- 39.0 meters grading 6.75 g/t Au and 58.2 g/t Ag (Zapote South trench samples) reported February 26, 2020;

- 58.5 meters grading 0.83 g/t Au and 20.2 g/t Ag (Guadalupe West trench samples) reported April 21, 2020;

- 63.0 meters grading 1.78 g/t Au and 71.0 g/t Ag (Tahonitas rock chip samples) reported June 30, 2020;

- 42 meters grading 1.93 g/t Au and 25.7 g/t Ag (Noche Buena surface sample) reported August 19, 2020;

- 46 meters grading 2.21 g/t Au and 95 g/t Ag including 2 meters @ 29 g/t Au and 226 g/t Ag (Rock chip sampling inside the old, Guadalupe East mine adit) reported October 26, 2020.

In a recent Guru offering, the following details were highlighted…

Due to the vertical orientation of these vein systems—there’s plenty of outcropping material between and beyond the eight known deposits (along the top of the unmined ridges, for example)—the company is employing a trenching campaign that will connect with the mineralization at depth.

This mineralization also outcrops along road cuts. On such cuts (image below), work crews carve out a deep chip channel, effectively creating a horizontal drill hole as it progresses along the cut.

There are multiple new high-grade (under-explored) surface discoveries slated for a test with the drill bit. New (untested) claim blocks added to the project have yet to see any real exploration.

There are multiple new high-grade (under-explored) surface discoveries slated for a test with the drill bit. New (untested) claim blocks added to the project have yet to see any real exploration.

After tabling a $10M raise earlier this Spring, the Company is now in the early stages of an aggressive 10,000-meter drilling campaign.

A three-pronged approach to exploration is now underway to:

1) Upgrade 7.1 million tonnes of the current Inferred resource to the Measured and Indicated category;

2) Add to the current ounce count by drilling along strike and down dip in areas adjacent to the existing eight open pit-constrained resource areas;

3) Define the potential to add new gold and silver ounces in unexplored areas where new data—mapping and sampling—confirm the target potential.

This initial 10,000-meter drill program, at a cost of roughly $6M, is expected to run until June 2021.

Looking ahead, Company anticipates a follow-up drilling campaign for the second half of 2021, one that will push the project much further along the development curve.

An updated resource estimate should follow fast upon completion of this first phase of drilling.

An updated resource estimate should follow fast upon completion of this first phase of drilling.

About to find a whole new gear

Last week, on November 24th, the Company dropped the following headline:

Prime Mining Begins Drilling Los Reyes As New Trench Results Show More High-Grade at Surface

The drills are turning at Los Reyes.

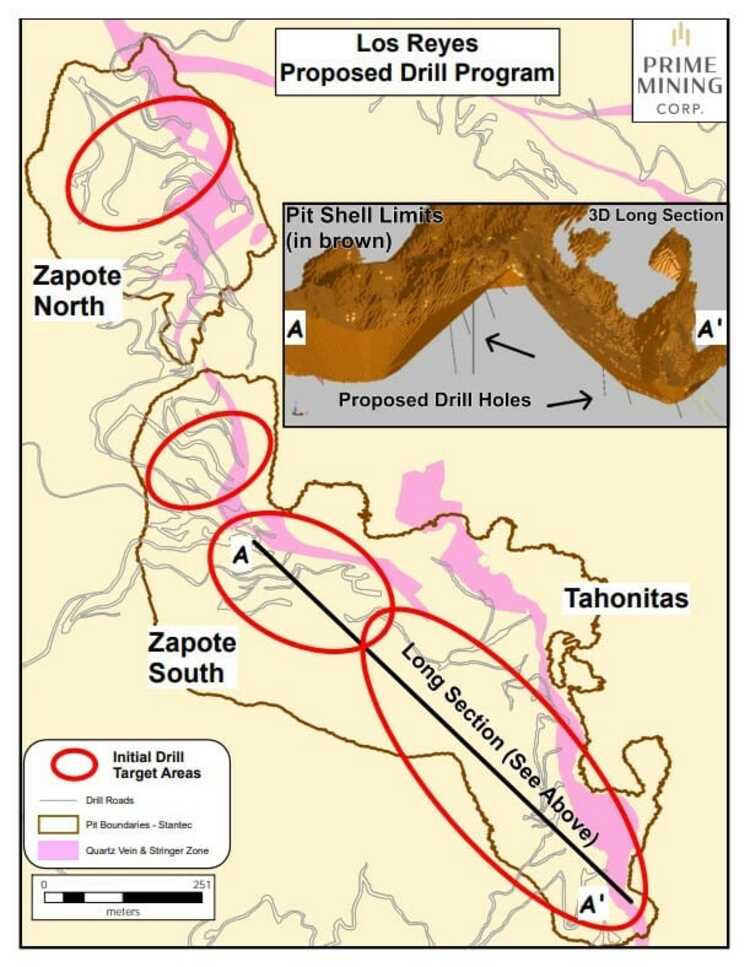

Core drilling is now underway at the Zapote North and Zapote South-Tahonitas deposits, the largest of the eight known deposits on the Los Reyes property.

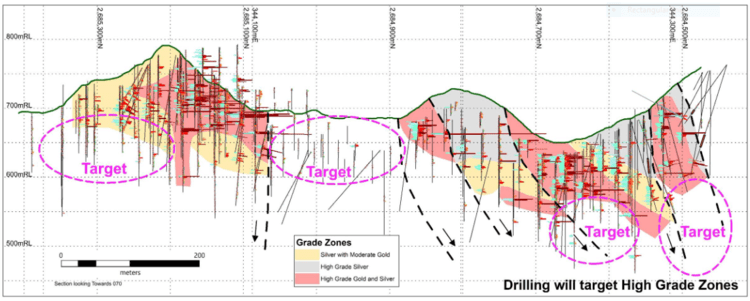

This next map gives us a long section view of the Zapote South-Tahonitas conceptual pit. The inset map shows the proposed drill holes that will probe areas below the current resource.

An initial twenty-one holes are planned to expand the resource along strike and down dip.

An initial twenty-one holes are planned to expand the resource along strike and down dip.

The drilling will also infill areas to increase the confidence of the Inferred ounces, pushing them into the Measured and Indicated categories.

Interesting to note, some of the historic reverse-circulation drilling was not assayed for silver—this campaign will shed light on those values and bring them into play (for the next resource update).

A very methodical and disciplined approach to resource expansion and exploration is being employed here.

- The year-long surface trenching and roadcut channel sampling campaign is near completion.

- Geological crews continue surface mapping and re-logging of historic drill core holes.

- Data from the historical drilling, new surface mapping, and the extensive surface trenching, adit, and roadcut channel sampling are being integrated to form a robust data-set that will help guide the drill bit.

According to this press release…

“Re-logging of several existing diamond drill core holes has identified that adularia, a crystalline mineral, containing high-grade gold and silver, and locally with visible gold, is associated with other nearby altered rock types. The adularia appears to be vertically zoned which may provide a guide to effectively target areas of higher-grade gold and silver during drilling.

A study of alteration types has been completed by an expert Francisco Querol, PhD. The objective of this study is to determine the specific minerals associated with the hydrothermal system and their relationship with the mineralized structures. The results of the study indicate that the clay kaolinite is related to the main mineralizing event and may be considered a pathfinder to locations of higher-grade mineralization. Secondary clays may also serve to indicate higher grade and include smectite, illite and montmorillonite. The initial data set was limited in size, so currently no assumptions can be made as to lateral or vertical zoning. Data will continue to be collected and analyzed throughout the drill program.”

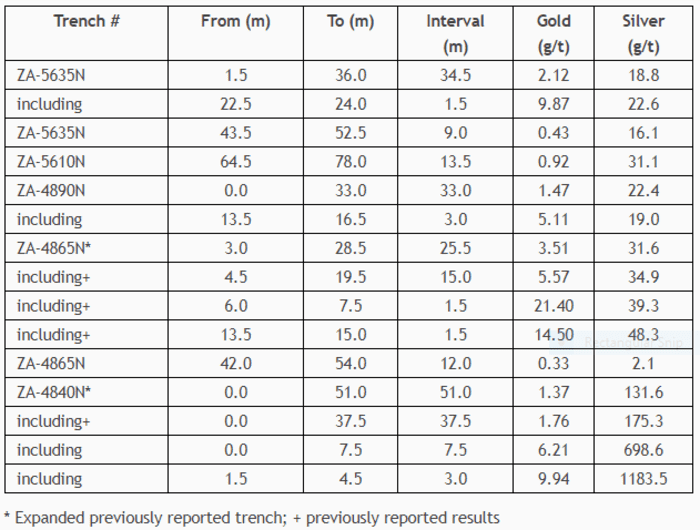

We also received another round of surface samples with this news.

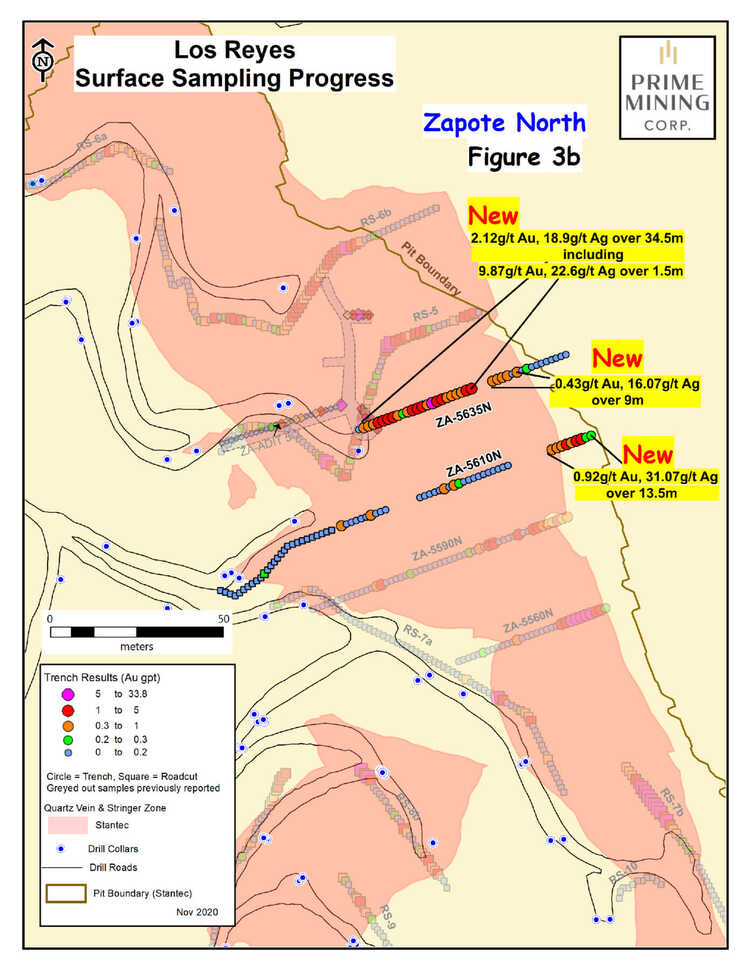

Areas at Zapote North with insufficient surface data were targeted with infill trench sampling. This new data has been incorporated into the current drilling plan to maximize the impact of this campaign.

The highlight from this round of trenching was 34.5 meters grading 2.12 g/t Au and 18.8 g/t Ag.

The following table tells all.

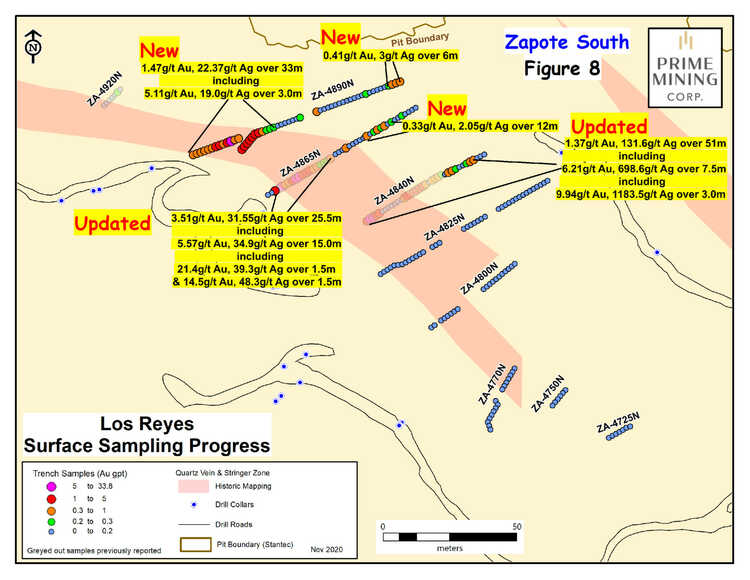

The following maps show the locations of these new trench sampling results (you really gotta appreciate the attention to detail here):

The following maps show the locations of these new trench sampling results (you really gotta appreciate the attention to detail here):

Daniel Kunz, Prime Mining’s CEO:

Daniel Kunz, Prime Mining’s CEO:

“We are pleased to begin drilling at Los Reyes. The trench sampling results continue to define high-grade gold and silver mineralization at surface. The Zapote deposits have outstanding gold and silver values over large outcropping areas and drilling there will focus on resource expansion.”

Final thoughts

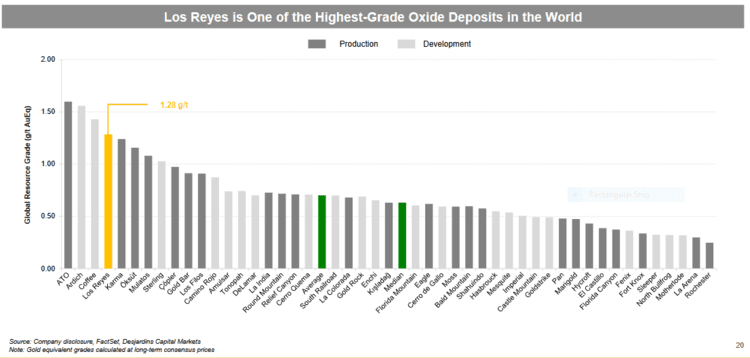

As per slide 20 on the company’s investor deck, Los Reyes is ranked among the highest grade oxide gold deposits on the planet…

With this aggressive first phase of drilling and regional approach to exploration, the Company is about to find a whole new gear.

With this aggressive first phase of drilling and regional approach to exploration, the Company is about to find a whole new gear.

We stand to watch.

END

—Greg Nolan

Full disclosure: Prime is not currently an Equity Guru marketing client.